How does the first pillar work and who finances it?

Updated on January, 8th 2024.

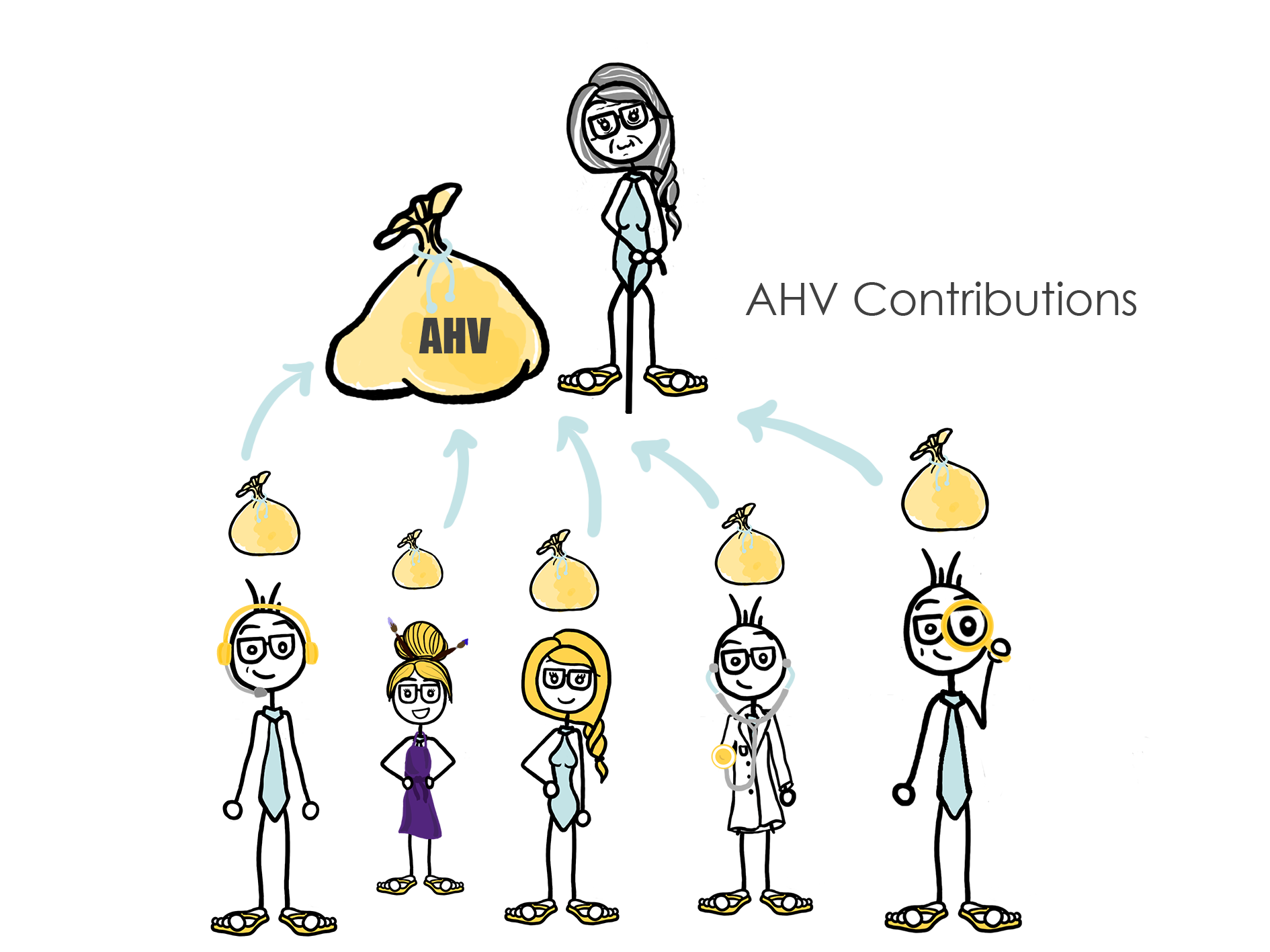

AVS (AHV), a pay-as-you-go social system

Oftentimes, workers believe that they contribute to the AHV (or AHV) in order to then pay their retirement. Which is completely false. Just like in the 19th century, both you and I sacrifice part of our income to ensure the retirement of those who have already worked until the agreed upon age. This is called the principle of solidarity!

Then, when you and I will be retired, it will be active workers’ turn to sacrifice part of their income in order for us to be able to pay for our rent and insurances.

The encouragement to set aside part of one’s income for those who are retired simply turned into a duty governed by the State and extended to the active part of society.

But then who is subject to AHV contributions, except for me?

Firstly, it is important to distinguish between insurees of the AHV and those who contribute to the AHV. All persons living in Switzerland are automatically insured by the AHV, whether they are students, without gainful employment or retired. However, not everyone is required to contribute to the AHV.

Who is insured with AVS but does not pay contributions?

In principle, all young people between the ages of 0 and 21 are insured with the AVS but do not pay any contributions. This insurance is intended to cover them if, before they reach working life, they are unfortunately no longer able to work.

Who is insured under the AVS scheme and pays contributions?

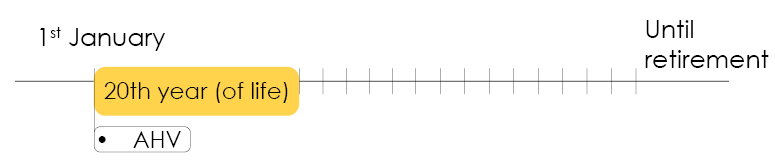

The first time you will be subject to compulsory AHV contributions will be the first anniversary following your 20th birthday. However, if you are gainfully employed before this date, your employer will have to contribute to your 1st pillar, as with all other employees.

Note that if you start working before the year you turn 21, you will still be obliged to contribute to the AHV from the year you turn 17. Although the AHV is calculated over 44 years (21 years to 65 years), if you were lucky enough to contribute before then, these years of “youth” as they are called, will not be lost. They will be useful if a few years later you have to leave:

– Around the world

– Employer abroad

– Sabbatical year

They will compensate for the amount so that you do not suffer a lifetime monthly loss during your retirement.

A 35 year old friend arrived to Switzerland two years ago. He thus started to contribute when he was 33 years old and will do so until the age of 65 years old. Then, when he will be enjoying his retirement in the heart of the Vaudois Riviera or the Broye verdant tranquillity, others will contribute for him.

Personally, I started contributing on 1st January following my 20th birthday. Bad luck for those who were born at the end of the year! And I will contribute until I turn 65.

By the way, how much do I contribute to the AHV? Now that is another excellent question!

Discover our new online platform to entrust us with your tax return!

Complete your 2023 tax return online!

In the blink of an eye!