Taxes on investments: How are your shares and their returns taxed?

As part of a series of articles on investing and tax, this one looks at the tax treatment of equities.

As with the other articles in this series, we will break this study down into several parts:

– What kind of returns can I earn and how are they taxed?

– How does tax on shares work in practice?

– Can I expect tax deductions on this investment?

– How can I report this investment on my tax return?

Let’s go!

Act 1: Dividends, those little tips that also please the tax authorities.

Fiery young business start-ups rarely pay out dividends. Instead, it’s the entrenched giants, the pachyderms of finance, who generously hand out these little treats based on their annual results. Let’s take an example of a deal you might find: for every share of my company you buy, I promise to give you CHF 1. So you know that if you buy 100 shares, you have a good chance of generating an income of CHF 100. That’s rather reassuring and pleasant, but unfortunately in Switzerland, the tax authorities will ask you to enter every penny received on your tax return, and tax it along with all your other income. If you had a taxable salary of CHF 60,000 before this investment, you would have to declare CHF 60,100. What would that mean? Your taxable income increases and so does your tax rate. It’s a nice trick, isn’t it? And yet you don’t know everything… There’s even a good chance that withholding tax will be levied to prevent the most careless from not declaring these dividends: more info in the rest of this article.

Act 2: Capital gains, legal tax evasion.

Where dividends look like a regular tip, capital gains are that (more or less) unexpected surprise, like discovering a CHF 50 note in an old jacket. Start-ups often start small, with few customers and even fewer profits. But with time and the right decisions, some of these tiny companies can take off and, by extension, boost the value of their shares.

The good news is that if your share price soars, Swiss tax won’t eat any of your gain – at least not on income. From CHF 5,000 to CHF 5,000,000, it’s all net to you. For the purists reading this, we are talking here only about income tax and not wealth tax, because you will still have to carry forward the value of your shares on 31.12 in order to establish your taxable wealth.

It’s also worth pointing out that we’ve simplified this type of investment here to one of two possibilities: dividend or capital gain, but in reality a share will always have a value that changes over time, whether upwards or downwards. On the other hand, a share may (and this is quite common) not pay a dividend. In conclusion, when you buy a share, you will inevitably have a variation in price and a potential dividend.

How does taxation of shares, and more specifically dividends, work in practice?

Step 1: Withholding tax

When we talked about dividends a few lines back, we raised an innocent but rather important question: why declare my dividends if they will ultimately be taxed as an income?

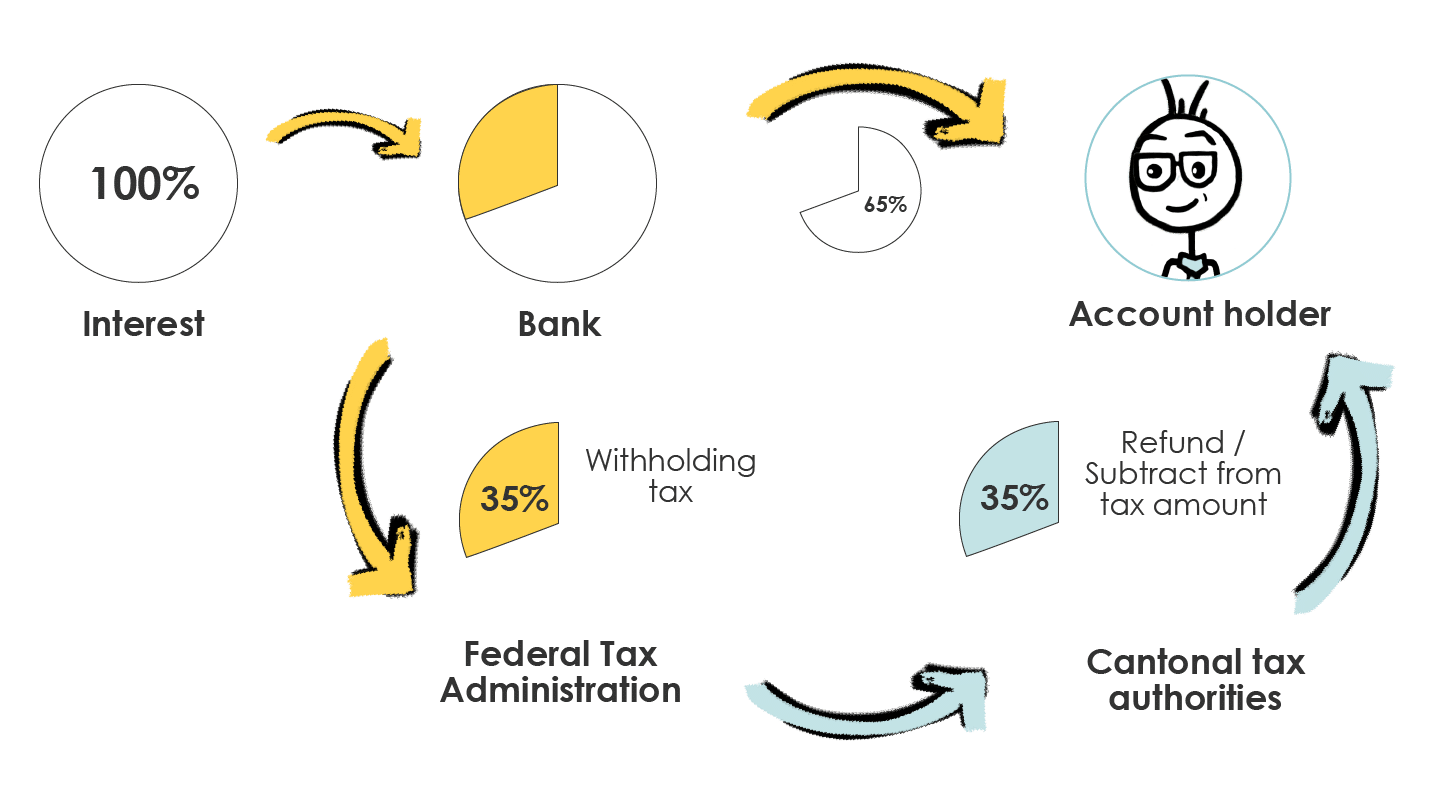

You should be aware that Swiss dividends, but not only, are not always paid to you in full. The tax authorities have obliged banks to deduct tax at source in order to spare you a dilemma, and to motivate you to declare what needs to be declared. Once they are sure that you have complied with your tax obligations, the tax deducted at source will be refunded to you. Graphically, this would look like this:

And to ensure that this mechanism makes you lose the urge not to declare them for good, the rate applicable to income from movable property (e.g. dividends) is 35%.

Step 2: Reclaiming withholding tax

Now that you have paid 35% to the tax authorities and declared your dividends correctly, you will be entitled to claim a refund of the full amount of withholding tax.

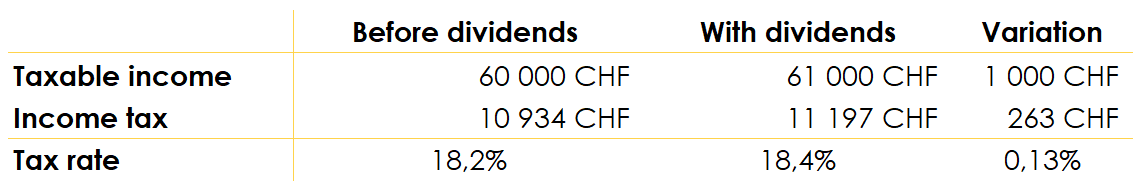

For example, if my taxable salary is CHF 60,000 and my FBKConseils shares generate a gross dividend of CHF 1,000, I will first receive CHF 650 in my account. I will have to declare this CHF 1,000 on my next tax return, which will increase my income from CHF 60,000 to CHF 61,000 and my taxes from CHF 10,934 to CHF 11,197. Finally, they will refund the CHF 350 in withholding tax. I will therefore have paid taxes of CHF 263.20 on the CHF 1,000 dividend.

Touto bene? So let’s get on with the deductions… And unfortunately, this chapter won’t be very long…

What are the tax deductions for equity investments?

I suggest that you don’t beat about the bush. If you invest in shares, don’t expect any mercy from the tax authorities. They agree not to tax the capital gain, so don’t ask for more.

In fact, there is no deduction for dividends received except in one very specific case, if you are what is known as a qualified investor. You only qualify as a qualified investor if you own more than 10% of a company’s shares.

The final chapter is in sight: how to declare it all on your tax return.

How do I report my shares in my tax return?

As with most investments and assets in general, only 3 points are essential for your tax return.

Wealth: What was the value of your shares at 31.12?

Although an increase in their value is not taxed as income, if the price of your shares rises from CHF 5,000 to CHF 5,000,000 you will have to report the latter amount as part of your assets.

Income: What income has been generated by your shares?

In addition to the value of your shares, you will need to enter in Swiss francs the gross amount of dividends paid to you during the year. It is this income that will be taken into account and taxed.

Withholding tax: Indicate the amount of tax deducted at source

To obtain a refund of the tax deducted directly, you will need to apply for one.

So, surprise or regular tip? Every investment has its charm… and its tax challenges.

Before you invest, check the tax implications.

Discover our new online platform to entrust us with your tax return!

Complete your 2023 tax return online!

In the blink of an eye!