Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on March, 16th 2024.

What is a share? And why should I buy some?

The line-up:

General comments

A share is a small part of a company that your purchase and therefore own.

Each share has a cost and corresponds to a property percentage. The sum of a company’s shares thus represents its total value.

You can purchase one or several shares of a company.

But why would you do so? To grow your assets, just like an investment. But how? By taking advantage of price increases and dividends. Plus, purchasing shares gives you certain rights towards the company, including a voting right, etc. Put simply, a share is an ownership title of a part of the company so, technically, you become its owner, proportionally to the amount of shares purchased.

How does buying a share work in practice?

Let’s dissect all of this…

What is capital gain?

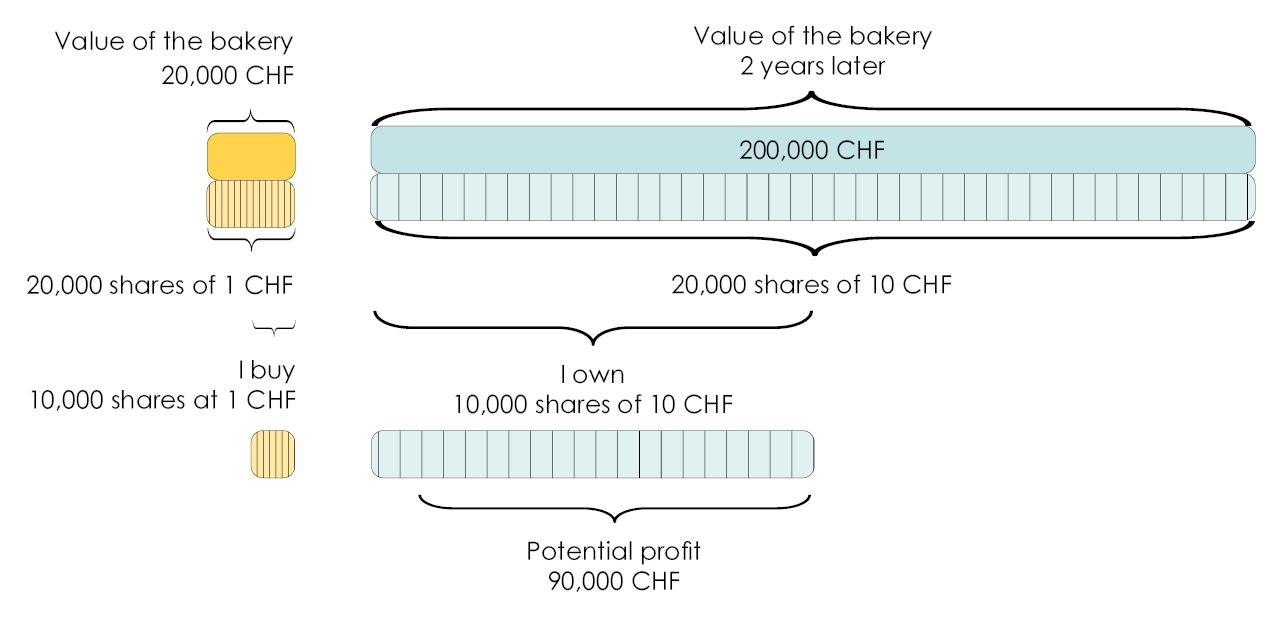

Once upon a time, my wife Zoé opened her own bakery. At first, its market value was 20,000 CHF, which was the assets she had invested in it.

At the beginning, she did not have any employees, but as the demand rose, she had to expand her facilities and hire an assistant. She thus separated her business into 20,000 shares of a 1 CHF value each.

I bought 10,000 shares and thereby purchased half of her business. And only two years later, her sales revenue reached 200,000 CHF. This was the new value of her bakery on the market.

Each share grew proportionally and became worth 10 CHF, since the company was still divided in 20,000 shares. My investment increased tenfold and was worth 100,000 CHF. Wow!

This was the theoretical value because it would have been effective only if I sold my shares. The potential profit would therefore have been 90,000 CHF.

Ok you got me; this was all a dream! Such a brilliant development rarely happens, but this logic is applicable no matter how spectacularly the company grows.

Be careful: for any investment, it is crucial to take into consideration the fiscal impact. In the context of a share and, more precisely, capital gain, there are no taxes! So, when you make profit with your shares, it will be tax-free.

It is one of the strongest points of shares.

What are dividends?

Dividends are a part of the profit that is paid out yearly to shareholders depending on the results of the company. Each share does not necessarily receive dividends.

The decision is made by the general assembly of the shareholders, who agree on the amount and date of the payment.

The shareholder receives the dividend without selling his/her shares. This is called the share return.

Let’s use the example of Zoé’s bakery once again, shall we? After several years of good and faithful croissants, Zoé’s business a huge success, hundreds of clients come enjoy her petits fours on a daily basis! She therefore decides to thank me for supporting her project. As I am not an employee, she cannot pay me a salary, but she can decide that on the 100,000 CHF profit, she will give me 5 CHF / share. Since I have 10,000 shares, I will have made 50,000 CHF in dividends.

In real life, there are (hardly) ever only two shareholders but more like hundreds, if not thousands. Dividends are the easiest way to thank those who accepted to financially support their project.

Be careful: upon receiving dividends, you must pay taxes, which will unfortunately lower the amount you will get at the end. In order save you a whole lot of deception, make sure not to consider the amount you got from dividends as net income but instead to factor taxes in when calculating the profit you will be making.

There you go! So? Do you want to start investing in shares now? You should also have a look at equity funds!