Why choose FBKConseils for your tax return in Geneva?

When and how to complete a tax return in the canton of Geneva?

As in many other cantons, Geneva requires its taxpayers to submit their tax return before March 31st.

As in many other cantons, Geneva requires its taxpayers to submit their tax return before March 31st. If you can’t meet the deadline, or wish to extend the documents’ submission timeframe, you can easily ask to postpone it until October 31st. Unfortunately, like lots of things in this world, this will not be done for free. A 3-month delay will cost 20 CHF, 5-month delay will be granted for 40 CHF. Any further extension will come at the cost of 60 CHF.

If you really couldn’t meet the October 31st deadline, it is still possible to ask for a supplementary delay between November 1st, and December 31st but as you can imagine, the process gets slightly more complicated. You will be required to provide the tax administration with a “duly motivated letter”, via mail! Things get serious, because obviously this letter will be examined and can be refused.

So, that’s about the “When”. Now, “How”? The possibility to fill manually all the administrative documents remain, and you can find these at the tax administration office (Rue du Stand, 26 – for those who wonder). On the digital end, two options are available: following the sets of “e-processes” or downloading and filling your tax return leveraging GeTax software.

Entrust your tax return to professionals

For those working in a trustee, performing tax returns is probably a piece of cake… Obviously, not every taxpayer can say so. Either way, you won’t have a choice, everyone has to fil its tax return…

For those working in a trustee, performing tax returns is probably a piece of cake… Obviously, not every taxpayer can say so. Either way, you won’t have a choice, everyone has to fil its tax return…

Small mistakes are rather common (especially in Geneva) when not familiar with the technical terminology and associated gibberish.

Moreover, finding all the proper and necessary deductions is a tedious, time-consuming, and well… painful work.

“Will my taxable wealth be impacted by the sale of my car? In which box should I register my house abroad? At fixed or actual costs? How does it work for foreign currencies?”

The main word to bear in mind when it comes to tax return is “accuracy”. Of course, we can always be like: “Worst case scenario: I’ll pay more taxes than necessary, no big deal.” Well, let’s be realistic for a minute, no taxpayer would want that.

By entrusting us with your tax return, we will handle all communications with the taxation authorities in order to assert your rights. We will also take responsibility for any necessary corrections on the tax return.

Optimizing your taxes in the canton of Geneva

At first glance, it seems easy as ABC. I meant, 1,2,3… No need for an accounting degree to gather and wrap up all tax deductions. The reality might be a little tougher.

At first glance, it seems easy as ABC. I meant, 1,2,3… No need for an accounting degree to gather and wrap up all tax deductions. The reality might be a little tougher.

The quantity of deductions and their aggregated amount will directly impact your taxable income and therefore, your tax burden. That’s why having a professional knowledge of the matter is essential to identify optimizable items!

Once we’ve taken care of your tax return, we always offer an optional advisory follow up meeting, free of charge, to discuss potential tax optimizations that will reduce your tax burden in the long run.

The main goal is to learn more about your situation and find possible deductions according to your future projects.

– Do you already have a 3rd pillar account? Would it make sense to contract another one?

– The 3rd pillar B is deductible in Geneva. What are the differences with a 3rd pillar A?

– Would you like to repurchase from your 2nd pillar? What to expect from it? How much can you repurchase and what will be the impact?

– Have a real estate project in mind? What would be the fiscal impacts of becoming a homeowner?

Of course, we want to make your life easier by relieving you from the administrative burden of a tax return, but the long-term target remains to minimize you tax burden.

Choosing the subsequent standard taxation in 2025 (TOU in French): to do or not to do, that is the question?

You may have heard about the new withholding tax law, effective since January 2021. It may not seem like, but it definitely is a gamechanger…

You may have heard about the new withholding tax law, effective since January 2021. It may not seem like, but it definitely is a gamechanger, offering an opportunity to decrease your tax burden by filling a “standard tax return” changer, offering an opportunity to decrease your tax burden by filling a “standard tax return”. The only point is that once you’ve chosen this option, you won’t be able to go back if you’re a taxpayer residing in Switzerland. This will be your taxation method forever… On another hand, for cross-border taxpayers, this option is renewable every year, requesting to be considered as a Swiss quasi-resident.

So, the subsequent standard taxation, yes, or no? Well, we can only answer case-by-case. Indeed, performing a tax simulation is critical to find out if the switch is actually financially advantageous. That will all depend on your situation. Going through this simulation exercise will provide you with both the detailed and global visibility required to make an informed decision. Believe me, it is always better to take a moment to simulate the impact before it hits you. And who knows, in the end, it may result in good news. But remember there is no way back.

Filling your taxes in the canton of Geneva with FBKConseils: How does it work?

1. The first meeting !

To fil your tax return in Geneva, you can contact us by email, or call us directly at 021/601.07.22. If you prefer, you can also make an appointment on our website so that you can introduce us to your situation and ask all your questions.

2. Let’s gather information!

At FBKconseils, we offer two methods for building your file.

The traditional method: After our first meeting, we’ll send you an Excel file. You can simply tick off everything that applies to your situation and our file will tell you exactly which documents we need to prepare your tax return.

The digital method: We have created a platform directly on our website that will enable you to draw up a personalised quote. Once your situation has been described, you can validate your quote and receive a list of the necessary documents in your inbox. You can then send them to us directly online.

3. Filing and sending your tax return!

Once your tax return is filed, we will directly send it and provide you with a copy so that you can also have a final check. We will take care of all the needed corrections.

4. Tax optimizations and follow-up!

Once the process completed, we offer the possibility to our clients to make an appointment, to assess potential optimization opportunities in Geneva for the following years.

How long does this process take and how much does it cost?

The time needed to fil out your tax return mainly depends on the complexity of your personal and financial situation. Once all required documents are in our possession, it takes approximately 10 days to FBKConseils specialists to finalize the tax return. But on top of these 10 days, you should consider the time you need gather all the useful documents, as well as a waiting time from the tax authority to revert with the final taxation decision.

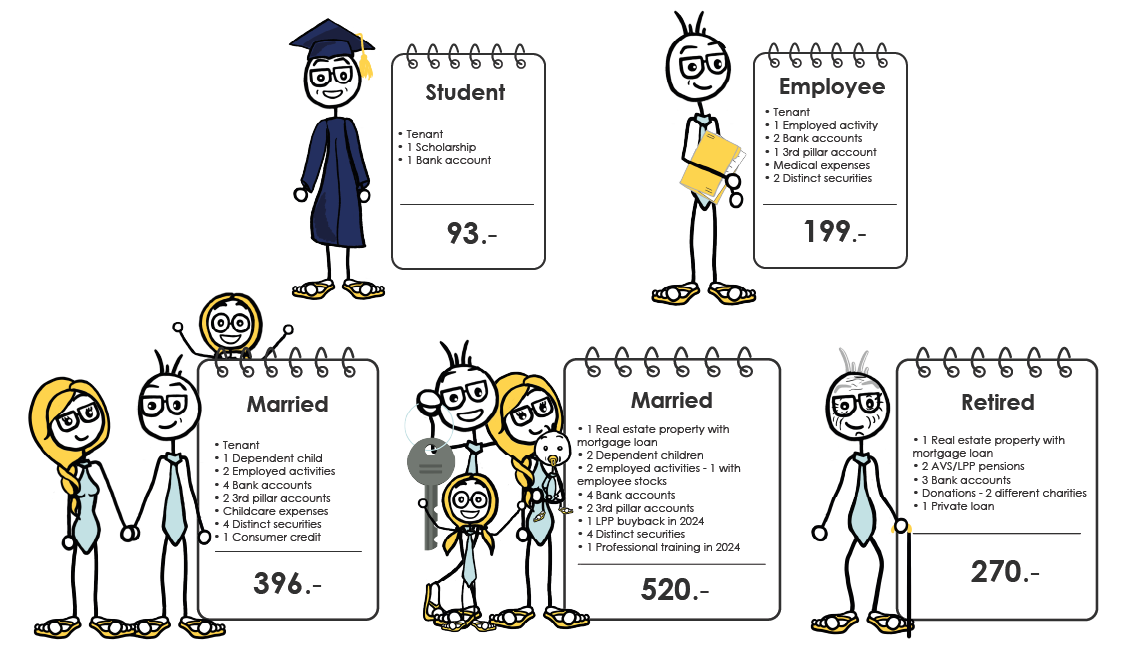

Regarding the cost of this process, it heavily depends on your situation. You can either ask us for a personalized quote, use directly our new online platform or take a look at the several situation examples below.

Download the pricelist

Entrust us with your tax return

In the canton of Geneva, you must have submitted you tax return by March 31st. If you can’t meet this deadline, it is possible to ask for an extension up until October 31st.

It is mandatory in the canton of Geneva to pay tax instalments. There are two possibilities: you can select a one-off payment, for the total amount, in February – so that you benefit from a slight discount, – or you can stagger the total over 10 months, from February to the end of November.

Until 2022, people taxed at source in Geneva could fill in the simple rectification form in order to deduct a given set of core expenses (such as a 3rd pillar, meals, transportation, etc). But today, no deduction will be accepted, unless you ask for a subsequent standard taxation (the famous TOU in French). This means that you remain taxed at source but ask to be taxed as a Swiss citizen or holder of a C residence permit.

Geneva tax authorities give access to a tax simulator on their website. Once you have filed your information, you will be provided a tax overview. From this point you will find out the amount to pay in instalments. One point of attention, the precautionary principle is key as Geneva tax simulator is not the most precise, and there will probably be corrections brought after you send your tax return.

In Geneva, and many other cantons, there is two types of delays, each leading to its own repercussions:

– Late in handing back his tax return: The canton of Geneva allows you to delay the submission of your tax return. Delays can be charged, and the later you are, the more expensive it gets.

– Late payment of taxes: Upon receipt of the bill in your maibox, you will have no more than 30 days to pay it. Then, you will be fined proportionally to the amount resulting from that final taxation decision .

Since 2022, the simple rectification has been modified so that it is possible to claim corrections on the scales to be applied, on changes in the spouse’s income, on changes in the children’s income. Conversely, it no longer allows you to claim deductions as such. If you have expenses (2nd pillar purchase, 3rd pillar contributions, transport, meals and others) to claim, you will have to file a subsequent standard taxation.