Written by Yanis Kharchafi

Written by Yanis KharchafiRepurchasing the second pillar: less taxes, more assets (the full guide)

Introduction

One morning, you wake up and you are 60 years old. Only a few years left before you retire. A well disserved rest after a life of hard work.

Excited by this idea, you calculate your future pensions. Just because, out of curiosity.

And then…you are taken aback.

You tell yourself: “if only I had known…”

But known what? That it is never too early to start saving money.

And one of the best ways of increasing your 2nd pillar pensions and capital is to buy back years in your 2nd pillar.

It is also one of the least well-known one. I prepared a little article to tell you everything about this peculiar practice, typical of the Swiss system.

The line-up:

What does buying back LPP years mean?

When I was little, my mother — after reaching her career goals — would often tell me, “This year I think I’ll buy back some years.”

Strangely, I didn’t understand that sentence… but I liked it. I had this image that she would gain more time, that she would “win” years, and the idea seemed almost magical.

Over the years, and after making pension planning my profession, I came to understand that LPP buy-ins don’t give you more time, but they do give you more freedom with the time you have.

Indeed, buying back contribution years in your 2nd pillar (LPP) lets you fill gaps in contributions caused by changes during your career, such as:

- a pay raise,

- a change in contribution rates,

- or a career interruption (studies, parental leave, part-time work, etc.).

Explaining it isn’t always straightforward. But here’s the idea: without buy-ins, your LPP capital at retirement (or your future pension) will effectively be calculated as an average of all the salaries you earned throughout your career.

And like everyone, what you want is a retirement aligned with your recent income, not with the wages from the start of your career.

By making a buy-in, you patch the “holes” in your contribution record caused by those variations. It’s a way to update your career history and strengthen your retirement provision, aligning your pension rights with your current situation.

Let’s now dig into this step by step — I’m sure it will become much clearer.

What situations allow for a repurchasing of your LPP?

- You worked aboard before moving back to Switzerland.

- You interrupted your professional career (either to dedicate your time to an independent project, or take care of your family, for instance), and have recently resumed an activity, potentially with new salary conditions.

- You and your spouse got divorced and the separation of property scheme created a gap (or should I say a crater?) in your second pillar.

- You recently changed employers and you went from a simple mandatory regime to a supplementary regime.

- You negotiated a salary raise. First of all, congratulations! Secondly, it is possible to repurchase the amount you could have saved if you always have had the highest salary.

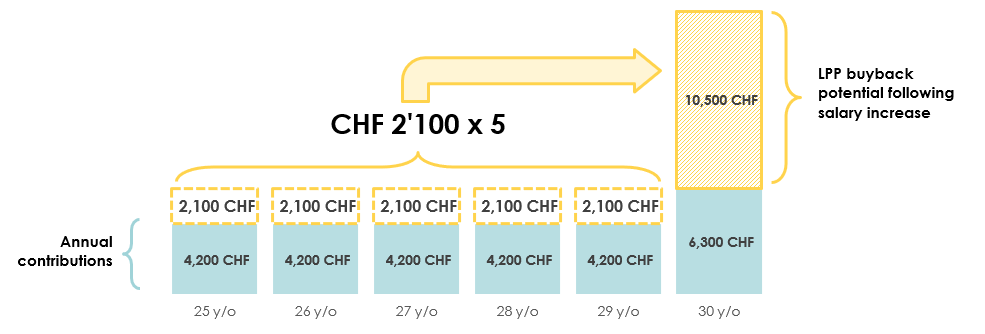

Example: between 25 and 30 years old, you make 5,000 CHF per month, i.e., CHF 60,000 per year. Between 30 and 35, your salary increases to 7,500 CHF per month, i.e., CHF 90,000 per year. You can repurchase what you could have saved if your income was 7’500 CHF between your 25 and 30 years of age.

Is repurchasing always attractive? Yes, if you pay attention to the following three aspects.

Investing money and making it grow before receiving it later on, while saving immediately on taxes, is always advantageous.

As long as you are aware of the potential impact of these three elements.

The solidity of your marriage

Nothing is more sacred than love. But the advisor in me must remind you that all you need is not (only) love.

In case of a divorce, half of your second pillar will go to your (ex) sweetheart. This element is to be taken into consideration before placing all your savings in your LPP account.

Occupational pension planning is a long-term project. So is your marriage? Perfect. Long live love!

How stable your company is?

Your employer negotiates the conditions of your professional fund. But what happens if he goes out of business?

Will you need to find a new pension fund?

Will you have access to your money without changing the withdrawal conditions?

This question is worth answering before adding money to your LPP account.

Your pension fund’s solidity.

You might say: “But Noé, what are you talking about, I did not pick my fund!”

It is true, you did not choose it. But you have to make sure it holds water.

How? By checking certain vital parameters of your pension fund:

- The current coverage ratio – Don’t worry, we’ll explain this concept further below. In short: Can the fund meet its obligations if everyone decides to withdraw their savings simultaneously? (Highly unlikely, of course, but still worth considering.)

- The return on your savings in recent years – In other words, is the fund investing efficiently and providing competitive interest rates on your assets?

- The applicable conversion rates – A broad topic covered in this article, but to summarize it in one question: What annual retirement pension will the fund offer you when the time comes?

- etc.

If we had to keep one essential criterion, it would be the coverage rate of your pension fund. Its what now? Its coverage rate. Please allow me to explain…

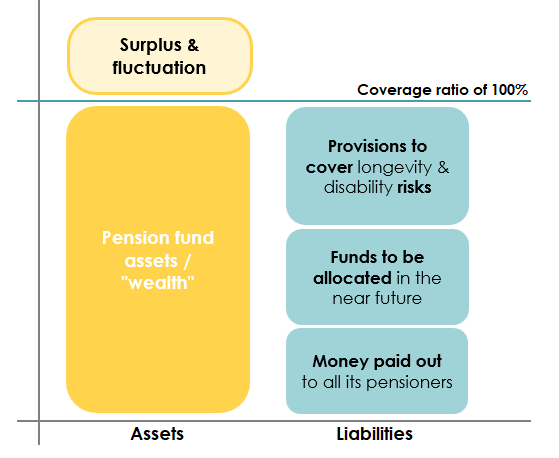

Your pension fund receives money, invests it, makes it grow… in short, your pension fund has wealth. Or assets in other words.

But it also owes you money. Just like it owes money to dozens, if not hundreds of thousands of other people.

If the pension fund can pay all the pensions and/or capitals at once, it is considered to have a 100% coverage rate.

Which is reassuring.

It highly unlikely that everyone suddenly asks for their money, but this rate nevertheless serves to provide information to about the pension fund’s financial health.

If the rate is above 100%, all the better.

If the rate is below 100%, then, one day or another, your pension fund will have to stabilize its finances. How will this impact your saving? Surprise.

And while surprises are nice at Christmas or for your birthday, this is not the case for your savings.

That being said, other factors can be taken into account when judging a pension fund’s quality.

But the coverage rate is one of the most important ones. This is also the easiest to assess, as this information must be made available by the pension fund.

Mastering your taxes

Honestly, it sounds crazy… but some clients have bought back more LPP years than their taxable income allowed them to deduct. It’s not illegal, but it’s tax-inefficient. The logic is exactly the same as with renovation expenses for homeowners: if you don’t earn enough to absorb the deduction, it’s useless.

Let’s imagine that after all your other deductions (health insurance, 3rd pillar, transportation costs, meals, etc.), your taxable income drops to CHF 40,000.

If you buy back CHF 50,000 in your pension fund (LPP), you simply can’t deduct more than what you declare. The excess is therefore lost from a tax perspective — even though it could have been used efficiently in future years.

We will see in the next chapter how to optimize your buybacks, but the basic rule is to make sure the amount you buy back is actually deductible.

The tip to save as much taxes as possible when repurchasing your second pillar.

Never needing your 2nd pillar within 3 years of a buyback

To benefit from its tax advantages, buybacks into the 2nd pillar must occur at least 3 years before your retirement or any potential need for withdrawal. We’re slipping this in quickly, but don’t be fooled by the casual tone of this article—it’s a crucial aspect to consider before making a buyback.

If you suspect that within the next 3 years, you might need to withdraw even a single franc from your 2nd pillar savings (not just the buyback amount—any amount), then buybacks are not advisable. Otherwise, you risk facing a “tax reclaim procedure.” As the name of this procedure suggests… best to avoid it!

To maximize tax savings, spread your buybacks over several years

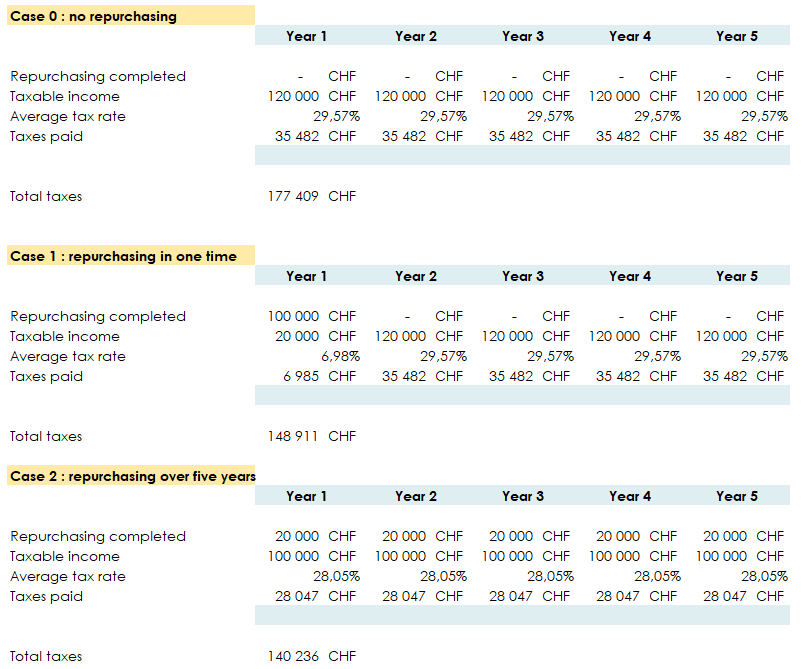

Take someone living in Froideville. This person wants to repurchase 100,000 CHF of savings. Let’s see how much they will pay in taxes after five years in the three following situations if we assume that after all deductions his taxable income is CHF 120,000.

1st case: no buyback with a salary of CHF 120,000: they keep this amount and does not repurchase anything. After five years, they paid a little over 177,000 CHF in taxes.

2nd case: buyback only in the first year of CHF 100,000 with a salary of CHF 120,000: the repurchasing at once allows them to save more than 25,000 CHF in taxes.

3rd case: buy CHF 20,000 every year for 5 years on a salary of CHF 120,000: the repurchasing in several times allows them to save 37,000 CHF in taxes.

Finally, if you wish to repurchase years of saving, do it when you risk being imposed the most.

The higher your income, the greater the tax savings.

For example? Your career is thriving and you were promised a significant raise. In this case, wait until you receive your new salary before investing.

Why? Because this is when your marginal tax rate will be at its highest, and therefore, when you can expect the most significant return on investment.

Conclusion: small regular repurchasing for big savings

We’ve reviewed the three benefits of a 2nd pillar buyback (LPP) over various time horizons:

- Short-term: you save on taxes.

- Medium-term: you make more of your money.

- Long-term: you benefit from a higher pension.

To make the most out of these advantages, you have to make sure your pension fund is solid. Just like the company you are working for. And, if possible, just like your romantic relationship as well.

Finally, we demonstrated that it is advisable to pay small amounts in several times rather than one big amount at once.

The best, as usual, is to have a personalised repurchasing plan, prepared by a professional.

How FBKConseils can help you with purchasing missing years in your 2nd pillar?

A free initial consultation

At FBKConseils, we continue to offer a free first consultation to all new clients in 2026. During this 15-minute session, you’ll gain a clearer understanding of the stakes involved in the 2nd pillar and any potential purchases of missing years. This meeting will give you the opportunity to ask your initial questions and get clear answers to guide your decisions.

A tailored study

For those seeking a practical and comprehensive solution, FBKConseils offers a turnkey analysis. This personalized study will help you precisely determine the amounts to purchase and the ideal timeline to fill in your missing years.

In-Depth advisory sessions

If you’re looking for more than just answers and want a deeper understanding of the system, FBKConseils provides another option: conducting the study with you in our offices. This interactive approach allows for exploring multiple scenarios, explaining every detail, and answering all your questions in real-time. An ideal solution for those who want to gain a comprehensive grasp of their pension planning.