Written by Yanis Kharchafi

Written by Yanis KharchafiHow much taxes will you have to pay if you withdraw your pillar 3A?

Introduction

Oh, I know what you are about to say!

“But Noé, if I opened a third pillar account, it was specifically to save on taxes, not to delay them until I retire!”

I know, I know. But the taxation of the third pillar is below the usual rates. The more your assets are important, the more the tax rate increases.

In this article dedicated to withdrawing your 3rd pillar, I suggest clearly separating the withdrawals made while you are a Swiss resident from those made when leaving Switzerland. This distinction is important because the tax mechanisms are completely different.

The line-up:

Taxes to be paid on the withdrawal of your 3rd pillar A when residing in Switzerland

We’ll begin this article with the situation of anyone who wishes to use their 3rd pillar assets to finance a home in Switzerland, launch an independent business, or simply enjoy their retirement. This first section therefore applies to people whose tax residence is in Switzerland at the time of the withdrawal.

I’m emphasizing this point strongly, because everything will be very different in the second part of this article.

To give you an overview of this first mechanism, you need to understand that as long as your tax residence is in Switzerland, the authorities know they can track and collect the tax payment. In other words: if you forget to pay, you’ll first get a polite reminder… then a second one… and eventually, perhaps, a slightly less friendly letter from the debt collection office.

In short, as long as you’re here, the tax office sleeps soundly.

Since the administration’s stress level is close to zero in such cases, it allows your full 3rd pillar capital to be transferred to your bank account without any immediate tax withholding. It’s only later that you’ll receive the inevitable “bill”: the tax due on the withdrawn amount.

In the next part of this article, we’ll explain how to estimate the tax burden to expect depending on the canton where you reside, once your withdrawal request has been submitted.

Taxes on 3rd pillar A withdrawals in the canton of Vaud

Even though I know you’re eager to find out how much tax you’ll pay if you live in the Canton of Vaud, I suggest we first take a brief theoretical and legal detour before diving into the concrete examples.

The 3rd pillar withdrawal mechanism in the canton of Vaud

For once, our canton can be seen as an example of simplicity: Withdrawals from the 3rd pillar A (just like those from the 2nd pillar) are considered income, just like a salary. However, they are not taxed together with your other income, but separately, and at a reduced rate.

What does “at a reduced rate” mean? Quite simply, it means that the tax rate is calculated in exactly the same way as for your regular income — but once the rate is determined, it’s divided by five.

Simple enough, right?

All of this is clearly stated in our dear Vaud Cantonal Law on Direct Taxes (LI-VD), Article 49.

Example of a 3rd pillar withdrawal calculation in the canton of Vaud

Time to talk numbers!

Let’s take the case of my friend Noae. This young woman decided to withdraw the CHF 200,000 she had patiently saved in her bank-based 3rd pillar A account to launch her self-employed activity.

Referring back to the theoretical part, this means that to determine the applicable tax rate, we need to ask: what would her tax rate have been if her taxable income for the year had been CHF 200,000? — for example, in March, when filing her tax return.

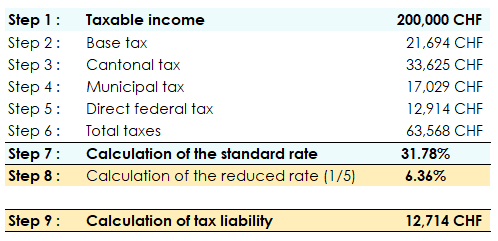

In the image below, this corresponds to steps 1 to 7:

For those who might not fully understand the details of these steps, I invite you to read my dedicated articles:

- on how income tax is calculated in the canton of Vaud, and

- on how to calculate the federal direct tax (see step 5).

Once you reach step 7, all that’s left to do is divide the tax rate you found (in this case, 31.78%) by 5.

You thus obtain an effective rate of 6.36%, which will be applied to the withdrawal amount — in this case, 200,000 CHF.

Taxes on 3rd pillar A withdrawals in the canton of Geneva

As with the canton of Vaud, let’s take a quick theoretical detour before diving into the calculation, which, I warn you, won’t be entirely straightforward. In Geneva, the reference is the LI-GE, the Law on Taxes of Individuals. Everything is specified in Article 45, and the good news is that the mechanism is exactly the same as in the canton of Vaud.

Pension fund withdrawals are taxed separately from other income, at a rate equal to one fifth (1/5) of the ordinary rate that you would pay on any other income.

With this knowledge, we can now move confidently to a concrete example to see this theory in action.

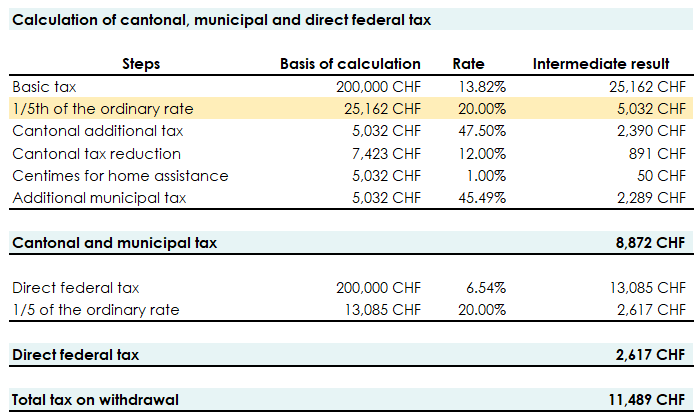

Calculating taxes on 3rd pillar withdrawals in Geneva

In my opinion, if you live in Geneva and receive your annual tax assessment, you know how confusing the tax calculation can seem…

The steps have impossible names, are far too numerous, and are often hard to follow.

That’s why, if you want to properly follow the example below, I recommend spending about ten minutes reviewing the dedicated article on income tax in the canton of Geneva.

If, as in our Vaud example, you had saved CHF 200,000 in your 3rd Pillar A and decided to withdraw it as a single person, here is how your tax calculation would proceed:

We can’t do all the examples and take all the amounts, but what we can do to make your life easier is to give you the Genevoise calculator website so that you can do your own simulations.

And I don’t need to tell you that calculating is good, but continuing to inform yourself and doing everything you can to reduce your tax burden as much as possible is even better.

Taxes on 3rd pillar A withdrawals in the canton of Valais

Valais makes no exception to the rule. Withdrawals from the 3rd pillar (or 2nd pillar) also involve exit tax.

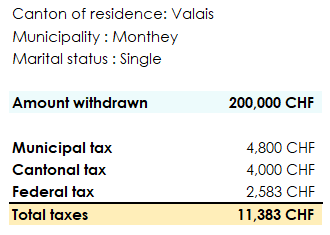

We will also consider the case of Noa, who has set aside CHF 200,000 over the years and wishes to withdraw it. He currently lives in Monthey.

Total tax will amount to CHF 11,383.

Lump-sum withdrawal of your pillar 3a: Other things to know

In this article we’ve tried to build a solid theoretical base and give you concrete examples that should allow you to estimate your tax burden fairly reliably.

But before we conclude and move to the final part — the withdrawal of Pillar 3a when leaving Switzerland — I want to share a few important clarifications:

- Marital status: At FBKConseils we don’t cover every canton (yes, I have my favourites!). For the cantons we do follow, civil status can play an important role, generally to your advantage. Don’t forget to include it in your simulations.

- Avoid withdrawing multiple plans in the same year: Whether you hold several Pillar 3a accounts or you’re married, avoid withdrawing them in the same tax year if possible. All withdrawn pension assets will be added together, and the tax rate will be calculated as if you had made a single large withdrawal.

- Schwyz — nice place to live (but not to dodge taxes): If you’re thinking of a little tax hop between age 61 years + 7 days and 61 years + 12 days to an Alemannic canton where, by fortunate coincidence, low tax and pleasant life rhyme — beware: it’s unlikely to work. Changing your tax residence without a genuine intention to stay there permanently will likely earn you a tidy tax correction.