Why choose FBKConseils to fill your tax return?

Entrusting your tax return: Quality as a standard

A friend of mine would tell you that filing your taxes is as easy as making an omelet… not mentioning he is an auditor, thus obviously making it simpler for him than for the great majority of taxpayers.

A friend of mine would tell you that filing your taxes is as easy as making an omelet… not mentioning he is an auditor, thus obviously making it simpler for him than for the great majority of taxpayers. Every year at FBKConseils, we witness errors in tax returns that inevitably lead to an increase in the tax burden.

But beyond the potential savings, finding all the deductions to which one is entitled is often seen as a tedious job. Of course, nothing is impossible, but let’s be honest: it is long and painful. Seeking the help of a professional guarantees a certain quality standard of execution for the tax return.

Entrusting your tax return: Delegate responsibility

Loneliness might hit you while filing your tax return… as nobody will tell you whether an item must be declared or not.

Loneliness might hit you while filing your tax return… as nobody will tell you whether an item must be declared or not.

– The sale of your vehicle that resulted in a nice capital gain?

– Your bank accounts held abroad?

– Selecting flat-rate expenses or actual expenses?

– The aid received and tax breaks linked to trainings.

– Etc.

On another hand, the tax authorities often ask for further justificative documentation, or worse, simply reject a given set of deductions. At FBKConseils, we complete your tax return and communicate with the tax authorities to assert your rights and justify our work. In this way, we accompany you to the end of the procedure.

Entrusting your tax return: Optimizing your situation

Paying more taxes than required is generous in the end, but unfortunately it represents a considerable and unjustified lack of savings. And let’s be honest, it’s usually not on purpose. Who wouldn’t want to save more taxes to enjoy themselves elsewhere?

Paying more taxes than required is generous in the end, but unfortunately it represents a considerable and unjustified lack of savings. And let’s be honest, it’s usually not on purpose. Who wouldn’t want to save more taxes to enjoy themselves elsewhere?

Relying on FBKConseils for your tax return does not stop there. Beyond the optimization that we can directly perform when we fill out your tax return – by entering all the possible deductions with respect to your situation – we propose to clients who entrusted us with their tax return to schedule an appointment afterwards, for free. This would allow us to review together the possible future optimizations in order to minimize your tax burden for coming years.

Entrusting your tax return: a significant time saving decision

Let’s admit it, the same feeling comes back each year. Early January, the excitement and motivation are peaking: “This weekend, I’m filing my taxes!” And a weekend after another, this motivation is slowly fading away…

Let’s admit it, the same feeling comes back each year. Early January, the excitement and motivation are peaking: “This weekend, I’m filing my taxes!” And a weekend after another, this motivation is slowly fading away… Couple of months later, you ask for an extension knowing that time is running out and that you no longer have any desire to do so. Then finally you do it quickly to relieve your mind. But unfortunately, when willing to go fast, we often forget some items. And in the case of the tax return, it is important not to miss any deductions to lighten the bill and the tax burden.

In concrete terms, if you’re the type of person who chases time to do the things you like, if you don’t know all the deductions you’re entitled to, and therefore loathe the idea of wasting time doing this research, it’s worth calling in a professional. You will save time, and taxes!

So, we offer you to stay in the January mood, keeping the official tax return mails accessible somewhere handy – what about a dedicated box? There, we suggest you add important documents about 2022. You usually receive these beginning of the year, such as your wage statement, your bank tax statements, and so on… Then, just reach out to us, and enjoy your spare time to do whatever makes you happy.

Filing your taxes in the canton of Vaud with FBKConseils: How does it work?

1. The first interaction!

Unless you select the traditional tax filing process and its numerous – sometimes messy, this depends on you – documents exchanges, we should have quite little interactions. We will welcome you to our platform, where you’ll be guided and able to directly proceed with tax filing steps. If you wish so, we can arrange an initial meeting, free of charge. You can select the most convenient option for you: via phone, videoconferencing, or even at the office should you prefer to meet the team first!

2. The tax filing!

Once all relevant documents uploaded or shared in the traditional way, we handle the next steps. If needed, we will request from the tax authorities a deadline extension before sharing with you the finalized tax return.

3. Final submission and fiscal optimizations!

Upon tax return completion, we will share it with you for a final check. In case of questions, adjustments or oversights, we will have a minimum 6-day slot and a maximum of until your tax return has been taxed, to perform required modifications until the tax administration considers it as final. When validated, you will have the possibility to benefit from an advisory session, so that we can wrap it up and focus on potential optimization items for the coming years.

How long does this process last and how much does it cost?

The time required to perform your tax filing heavily depends on your personal situation, and the complexity of your financials. At the busiest period of the year, it can take up to 10 days to FBKConseils to process your tax filing, once all documents are in our hands.

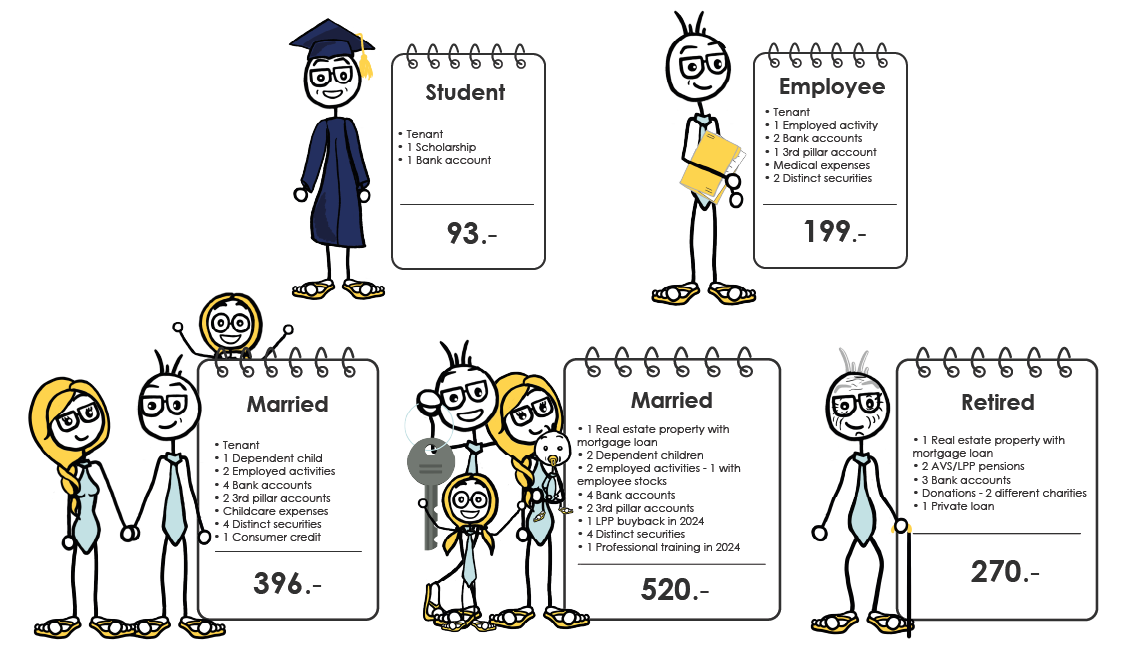

Now about how much will be your tax return, it is complicated to give a general estimate because everything depends on your situation! You can either ask us for a personalized quote, use directly our new online platform or take a look at the several situation examples below.

Download the pricelist

Entrust us with your tax return

You probably got used to this type of answers living in Switzerland, but it all depends on the canton you live in. As an example, the canton of Vaud has set the deadline for March 15th, 2025, while Geneva and Valais chose March 31st, 2025. Nonetheless, all Swiss Cantons allows to differ tax filing by couple of months, but you’ll sometimes need to pay for the delay. For the canton of Vaud, an automatic extension, free of charge, has been set for 30 June 2025. If, for real and exceptional reasons, you are still unable to send in your tax return, you may request a new deadline of 30 September 2025.

Tax installment as well as how many of them should be paid depend on the canton. In Vaud and Geneva, you will get 12 installments, while in Valais, there will be only five. Despite this, it is often possible to pay it all at once.

It all changed in 2022. With the suppression of the simple rectification, it is unfortunately no longer possible to claim the standard deductions such as 3rd pillar, transport costs, meal costs. Should you desire to apply deductions to your revenues and potentially decrease your tax burden, you will have to go through a subsequent ordinary taxation. You will have to file the same tax return as a Swiss resident or a resident with a C permit. Once this subsequent ordinary taxation is done, you will be able to claim the full amount of the authorized deductions.

That’s rather easy. If you were already taxed in Switzerland the previous year and your situation has not changed much, your instalments will be calculated on the same basis. However, if this is the first time you are to be asked to pay tax in instalments, visit the website of the relevant tax authority to see if there is a tax simulator to find out the amount. If this is not the case, do not hesitate to contact us.

Depending on the canton you live in, you may receive a call from the tax authority, or postal mail accompanied with “late fees” also known as moratory interests. For example, in the canton of Vaud, this interest amounts to 4.75% per year (in 2024) in contrast to 4% in 2022.

If you fail to pay the required amount of tax, the tax authority is entitled to tax you at its discretion and to collect a fine for non-compliance with the procedure. If this penalty remains unpaid, the tax authority will initiate a procedure with the debt collection office of your canton to claim the unpaid amount. You will therefore have debts to the tax authority of your canton.