Written by Yanis Kharchafi

Written by Yanis KharchafiTaxes and real estate: How are rents, value and gains taxed when you sell your property?

If you’ve discovered our article series on investing and taxes, then here you are in this new issue devoted to real estate investment projects. Very popular in the last few years, with mortgage interest rates falling sharply and real estate prices continuing to rise, you’ve probably also considered investing in property.

So let’s not get ahead of ourselves: let’s have a quick look at what’s in store for you, and then we’ll get down to business:

- Property rental income: the more or less certain recurring return on a property project

- Capital gains: a one-off additional return on sale

- Investment properties and tax returns

The line-up:

Property rental income: the more or less certain recurring profit on a real estate project

There’s no debate about it: when you buy a property to generate a profit, the primary aim is to collect rent every month. The question here is how these rents will be taxed and how they will affect your overall tax burden.

The question we receive most frequently from our customers is: should I buy a property in my own name or would it be better to buy it in the name of a company? Let’s take a closer look at the two possibilities.

Tax and real estate: direct purchase (in your own name)

Income tax

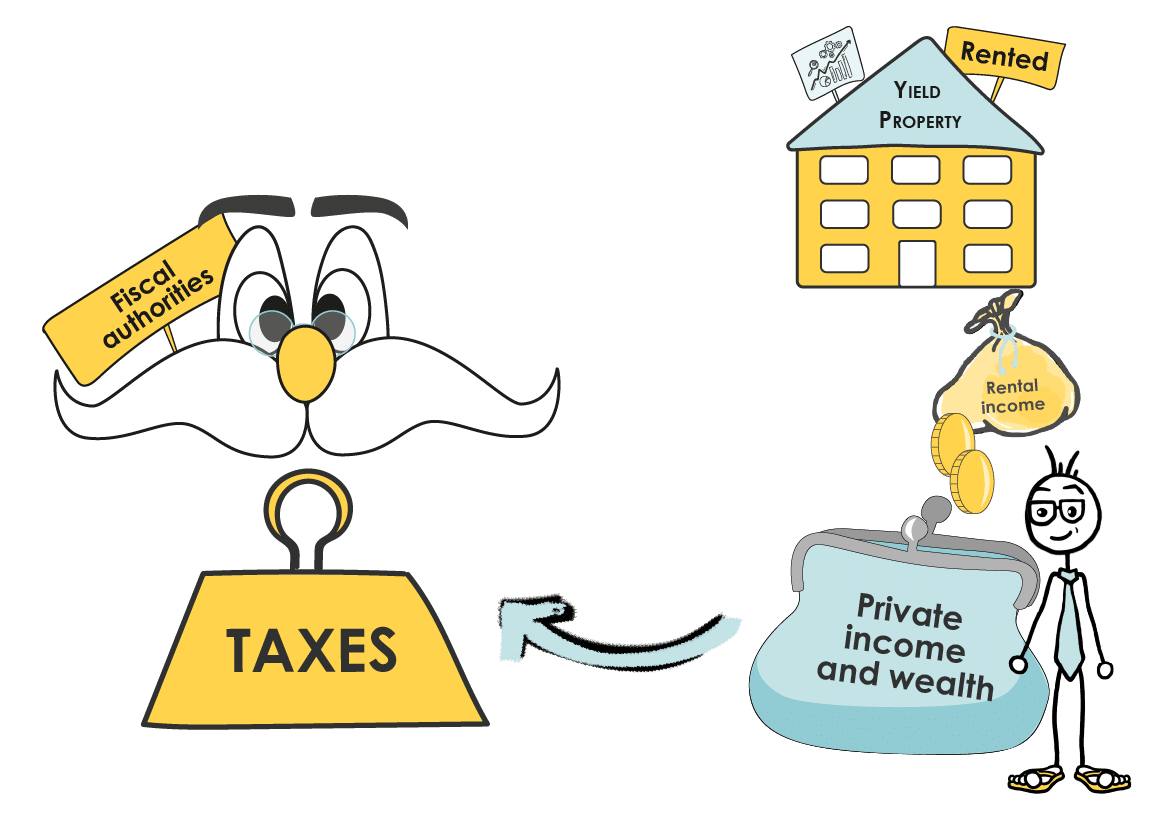

If you have decided to buy your investment property in your own name, then you will have no choice but to receive the rental income directly into one of your personal bank accounts. That said, you will have to declare them as income in its own right, and they will be taxed in the same way (almost) as your salary, for example. And a salary means a high tax burden.

Of course, you will not be taxed on all of this income because you will be entitled to deduct a large proportion of the costs you will incur as a homeowner:

- Building insurance

- Maintenance costs

- Property tax

- Mortgage interest

- PPE charges

- Management fees

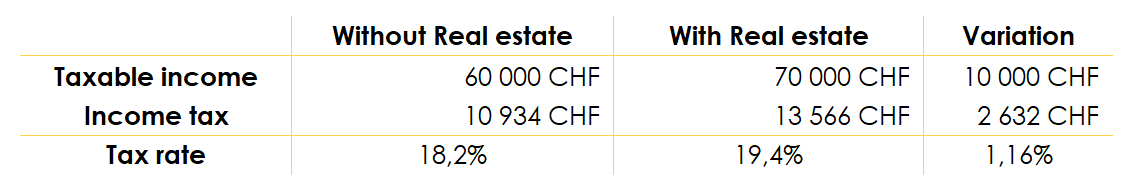

At this point, all your taxable rental income is considered to be revenue and forms part of your taxable income. Let’s take an example: you have a taxable salary of CHF 60,000 and have bought an investment flat which, after all expenses paid, generates CHF 10,000 a year.

The important thing to remember here is that even if your property generates an attractive return of 3%, 4% or 5%, you will have to cut almost 20% of this income to obtain the income actually available.

We would like to draw your attention to the fact that in this example, the 20% tax has been calculated on a total taxable income of CHF 70,000. With a higher income, the tax burden could be much heavier.

Wealth tax

As for all working people in Switzerland, in addition to income tax there is wealth tax. That’s right.

Depending on your canton of residence, property wealth tax will be calculated very differently. It is not uncommon to read that the tax value is equivalent to 70% of the purchase price, but this is only a simplified way of approximating this value.

In reality, as in Geneva for example, they will take the net income received and divide it by a capitalisation rate. This rate varies according to the type of real estate. In other cantons, such as Vaud, the tax value will be defined as the average of the purchase price and the yield value, calculated by the land registry. In short, each canton will have its own way of valuing your property. As for income, the taxable value will be reduced by the amount of your debts to obtain the taxable wealth.

If we had to sum up this solution, it is perfectly suited to someone who wants to live off the income generated by their property, in other words, someone who wants to pay themselves all the rent so that they can dispose of it freely. What’s more, it’s simpler in terms of management: there’s no accounting, no company tax return!

A word of advice: If I were you, I’d start with this method for your first property investment. There will already be enough difficulties, and with time and experience, if there’s a real advantage to it, you’ll be able to make your situation more complex.

Let’s move on to the other scenario: buying through a company.

Indirect purchase: property investment through a company

The term SCI is often used in France, and SI in Switzerland. In Switzerland, however, this type of company is no more and no less than a public limited company (SA) whose purpose is to manage real estate. It offers no particular tax advantages.

Taking into account the amounts involved in a property project, the public limited company (société anonyme SA) is the form of company most used by private individuals to acquire and manage their real estate assets.

In this article, we will only look at the tax implications for the private individual, without going into more detail on the accounting and tax return aspects of property companies.

When you own a limited company that holds one or more properties, there are a number of items that need to be reported on your private tax return:

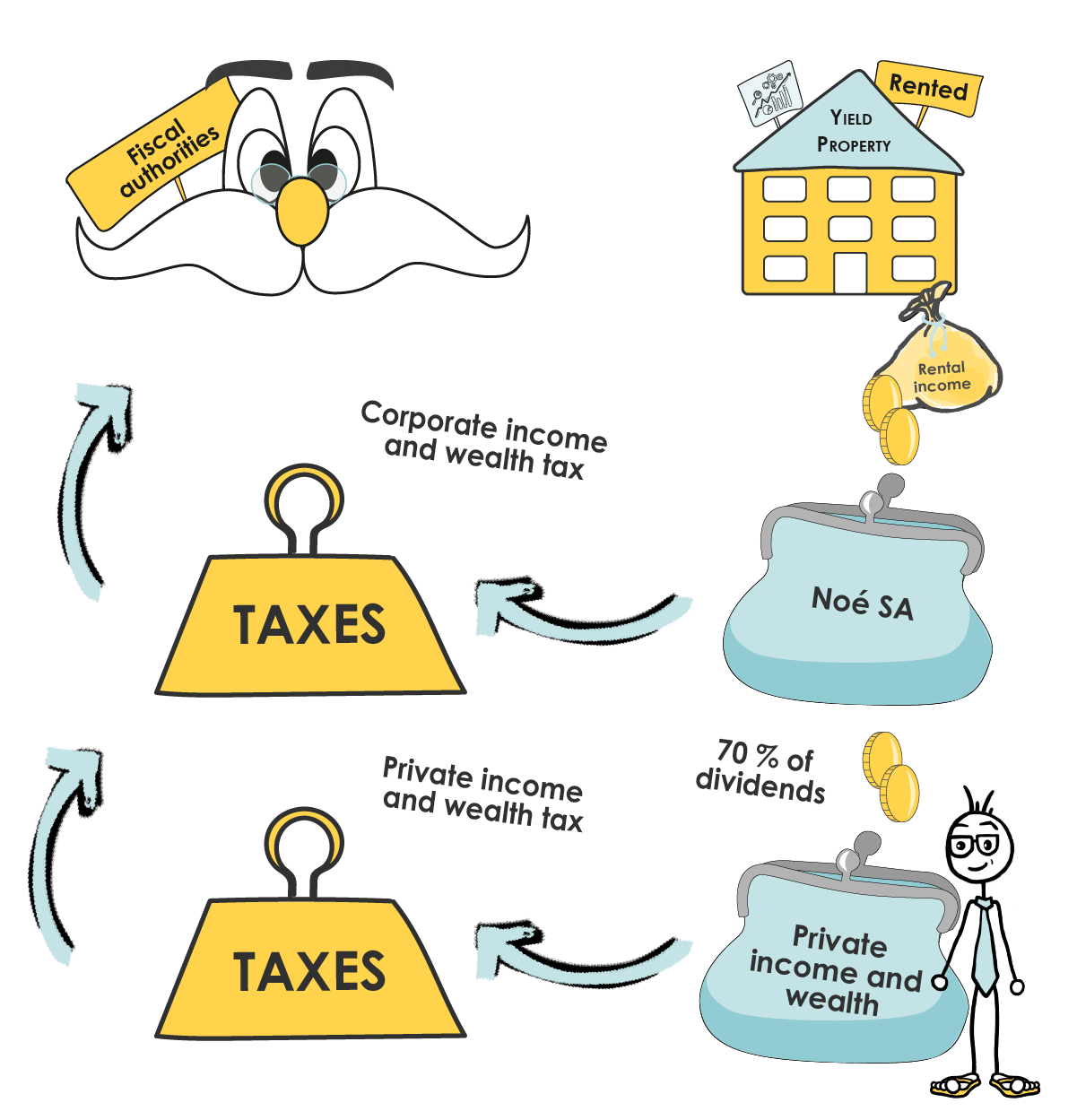

Dividends

In addition to the income and wealth tax that your company will have to pay, you, as the owner, will have to pay yourself dividends so that you can spend the money generated by your rents privately. These dividends will be taxed twice: first as income in your own hands and then at the level of your company. Fortunately, for owners of companies that hold at least 10% of the share capital, “only” 70% of the dividends received will be taxable.

Unlisted shares

To be able to pay dividends, you need to own shares, and these shares have a value in the eyes of the tax authorities even if your company is not listed. As these shares are not traded on the financial markets, they will be valued by the authorities on the basis of your company’s income and assets, among other things. It is this same authority that will give you the value to be entered on your tax return.

After reading the above, you will begin to realise that owning a company is not that simple. You will need to keep your accounts and prepare a corporation tax return so that you can complete your own tax return.

The primary aim of setting up a property company should be to build up your assets. The rents you collect can be accumulated so that you can easily reinvest them and grow your project. Another advantage of companies is that they are easier to transfer. Selling a share is simpler than transferring a tiny piece of real estate.

Wealth and rental income are now under control. Finally, I’d like to explain how your property will be taxed on resale.

Capital gains: A potential additional return on sale

Unlike capital gains realised on the financial markets from movable assets (such as shares), which are generally tax-free, gains realised between the purchase price and the sale price will be taxed.

Before you find out how much you will be taxed, I suggest you start by defining the amount that will be taxed – known as the capital gain.

Determining capital gains

Capital gains on real estate are calculated on the basis of the following factors:

The purchase price

Nothing more than the price you paid at the time of purchase.

The sale price

This is the price at which you sell your property after a certain period of ownership.

Expenditure

These are all the costs and expenses you incur before, during and after the sale of your property. Here is a fairly exhaustive list of deductible expenses:

Transfer tax

Tax paid at the time of purchase, when the owner changes. Rates vary between 3.5% and 5% of the purchase price.

Commissions and brokerage fees

It is not uncommon to use a broker to sell your property. With rates ranging from 2% to 4% of the sale price, these fees can also be deducted.

Renovation costs with added value

Have you built a swimming pool? Have you demolished walls or undertaken other major works that have increased the value of your property? If you were unable to deduct these from your income as maintenance costs, then you can deduct them from the sale price.

Other costs may also be deducted, such as loan charges, the acquisition of easements, etc.

Once the capital gain has been determined, all you have to do is understand how it will be taxed: the nice version, as a capital gain, the not-so-nice version, as self-employed income.

Are you a real estate amateur or professional?

It’s not as cool, but it’s still important to know. Switzerland can look at your real estate sale in two ways:

As a real estate professional

if you thought you could simply buy, renovate or sell without paying tax, well… sorry, but it won’t work. Depending on the number of transactions you carry out, the time between each transaction and the value of the transactions, you risk being considered a property professional in the eyes of the tax authorities. As a self-employed professional, you can keep accounts and deduct all your costs. On the other hand, the surplus will be regarded as a taxable profit, and that can hurt. In addition to declaring this gain as income, you will be liable for all social security contributions. You might as well say that half your gain will disappear.

As a non-professional

To determine the tax rate, you need to refer to the cantonal tax scale for the canton in which your property is located. As a general rule, the longer you own the property, the lower the tax rate.

Tax deferral, or how to postpone paying taxes

One final point concerning only people considered as non-professionals who have sold their home with a view to acquiring a new one: in principle, if you plan to buy back a property within a certain period of time, you can ask to defer the tax payable in order to acquire the new property.

Make no mistake, one day or another you will have to pay this tax.

Phew, finally finished! Hopefully everything is a bit clearer now: rent = income, capital gain = tax on real estate gain. Whether you’re a real estate professional or just starting out, you’ve got it all figured out.