Written by Yanis Kharchafi

Written by Yanis KharchafiWhat will be your second pillar contribution (LPP)?

For most people in Switzerland, the 2nd pillar (BVG) is the account where most of their savings are held. Not always aware of the sums saved or how they are calculated, we’ve decided to write an article to tell you more about the subject.

The line-up:

The compulsory and extra-compulsory portions of your 2nd pillar

The first very important thing to bear in mind is that for all employees, regardless of your company, salary, age, etc., the rules are the same. One of the first things you need to know is that your employer is obliged to contribute at least as much as you do for yourself. In other words, part of the LPP contributions is paid by the employee, another part is paid by the employer.

The second important specificity is to understand the basis on which BVG contributions are calculated. The law sets out a fairly clear legal framework. All the legal minimums are set (insured salary, contribution rate, interest paid, etc.). It is these legal minimums that will create what is known as :

- Mandatory part: This first component of your 2nd pillar is and always will be the same, regardless of who you work for or the conditions under which you are paid. Employers are required by law to comply with certain rules:

- Minimal retirement credits per age range (see below).

- Interest rates paid yearly based in the policyholder’s assets (1%).

- Minimal conversion rate on the mandatory part (6.8%). It will still be valid in 2023, but unfortunately for future pensioners it will fall very soon with the entry into force of the LPP reform.

- The employer must pay at least as much as the employee

- Non-mandatory part: the law always determines minimum requirements but does not preclude them from being more generous. They can decide freely on how to insure their employees, as long as their situation remains at least as good as what the law prescribes.

- Retirement credits greater than the minimal requirements per age range.

- The portion paid by the employer can be higher than the portion paid by the employee.

- A coordination deduction below 25,725 CHF.

Whew, I know what you are thinking: “why do you keep adding new complicated words Noé? There are enough already!”

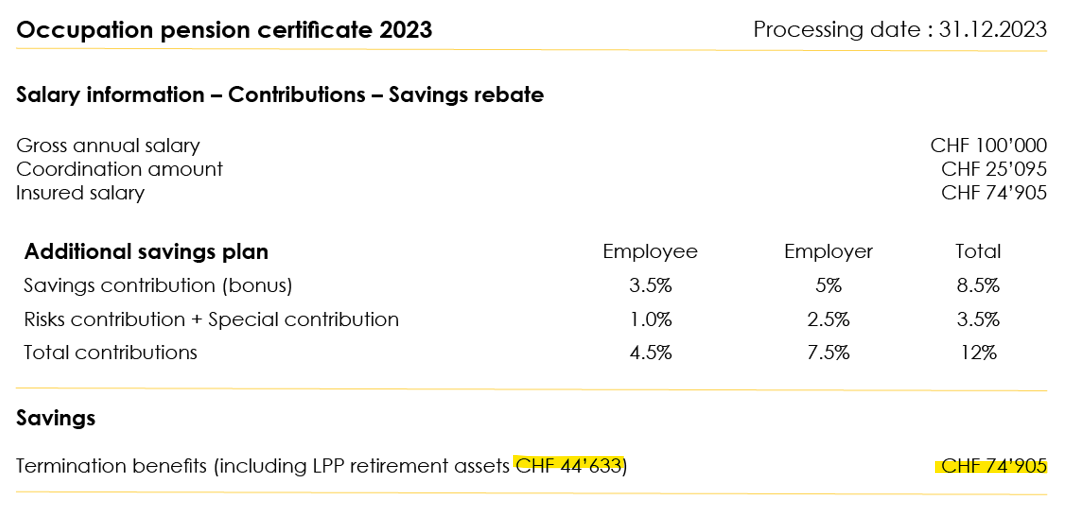

What’s important to remember? When you look at your BVG certificate, there’s a good chance you’ll see a line marked “BVG portion” or “compulsory portion”. You now know that this is the legal minimum to which you are entitled. Then, if your employer has decided to be more generous, you will see a 2nd line with the words “total vested benefits, including BVG credit”. This 2nd line shows your total balance, including the compulsory part and the mandatory part.

Here’s a small example. Here is part of the BVG certificate I received at the end of 2023:

We can see that my total assets are CHF 74,095 and that the compulsory or BVG portion is CHF 44,633. We can therefore conclude that the over-mandatory part is CHF 74,095 – 44,633 = CHF 29,462.

What are the annual 2nd pillar contributions?

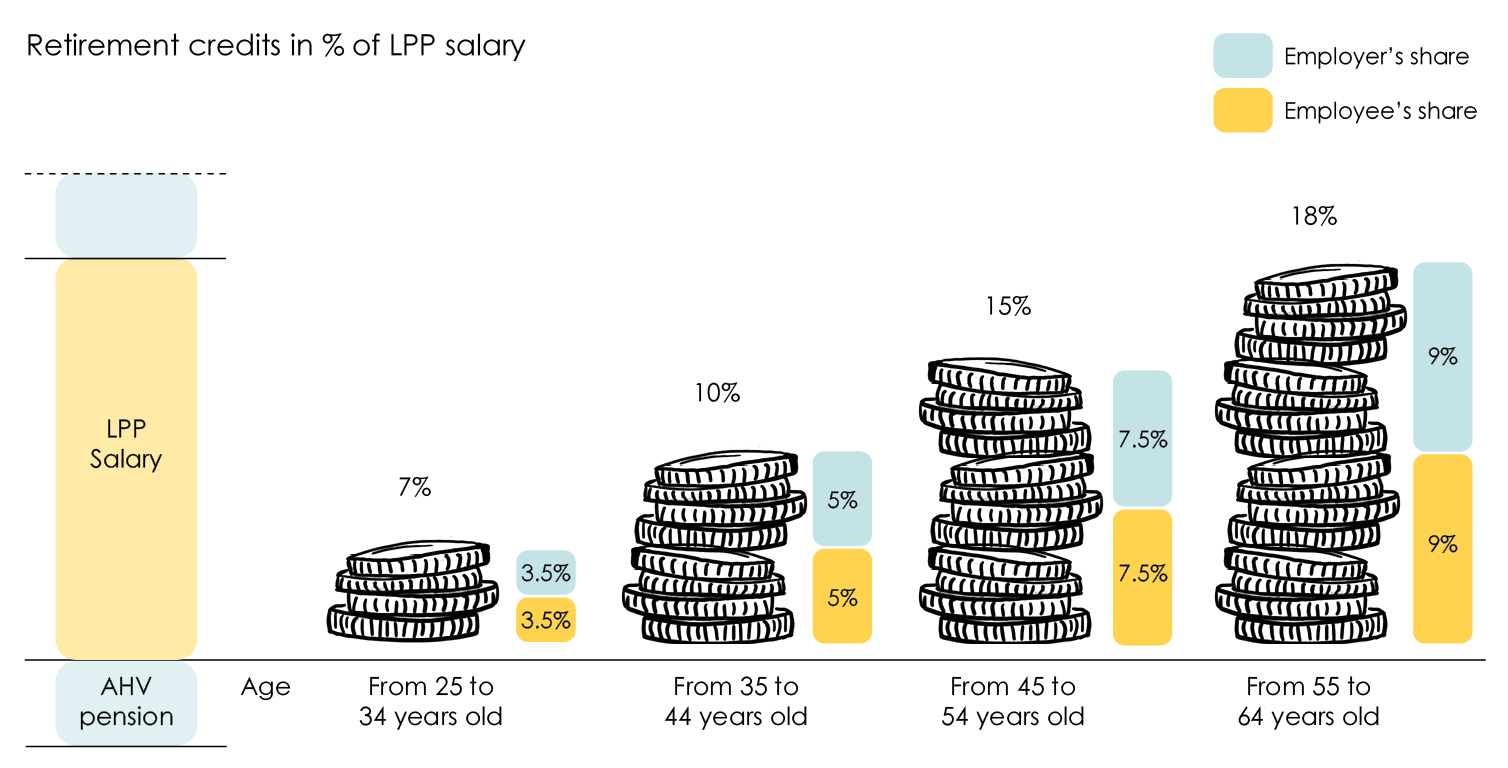

As noted in the first part of this article, part of the contributions (the compulsory part) is set by law. Nobody can contribute less than that. Here are the contribution rates in force until the end of 2023:

Minimum BVG/LPP contributions

- From 25 to 34 years old: 7% of the annual salary (3.5% on you, 3.5% on your employer). On a monthly income of 5,000 CHF at 27 years old, a 350 CHF contribution will be required in total. 175 CHF will be deducted from your salary and your employer will be in charge of the other 175 CHF.

- From 35 to 44 years old: 10% of the annual salary (5% on you, 5% on your employer). On a monthly income of 6,000 CHF at 39 years old, a 600 CHF contribution will be required in total. 300 CHF will be deducted from your salary and your employer will be in charge of the other 300 CHF.

- From 45 to 54 years old: 15% of the annual salary (7.5% on you, 7.5% on your employer). On a monthly income of 7,000 CHF at 52 years old, a 1,050 CHF contribution will be required in total. 525CHF will be deducted from your salary and your employer will be in charge of the other 525 CHF.

- From 55 to 64 or 65 years old: 18% of the annual salary (9% on you, 9% on your employer). On a monthly income of 8,000 CHF at 61 years old, a 1,440 CHF contribution will be required in total. 720 CHF will be deducted from your salary and your employer will be in charge of the other 720 CHF.

That is what is called a sharp increase! But since salaries tend to increase as we grow older. The fact that LPP contributions increase should not be an issue, turns out, the whole thing is rather well thought through.

There’s more to come. So far, our aim has been to explain to you in a fairly simple way how contributions to your 2nd pillar work. To do this, we’ve had to simplify things a little… For the more adventurous, I suggest you hang on a little longer, because there are some small subtleties that can make a big difference if they’re not properly understood.

What is your real insured salary under your 2nd pillar?

The 2nd pillar was created in another era… Salaries were not the same, nor was the cost of living, and life in general was very different. Yes, the 2nd pillar is trying to adapt, but it is only partially successful. The first example is your insured salary.

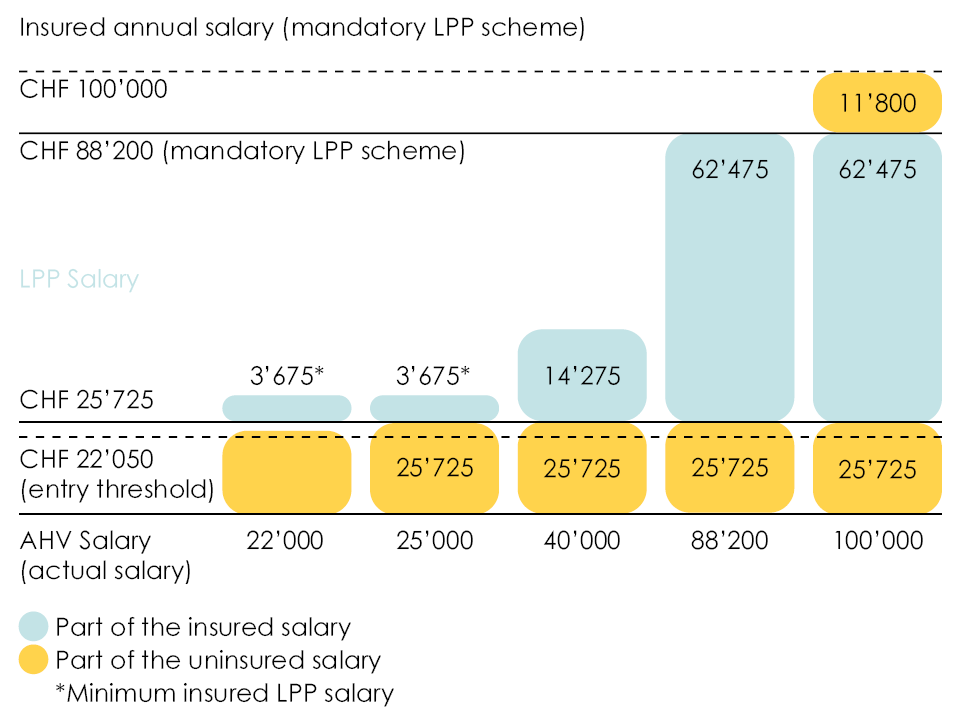

The LPP (the law) obliges employers to deduct contributions from a salary… but unfortunately not necessarily from yours… The law allows employers to do some very important things:

- Insure a maximum of CHF 88,200 per year. In other words, if you earn CHF 100,000, your employer can insure “only” CHF 88,200, without asking you, and therefore only contribute on that salary. The problem? When you reach retirement age, your standard of living is based on CHF 100,000, but your contributions have been calculated on CHF 88,200… And wait, that’s not all.

- Coordination deduction: It’s a complicated word and not necessarily good for your contributions. As well as not being obliged to insure what exceeds the LPP salary (CHF 88,200), your employer is also entitled to deduct CHF 25,725 from your salary, which is supposedly already covered by the 1st pillar (AVS).

What does all this mean? If you earn a salary of CHF 100,000, are 40 years old and your employer wishes to keep to the legal minimum, then he is entitled to insure a salary of CHF 88,200 and deduct CHF 25,725. Your insured salary will fall from CHF 100,000 to CHF 62,475. In our example, you are 40 years old, so the contribution rate is 10%. You will contribute 10% x 62,475 = CHF 6,247.50 per year.

What is the maximum insurable salary for your 2nd pillar?

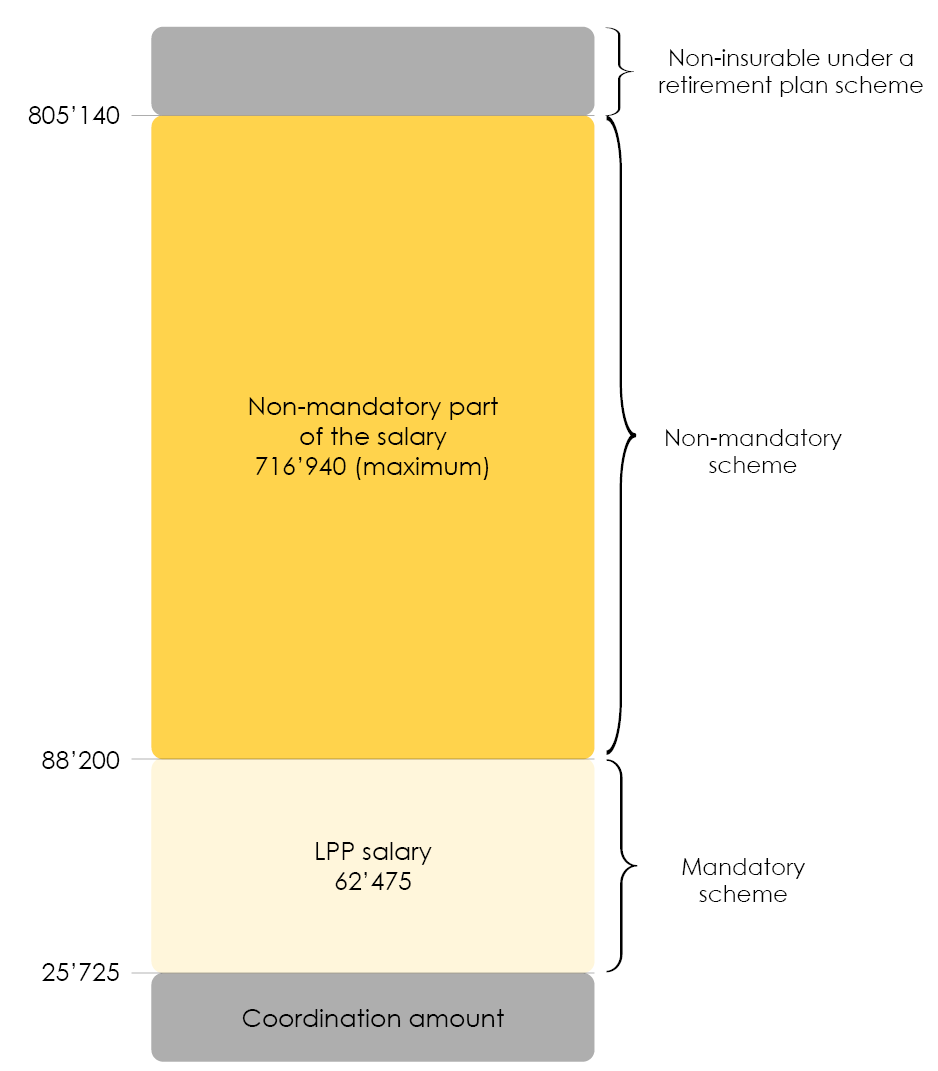

Fortunately, there are as many “stingy” employers as there are generous ones, and so much the better, because the law sets minimum amounts but also allows them to be exceeded by a considerable margin.

Among other things, employers can decide not to apply the coordination deduction in order to guarantee your real AVS/AHV salary. They can also decide to apply higher contribution rates than those in force for your age bracket.

Isn’t that nice?

Here’s another table to help you understand the minimum and maximum amounts authorised for your 2nd pillar.

Phew… here we are…

We hope that by now you’ve understood that the 2nd pillar is a precious source of savings which, at one point or another in your life, will be crucial. It could be the means by which you buy your principal residence one day, become independent or simply enjoy a comfortable retirement.