What is a bond and why buy some?

Which a share is an ownership title, a bond is a debt instrument which is issued either by a private company, or a public authority (municipality, state, etc.). Put differently, it is a loan, a debt. When you purchase a bond, you are lending money to an entity. You are acting as a bank.

No only will you receive interest, but you can also ask for the bond to be reimbursed when it expires. The general validity time of a bond ranges between five and ten years.

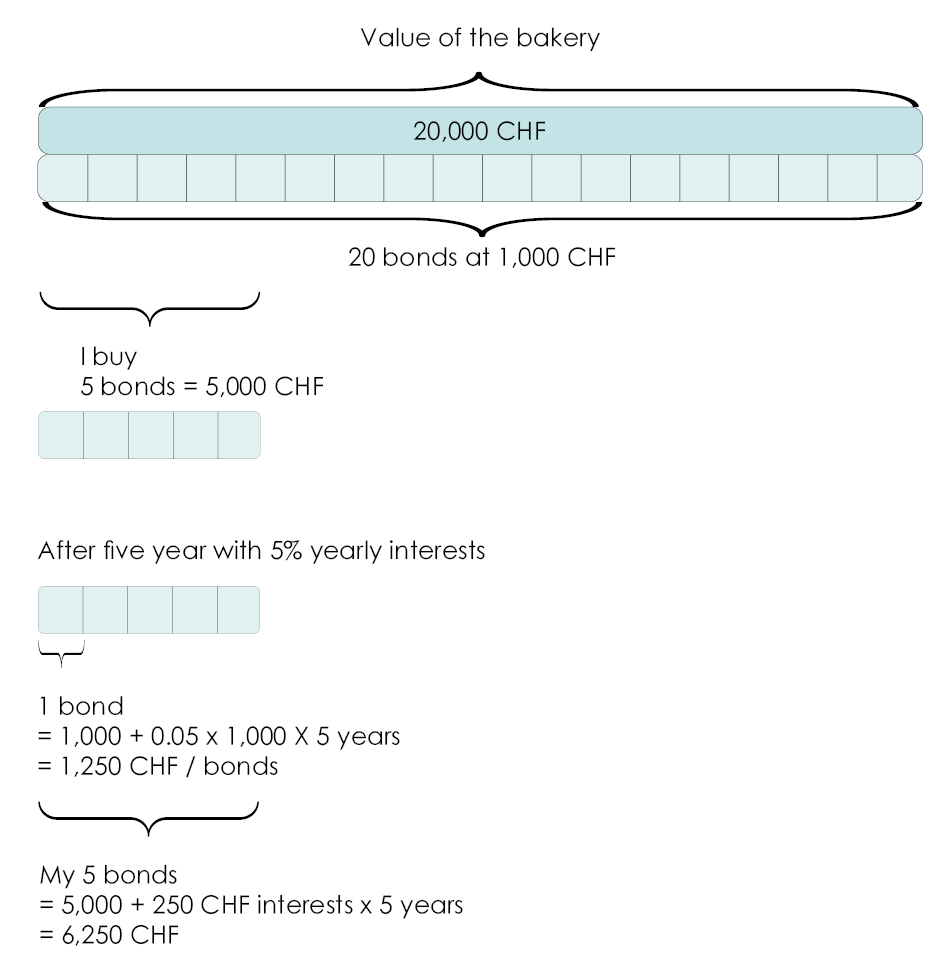

Buy why would you buy a bond? If Zoé, instead of dividing her bakery into share, had issued 20 bonds each valued at 1,000 CHF with an annual interest of 5% over five years, I would have bough five from her in a heartbeat.

Upon signing the contract, I had to get rid of 5,000 CHF and transfer them to Zoé’s account. She would have paid me interests at the end of the year: 50 CHF per bond, or 250 CHF in total.

After the five contractual years, I would have gotten my 5,000 CHF back and ended up with 1,250 CHF profit from the interests (250 CHF multiplied by the five years), that is a total of 6,250 CHF.

Bonds are one of the safest investments. Why? For two reasons.

- The entity you are lending your money to is legally obliged to reimburse you.

- Bonds are usually signed with states, which are extremely unlikely to go bankrupt.

Of course, if a private company goes bankrupt, investors might not be able to get their original investment back.

Some bonds are therefore riskier than others.

Even though bonds can (also) contain an element of risk, they remain less risky than shares due to the fact that they benefit from a priority rank based on insolvency law regulations. Which means that in case of bankruptcy, those who own a bond will be reimbursed before any other creditor.

Good to know: there are comparators that rank bonds based on their debtor (the party that owes the debt).

Be careful: it is very important that every investment factors the fiscal impact in. The coupons (the part that is reimbursed every given period of time) will be imposed as income. This fiscal characteristic can lower the net return you will make on your bonds.

If you want to dive deeper into the world of bonds, come discover bond funds!

Discover our new online platform to entrust us with your tax return!

Complete your 2023 tax return online!

In the blink of an eye!