Why choose FBKConseils for your tax return in Valais?

Deadlines for sending in your tax return in the canton of Valais

For the 2024 tax return, there are a few dates to keep in mind. Which ones?

For the 2024 tax return, there are a few dates to keep in mind. Which ones?

The standard deadline:

From January 1st to March 31st: This is the official deadline by which the Valais tax authorities should have received your tax return.

The first extension:

From March 31st to July 31st: This second due date allows all taxpayers to extend the original deadline for submitting their tax return. There is no need to make any written request, the payment of a 20 CHF fee is enough. You will find the pay-in slip inside your tax return.

The final deadline:

If you are not successful in filing your tax return within this time frame, the fiduciaries can request up to two additional delays to file your tax return, but no later than December 31st.

For latecomers, remember that submitting your return after the deadline can lead to quite substantial fines.

How can I file my tax return in the canton of Valais?

As strange as it may seem, whether you live in the canton of Valais or elsewhere, you are fairly free to choose the method for returning your tax return.

As strange as it may seem, whether you live in the canton of Valais or elsewhere, you are fairly free to choose the method for returning your tax return. Your only duty is to declare your income and wealth in accordance with the reality.

Nevertheless, the canton provides you each year with online tools such as VStax 2023 and other forms to help you claim your deductions.

Over the years, the vast majority of the Valais taxpayers (more than 90%) have decided to switch to digital tax return submission.

Entrust your tax return to the right fiduciary

Despite the available software and pre-filled forms, filing taxes remains a time-consuming and challenging task.

Despite the available software and pre-filled forms, filing taxes remains a time-consuming and challenging task. Many taxpayers are able to accurately report their income and wealth, but their ability to do so tends to decrease when it comes to recording their 2023 authorized deductions.

Involving tax professionals is a secured way to save time and ensure your compliance with your local tax regulations, while optimizing your tax burden.

Keep in mind that overpaying taxes is not a crime, it’s just an avoidable expense.

Advice and optimization to minimize your taxes

You cannot go back in time, and this certainly applies to taxation. Once the year is over, your income and expenses are fixed.

You cannot go back in time, and this certainly applies to taxation. Once the year is over, your income and expenses are fixed. You can no longer optimize your situation. Your only option will be to report your situation in the best possible way.

At FBKConseils, once your tax return has been transmitted, we propose videoconference appointment to highlight the key points and the optimization opportunities for the current year. The objective is to bring clarity on how you can further minimize your tax burden for the years to come.

This appointment is optional and, in any case, non-binding.

If you are interested in any of these proposals, we will carry out all the tax simulations and we will calculate the exact financial impact of each solution.

The main tax simulations are:

Buying back BVG years (LPP):

Should I buy back years in my 2nd pillar? How much can I buy back? Over what time frame should I buy back these years in order to maximize the tax gain?

Real estate acquisition:

What impact will a real estate purchase have on my tax return? How will my wealth and income be affected by this purchase?

Change of civil status:

What will happen if you get married in 2025? How will your taxes be calculated after the birth of a child?

3rd pillar:

Are you considering taking out a 3rd pillar? What tax savings are associated with these financial products?

Feel free to make an appointment directly on our website.

Subsequent ordinary taxation (TOU) in the canton of Valais

You have been taxed at source and you have heard about the possibility of deducting certain expenses by requesting an ordinary tax return?

You have been taxed at source and you have heard about the possibility of deducting certain expenses by requesting a subsequent ordinary taxation? You should know that once you file a regular tax return, you can’t go back. This choice is irreversible, whether or not it is in your favor.

In order not to have regrets about this decision, it is essential to carry out a simulation. The goal is to precisely assess your tax burden upon submission of this request. If the balance is in your favor, you can safely go through with the process. If this is not the case, you will save time and money by not proceeding.

Your tax return in the canton of Valais with FBKConseils

1. The first interaction!

The easiest way to get in touch with us is to send us an e-mail at [email protected], call us at 021/ 601 07 22, or even book an appointment. You can introduce us to your situation, and we will explain you in detail how we work. If you have specific questions, do not hesitate to make an appointment directly on our website.

In order to complete your tax return, we will provide you with our checklist so that you can revert all the necessary documents to prepare your tax return.

2. The tax filing!

Once all relevant documents received, we handle the next steps. If needed, we will request from the tax authorities a deadline extension before sharing with you the finalized tax return.

3. Sending your tax return!

Once completed, we will address your tax return to the tax administration and share with a copy for a final check. Should the need be, we will stand-by to bring the final adjustments

4. Appointment and follow-up!

We offer to our clients an appointment, to review your tax return and advise you on the various extra deductions that could apply in the canton of Valais. This way, you will have enough time to ensure your situation is optimal for the following years.

How long does this process last and how much does it cost?

The time required to perform your tax filing heavily depends on your personal situation, and the complexity of your financials. On average, it takes 10 days to FBKConseils experts to finalize your tax return, once all required documents and information are received. On top of our processing time, you have to consider the time needed for you to gather the required documentation, as well as a waiting period from the tax authority to obtain the final decision of taxation.

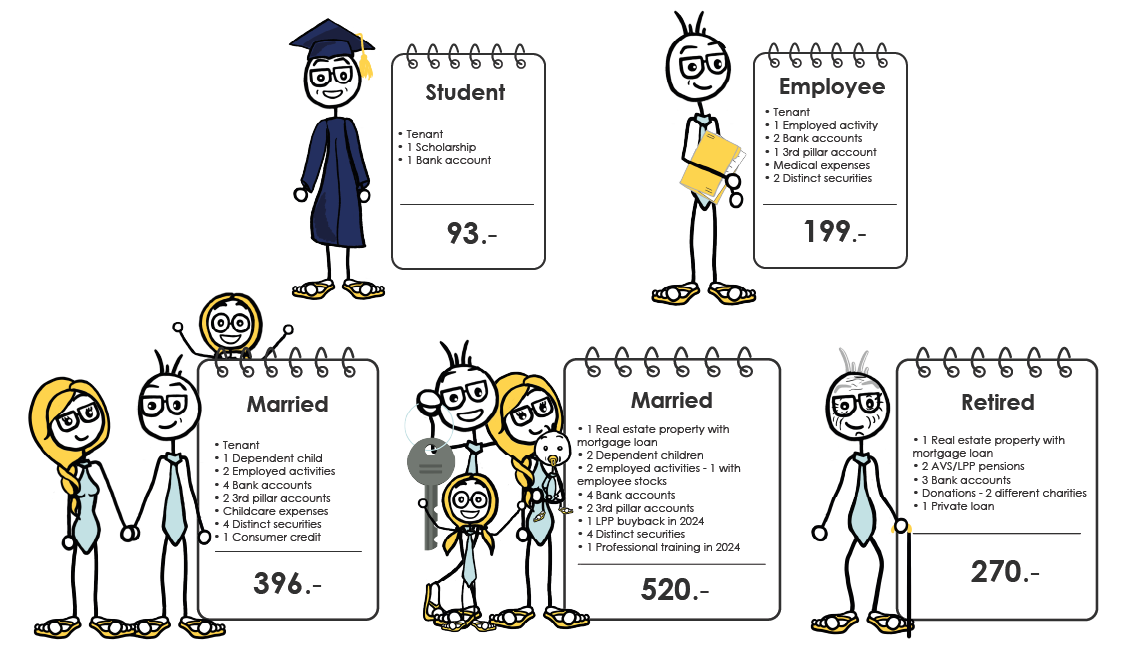

Regarding the cost of this process, it heavily depends on your situation. You can either ask us for a personalized quote, use our new online platform take a look at the several situation examples below.

Download the pricelist

Entrust us with your tax return

The rule is quite simple. Your canton and commune of residence as of December 31st of the fiscal year are decisive.

If your family status changes during the year, the same rule that applies to your residence also applies to your civil status. Your situation on December 31st will be taken into account in your tax return.

Whether you live in the canton of Valais or elsewhere in Switzerland, retirement pensions are 100% taxed as part of your income.

Each canton has its own particularities. For the canton of Valais, it is allowed to deduct 30’000 CHF for single people and 60’000 CHF for married people or people with children.

Until you receive the final tax decision, you are free to adjust it. You will then have 30 days from the receipt of the final decision to make modifications.