Written by Yanis Kharchafi

Written by Yanis KharchafiWhat kind of investor are you?

Imagine winning 50 CHF. Now, you have two options…

- Either you keep it for yourself.

- Or you take part in a game and have a chance to either make double the amount, or loose it all.

What will you decide? Are you a rather careful person, or are you more of an adventurous type of person?

It is only by finding out your aversion to risk that you will be able to invest your money and make it work for you while not losing any sleep over it.

How? By measuring your objective risk capacity and your subjective risk tolerance. And this is exactly what is article is all about.

The line-up:

Part 1 : your risk capacity

To what point can you absorb the losses of your investment without jeopardising your desired lifestyle?

More bluntly said: if the market is down, will you be forced to sell your car in order to pay your bills? Nobody enjoys watching their investment melt like snow under the sun, but some losses are not as big as a deal as others are.

Your capacity to take risks is evaluated based on quantifiable data. And just like the time-frame of your investment, your financial situation, as well as your objectives, are personal.

The time-frame

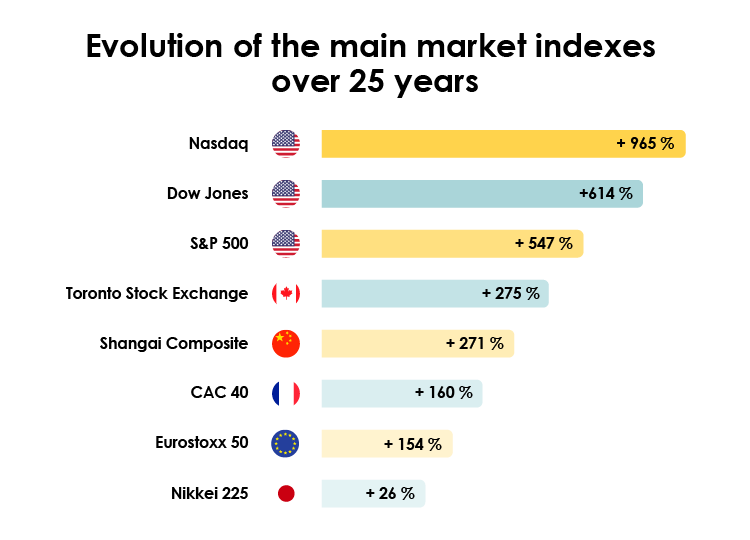

Over a long period of time, the vast majority of market indexes grew dramatically.

What does this imply? That the longer your investment, the more risks you can take.

“Time heals all wounds” as they say. This saying is also applicable to economics. Indeed, after each crisis, markets were always able to recover and grow stronger.

Plus, the first profits are usually used to amortise various costs, such as purchasing and transaction costs.

Let’s take an example: you invest 100 CHF in an investment fund. The purchasing costs represent 2%. You are actually only investing 98 CHF.

If the fund generates a nice 4% return, half of it will be used to pay back the usual management fees. At the end of the year, you will have 99.96 CHF let, which is less than your initial investment.

However, at the end of your second year, you will have 102 CHF. And that’s when it starts getting interesting.

In short, investments, just like wine, get better with age.

What is the ideal time-frame?

If I was a Federal Councillor, I would answer you “as quickly as possible, but as slowly as necessary”.

But let’s be a little more precise here shall we…

Do you want to grow your money within five years or even less? You may be thinking that you will have to bid on high-risk products. In reality, it is quite the opposite…

Why? Because the chances to lose are too high. Invest on low-risk markets, such as bonds, real estate or the currency market. While they offer lower yields, they are more reliable.

Do you want to cash-in your profit in ten years? You should opt for a diverse portfolio. Mix in equal part of shares, real estate and bonds. Give it a stir. And let it rest for five to ten years. Enjoy!

Your financial situation

The first rule in Fight Club is not to talk about the Figh Club. Here, the first rule to investment is to invest only in what you are prepared to lose.

The thicker your financial mattress, the more risks you can afford to take without it keeping you up at night.

Your personal situation

It is better to be in a good financial situation in order to invest. But that is not all there is to it. Your current personal situation is also to be taken into account.

Are you single, married with kids, self-employed, do you have financial obligations towards close friends or relatives?

All these questions directly impact the amount you will be able to invest and, most importantly, the risk you will be willing to take.

Your personal goals

The more precise you are when it comes to your goals, the more likely it is that you will reach them. Every one of us would love to double their assets. But within which time-frame? Ten or thirty years?

The strategy will depend on your answer. In the first case, you will have to take more risks. In the second, a moderate risk could be enough.

And actually, why do you want to invest your money in the first place? Is it simply not to let it sit in your bank account? Or are you aiming to retire by the time you turn 50 years old?

In the field of investments, like other fields, those who succeeded the most are those who have concrete, quantifiable and attainable objectives.

Part 2 : your risk tolerance

Being capable of supporting a financial risk is one thing. Being capable of psychologically handling it is a whole other one.

To avoid having to retreat yourself in a nuclear bunker in the mountains to meditate away from the civilised world each time a market is dropping, it is advisable to know what is called the “risk tolerance”.

How can you measure emotional data? Such a calculation is necessarily subjective and depends on several factors, including your friends and family, your academical background, your experience and, mostly, your character.

Fortunately, there are a whole bunch of tests out there that will help you measure your tolerance to risk. They are made of questions that will identify not only which investment will generate the most return but mostly, which one is best for you.

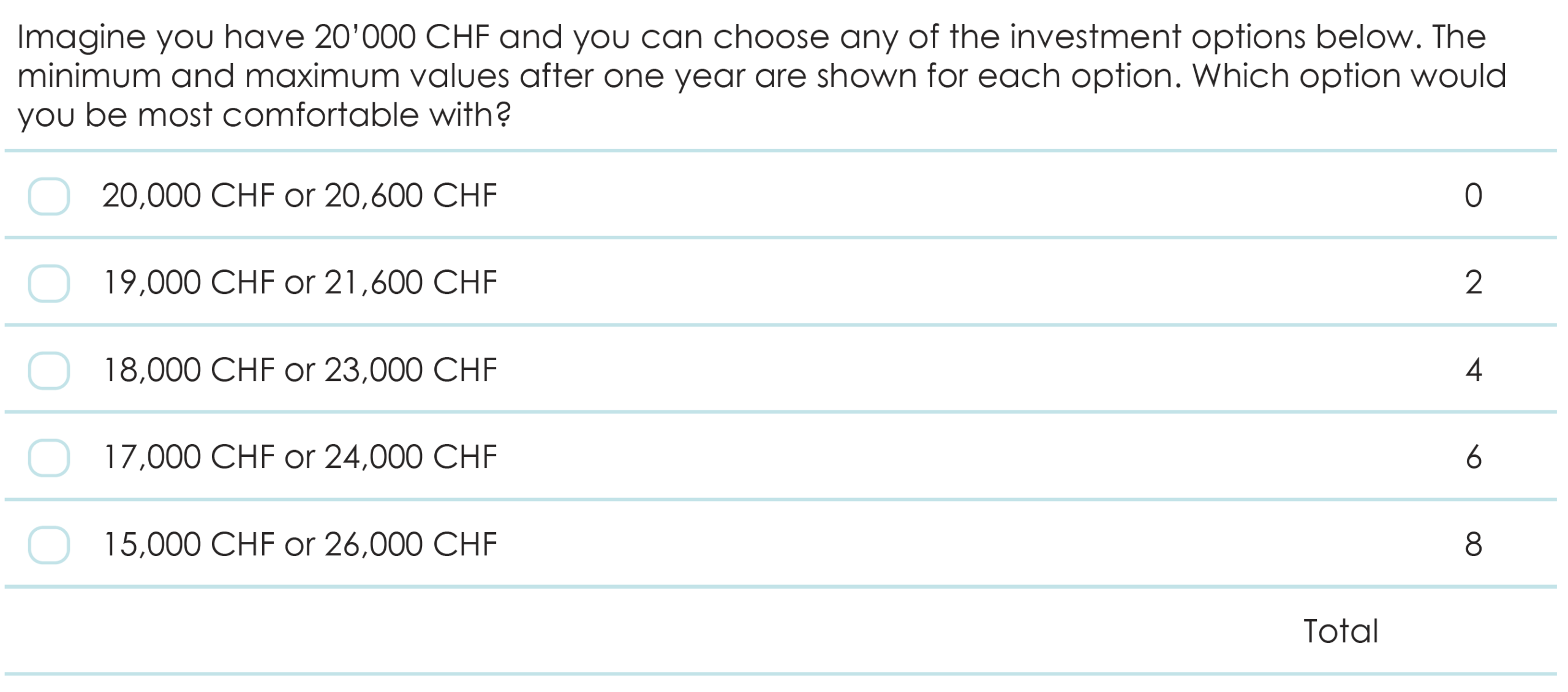

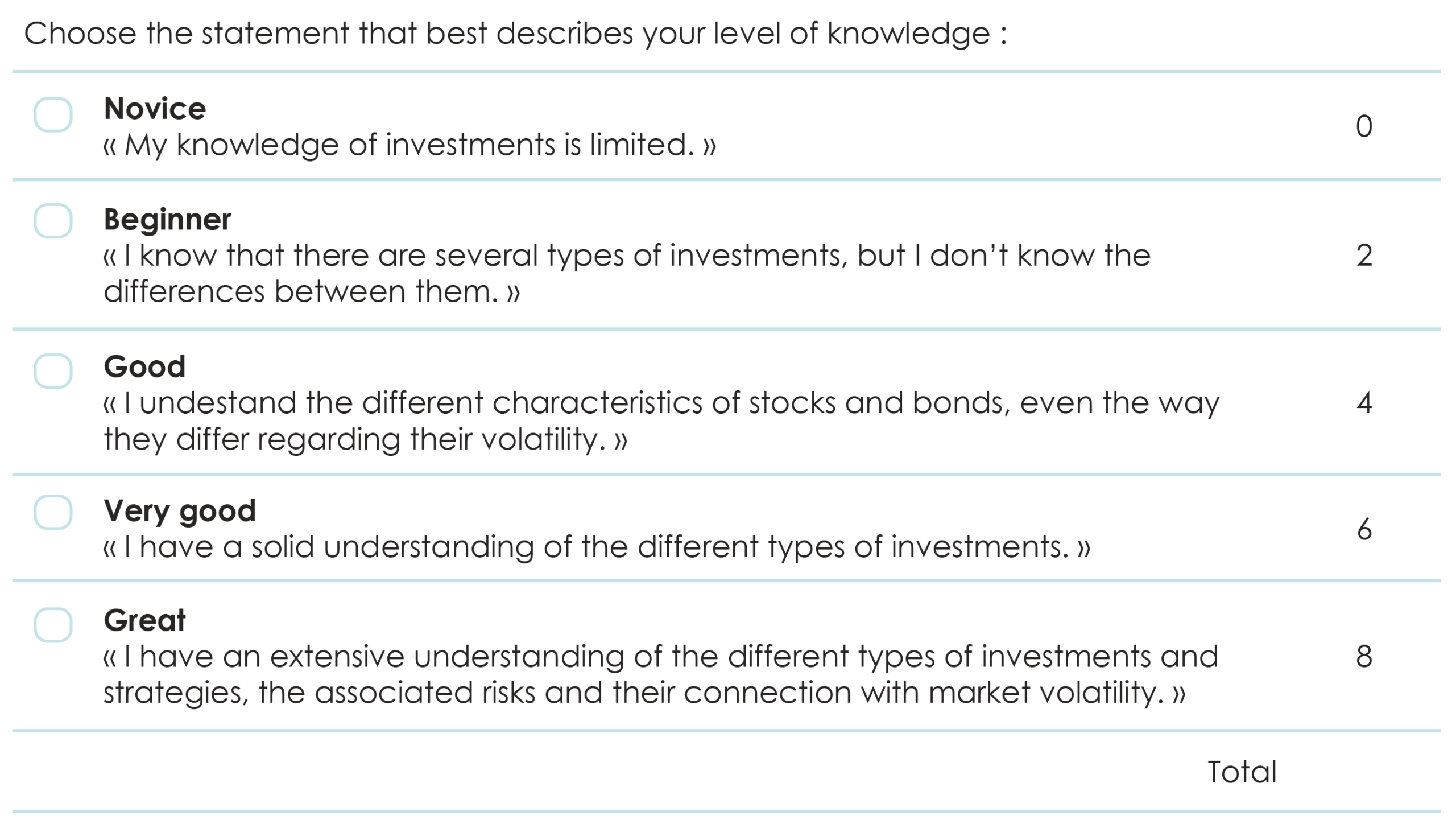

Here are two examples of the questions:

The lower the ticked box is, the better you are at tolerating risk.

Come check out our test!

Choose your investments the same way you choose your partner

The goal of an investment is not only to make your money grow, it is also to not lose it.

Generally, an investment is a relationship that should last overt time. For this reason, it must be chosen according to its returns, but also your personal objectives, your current financial situation and your risk tolerance.

Do you have any other questions? I remain available anytime via the chat box. You can also give a call to one of our investment advisors if you would like to ask them to personally support you and set a first cost-free appointment.

The aim? To compare the different investments, make your assets grow, while making sure you have peace of mind. And make you proud of your investments!