When and how to withdraw the pillar 3A?

Updated on November 30th, 2023.

Wearing nice comfy slippers and my favourite purple silk robe made by the village seamstress, steaming coffee in one hand, morning paper in the other, contemplating the beauty of the lake from my terrasse in Lavaux.

This is how I picture the morning of my 65th birthday.

Ok, ok, maybe I am taking it a little too far. But I take care of my future. So, I can dream. Just a little…

When can I withdraw my first pillar?

There are exactly five requirements to withdraw your third pillar A.

The third pillar B being linked to the retirement age, the same requirements than those of the second pillar are applicable. These 5 solutions are presented later in this article.

In what form can I withdraw my pillar 3A?

Ok, it is raining cats and dogs and I have been working for 20 hours without a break. I’ve made up my mind! I am leaving the country and retiring in a small village at the Basque coast. I found this adorable home to happily relax in.

I get in touch with my insurance. Even better: I contact FBK Conseils, they do all the work for me and let me know that I will receive my third pillar as a capital. In other words, the entire amount will be transferred to me at once.

This is standard practice. Although, some insurances now offer to pay the third pillar as a pension.

In the event of a withdrawal, I will be sure to report it to the relevant tax authorities after having fully informed myself of the tax risks involved.

I can withdraw my pillar 3A at retirement age or five years earlier

At 65 years old for men and 64 years old for women. If you are in a rush, you can withdraw it five years before you retire. That is 59 years old for women and 60 years old for men.

I can withdraw my pillar 3A to purchase or to build my main residence

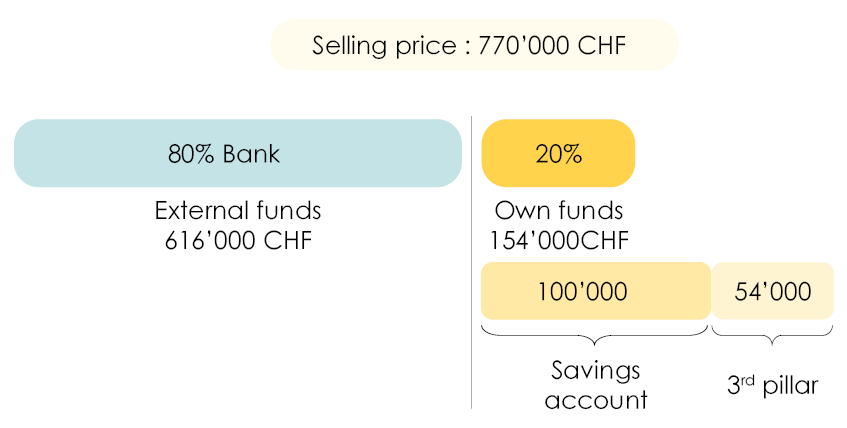

How many times have you dreamt of this villa in the middle the of Gruyère lake region, away from the hustle of city centres? An idyllic location to call home and grow your little family. And finally, an opportunity presents itself. Its price: 770,000 CHF.

On your savings account, the sum of 100,000 CHF is patiently waiting for the day it will be used. The required down payment is 154,000 CHF, which corresponds to the minimal 20% required (some banks demand a higher personal contribution).

You are still 54,000 CHF away from your beautiful dream. In this case, you can withdraw all or part of your third pillar, provided that you will live in the purchased or built home.

Finally, you can also withdraw your third pillar to repurchase shares of your future home or to reimburse a pre-existing mortgage debt.

If I want to demolish an old farm at the countryside of La Broye in order to transform it into a rental complex, I will not be able to use my third pillar. However, if I want to build my primary (and not secondary) residence there, I will have access to it.

I can withdraw my pillar 3A if I want to start a business

Last night, the sandman fell asleep before reaching my house. All kinds of thoughts went through my mind. All of a sudden, one of them lit the entire room up!

I will create the most detailed and comprehensive information-wise website about insurances, finances, banks, and above all my favourite: taxes. A completely free platform, accessible to all. I will transfer the knowledge from the advisor to the client. Because knowledge is power!

In order to hire the best writers, the most talented graphists and the most innovative developers, I require a buget that I do not have. I discuss this with my banker who advises me to use my third pillar.

Shoot! After a thorough market research, it turns out such a website already exists: FBK Conseils.

The bottom line is, it is possible to withdraw one’s third and second pillar when changing status. If you decide to become self-employed, you will have the possibility, without any limitations, to withdraw your entire third pillar account.

Be careful: Creating your own company does not suffice to withdraw your third pillar! You must be independent and cannot be an employee of your own structure!

I can withdraw my pillar 3A in case I become disabled

In case you become disabled, you can withdraw your pillar 3A if you benefit from a full disability pension from your first pillar (from the DI, disability insurance) and that this disability is not covered by your third pillar.

I can withdraw my pillar 3A if I leave Switzerland

What if I do not find my Eldorado at the Gruyère lake but rather in a small village at the Basque coast? Walking around in slip-ons, eating pintxos in San Sebastian and watching the surfers caress the waves as if I was in California….

I am not saying I am about to leave… but I must admit I did think about it, after a never-ending rainy day, or a 50-hour work-week. And I know that should I decide to leave for good, I will not be leaving alone, I can count on my third pillar!

Be careful: there are two important elements to keep in mind when taking out your little jackpot and wandering away to other horizons:

The third pillars in insurances have a repurchasing value (as explained at the bottom of this article! This repurchasing value is set down in black and white in the contract and determines your amount when you decide to terminate the contract. These values can be extremely low the first years. Before signing such a contract, pay attention to the fact that a premature departure may result in a significant loss!

And unfortunately, you must pay an exit tax.

Discover our new online platform to entrust us with your tax return!

Complete your 2023 tax return online!

In the blink of an eye!