Written by Yanis Kharchafi

Written by Yanis KharchafiAVS (AHV) contributions for employed persons

The line-up:

AHV contributions for persons in gainful employment

AHV contributions for persons in gainful employment amount to 10.6% of their gross income. I was alarmed when I first read this! Then, I found out my employer would be footing half the bill.

What’s more, the 10.6% is not paid in full to finance AVS pensions; by paying this sum you are contributing to two other social systems:

- Invalidity insurance (AI): 1.4

- Loss of earnings insurance (APG): 0.5%.

Depending on your canton and your situation, other social security contributions may be deducted:

- Unemployment insurance (AC)

- Family insurance (AF)

- Maternity insurance (Amat)

- Etc.

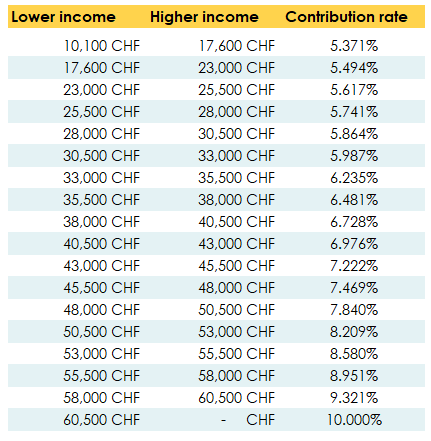

AHV contributions for self-employed persons

Unlike employed persons, self-employed persons must contribute in full on their own, according to their annual earnings. Therefore, OASI contributions of self-employed persons are more onerousand globally, the contribution rate remains below that of an employed person (10%, compared with 10,6% as an employed person).

In addition, different AVS contributions exist for persons without a gainful activity.

For more information, I would recommend that you go check out directly the website of those who are in charge of your first pillar (https://www.ahv-iv.ch/p/2.03.f).