Summary of your situation based on your income

Your data

I. How much equity is needed to buy your home?

Current laws prohibit banks from lending more than 80% of the price of the property

There are different scenarios, depending mainly on the amount of equity you wish to contribute, ranging from

20% to 35%. The amount of debt will vary accordingly (between 65% and 80%), and this will also impact your amortisation.

II. How to raise the necessary equity?

The equity for buying a house can be composed of :

- 1. Your savings (savings account, current account)

- 2. Your private pension (Pillar 3A and B)

- 3. Your occupational pension (LPP: 2nd pillar)

- 4. Loan or donation

- 5. Advance on inheritance

As we have only limited information, this is only a first estimate. However, it is possible that in your household you have enough funds of your own (between your 2nd and pillar 3a and b) to proceed with this purchase.

(Caution: Using your 2nd pillar can create significant gaps in coverage! It is important to check each situation (retirement / illness / accident) before withdrawing your LPP assets).

III. What is the minimum income required to take out this mortgage?

Financial institutions calculate a customer’s solvency (commonly known as charge-holding) as described below:

| Mortgage charges (estimated at 5% of your total mortgage) |

720'000 x 0.05

36'000 CHF |

| Amortization of the second rank (estimated amortization of your 2nd rank (15% of the total mortgage) over 15 years) |

135'000 / 15 années

9'000 CHF |

| Maintenance costs (estimated at 1% of the property price) |

900'000 x 0.01

9'000 CHF |

| Total Charges |

54'000 CHF |

To guarantee your solvency, they have to make sure that in your household you earn at least three times the amount of the total calculated charges (last result in the table).

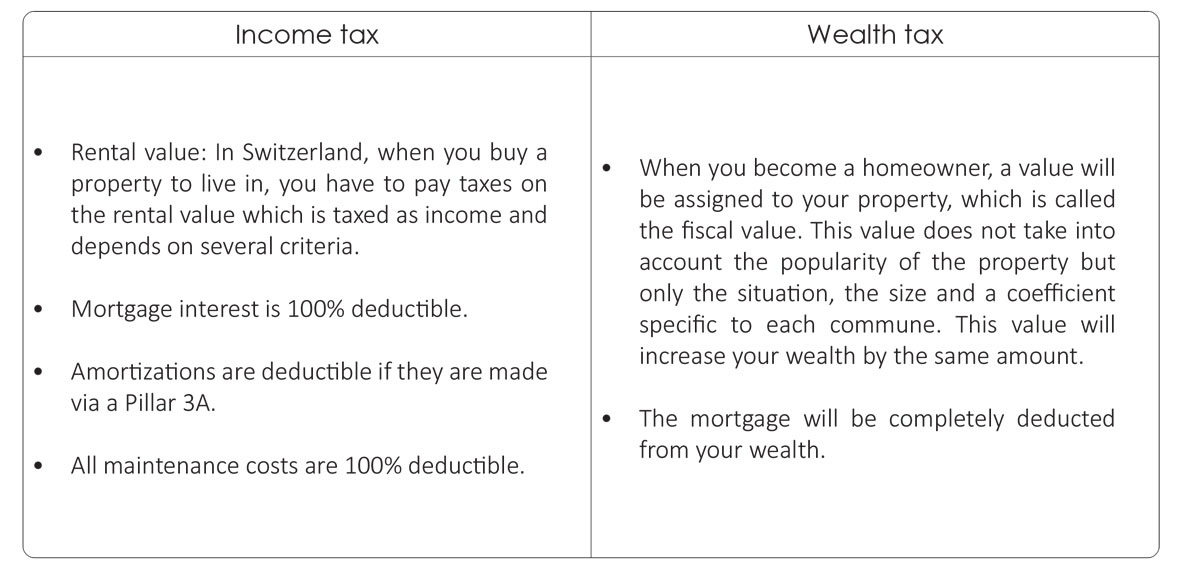

IV. What impact will your purchase have on your tax return?

When you buy a property, you go from being a tenant to an owner, which has an impact on certain sections of your tax return.

(See table below)