Written by Yanis Kharchafi

Written by Yanis KharchafiPillar 3A at the bank or with an insurance, what is the best choice?

Introduction

Everyone who ever took interest in the pillar 3A has been faced with this dilemma: bank or insurance? Over time, with what we hear and what we read, we get a more or less general idea of what both options imply.

Quick reminder: the third pillar B cannot be contracted via a bank and is in principle not deductible, except in a few cantons!

However, what we hear and read is directly related to what bank or insurances want to put forward. They all try to make you tilt on their side of the scale.

But how can you make the right choice?

The line-up:

What’s the difference between opening a 3rd pillar account with a bank or with an insurance company?

To avoid spoiling everything you’ll discover below, let’s start by laying out the basic theory behind the two types of Pillar 3a accounts.

Simply put, a bank-based Pillar 3a is nothing more than a locked savings account, similar to a traditional savings account.

The amounts you deposit are tax-deductible each year, up to the limit set by current legislation (CHF 7,258 for the years 2025 and 2026). For those who want to go a step further, these funds can also be invested in financial products in the hope of generating returns and growing your capital over the long term.

As for the insurance-based Pillar 3a, things get a bit more complex. In this case, you’re not depositing your money with a bank — you’re signing an insurance policy. The insurer receives your contributions, keeps a portion to cover certain risks (such as death or disability), and then invests the rest through a bank or wealth manager to help your savings grow.

In short, an insurance-based Pillar 3a is essentially a bank-based Pillar 3a with built-in risk coverage, but it’s usually associated with higher fees.

Now that we’ve covered the basics, let’s take a closer look at each of these two options.

Opening a 3rd pillar insurance policy: how to choose the best company?

One of the two alternatives to open a third pillar is to go through an insurance. Be cautious, not all Swiss insurances offer private providence! If you get in touch with Helsana or Assura to contract a third pillar A, the broker you will have on the line might not understand the purpose of your call.

The 3rd pillar in insurance: What is your 3rd pillar made up of?

If you opt for opening a third pillar A with an insurance, you will be deciding for what is called a life-insurance (pure risk or combined risk and savings insurance). I must say this wording sounds very American and immediately makes me think of the huge jackpot my successors will get when I pass away.

This popular belief is not absurd but it is slightly inaccurate.

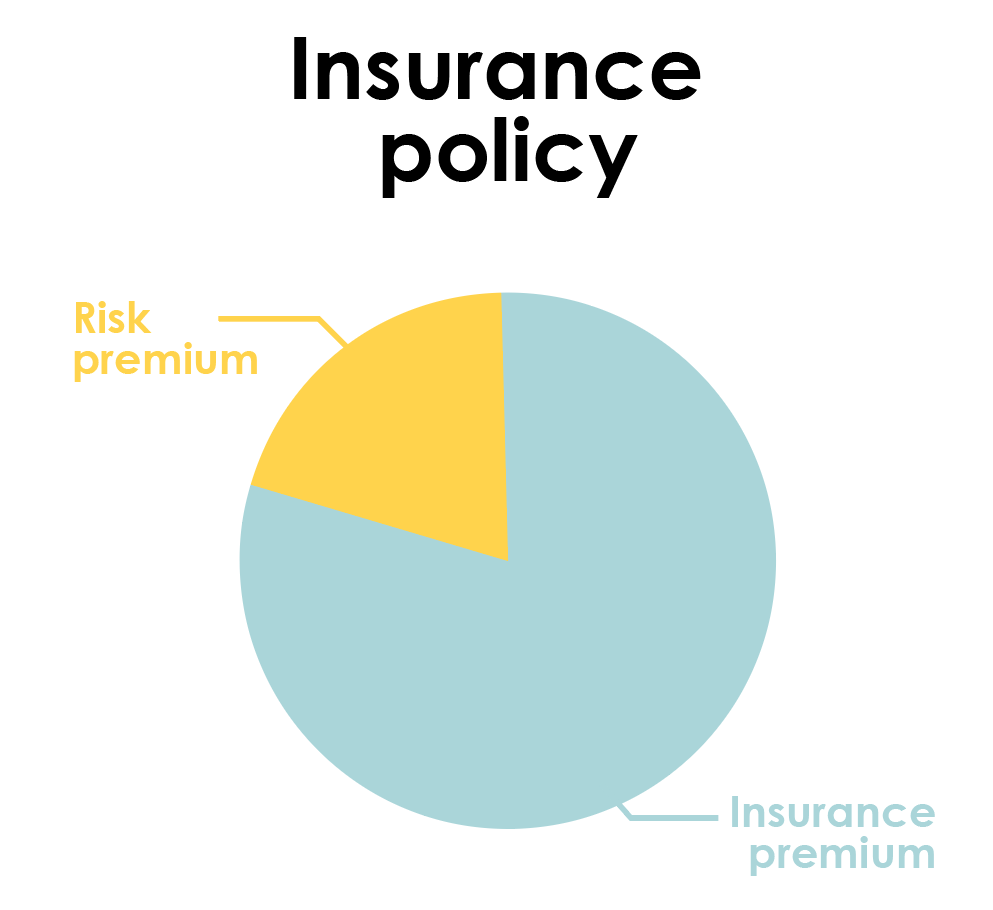

Again, for the sake of simplicity, let’s say that insurance-based Pillar 3a plans are almost always made up of two main components, sometimes even three — although in practice, it’s also possible to have only one of them.

Component 1: The savings premium

It is the part of your periodical investment (monthly/annual) which will be dedicated to your retirement. This part will go back to you when you will need it!

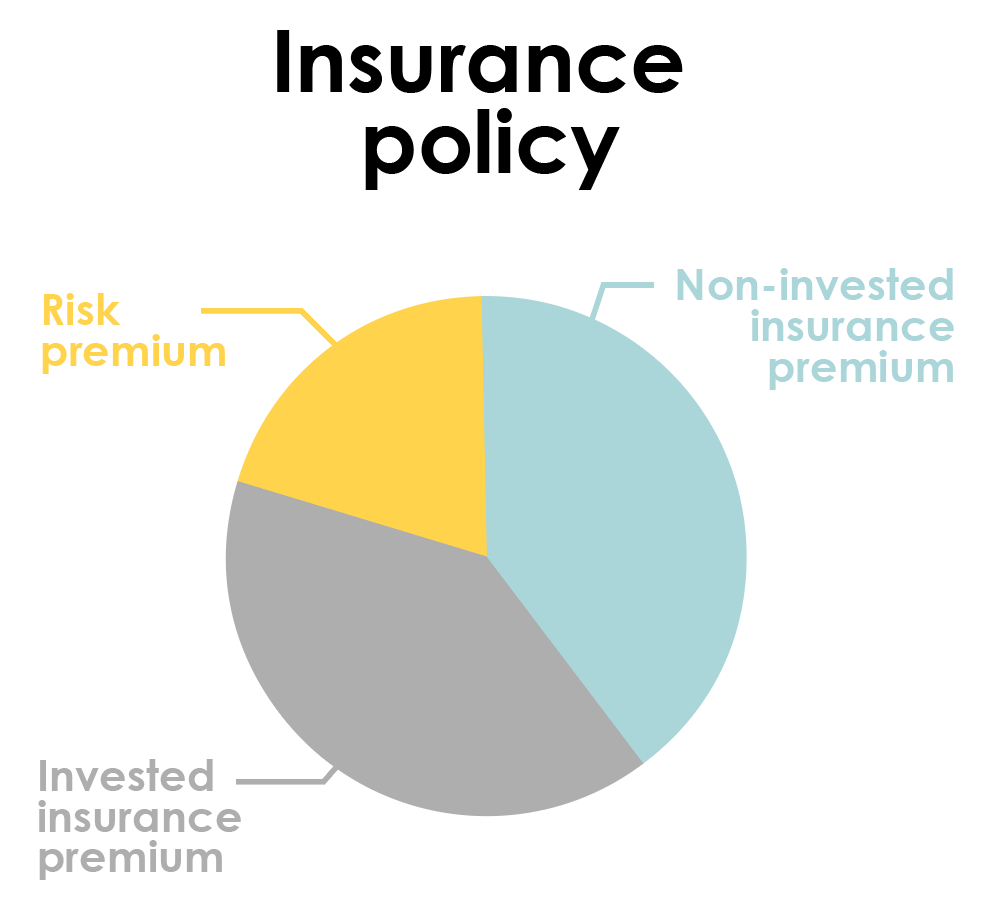

If we want to explain even further, we can divide the savings premium in two subsections:

- The non-invested premium

- The invested premium

At the end, your private providence will look something like this:

This new part is the part of your savings which will be linked to investment funds and managed either by the insurance company’s asset manager or through the banking products your insurer partners with.

As you can imagine, the higher the invested part and the more talented the manager will be, the more your final amount will be undetermined.

Component 2: The risk premium

If you rely upon an insurance, it will, as its name suggests, have to insure something. It will not be able to simply keep your money. This risk part can be more of less important depending on what the insured person desires.

Most of the time, this cover offers protection against:

- The death of the insured person by guaranteeing assets for the family members.

- The policyholder’s invalidity, the insurance policy pays pensions to bridge the gap in income following an incapacity of work.

- A future capital guaranteed for your retirement.

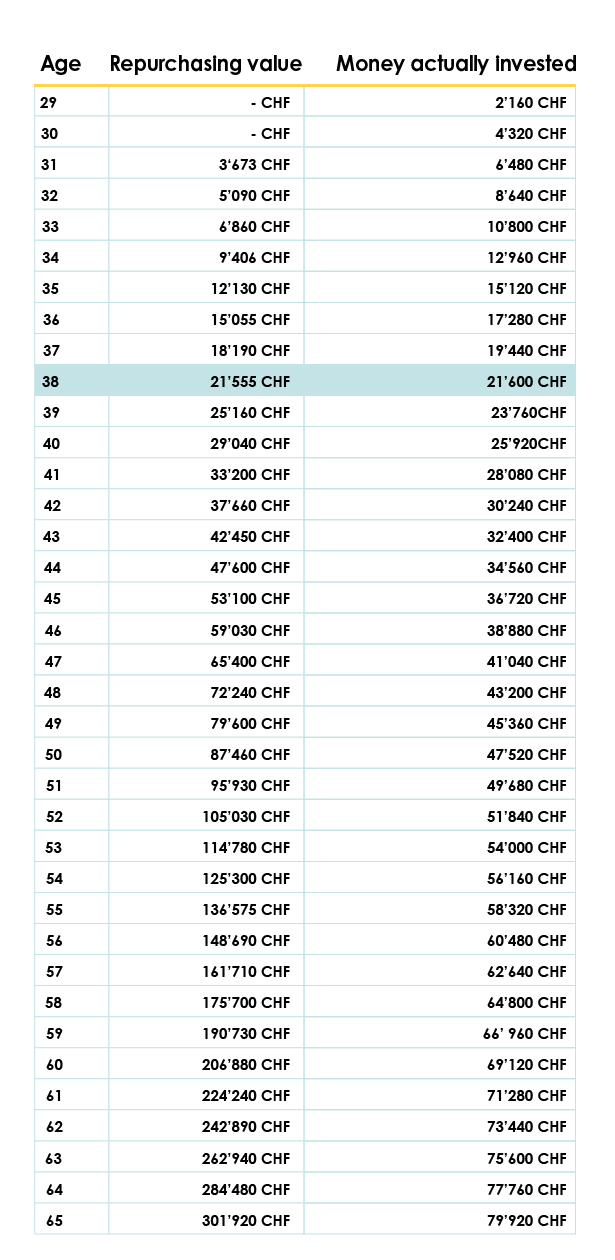

Repurchasing values

Just to be clear, this is the most important part of your contract, and probably the vaguest one too.

Even though explaining this is no small feat, there is not choice, we must do it.

It is important to differentiate:

Let me explain, the amount paid each month / every year will not be equivalent to the amount your insurer will withhold. During the 10-15-15 first years depending on the structure of your product, your repurchasing value will be lower than the actual amount.

This first example, which is an almost entirely invested third pillar shows us that I will have to wait from my 29th year of age to my 38th birthday in order to be able to get back an amount at least similar to the one I originally invested.

This example does not represent every offer on the market! It is important to be very careful and specially to fully understand that if you wish to recover your assets in a couple of years to buy your home, become a freelancer or enjoy early retirement, the solution offered by the insurers is not always the most suitable one.

Why do repurchasing values exist?

It is time to break the ice! Do you know why repurchasing values offered by insurances are so law during the first years? The answer is very simple:

1- They will use part of the premiums paid over the course of the first years to finance the risk you want to get insured. Once you paid the part of the risk, they are safe!

2- The broker (as generous as he may be ;)) has to earn a living. Yes, brokers can make really big commissions on your insurance contracts. This commission paid by the insurance to your broker will be financed by the first years of your contract.

3- Just like everywhere else, a contract requires administrative, surveillance and monitoring. These administrative fees will also be deducted during the first years.

There you go, now you know everything. Once you will have paid the administrative fees, your friendly broker’s commission and the risk you wanted to insure, only then will you start saving, not any sooner!

In which case is a third pillar with an insurance the best alternative?

After reading the section on surrender values, you’re probably wondering: “So why even bother with a 3rd pillar A insurance plan?”

Honestly, as I write this, I’m asking myself the same question… It’s true that, early in my career as a financial advisor, I used to believe that allocating part of one’s savings to risk coverage made sense — a way to protect yourself against life’s uncertainties. In that mindset, 3rd pillar A insurance policies seemed ideal: they allowed you to save for retirement while also protecting yourself in case of hardship.

That idea still holds true — but over time, I realized that the Swiss system is already very comprehensive. In most cases, people are already sufficiently insured, which means that this type of product is often neither necessary nor profitable.

And even if you happen to be one of the few people who are underinsured, and an additional layer of protection truly makes sense, then yes — I would go through an insurance company, because banks simply don’t offer that.

However, in that case, I’d choose a pure insurance product, with no savings component — just like with health insurance: I pay CHF 100 a year; if something happens, you pay. If not, you keep it.

On the other hand, I would keep my savings separate, in a bank account, to reduce management fees and let professionals focus on their actual job: managing their clients’ wealth. This kind of product is called pure risk insurance, as it contains no savings portion.

In summary, a 3rd pillar A insurance policy is often a complex contract, loaded with fees, and not always suited to your real needs.

If you don’t want to spend hours dissecting product details, and your main goal is simply to save on taxes while investing your savings, then a bank-based 3rd pillar is, in my opinion, the smartest choice.

It might disappoint the broker who’s been calling you over and over to set up a meeting… but trust me — I used to be one of them: it’s rarely the best option.

Enough about insurance — let’s now move on to the bank-based 3rd pillar.

3A bank accounts: what is my third pillar made of?

For once, I will tell you that it will be simple. Bankers are simple people, or at least, there is nothing complicated about their third pillar products.

There are only two alternatives:

- An invested bank account

- A non-invested bank account

Every main Swiss bank offer both solutions along with several variations for investments based on the risk you want to take, or rather what they call in their lingo: your risk profile.

There is no form of guarantees, death capitals or pensions. If you decide to go for invested savings and it works out well, that’s great. If not, that’s too bad!

Just take the time to pay attention to the management fees taken from your account. Remember these fees are there for a purpose! It is important that the returns are in accordance with the amount of fees you are paying.

That is it, saying more about bank will be useless. Each bank offers rather similar solution with varying results, the only elements to take into account are:

- The managers’ quality.

- The bank’s advantages compared with its competitors.

- Whether the solution offered by the bank truly meet your needs and correspond to your profile.

That’s it. Saying more about banks would be useless. Each bank offers similar solutions with varying results, the only elements to take into account are:

- The managers’ quality.

- What the advantages of this bank would be in comparison with their competitors.

- Whether the solution offered by the bank truly meets your needs and corresponds to your profile.

Bank or insurance, how to make a decision?

If you read our articles about the third pillar at banks and at insurances, you probably understood that choosing an insurance and more specifically a product including an invested part, a part that is simply saved and covering the risk is not an easy task but it can be worth it in rare cases.

Choosing a bank is easier, all you have to do is ask for the factsheet of several banks and check their results for the previous years.

Now, how to choose between a third pillar at a bank or at an insurance? It is very hard to say… it will depend on whether you have persons you want to cover (partner, children, etc…), if you have a mortgage debt you want to insure, if you are afraid to invest or not, etc.

Keep in mind that it is possible to open several third pillar A so nothing prevents you from mixing both to vary the pleasures and the risks.

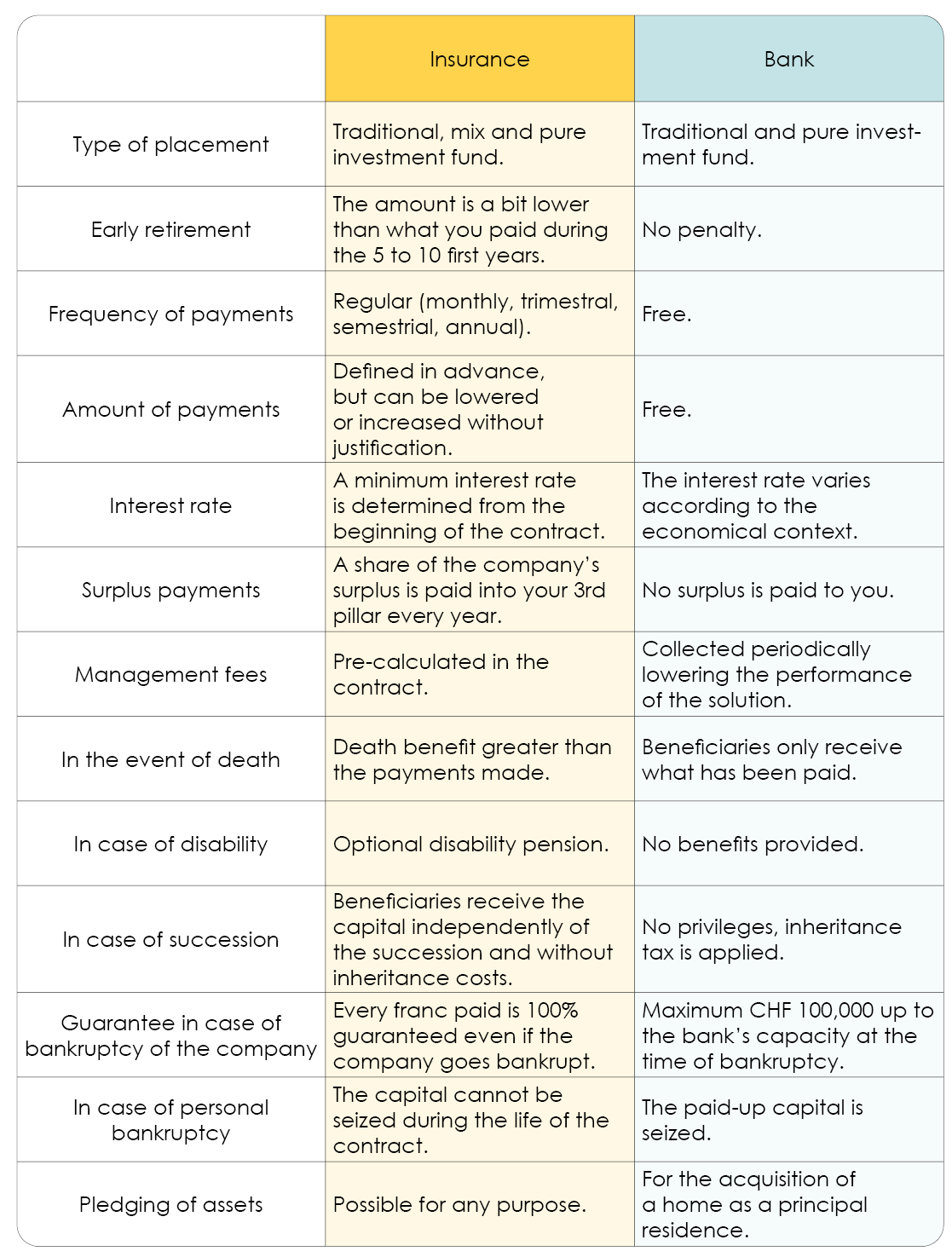

Summary of the differences between banks and insurances

It is always simpler to get help in order to compare what is comparable. This is why I prepared a table for you which will allow you to see the main differences between both alternatives.

But stay attentive, these differences on third pillars A at banks or insurances are not set in stone and insurers frequently create products which contravene to these basic principles.

How FBKConseils can assist you with your 3rd pillar A?

Introduction meeting

Many of you reach out to us to ensure you make the right choice for your private pension plan, and we truly appreciate your trust. That’s why, even in 2025, we continue to offer a free 20-minute session to address all your questions and guide you in the right direction.

Tax simulation

For some, opening a 3rd Pillar account isn’t about choosing between a bank or an insurance provider but about determining whether this tool actually provides significant tax savings. Indeed, depending on your situation, the tax benefit can vary greatly. We provide precise tax simulations to help you decide.

Advisory session

If you’re looking for specific answers while raising new questions, we also offer in-depth advisory sessions for our clients. These sessions have no time limit, allowing us to perform simulations, provide feedback on contracts you’ve shortlisted, and answer any remaining questions you may have.

Account opening

To save you time and simplify the process, FBKConseils offers support for account opening and liaises directly with banking institutions on your behalf.

Let us help you navigate the complexities of your 3rd Pillar A with ease and confidence!