Written by Yanis Kharchafi

Written by Yanis KharchafiHow can I make the most of my retirement in Switzerland?

Introduction

For some readers, retirement is still a vague, distant and above all uncertain concept, while for others it’s tomorrow. For many, it’s not something you prepare for, but something that simply happens one day or another. For FBKConseils, after your career, retirement is probably the 2nd longest period of your life (at least that’s what we hope for you), so believe me, you might as well prepare for it as well as possible.

In this article we’re going to start by defining the main sources of income for a Swiss retiree, then help you to define in more detail the expenses you’re likely to face. We’ll take everything together and add tax to this budget so that you can see exactly what you’ll have and what you’ll spend.

Finally, depending on how far you are from retirement, we’ll show you the tools and tips you need to put in place to plan ahead and maintain your desired lifestyle for as long as possible.

The line-up:

How much will I earn when I retire?

Like all countries, Switzerland also has a more or less reliable pension system, which since 2021 has been nothing short of a major project (with no end in sight). The 3 pillars at the heart of our system are without exception being reformed in order to adjust and try to best meet the needs of its population.

For all the following paragraphs, please note that FBKConseils has written a large number of articles on the specific features of the 3 pillars in Switzerland, and you will find a summary here. To find out more about each of these subjects, don’t hesitate to read them all. What’s more, at the bottom of this article you’ll find a list of links to legal sources providing a legal basis for all this information.

What pension will you receive from the 1st pillar (AVS)?

The 1st pillar works solely on the principle of pay-as-you-go, in other words, young people pay the pensions of those already retired in real time: what comes in comes out immediately. The 1st pillar does not allow you to build up capital. Your AVS retirement pension will consist solely of monthly pensions paid in 13 instalments from the 2024 vote. These pensions are calculated according to two very simple principles:

Average salary

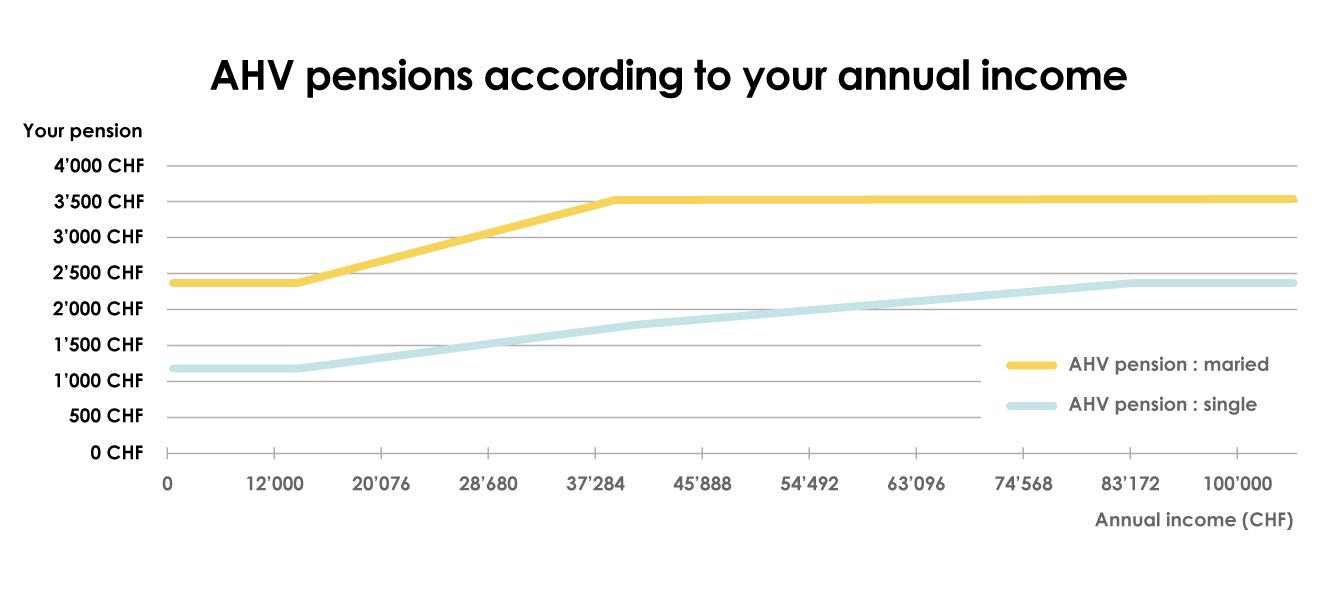

How much have you earned during your career in Switzerland? The average minimum salary is 0 and the maximum is currently CHF 88,200 per year. If you have exceeded this amount throughout your career, you cannot expect to earn more. In terms of pension, for the lowest salaries, you can expect to obtain a minimum of CHF 1,225 and for the highest salaries CHF 2,450 (exactly double).

Read the full article here: How to secure a full AVS (AHV) pension for your retirement?

Number of years of contributions

The second question to ask yourself is: how many years have you worked, or rather contributed, in Switzerland? In 2024, men and women alike will need to have contributed for at least 44 years to be eligible for the maximum pension. A person who should have received CHF 1,600 from the AVS but who has worked for “only” 22 years will receive exactly half that amount, i.e. CHF 800.

Read the full article here: How to secure a full AVS (AHV) pension for your retirement?

What you need to remember from this paragraph is that you can expect a maximum of CHF 31,850 per year from the AVS for 44 years of contributions, and a minimum of CHF 15,925 per year for the lowest incomes.

How much will my 2nd pillar (LPP) pay me?

The first very important thing to remember when talking about the 2nd pillar is that, unlike the 1st pillar, nobody is equal. It is simply unthinkable and probably impossible to compare one person with another, let alone write an article that will enable you, as with the 1st pillar, to determine what you will have once you retire. The reason? The 2nd pillar is not state-run, it is the responsibility of the employer, so even though there are a large number of laws governing contributions, pensions and other important variables, your employer will be of paramount importance in determining what you get once your loyal service is over. The best we can do to help you see things more clearly is to give you as many keys as possible to understanding how the 2nd pillar works by starting with these three articles:

- Article 1 : What can I expect from my second pillar for my retirement?

- Article 2 : How to read your LPP certificate?

- Article 3 : Withdrawing the LPP: as a pension or as capital?

Now that you have done this, you will have a better understanding of the colossal differences between two people who would have had the same salary throughout their career. What’s more, you also know that you will have to make a crucial choice: annuity or capital? And that this choice will shape a large part of your income, your tax and, more generally, your retirement.

How much will my 3rd pillar (A & B) pay me?

The 3rd pillar A or B is a private supplementary savings plan, which depends on nothing but you. You can decide to put extra money into it every year for your retirement, or not at all, or only from time to time. In the end, it’s a savings account that’s more or less locked in. The 3rd pillar A is always tax-free, and in some parts of Switzerland this is also the case for the 3rd pillar B.

The most general rule is that the 3rd pillar, whether taken out with a bank or insurance company, type A or type B, will be paid out as a single lump sum. And don’t forget, before you can spend your 3rd pillar A freely, you will have to go through the tax system. Once this tax has been paid, you can use what’s left over to make the best possible provision for your retirement. We would have liked to have been able to give you more information here on the taxes linked to withdrawals from the 3rd pillar, but this is a vast subject that will vary depending on your country of residence, your canton, your municipality and your marital status.

I think that, after these few paragraphs, we have more or less covered the range of pensions and capital available under the Swiss pension system. For some, these 3rd pillars are the only component of their retirement, while for others, other income or capital will be available. Let’s take a few moments to add them to our budget.

What other ancillary income can I count on?

My stock market investments

It is not uncommon for our customers to decide not simply to put money into their bank accounts, but rather to save in investment products (ETFs, property funds, trading, wealth management, etc.). In principle, if the work is well done and the economy is doing well, this invested capital should generate regular income. To plan for your retirement as effectively as possible, the aim will be to “simulate” as accurately as possible the return that this capital will generate over your entire retirement.

Property income

The stock market is all very well, but some people opt to diversify their portfolios by investing part of their assets in directly owned property, which pays rent every month or every year after maintenance costs, mortgage interest and tax have been paid. After a fairly long holding period, it is generally easier to define the future income from this type of investment.

Annuities and pensions

By this we mean invalidity pensions, widow’s/widower’s pensions, other retirement pensions from abroad or simply pensions paid after a divorce. All this income needs to be added to your budget to get the full picture.

Planning for inheritance

Nobody wants to think about that, but life being what it is and our tax system being what it is, in certain situations it is possible to obtain capital from donations or inheritance.

So, while I’m sure there are other sources of income, we now have enough information to go ahead and start planning your retirement.

Tailor-made budgeting, building a financial plan

At FBKConseils, after taking the time to define your assets and available income in detail, we start by drawing up an initial budget, which should be valid from day one of your retirement. This budget highlights the main household expenditure items:

- Household expenses

- Leisure activities

- transport

- Property-related costs (main residence)

- Other expenses (clothing)

Once this monthly or annual budget has been determined, it will be crucial to identify which items of expenditure are likely to change over time: expenditure at 65 will probably not be the same as at 85. Some items will decrease (travel, leisure, transport, etc.) and others will inevitably increase, such as health-related costs, home help, etc.

What’s more, at FBKconseils we always advise you to deliberately opt for the pessimistic scenario, where spending is higher than it actually is and inflation continues to weigh heavily on households. In addition to the budget per age bracket, we recommend increasing spending by at least 2% to 3% per year.

At this stage, we have just defined our income, capital and financial needs throughout our retirement. In our view, there is still one very important parameter before we can start the calculations: what taxes will we have to pay, and therefore add to our budget?

How much tax will I pay when I retire?

We still sometimes come across customers who are unaware that even after retirement you will still have to declare your taxes and, by extension, pay tax on your income and wealth. Apart from rare cases, such as supplementary benefits (PC), all income is taxable.

How will 1st pillar (AVS) pensions be taxed?

AVS pensions are taxed in the same way as income, and the gross annual amount must be declared. Some cantons, such as Geneva, may allow deductions from these pensions.

How will 2nd pillar (LPP) pensions be taxed?

In principle, as with AVS, pensions from occupational pension schemes should be declared like any other income. Some cantons, such as Vaud, may allow a deduction if the pension started a long time ago.

How will my private pension (3rd pillar) capital be taxed?

As explained above, 3rd pillar A capital is taxed once and for all at the time of withdrawal and must then simply be declared as part of your taxable assets. Type B 3rd pillar capital, on the other hand, is not taxed at the time of withdrawal but, as with 3rd pillar A, must be declared as assets.

How will my stock market investments be taxed?

It would take far too long to give you details of all the investments in movable property. As far as Swiss investments are concerned, you should be able to request a tax certificate from your financial institution, which will give you precise details of the income and assets to be declared each year.

How will my property income be taxed?

Here again, there are many possible cases. Do you own the property privately? Are they held through a company? Are they part of your business assets? Is it abroad? There are as many questions as there are ways of taxing the income… To put it simply and for those who hold them privately, all property income is taxable as income once overheads have been deducted.

Simulating your future tax bill

A crucial part of a successful pension plan is an accurate simulation of your annual tax bill. To do this, you not only need to enter your income and assets, but also all the deductions that will be applied.

Falling incomes and stagnating taxes

Even without any figures, it seems fairly obvious that for most retired Swiss people, their income will be lower than it was during their career. What’s more, the most important deductions often reported on tax returns are directly related to the main activity: meal expenses, transport costs and other professional expenses. Once you retire, you can simply forget about them. The bottom line is that your income will be lower and your deductions just as small…. It’s not unusual for the tax burden not to fall while income plummets.

Once you have carried out this tax simulation, you will have all the information you need to determine how much you will earn, how much you will spend and how much tax you will have to pay. There are 3 possible scenarios at this stage:

Retirement income far exceeds expenditure.

This is the optimal scenario: you can relax in the knowledge that you will be able to maintain your desired lifestyle without having to cut back on certain items of expenditure.

Retirement income is just equal to expenses.

It’s a pleasant scenario, but you need to remain vigilant and see to what extent your capital can support certain unexpected expenses. In this case, it is a good idea to keep part of your assets in low-risk, liquid products.

Retirement income is lower than expenses.

This is a very common scenario, and one that unfortunately forces retirees to adapt. There are several possible options:

- Reduce your expenditure: You need to go back to your budget and remove “unnecessary” expenditure in order to bring your income into line with your expenditure.

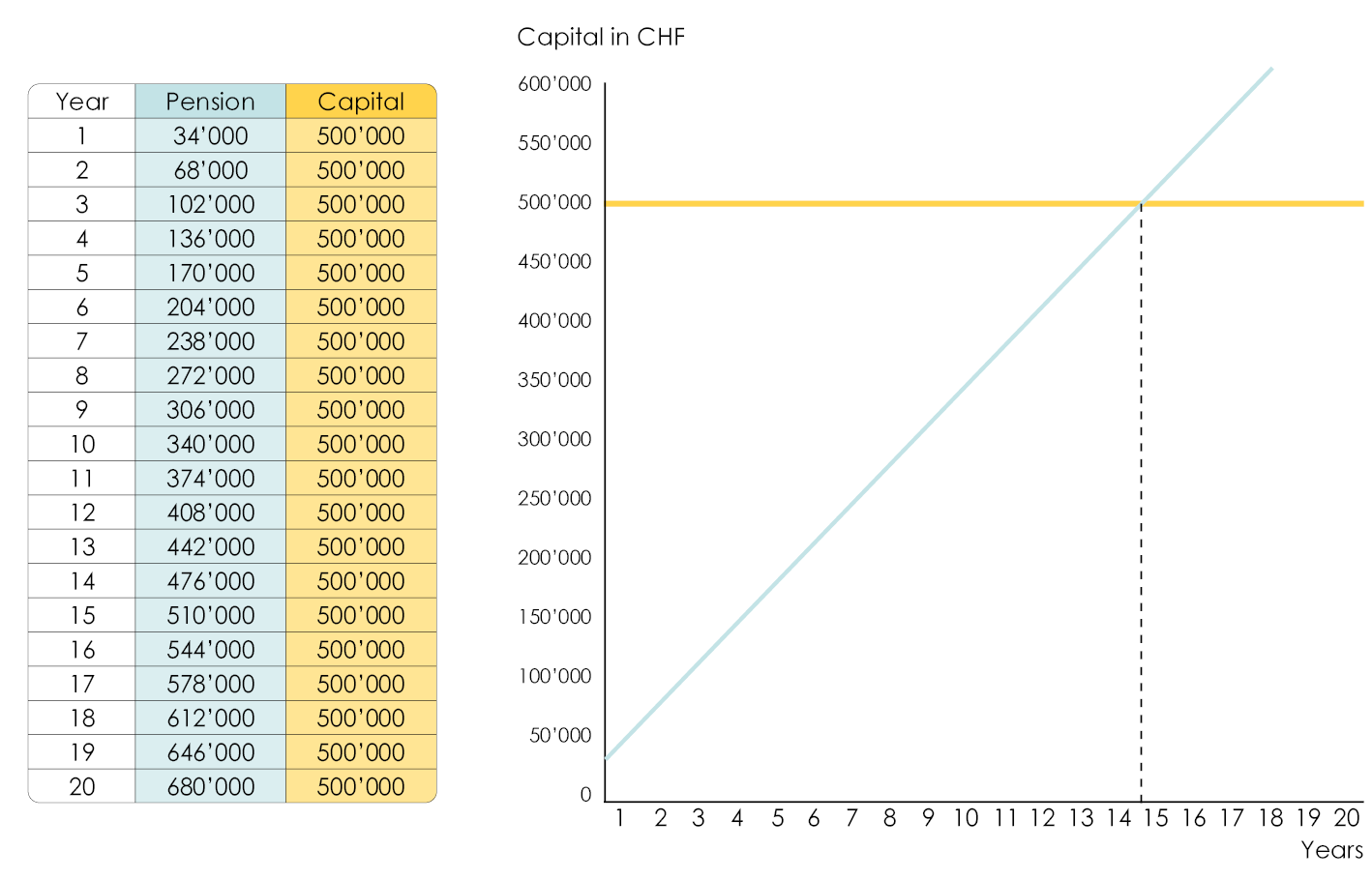

- Draw up a disinvestment plan: If you have some capital available, you can calculate the annual financial shortfall and decide each year to draw on this amount to make up the annual shortfall. The problem with this type of plan is that it is difficult to predict how many years you will need it for (your life expectancy) and each franc you divest will not bring you any income in subsequent years.

- Modify your assets: Some retired people have spent years saving to buy their main residence, which means that instead of remaining the owner, they can sell the house and generate substantial capital that can then be divested over the necessary period.

All these solutions are fairly straightforward on paper, but in reality, every situation is so different that it’s strongly recommended that you find out all you can about them and see what options are available to you.

Our advice on the best way to plan for retirement

Planning your retirement 30 years in advance

When you first start working, it’s almost unthinkable to worry about your pension, yet it’s the ideal time to start looking at the system: How much am I contributing? Why am I contributing? If I do nothing, what will my pension be like? At what age do I want to stop working? If you take a closer look at all these questions, you’ll realise that when you negotiate a salary, your retirement will be largely affected. You’ll also realise that it’s perfectly possible to combine returns, savings and tax savings over a long period of time, and that in the end it’s a good idea to rely on the State, but you’re the first person involved and you also have a role to play. Strangely enough, if I had to give one piece of advice, it would be to focus less on reducing your expenditure and more on increasing your education in the early years, taking a few calculated risks and ultimately increasing your income.

Plan your retirement 15 years in advance

With 15 years to go before retirement, we can start to simulate certain figures with precision. You’re well established in your career and you know what your prospects are. At this stage, we strongly advise you to take an interest in subjects such as BVG buy-backs, which are a game changer for future retirees: less tax and bigger pensions. In addition to these purchases, personal savings and investments are becoming increasingly important. You should also take the time to look at your BVG certificate to determine the conditions under which your pensions and capital will be paid out. A simple change of job before retirement could significantly increase your budget. As the statutory conversion rates become lower and lower, the differences between pension funds can offer enormous economic optimisation.

Plan your retirement 5 years in advance

Here we are, retirement is tomorrow. At this stage, the figures are becoming more and more precise. The first piece of advice is to carry out a retirement assessment and start to establish your budget, your income and your desires. Look at the scenario you find yourself in, and from there you still have a few years to make major changes that will have a significant impact.

Here are the links, laws and external resources useful for writing this article

The aim of our articles is always to simplify understanding of all areas of finance, but it seems crucial to make certain legal sources available so that you can delve deeper into each subject.

- AVS Memento: everything you need to know about AVS

- Calculate your AHV pensions using scale 44

- Law on occupational pensions (2nd pillar – LPP)

How can FBKConseils help you with your retirement planning?

Along with personal taxation and real estate as a whole, retirement is at the heart of our business. At FBKConseils we are able to answer all your questions, carry out economic and tax simulations and propose solutions to optimise your situation.