Written by Yanis Kharchafi

Written by Yanis KharchafiWhy is it advantageous to have several pillar 3A accounts?

Introduction

“Opening several third pillars A? Really?”

Admit it, you are wondering how on earth this can be useful? Especially since we know that the maximal amount that can be saved to these pillars 3A altogether is 7,258 CHF for 2025 and 2026 (it was 7,056 CHF for 2023 and 2024), whether at insurances or banks.

For the simple reason that no one is stopping you from saving to several accounts! It is totally possible to open two accounts with insurances and three accounts with banks, as long as the total amounts paid to all your 3A put together does not exceed 7,258 CHF (for 2026).

The line-up:

Opening several 3A accounts to save on taxes

If you’ve read our article “How much taxes will you have to pay if you withdraw your third pillar A?” , you know that withdrawing your third pillar A comes with an exit tax.

And this is what this article is all about! The bigger the amount withdrawn, the higher the taxes!

Do you see what I am getting at? Yes, separating your private providence will allow you to reduce the amount in each account and thereby, you will be able to take out money these different accounts, gradually, depending on your needs, rather than emptying the whole thing in one go.

Numbers! Numbers! Numbers!

Indeed, it is always easier with an example:

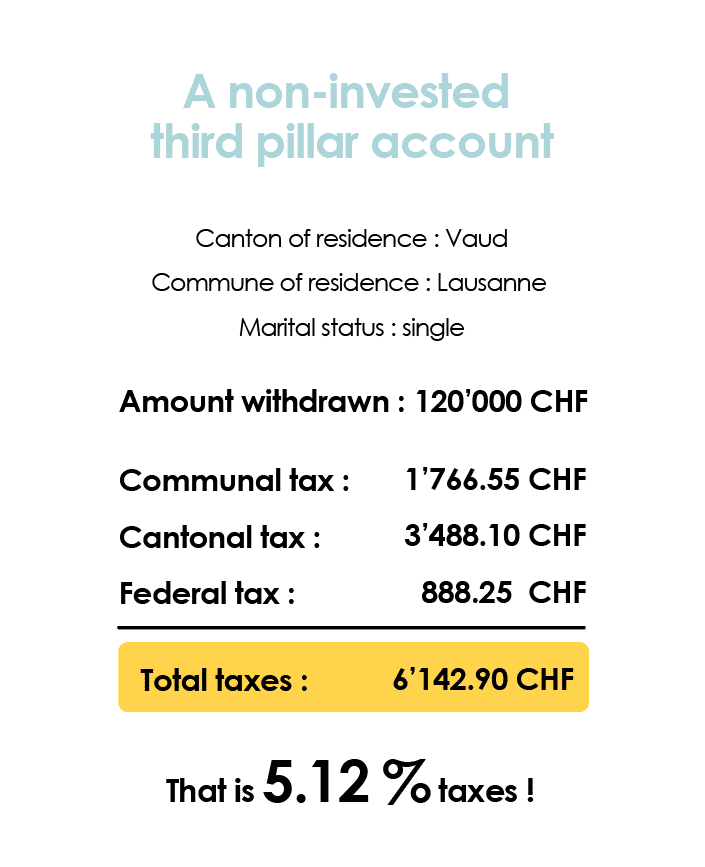

First case: I have only one non-invested third pillar A account on which I paid 4,000 CHF per year from my 30 to my 60 years old. I thus saved 120,000 CHF, that I will withdraw in full:

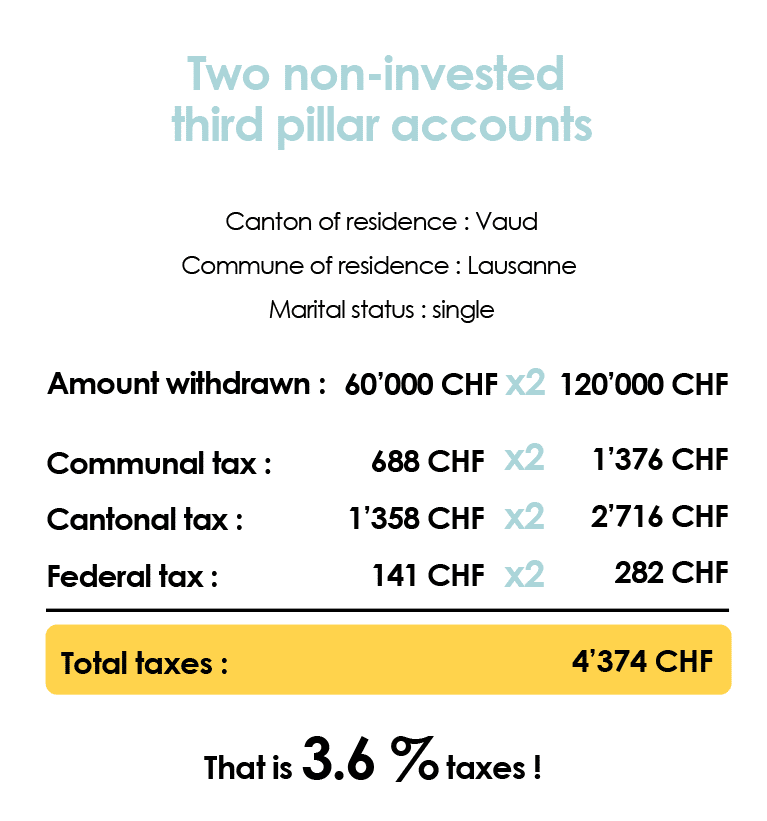

Second case: I have two non-invested third pillar A accounts on which I paid 2,000 CHF each per year from my 30 to my 60 years old. I thus saved 60,000 CHF per account, that I will make sure to withdraw separately:

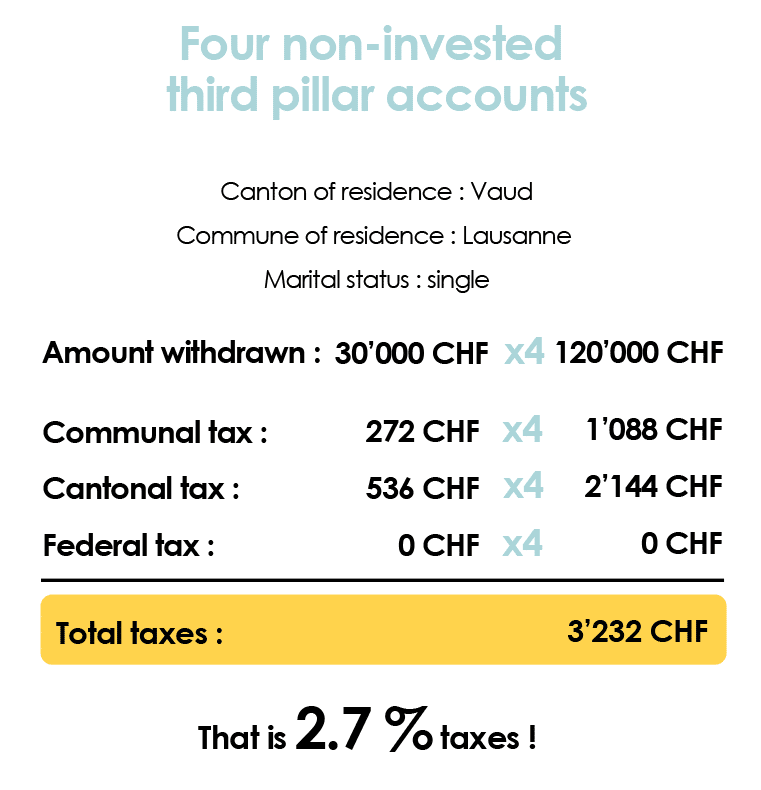

Third case: I created not two but four non-invested third pillar A accounts on which I paid 1,000 CHF each per year from my 30 to my 60 years old. I thus saved 30,000 CHF per account, that I will make sure to withdraw in four times:

I know what you are thinking, this is good advice! By simply separating your savings, you go from taxes exceeding 6,000 CHF to taxes of 3,200 CHF. I must however warn you about the fiscal authorities who do not like this method, which it considers to be tax evasion! So if I may give a piece of advice, do not push your luck too far with this.

Opening several 3A accounts to make the most out of the third pillar

Few people know this but the third pillar A can be used for several things apart from saving on taxes:

- Products with interesting returns.

- Products capable of protecting your family.

- Mortgage amortisation products.

If you have the time and the patience to look into the complexity of the products that are on the market, you will find out that you can find solutions meeting almost perfectly your expectations.

Let’s imagine you want to buy a home in 10 years and you still need 60’000 CHF in personal funds. If you pick only one product, you will have to decide between:

- Placing your savings on a product invested on the market and take the risk of returns lowering at the end and thereby failing to meet the 60,000 CHF goal

- Placing your savings on a non-invested product in order to make sure to have the desired amount when needed, but by doing so, preventing you from making potential returns over the next 10 years.

Fractionning your pillars 3A will offer you more freedom and, most importantly, makes your private providence even more useful.

How FBKConseils can assist you with your 3rd pillar A?

Introduction meeting

Many of you reach out to us to ensure you make the right choice for your private pension plan, and we truly appreciate your trust. That’s why, even in 2026, we continue to offer a free 20-minute session to address all your questions and guide you in the right direction.

Tax simulation

For some, opening a 3rd Pillar account isn’t about choosing between a bank or an insurance provider but about determining whether this tool actually provides significant tax savings. Indeed, depending on your situation, the tax benefit can vary greatly. We provide precise tax simulations to help you decide.

Advisory session

If you’re looking for specific answers while raising new questions, we also offer in-depth advisory sessions for our clients. These sessions have no time limit, allowing us to perform simulations, provide feedback on contracts you’ve shortlisted, and answer any remaining questions you may have.

Account opening

To save you time and simplify the process, FBKConseils offers support for account opening and liaises directly with banking institutions on your behalf.

Let us help you navigate the complexities of your 3rd Pillar A with ease and confidence!