Written by Yanis Kharchafi

Written by Yanis KharchafiHow to read your LPP certificate?

Introduction

“Dear God, what on earth is a coordination amount?”

If you landed on this page, you are probably wondering how to crack the code of your retirement pension certificate.

How much will your pensions be? How can you withdraw to finance your real estate purchase? What percentage of your income is insured in case of a mishap?

There exists a piece of paper on which part of your future is written down. It is illegible, for anyone who doesn’t know FBKConseils yet. It is frustrating but it is not your fault. I cannot tell you why but insurances just love complicated words.

In this article, we will unscramble together each paragraph of your LPP certificate.

We will shed light on as well as clarify relevant information according to your goals.

The line-up:

A Brief Reminder of Occupational Pension – The LPP

Let’s start with a quick recap of the foundation of the topic: the LPP, more commonly known as the “2nd pillar.” This is your occupational pension, governed by the Federal Law on Occupational Retirement, Survivors, and Disability Pension Plans (LPP). As soon as an entrepreneur hires employees, they are required to affiliate with a pension fund to ensure their employees contribute to the 2nd pillar for their retirement.

In essence, this is an account in your name where the majority of your retirement assets are typically deposited. These assets are funded throughout your career, both by yourself and your employer. Put simply, if you are employed, a portion of your income is deducted from your salary and allocated to your 2nd pillar.

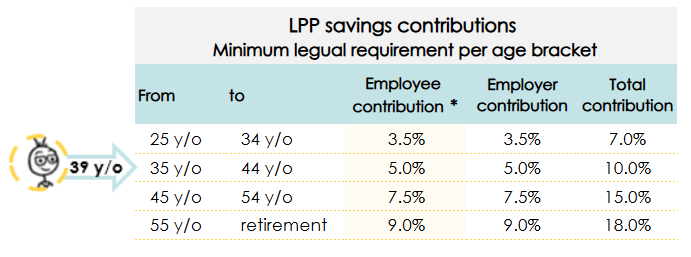

These deductions, called “contributions,” are transferred to the account of a pension fund chosen by your current employer, which also acts as insurance in case of disability… or death. The minimum contribution rates are set by law and increase with age. Employers can offer certain social benefits, such as contributing a higher percentage than you do.

In any case, your funds are securely stored there, awaiting either a change of employer or the fulfillment of one of the rare criteria that allow you to withdraw and benefit from it.

Even though this often-overlooked part of your compensation tends to be relegated to the back burner, or even forgotten, the sums involved are significant and form a crucial part of your savings. For this reason alone, it’s important to understand the basics and even wise to check in on its status from time to time.

What is an LPP certificate?

At the end of every year, your pension fund (chosen by your employer) sends you a paper informing you of your account’s state and the developments in your coverage. This document is called the LPP certificate, occupational pension certificate, or pension fund certificate. Taking a look at it before filing it away won’t hurt. Through this article, we’ll dissect every line so that it holds no secrets for you!

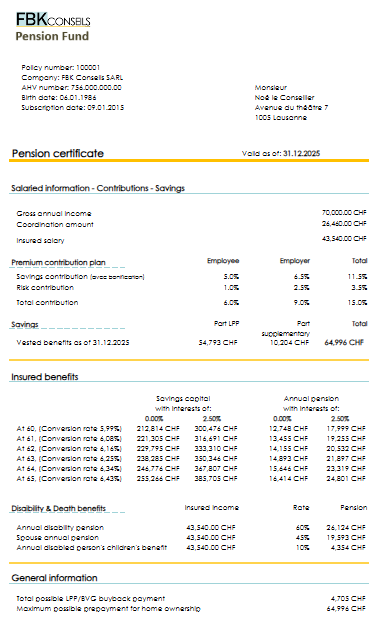

First part: personal information

The certificate is personally addressed to you. This is why you will find your contact information at the top of the document.

In addition to your name, surname, and address, the certificate includes your insured number, AVS number, and the date you joined the pension fund in question. This date should match when you started this job (or when your employer switched to this pension fund).

So far so good.

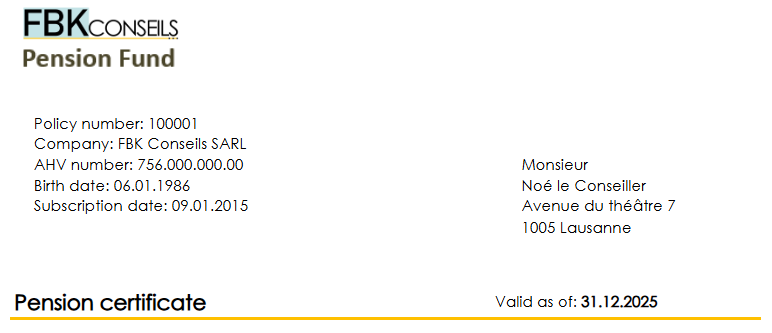

Second part: income information – contributions – savings rebate

After a reminder of your gross annual salary – which you are probably aware of – appears the first mystery of your certificate.

What is a coordination amount/deduction?

It is the amount that is not insured by the second pillar. Why? Because it is already insured by the first pillar, the OASI.

Under the law, the pension fund can deduct up to CHF 26,460 per year starting in 2025 (CHF 25,725 in 2024). A quick aside: if the new pension reform, rejected by referendum on September 22, 2024, had been adopted, the coordination deduction would no longer be a fixed amount but instead a percentage of the AVS salary. Regardless, that’s in the past, and another alternative will need to be found.

The amount is specified on your certificate because your employer can reduce, or even fully compensate this deduction.

For example, if I make 100,000 CHF gross and my pension fund deducts the statutory maximum, I am ensured up to 73,540 CHF.

If they are more generous and choose to cover an additional CHF 10,000, my gross income will be insured up to CHF 83,540. And so on…

Your gross salary – the coordination amount + the potential contribution of your employer = the salary insured by your occupational benefit.

The logical question that arises once the insured salary is defined is: what does it correspond to? And, by the way, what exactly does this insured salary cover? Patience… we’re getting to that!

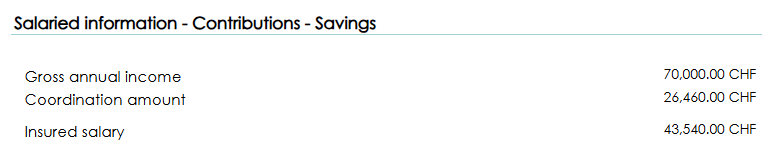

Third part: The savings plan.

Let’s first talk about retirement and the savings contribution: this is where you’ll find out if your employer is generous!

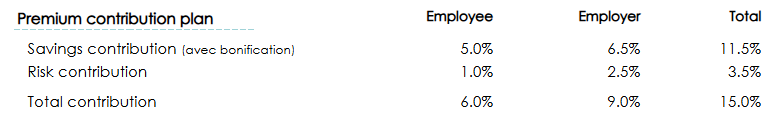

Expressed as a percentage, the savings contribution indicates the portion of your income set aside for your retirement, safely tucked away. As mentioned earlier, the minimum contribution rate depends on your age group: the older you get, the more your employer and you must contribute. See for yourself:

In reality, the only “mandatory” contribution value in this table is the total contribution, which, for my age group, is 10%. The other percentages are logically deduced because the second condition is that my employer must contribute at least as much as I do—therefore, half, or 5%. Consequently, I contribute the remaining share, which is also 5% of the insured salary.

In the end, my employer could very well have decided to cover the entire minimum total contribution while still staying within the rules. Too bad for me! But I can’t really complain, as my conditions are still more favorable than the legal minimum.

Let’s go back to my certificate and analyze its contents.

- My total savings contribution exceeds 10%, so we are within the rules. It’s even better for my retirement.

- This comes from my employer, who has chosen to contribute more than the minimum for an employee of my age — 6.5% instead of 5%: nice. This is called a “bonus,” here of 1.5%.

- I still contribute 5% of my insured salary, which is CHF 43,540 * 0.05 = CHF 2,177 in 2025. This amount is directly deducted from my gross income.By allowing me to contribute 11.5% instead of 10%, I have access to a higher contribution plan, which increases the assets I will be entitled to for my retirement.

Since my second pillar also acts as insurance — which will cover me if life leads to me being unable to work before my retirement — a contribution for risk is also deducted. In essence, this will allow me and my loved ones to receive an income in case of disability or death.

Finally, the total contribution represents the sum of both contributions.

Fourth part: The pension assets

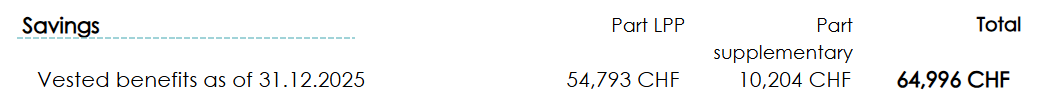

The total amount of your savings is specified on the right side of the exit benefit line, and it represents the current state of your funds. This line shows how much you have today (or rather, as of the date the certificate was issued).

It consists of:

- The LPP retirement savings, referred to here as the ‘LPP part’: this is the amount saved according to the minimum contribution rates set by law, here CHF 54,793.

- The surplus retirement savings, referred to here as the ‘surplus part’: the amount contributed over and above the legal minimum, which, in my example, was fully funded by my employer, here CHF 10,204. We can see that the surplus part is a significant amount. The social benefits offered by an employer should not be taken lightly!

- Finally, the total savings, which is the sum of the LPP mandatory part and the surplus part: CHF 54,793 + CHF 10,204 = CHF 64,996.

Fifth part: Assured benefits in case of retirement (projected).

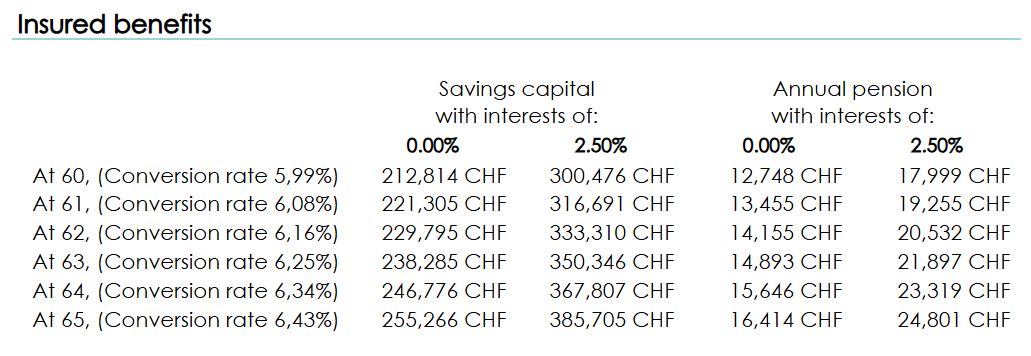

This section simulates the capital saved and the annuities you will receive upon your retirement (early or not), assuming that you will maintain your current conditions until the end of your career. First without interest, then with a hypothetical interest of 2.5%.

Looking more closely at my LPP certificate, and focusing on the simulation without interest:

- If I retire at 60, I will receive either an annual annuity of CHF 12,748 (CHF 1,062 per month), which corresponds to a lump sum of CHF 212,814.

- However, if I wait until the legal retirement age, my annual annuity would be CHF 16,414 (CHF 1,368 per month). If I choose the lump sum instead, it would amount to CHF 255,266.

The difference is significant, right? This is for a simple reason. Between 55 and 65 years old it the time where we contribute the most to our retirement pension, because that’s when rates are the most important.

Sixth part: disability and death insurance.

The second pillar is not limited to mere savings paid as pensions when you retire. Neither can it be described as an amount you can withdraw when you want to buy your first house.

The second pillar is more than just a savings plan. It is also an insurance that covers you and your household members against life’s risks. In case of trouble, how does it work, and what can one expect from their second pillar? It’s never easy to discuss these topics, but it’s better to know what to expect.

In case of an issue that would leave you permanently unable to work, you would be entitled to one or more annuities. These are paid once the AI (disability insurance) has determined your degree of disability, which takes around 720 days (two years). You will receive annually the percentage of the annuity indicated on your certificate, corresponding to your degree of disability. In other words, if the AI determines that you are completely unable to work (100% disability), you will receive 100% of the annuity each year, until your retirement. However, if they decide that you are still able to perform some work, you will only receive a portion of the disability annuity. The disability section and annuity rates are explained in article 24, paragraph a of the LPP.

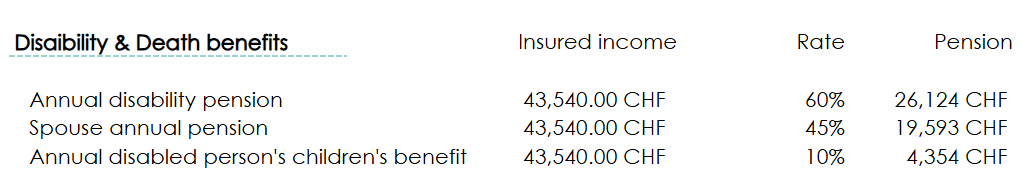

Let’s now look at the various annuities covered:

Temporary disability pension:

It compensates for an eventual incapacity to work following an illness. In my case, I see that my maximum disability annuity corresponds to 60% of my insured salary. If something were to happen to me and I am recognized as totally disabled, I would receive an annual annuity of CHF 43’540 * 60%, which amounts to CHF 26’124.

And in the case of an accident? It’s the LAA (Accident Insurance Law) that takes care of it.

Spouse pension:

Is a pension paid to your spouse in case of death. If the time of Noé, myself, has come before Zoé’s time, my wife, Zoé will get 45% of my last insured salary. That is 19,593 CHF per year, or 1,633 CHF per month.

Orphan pension:

It is an annual sum paid to orphan children, most often to minors or students until 25 years old. In my case, it amounts to 10% of my last salary. If myself, Noé, and my wife Zoé, passed away, our children, Lea and Leo would get each 4,354 CHF per year, or 363 CHF per month.

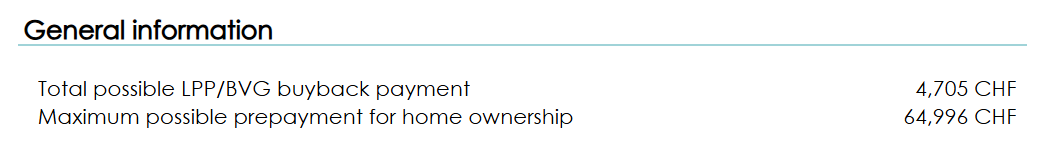

Seventh part: Additional information (repurchase and withdrawal EPL).

Finally, this last section details how many parts you can repurchase this year.

Don’t forget, LPP repurchases can be a significant source of tax savings, but it is essential to fully understand all the implications before proceeding with such a mechanism. To get a clear idea and be sure that it’s a good idea in your case, visit our dedicated article on LPP repurchases.

But also the total available amount, should you withdraw your second pillarbefore you retire, for instance to purchase a home by withdrawing it thanks to the homeownership promotion scheme (EPL).

In conclusion: no providence without clairvoyance.

We have seen how to interpret your LPP certificate. You now know how much you may withdraw, what part of your income is insured by your second pillar and your pensions’ evolution.

How FBKConseils can help you?

A free initial consultation

For those who haven’t found all the answers in our articles dedicated to the 2nd pillar, we offer a free first consultation. During 15 to 30 minutes, you can ask your initial questions and get clear answers tailored to your situation.

A personalized advisory appointment

Even with our numerous articles and resources, it can sometimes be difficult to grasp the full complexity of professional retirement planning, which can quickly become a complex subject depending on your situation. To assist you, we offer advisory appointments lasting 1 to 3 hours. These sessions allow you to take stock of your personal situation, carry out all the necessary simulations, and guide you toward the best decisions for your future.