Written by Yanis Kharchafi

Written by Yanis KharchafiHow much can we save in taxes thanks to the pillar 3?

The line-up:

Introduction

If you’ve landed on this page, chances are you received a call from a broker who kindly suggested setting up a meeting to show you the amazing savings you could achieve by investing in a 3rd Pillar A. Or perhaps it wasn’t a friendly broker but your childhood friend over the holiday season. One thing is certain: you’ve heard about the 3rd Pillar A, but if you haven’t taken the plunge yet, it’s likely because a little voice in the back of your head is saying, “Wait, take a moment to understand before diving in headfirst.”

That’s a wise move on your part, and with this article, you’ll at least be able to figure out how much tax you could save with it.

Let’s dive in!

What is the 3rd Pillar A?

Defining the 3rd Pillar A in detail isn’t the purpose of this article, but rather the focus of this one: What is the 3rd Pillar?. In short, it’s a bank account or insurance policy that allows you to set aside a certain amount annually and deduct it from your taxable income. Essentially, all contributions made during a fiscal year are excluded from taxation.

Who can subscribe to a 3rd Pillar A?

Without going into too much detail, the 3rd Pillar A is available to anyone who, during the year, had income subject to AVS (Swiss social security) contributions. This means that if you received salaries or other earnings on which retirement contributions were paid, you’re eligible for the 3rd Pillar A.

People eligible to contribute to a 3rd Pillar A

Among those allowed to make contributions, we find:

- Employees with a Swiss employment contract

- Self-employed individuals in Switzerland

- Board members

People not eligible to contribute to a 3rd Pillar A

Others, even if they have income or an interest in reducing taxes, are not eligible:

- Non-working spouses: Only the household member engaged in gainful employment is eligible.

- Company shareholders: Dividends received count as taxable income but are not subject to AVS contributions, so no contributions to a 3rd Pillar A are allowed.

- Pensioners (retirees): Pensions and retirement income are considered 100% taxable income in Switzerland. However, since no AVS contributions are deducted, no contributions to a 3rd Pillar A are permitted.

How much can you deduct annually from your 3rd pillar A?

Before simplifying things, let’s complicate them briefly to provide those who are interested with the legal basis for determining the deductible amount each year for the 3rd Pillar A, more formally referred to as private pension planning. The allowed deduction is based on two laws:

- The LIFD (Federal Direct Tax Act) Article 33, Paragraph 1, Letter 3

- The OPP3 (Occupational Pensions Ordinance – 3) Article 7

For those who prefer to skip the legal foundations, here’s the key takeaway: All your contributions to the 3rd Pillar A are tax-deductible.

Is there a minimum contribution for the 3rd pillar A in 2025?

The answer is no, but with a caveat.

From a strictly legal perspective, you could theoretically invest as little as CHF 5 per year—or even CHF 1—though I doubt the practicality of such an approach. A 3rd Pillar A is, in most cases, a simple savings account that offers tax benefits.

Now, the “but” in my answer refers to 3rd Pillar A accounts concluded through insurance. Unfortunately, without any legal basis, insurers often impose a minimum annual “premium” ranging from CHF 100 to CHF 150 per month!

Is there a maximum contribution to the 3rd pillar A in 2025?

This time, the answer is yes, but it’s nuanced: there is indeed an annual deductible maximum, but this maximum varies depending on your professional status.

Individuals affiliated with a 2nd Pillar

Most people refer to this group as “employees,” but that’s a simplification. In rare cases, employees may not be affiliated with a 2nd pillar—such as detached workers. In summary, if you are an employee, you most likely fall into this category, and the maximum deductible amount for you in 2025 will be CHF 7,258.

Individuals not affiliated with a 2nd Pillar

This group includes self-employed individuals who have chosen not to affiliate with a 2nd pillar and detached employees. For this category, the maximum deductible amount is five times higher than for employees: CHF 7,258 x 5 = CHF 36,288.

Self-employed individuals also face an additional constraint: the amount invested in their 3rd Pillar A cannot exceed 20% of their annual profit. In other words, a self-employed person with an annual profit of CHF 100,000 can deduct a maximum of CHF 20,000.

How much can you save each year with your 3rd pillar A?

It is one thing to know how much you can deduct from your income but it would be nice to also know what that means for your taxes!

To find out the real impact of your investment to a third pillar A, you will have to compare:

- Your situation without a third pillar

- Your situation with a third pillar

The difference between the two represents the fiscal impact (of your private retirement planning).

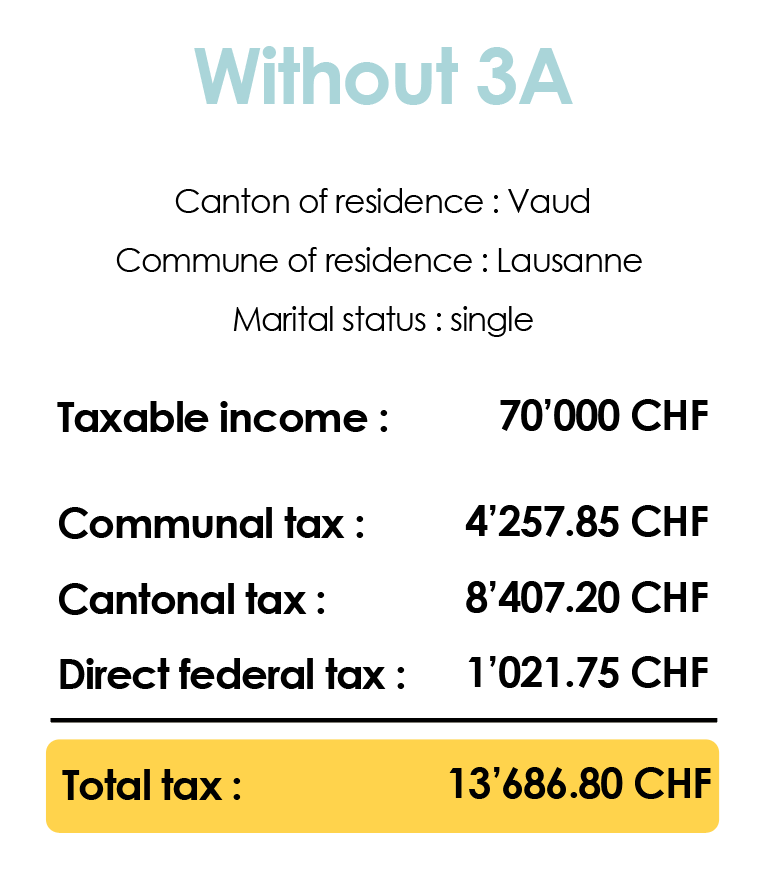

Let’s take my friend Noa as an example, perennial bachelor from Lausanne with a taxable income of 70,000 CHF must pay 13,686 CHF in annual taxes, everything included, before investing in a third pillar A.

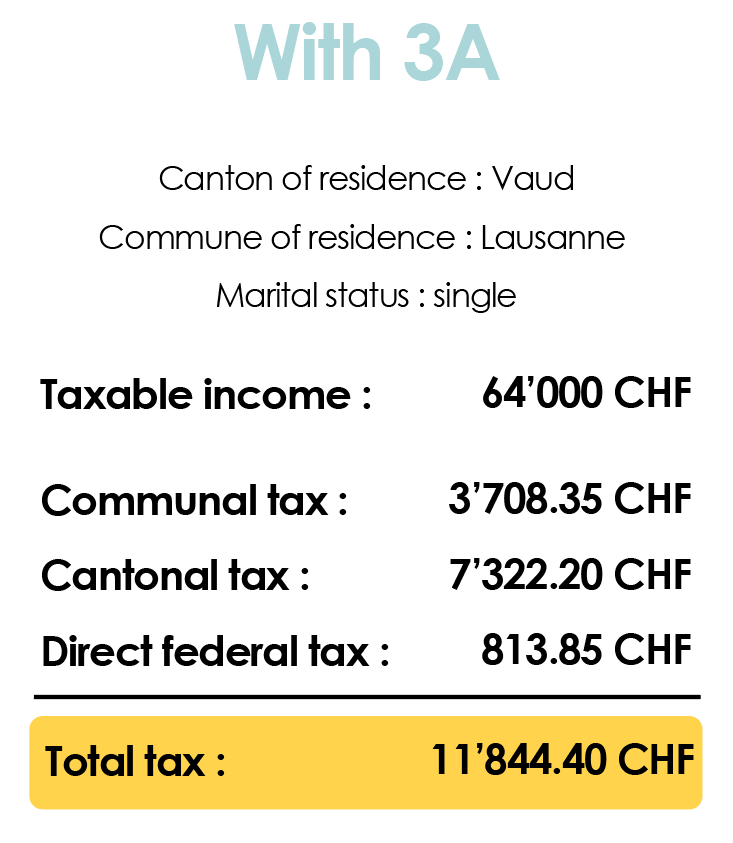

Once the financial institution and the amount are chosen, he decides to go for a yearly amount of 6,000 CHF.

Thanks to the image above, you can easily realise the impact this decision will have on your tax burden.

His tax bill thus went from 13,686 CHF to 11,844.40 CHF. This is a non-negligeable saving:

- He will have saved 13% in taxes.

- He will have made a 30% return on the 6,000 CHF invested.

In conclusion, it is very frequent to see on billboards “invest in your third pillar and save 2,000 CHF”. But the answer cannot be that simple. There are numerous factors influencing your tax savings:

- Your income.

- Your other deductions.

- Your marital status.

- Your commune and canton of residence.

If you wish to know the amount you can save thanks to your pillar 3A, do not hesitate to call us or use our fiscal calculator prepared for you.

How FBKConseils can assist you with your 3rd pillar A?

Introduction meeting

Many of you reach out to us to ensure you make the right choice for your private pension plan, and we truly appreciate your trust. That’s why, even in 2025, we continue to offer a free 20-minute session to address all your questions and guide you in the right direction.

Tax simulation

For some, opening a 3rd Pillar account isn’t about choosing between a bank or an insurance provider but about determining whether this tool actually provides significant tax savings. Indeed, depending on your situation, the tax benefit can vary greatly. We provide precise tax simulations to help you decide.

Advisory session

If you’re looking for specific answers while raising new questions, we also offer in-depth advisory sessions for our clients. These sessions have no time limit, allowing us to perform simulations, provide feedback on contracts you’ve shortlisted, and answer any remaining questions you may have.

Account opening

To save you time and simplify the process, FBKConseils offers support for account opening and liaises directly with banking institutions on your behalf.

Let us help you navigate the complexities of your 3rd Pillar A with ease and confidence!