Written by Yanis Kharchafi

Written by Yanis KharchafiThe main 15 tax deductions in the canton of Vaud for 2024

Introduction

Did you follow our advice and are now an expert on different existing types of income? All you have left to do now is to understand the various deductions authorised in the canton of Vaud and how to maximise your tax savings, and taxes will no longer hold any secrets for you. And of course if you need a hand, feel free to ask us, we can even file your tax return in the canton directly if you wish.

In this article, you’ll discover the main tax deductions in the canton of Vaud. Not all of them are possible, but at least after reading this article, you’ll be certain that no large tax deduction will have escaped you. Here’s what’s in store:

The line-up:

Private pension plans: the pillar 3

One of the best way to lower your taxable income is to open a pillar 3.

In 2024, employees can deduct up to CHF 7,056 from their 3ᵉ pillar. For the self-employed, this amount can rise to CHF 35,280. The good news is that in 2025, these deduction limits will rise again, to CHF 7,258 for employees and CHF 36,288 for the self-employed.

Transportation fees

The canton of Vaud does not cap this category. However, deductible amounts depend on your means of transportation.

You are a sportive person and go to work by bike

You can enjoy a flat-rate deduction of 700 CHF per year.

Example: I go to work by bike, I can deduct 700 CHF from my taxable income (this one is easy).

You are an adventurer and go to work by motorised two-wheeler

You have to calculate: how many kilometres separate you from your home and your workplace * 2 (round-trip) * the number of days you go to work * 0.4

Example: I live 10km away from where I work and I go there on my motorbike. I did not miss a single day of work (max. 240 days of work). Which gives me: 10 * 2 * 240 * 0.4 = 1,920 CHF deductible per year.

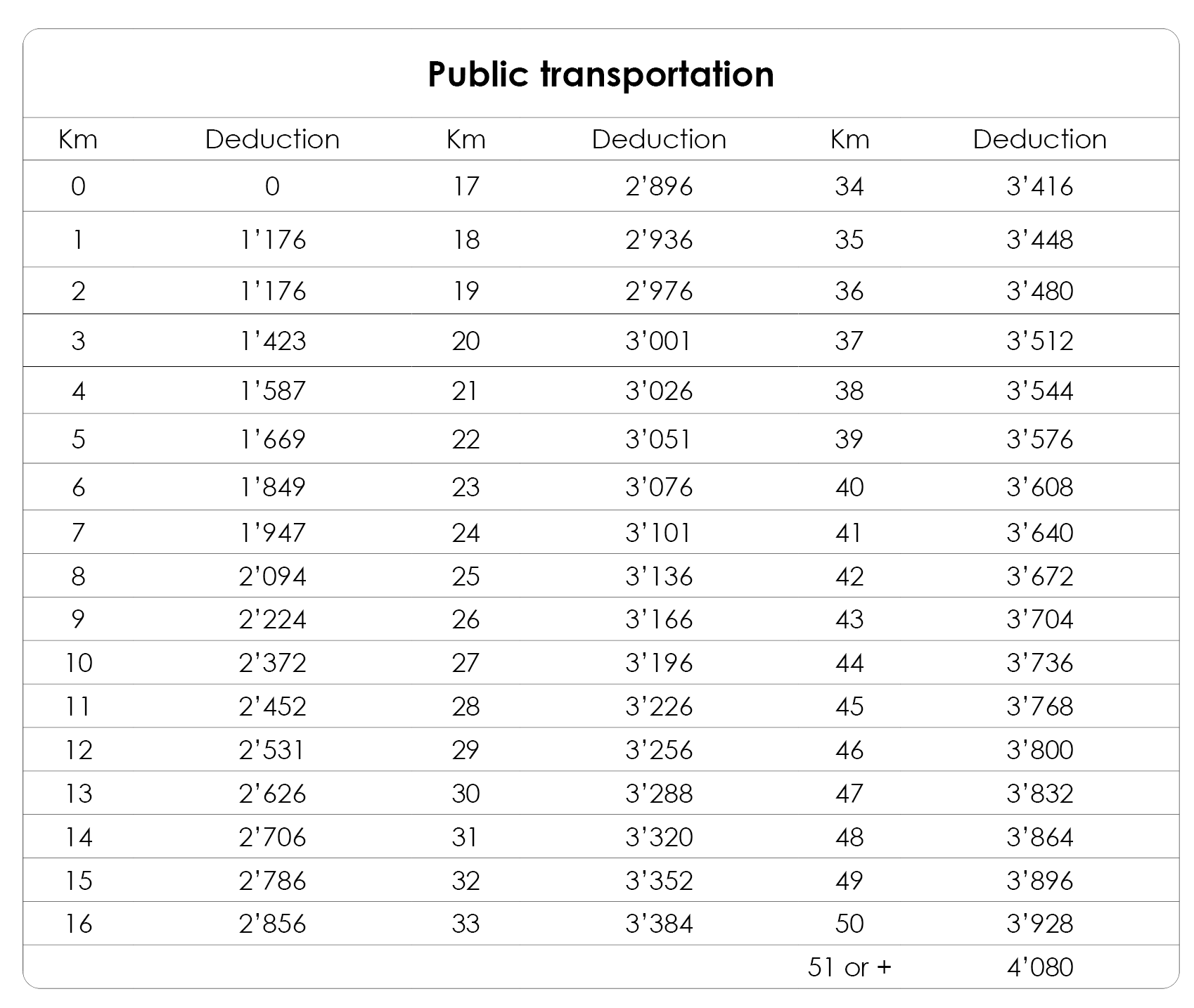

You are an environmentalist and go to work in public transportation

You will find below a table determining precisely the amount you can subtract to your taxable income.

How many kilometres separate you from your home and your workplace? Four little kilometres? You can deduct 1,587 CHF from your taxable income per year. 42 kilometres? You can deduct 3,672 CHF. 51 kilometres? 4,080 CHF. 100 kilometres? Same amount, 4,080 CHF (it is the maximal amount).

Busy schedule? Can’t find a bus? The car is the only solution

If you are like most workers in Switzerland, your morning routine can be summed up as follows: you grab a quick breakfast, a coffee and you turn the key to start your car’s engine.

How many kilometres do you travel yearly to commute from your home to your work?

The first 15,000 kilometres are deducted 0,7 cents per unit, all the remaining ones are deducted 0.35 per unity.

If you travel 10,000 kilometres per year, the calculation will be the following: 0.7 * 10,000 = 7,000 CHF. Generous!

If you travel 20,000 kilometres per year, the calculation will be the following: (0.7 * 15,000) + (0.35 * 5,000) = 10,500 + 1,750 = 12,250 CHF deductible per year.

This year, we have decided to add an important clarification concerning deductions for the use of a private vehicle. Many taxpayers mistakenly believe that they can freely deduct these expenses, but the canton of Vaud applies strict rules. Saving time alone is not a valid reason for making this deduction. In order for the tax authorities to accept it, you must provide a legitimate reason, such as great difficulty in getting to your place of work, compulsory travel during the day, irregular working hours, etc. Although car travel costs can offer attractive deductions, these are by no means guaranteed!

Meal expenses

You are an employee and have to handle your meals? Regardless of whether you make them yourself, you are a huge fan of the local restaurant or that you alternate between Coop and Migros, you can deduct a maximum amount of 3,200 CHF per year.

You are an employee and your nice boss pays for part of your meal (flat-rate per meal or cafeteria with preferential rates for example): you can deduct a maximum of 1,600 CHF per year.

Finally, maybe your super kind boss bares the costs of all your meals? In this case, you cannot deduct anything.

Other flat-rate business expenses

For once, the canton of Vaud has taken a rather generous approach to the deduction of business expenses. In addition to meal and transport costs, it believes that all taxpayers must bear certain expenses in order to carry out their professional activities. This is why a flat-rate deduction (without any justification) is granted to cover expenses such as work clothes, tools and other costs. This flat-rate deduction is easy to calculate: you can deduct 3% of your net salary (shown in box 11 of your salary certificate), with a ceiling of CHF 4,000 and a minimum of CHF 2,000.

Other actual business expenses

In certain very specific cases – and I can assure you that this is a minority – it is possible to show that the 3% flat-rate is not enough to cover all the business expenses you have had to pay out of your own pocket. These may include travel, meals away from home, tools, clothing or any other business-related expense. The rule is simple: if you can establish a direct link between an expense and your income (salary), that expense is in principle deductible.

A special case is that of ‘teleworking’ or the ‘home office’. Less common just a few years ago, this way of working has become increasingly common in the wake of recent events. If your employer no longer provides you with an office, or if your employment contract stipulates that you must carry out part of your work from home, it is possible to deduct not only part of your rent, but also all household costs (electricity, heating, internet, etc.). This is good news, but beware: this deduction must be justified and is still quite rarely accepted.

Training costs

In order for your training to be tax deductible, it must be equivalent or more than the federal maturity level. Maximum deductible: 12,000 CHF per year.

The “double activity of the partner” plan

We all know that getting married, implies paying more taxes. What we are less aware of is the fact that when both partners are in gainful employment, they are entitled to an annual tax deduction of 1,700 CHF for the couple.

Health insurances

In the canton of Vaud, health insurance premiums are deductible, but only to a limited extent. Although the tax authorities have been gradually increasing the maximum ceiling for the past two years, it is still far from the amounts actually paid by taxpayers. In 2024, the deduction limits for health insurance are set at :

- CHF 4,900 for single people,

- CHF 9,800 for married couples,

- CHF 1,300 for each dependent child.

Despite this increase, the deduction remains lower than the actual cost of health insurance premiums for many households.

Medical costs

On top of health insurance expenses, you have the possibility to deduct 5% of the total costs in excess of your net income.

To give you an example, if your gross salary is 100,000 CHF, that your net salary is 70,000 CHF and that over the course of this year your medical costs were 5,000 CHF, you will be able to deduct everything above (70,000 CHF x 0.05 = 3,500 CHF). Your deduction will be 1,500 CHF.

After a lot of feedback from our readers, we’ve realised that the term ‘middle income’ doesn’t really speak for itself. And you’re right! To complete this explanation, intermediate income corresponds to your net income after almost all deductions, with the exception of certain social deductions, donations and dependants. In short, it’s practically your taxable income. To find it, simply consult your tax return and look for box 700.

Deductions for families

If you have a child/children, you benefit from additional deductions.

For married couples, 1,300 CHF per household + 1,000 CHF per child are deductible from your net income.

For single-parent families, the aid is greater: 2,800 CHF + 1,000 CHF per dependent child.

Childcare expenses

With supporting documents, you will be able to deduct CHF 2,000 more than in 2023, or CHF 15,000 per year per child (under 14) or needy dependant, on your 2024 tax return.

The repurchase of your LPP

If you can repurchase part of or your entire pension fund, each franc repurchased will be deducted from your taxable income, with no upper limit.

Just like for the pillar 3, it is important to understand the functioning of the Swiss retirement system before repurchasing.

The mortgage loan

Did you invest in real estate or are you looking into trying it out? Good news! The annual interest on your mortgage debt is entirely deductible from your taxable income.

Renovation and maintenance costs

For property owners, this deduction is one of the most important, but it is often misunderstood. Yes, you can deduct the cost of maintaining your property, whether in Switzerland or abroad. However, digging a hole to build a swimming pool is unfortunately not maintenance, but an improvement to the property. In the canton of Vaud, and fairly uniformly throughout Switzerland, two types of work are generally deductible:

- Maintenance work: This work does not increase the value of your property, but helps to keep it in good condition. This includes repainting, changing the sanitary fittings after several years’ use, or repairing water ingress, for example.

- Energy improvement work: All work to make your home more environmentally friendly can be deducted from your income for the year in which the work was carried out. What’s more, if these deductions cannot be fully offset during the year in question, they can be carried forward to the following year.

In conclusion, improvements such as installing a new swimming pool, opening a living room onto a kitchen or any other major transformation will probably be refused by the tax authorities for an annual deduction. However, this does not mean that these expenses will never be deductible. Work that is not deductible from income can be taken into account when you sell your property, thereby reducing the tax on the property gain. Depending on how long you have owned the property, this saving can be just as significant.

The deduction for low-income taxpayer

If the income of your household is lower than average, you can ask for a deduction for low incomes.

At this point, you should be able to estimate your taxable income quite precisely.

Do you want to estimate how much taxes you will pay? Go check out our fiscal calculator!

Social deduction on housing

Last year, we did not mention this deduction because it is calculated automatically by the tax authorities. However, all too often we see tax returns where taxpayers forget to enter their rent, which prevents the system from checking their eligibility for this deduction. It is therefore essential that you enter your rent correctly on your tax return.

As the name suggests, this deduction only applies to taxpayers with modest incomes and/or large families. However, if over the course of the year you have managed to apply significant deductions – such as BVG/LPP buy-ins, substantial savings in your 3ᵉ pillar, or major maintenance work – these reductions can lower your taxable income to the point where you qualify for this social deduction, allowing you to maximise the cumulative effect of all the other deductions made voluntarily.

FBKConseils tips for optimising your tax deductions

Tip 1: Explore all possible deductions

The canton of Vaud offers a multitude of tax deductions, some of which are specifically linked to your personal situation. In this article, we have only touched on the main ones, but there are many others. Take the time to find out more and, if necessary, don’t hesitate to ask us questions to find out more.

Tip 2: Check your tax ruling

Many taxpayers simply send in their tax return and wait for the bill without even checking the tax ruling. Yet this is a crucial step. Always compare what you have declared with what has finally been withheld by the tax authorities to avoid any errors.

Tip 3: Contest if necessary

Sometimes the taxman does not understand your return, changes certain deductions or deletes them. This does not necessarily mean that you are wrong. You have 30 days in which to contest a decision by explaining and justifying your deductions. Don’t miss this opportunity if you believe the decision is wrong.

Tip 4: Theory versus practice

In the canton of Vaud, certain tax rules can be interpreted in different ways depending on the situation. With solid arguments and a clear presentation, it is sometimes possible to obtain deductions that, without a detailed context, would have been refused. Don’t hesitate to contact us to help you adapt your situation to the legislation in force.

How can FBKConseils help you with your tax deductions?

Delegate your tax return

Like any fiduciary, FBKConseils offers you the option of entrusting us with all your tax documents, so that we can take charge of the entire process, from A to Z. Once we have finalised a first version of your return, we will present it to you, answer any questions you may have and make any necessary changes until we have a final version that meets all your expectations. We will then submit this final version to the Vaud tax authorities, and provide you with proof of submission and a copy of the submitted return.

Learn how to file your tax returns on your own

For the past 2 years, FBKConseils has been offering a personalised training service. For 2 hours, we welcome you to our office to complete your tax return together. At the end of this appointment, not only will your return be sent, but you will also have received answers to your questions, a template for future years, and you will gain greater autonomy in managing your future returns.

Check or contest your tax decision

You’ve sent in your tax return, but the tax authorities haven’t returned it as you expected? Have some of the headings been changed? Let us check your tax decision, explain the changes that have been made and the reasons for the adjustments, and help you draw up any appeals that may be necessary.