Written by Yanis Kharchafi

Written by Yanis KharchafiTax and advance payments (acomptes): When and how do you define your instalments?

Whether you’ve been Swiss all your life, for two days, or have just obtained a C Permit, you all have one thing in common: you have to define and pay instalments (or acomptes in French). Luckily, your research has led you to this article, probably because you have a lot of questions on the subject. So here goes! We’re going to clarify the following points:

– Who has to pay instalments, and when?

– How do you define your instalments, and what happens if you make a mistake?

The line-up:

First things first: what are instalments?

Don’t worry, we’ll get you off to a good start. Advance payments are simply payments you make throughout the year to the tax authorities in your canton of residence. For those of you who once had a B Permit (for example), advance payments are a sort of replacement for withholding tax, the difference being that they are not deducted by your employer. To pay your instalments, you need to take certain steps (simple procedures, admittedly, but procedures nonetheless).

So who needs to worry about paying their instalments?

Once again, the rule is quite simple. Anyone whose income is not, or is no longer, taxed at source must define, and pay, instalments. In short :

– Swiss citizens, of course,

– C permit holders, and,

– Swiss property owners living abroad.

If you obtained your C permit during the year, you will no doubt have noticed a little extra in your bank account at the end of each month: enough to rejoice, on the face of it… But not for long, as you can tell yourself that this is just a nice little addition to your account. In fact, the month after you obtained your Permit C, your employer had to stop deducting tax at source from your salary and pay you the amount. A word of advice: don’t spend it all straight away, because sooner or later you’ll have to pay at least some of it back to the tax authorities!

For those who have recently purchased a property outside their canton of residence, the process is not exactly the same. Please feel free to contact us for more information, or if you need any help.

How can I find out the amount of my instalments?

Ideally, the total amount of the instalments paid during the year corresponds to your final tax amount, once the tax return has been completed, sent in and potentially corrected by the taxman. But how do you get there, and what amounts should you declare?

Rest assured, the tax authorities will not ask you to calculate the amount of advance payments yourself. Your only task, which is an important one, is to estimate your taxable income and wealth for the tax year. Please note that we are talking about taxable amounts, i.e. after all applicable deductions.

Since we’re in the middle of it all, we’ll give you a quick summary, assuming that you don’t own any property abroad (which in reality means outside your canton of residence). Hold on tight! Taxable income is :

- Your gross income (wages, family/unemployment/other benefits, dividends, rent received in Switzerland, etc.),

- Minus the social security contributions deducted by your employer,

- Minus your business expenses

- Less the deductible amount of health insurance premiums, medical expenses, childcare costs, maintenance paid, training costs, third-pillar contributions, maintenance costs, BVG buy-backs, interest paid on debts, etc.

On the wealth side, take :

- The balance of all your assets in Switzerland and abroad, i.e. savings and investment accounts, the value of your other securities, banknotes, crypto-currencies, works of art, etc. Add to this the tax value of your real estate.

- Remove the balance of all your consumer, private and mortgage debts, and you’re there!

These are the results that need to be communicated to the tax authorities in order to calculate your instalments.

To avoid headaches, here’s a little tip: if your situation has changed very little since the previous year, simply take the taxable amounts available on your last tax ruling. We still recommend that you check this tax ruling or have it checked to ensure that a past error is not carried over several years.

Great, but what happens next?

Keep an eye on your mailbox, because you’ll be hearing from the tax authorities fairly soon. Their letter will contain the two elements you are looking for:

- The amount of your advance payments

- A schedule showing the dates on which your advance payments are due.

If you notice a mistake afterwards, or realise that you have under/overestimated certain aspects, don’t panic: you can start the process again at any time to adjust them!

How will advance payments during the year be accounted for?

Paying instalments does not release you from the obligation to submit a tax return at the end of the year, declaring your actual income, deductions, assets and debts.

Remember, advance payments are calculated on the basis of the amounts of taxable assets and income that you have estimated and notified (using the form for determining advance payments) to the tax authorities. The amounts paid constitute what might be called a “tax provision”, but they are not final. It’s worth distinguishing between two scenarios, and we’ll take two examples to illustrate the mechanism in detail. In any case, you are a single person with no children, living in Morges in the Canton of Vaud.

First scenario: You have made advance payments for the whole year

At the end of 2022, your crystal ball, aided by your little finger, enabled you to estimate a taxable income of CHF 60,000 for the year 2023 and taxable assets of CHF 90,000 at 31 December 2023. Confident in the accuracy of these tools, which have never failed you, you sent these amounts to the cantonal tax authorities, who sent you 12 invoices for CHF 822. During the year, you pay your instalments and set aside a total of CHF 9,864.

At the beginning of 2024, you receive the form for submitting your 2023 tax return, which includes your tax return identification details. You fill it in using the supporting documents, and surprise, your ICC taxable income does not appear to exceed CHF 55,000. Your final Cantonal and Communal tax should be around CHF 8,768. What about the CHF 1,096 overpaid?

The tax authorities will simply compare the amount already collected through advance payments with the amount of your tax assessment. Any overpayment will be refunded to you, or credited to you for the following year. On the other hand, if you have underestimated your income, you will receive a new bill for the difference.

Second scenario: You obtain your C Permit in mid-August 2023, and have already paid withholding tax for the first 8 months of the year.

In this case, you will be asked to pay tax on account from September to December, and the amount of withholding tax will also be accounted for. Finally, if :

- Withholding tax + advance payments > tax decision, you will be partially reimbursed/credited for the overpayment

- Withholding tax + advance payments < tax decision, you will receive an invoice for the difference.

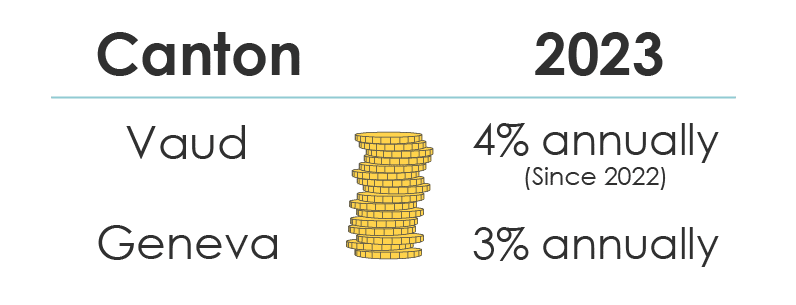

We’d just like to warn you! If you accidentally forget to pay your (cantonal and municipal) advance payments, the tax authorities have the right to charge interest. And the rates of default interest are there to help you think things through… We’ll give you an overview below:

You now have all the information you need to set your instalments for the coming year, but of course we’ll be happy to help if you have any questions or need any assistance.