Written by Yanis Kharchafi

Written by Yanis KharchafiWhat is a third pillar and how to choose between a 3A or a 3B?

The line-up:

Introduction

The third pillar A is an unquestionable fiscal tool but do you truly understand how it works and its role in the Swiss retirement system?

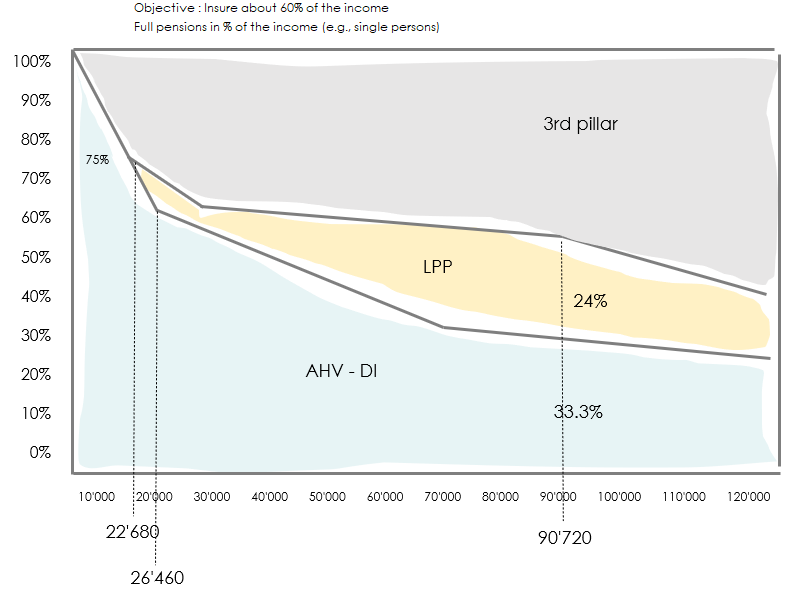

How much do you make in a month? Take this number and divide it by two.

There, this gives you, more or less, a preview of your retirement after having received the first pillar and second pillar. With such a pension, do you think you will manage to maintain your current lifestyle?

After over 40 years of hard work, wouldn’t you want to have some free time to keep travelling? Discovering new restaurants? Buying gifts for your grandchildren?

While the first and second pillars aim to maintain your usual standard of living, let’s say the third pillar aims to maintain your usual standard of living, including leisure activities. Which makes a world of difference.

The third pillar A is the private part of your retirement. Optional, but strongly advised to the point that the Government implemented a tax incentive system. Every person working in Switzerland can open one or several 3A accounts.

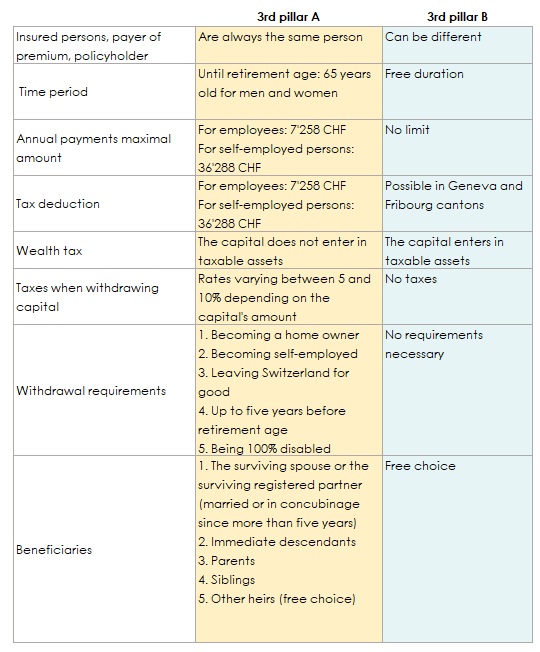

Careful. There are two types of third pillars: private retirement savings related to the age of retirement age (also called 3A) and free private retirement savings, non-related to the age of retirement (called 3B or unrestricted pension provision).

As its name suggests, as part of a retirement saving strategy, the 3A is what interests us the most. That being said, the 3B is also interesting.

Fiscally less attractive, it is more flexible and thus allows for more options. Here is a table with the main differences between the restricted third pillar (3A) and the free third pillar (3B).

When can I open a Pillar 3 A or B account?

Given that the 3rd pillar A and the 3rd pillar B are two very different financial products, I suggest once again that we separate them in order to answer this question.

When can I open a Pillar 3 A account?

The answer is: as soon as you have an income that is subject to AVS, in other words, as soon as you start working in a dependent or self-employed capacity. You need to have an income to be eligible for 3rd pillar A contributions.

Please note: Having the right to open a 3rd pillar A does not mean that it is necessarily a good idea to do so. There is a big difference. The most important thing is not to contribute at any price, but to plan your budget carefully and check whether or not it would be worthwhile opening such an account.

When can I open a Pillar 3 B account?

Anyone living in Switzerland, whether employed or unemployed, is free to open a 3rd Pillar B account. There are no restrictions.

How much can you expect to get from your 3rd pillar A when you retire?

Everyone sells the 3rd pillar as an unstoppable weapon against future financial difficulties. But is this really the case? For once, the answer is quite simple: it all depends on 4 factors:

The monthly amount invested

It is possible to save between CHF 0 and CHF 7,258 per year in 2025 (it was 7,056 CHF in 2023-2024).

The contribution period

It’s no secret… the earlier you start, the bigger your capital will be.

Guaranteed or invested product

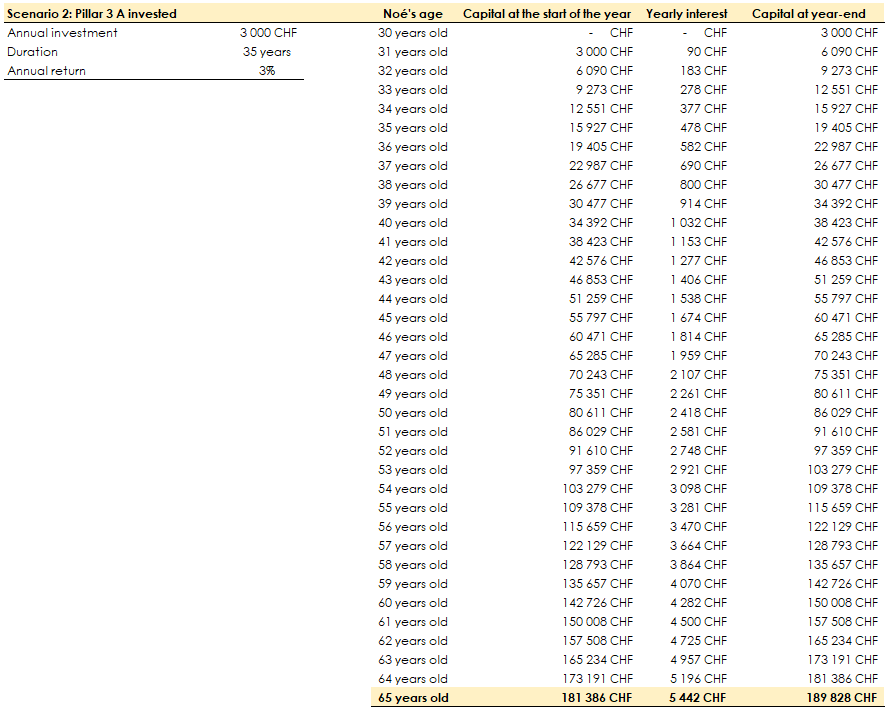

There are guaranteed (or non-invested) 3rd pillar A accounts in which all your monthly payments will be returned to you, subject to annual account charges. Then there are invested products, which will fluctuate up and down depending on the investment chosen, market performance and, of course, management fees.

Bank or insurance

Insurance products are usually more opaque than bank products, with complicated clauses, surrender values and significant charges. On the other hand, as the name suggests, a 3rd pillar A insurance policy will cover you against various life risks (illness, accident or death).

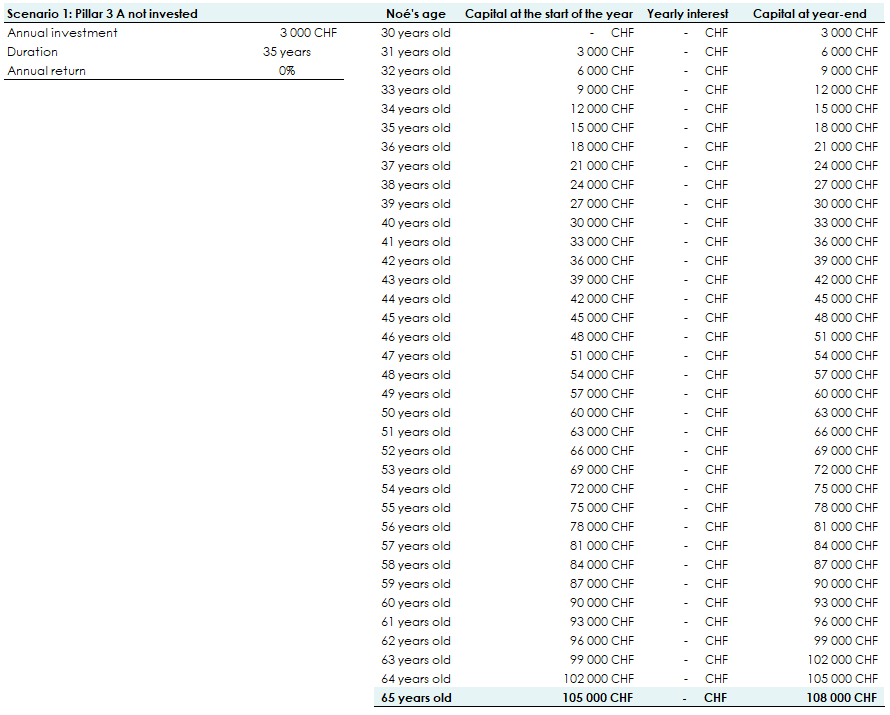

So that you don’t get left out in the cold, let’s take a concrete example. I, Noé, have decided to invest CHF 3,000 a year from the age of 30, once in a non-invested bank product and a second time in an invested product generating 3% interest a year.

So are you more of an investment team? Or a risk-free team?

We would still like to warn you about two very important points:

Capital only

Unlike the 1st and 2nd pillars, the 3rd pillar A can be withdrawn almost exclusively in the form of capital. It will not be possible (or rather difficult and not very attractive) to convert it into a pension.

Tax on capital withdrawals

As with the 2nd pillar, you will pay tax on withdrawals from the 3rd pillar A, which will reduce your final capital to a greater or lesser extent.

How FBKConseils can help you with your 3rd pillar A?

Introductory Meeting

Many of you write to us and schedule appointments to ensure that you make the right choice for your private pension plan, and we are grateful for that. That’s why, in 2025, we still want to take twenty minutes free of charge to answer all your questions.

Tax Simulation

For others, opening a 3rd pillar is not just about choosing a bank or insurance company, but about whether this tool really helps save on taxes. Yes, depending on the situation, the tax savings can vary greatly. We offer a precise tax simulation to help you understand this.

Consultation Meeting

If you want to get detailed answers while also asking new questions, we also offer unlimited time meetings with our clients. This will allow us to perform simulations, give our opinion on the contracts you have selected, and, above all, answer any remaining questions.

Account Opening

To save time and for simplicity, FBKConseils offers assistance in the account opening process and will interact on your behalf with the banking institutions.