Written by Yanis Kharchafi

Written by Yanis KharchafiUnderstanding cantonal income taxes in Valais

Before starting with a cheerful “Adieu, shall we have a drink or what?” (with a great Valais swiss accent), let’s take a few moments to go over the tax system in Valais. This will help you avoid any unpleasant surprises if you’re sure about settling in Valais.

In this article, we’ll focus solely on one aspect of taxation in Valais: cantonal taxes. These are one of the three layers of income taxation you’ll be subject to.

To accurately understand and calculate cantonal and municipal taxes (ICC), it’s also important to get familiar with how municipal taxes in Valais work, as well as the additional layer of federal taxes (IFD).

Only by adding these three levels of taxation will you be able to determine the total amount of your tax bill.

And of course, if you need assistance with your tax declaration in Valais, our team would be happy to help.

The line-up:

What does income tax look like in the canton of Valais?

While this article primarily focuses on cantonal tax, it’s essential to set the stage by giving you an overview of what living in Valais might cost in terms of income tax. The first thing to know: as is the case throughout Switzerland, municipalities play a significant role and can greatly influence your overall tax burden.

Let’s look at a concrete example. With an annual income of CHF 70,000, here’s what you might pay in taxes depending on where you live:

- At the minimum: CHF 10,542 in municipalities like Verbier (Val de Bagnes).

- At the maximum: CHF 13,542 in municipalities like Kippel (which, let’s admit, is less famous).

- For all other Valais municipalities, your taxes will fall somewhere between these two amounts.

What can we conclude from these figures?

This brief introduction provides a glimpse into the tax rates you might encounter in Valais and highlights that, depending on the municipality you choose, your tax burden can vary by around ±5%, which is not insignificant.

Now, let’s break down the CHF 10,542 (the minimum amount for Verbier):

- The canton of Valais takes 48.91% of the total tax, which amounts to CHF 5,157.55.

- The municipality of Verbier takes 41.75%, equaling CHF 4,400.95.

- The Confederation collects the remaining 9.32%, or CHF 983.50.

At this point, you should have a clearer understanding of the purpose of this article: to provide the necessary information to calculate the cantonal portion of your taxes (in this case, CHF 5,157.55 for an income of CHF 70,000 in Verbier) and thereby help you better anticipate your overall tax burden.

Calculating cantonal income tax in three steps

Admit it, just reading the title brought you a sense of relief, didn’t it? We felt the same before diving into the calculations and untangling the ironclad logic of the Valais tax administration.

You might have expected a straightforward system: a clear tax table, your taxable income, and voilà—a tax amount. Well, think again! This year, the tax administration has opted not to publish the 2024 tax tables, as doing so is apparently “no longer permitted” (or so we’ve been told).

Undeterred, we rolled up our sleeves and worked with the available data. The good news? We’ve managed to replicate the results accurately. Here’s how you can do it:

Step 1: De-index your taxable income

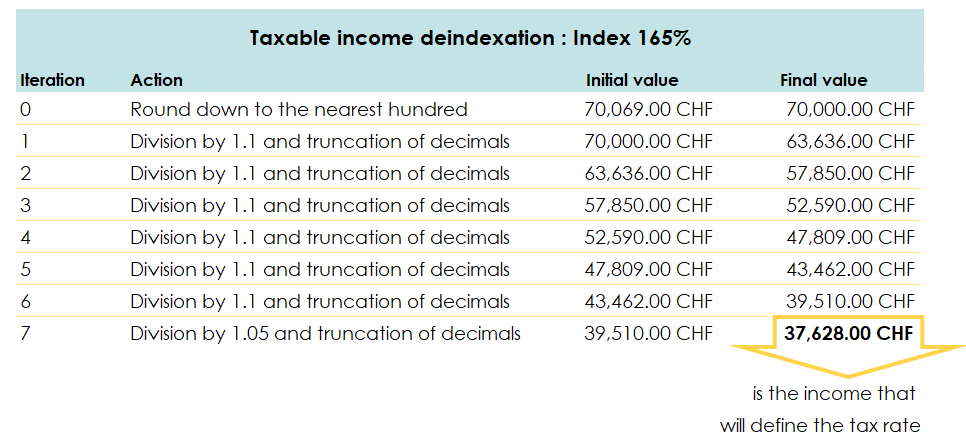

The first goal is to adjust your taxable income to the base income used for determining the tax rate. To achieve this, we follow seven relatively repetitive steps as outlined below:

- Start with the taxable income, rounding it down to the nearest hundred. For example, CHF 70,000 does not require rounding, but if you earned CHF 70,069, you would also start from CHF 70,000.

- Divide this amount iteratively as many times as necessary to reach 100%.

- Iteration 1: 70,000 ÷ 1.1 = 63,636.3636… Keep only 63,636 (cut off everything after the first decimal place without rounding) and proceed to the second iteration.

- Iteration 2: 63,636 ÷ 1.1 = 57,850.9 (again, cut off the decimals and keep 57,850 for the next iteration).

- Iteration 3: 57,850 ÷ 1.1 = 52,590.

- Iteration 4: 52,590 ÷ 1.1 = 47,809.

- Iteration 5: 47,809 ÷ 1.1 = 43,642.

- Iteration 6: 43,642 ÷ 1.1 = 39,510.

- Since the index is 165%, divide six times by 1.1, remembering to cut off decimals.

- Final iteration (7th in this case): Divide 39,510 ÷ 1.05 (since the index is 165%, if it were 163%, you would divide by 1.03… but let’s save this detail for the communal tax calculation).

Summary table of values for the example:

After this somewhat bizarre methodology, we finally obtain a de-indexed income that will serve as the basis for calculating the tax rate: CHF 37,628. This rate, as its name suggests, will determine the percentage applicable to your taxable income.

If, by miracle, you are still with us, don’t lose hope! There is only one more step of this kind before finally seeing the light at the end of the tunnel.

Step 2: Searching for the Valais tax rate

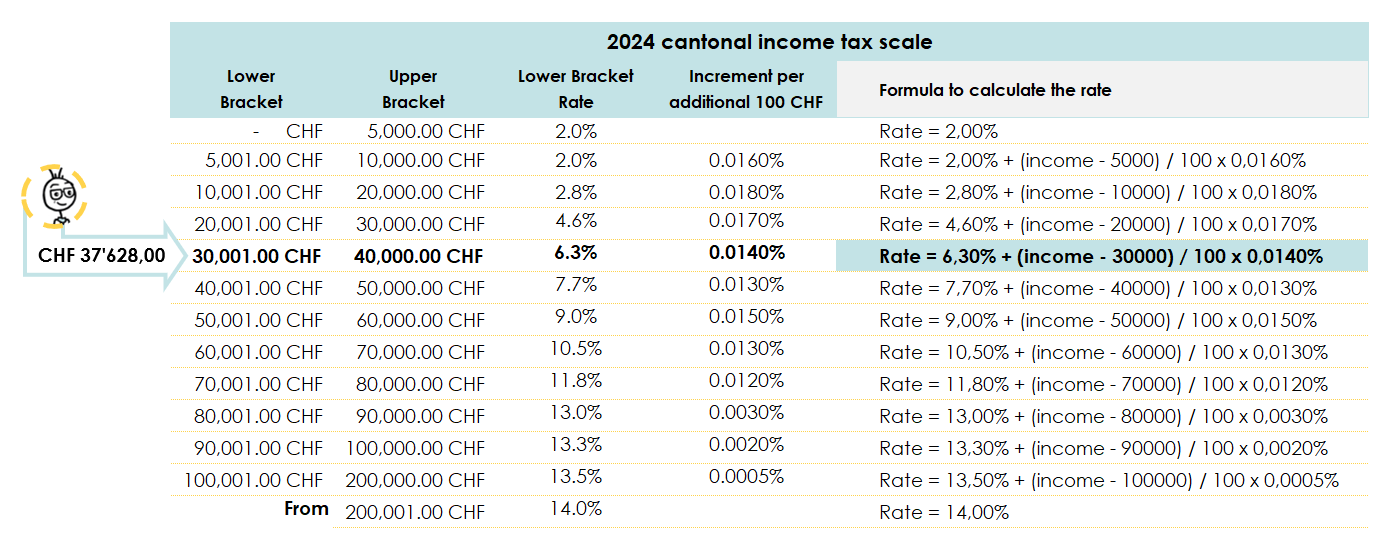

Let’s recap: this step involves determining the tax rate applicable to your income. But how do we go about it? With our freshly de-indexed income and the cantonal income tax scale.

Don’t worry, once again we’ve taken care to provide you with this scale on a silver platter. However, let’s be honest: even if it’s presented here without explanation, it might not be immediately useful. But don’t panic, we’ll break it down together.

Here is the famous table of Valais tax rates:

We have already highlighted the line of the tax scale that interests us for our example:

Noé has a taxable income of CHF 70,000, which after de-indexation, becomes CHF 37,268. Therefore, we focus on the range CHF 30,001 – CHF 40,000, as CHF 37,268 falls between these two values.

To calculate Noé’s cantonal income tax rate, I suggest we go straight to the formula that we’ve carefully checked and apply it:

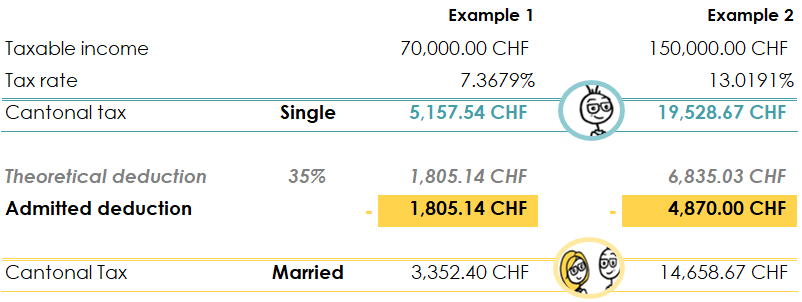

2024 Rate for Noé = 6.3% + (37,628 – 30,000) / 100 * 0.014% = 0.0736792, which is 7.3679% (rounded to 4 decimal places).

Step 3: Calculation of cantonal income tax

Here we are, finally! The last step: calculating the cantonal income tax. To wrap things up nicely, forget everything we did in the first step. This time, we simply focus on one basic operation: multiplying your income (CHF 70,000) by the applicable tax rate.

Here’s the calculation:

CHF 70,000 × 7.3679% = CHF 5,157.55

So, CHF 5,157.55 is the cantonal income tax to be paid for the year 2024!

Crazy, right? This amount matches exactly what we had announced in our first paragraph. Mission accomplished!

How does the Valaisan income tax work when married?

Perhaps you’ve already found your soulmate, or perhaps not yet? In any case, it seems relevant to examine the impact of marriage on the amount of taxes to be paid.

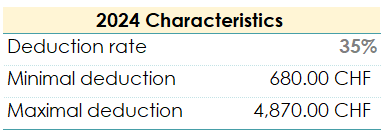

This is where the term “deduction” comes into play. It’s a flat sum that the Valaisan tax administration will subtract from the taxes due by the married couple.

As a married person, you can subtract 35% of the tax you would have paid if you were single. However, for the 2024 taxes, this deduction cannot be less than CHF 680 or more than CHF 4,870. In other words, you take the tax you would have paid as a single person, considering the income and deductions of the entire household, and then calculate 35% of this amount. If the deduction is less than CHF 680, the amount will still be CHF 680, and if it exceeds CHF 4,870, the amount will be capped at CHF 4,870. Any other amounts falling between the two can be deducted as is.

If this wasn’t perfectly clear, for once, the Valaisans have been “chill.” Instead of spending an afternoon trying to make something simple more complicated, they simply decided to keep everything the same for singles but allow a small 35% deduction that cannot be less than CHF 680 nor more than CHF 4,870.

Let’s take several examples.

Married couple with a taxable income of CHF 70,000

As a single individual with the same income, you would have had to pay the canton the hefty sum of CHF 5,157.55, but since you are married, you can subtract 35% of the tax. This results in a reduction of CHF 1,805.14. Since this amount falls between CHF 680 and CHF 4,870, it will be accepted as is.

You will therefore pay a final cantonal tax of CHF 3,352.40.

Married couple with a taxable income of CHF 150,000

The same principle applies: first, consider the tax as if you were single with a taxable income of CHF 150,000. In this case, the tax would have been CHF 19,528.70. If we subtract 35% from this amount, we get CHF 6,835.05, which exceeds the maximum limit of CHF 4,870. Therefore, the deduction applied will be CHF 4,870, resulting in a final tax of CHF 14,658.70.

The tax deduction in a more general way

We now know that you cannot deduct less than 680 CHF, and you cannot deduct more than 4,870 CHF.

Here, we will approach the problem from the reverse angle by finding what taxable income is needed to fall within these different scenarios.

The minimum deduction of 680 CHF

To find the amount of tax that, when multiplied by 35%, gives 680 CHF, we calculate 1,942.86 CHF. Then, we find what taxable income corresponds to a tax of 1,942.86 CHF, and that amount is 38,200 CHF.

What this tells us is that if the taxable income of the household is between 0 CHF and 40,000 CHF, then you will be able to deduct 680 CHF from your taxes as a married couple.

The maximum deduction of 4,870 CHF

Here, we do the same thing but in the opposite direction. We need to find what amount of tax, when multiplied by 35%, gives 4,870 CHF, and that amount is 13,914.29 CHF. Then, we find what taxable income corresponds to a tax of 13,914.29 CHF, and that amount is 123,200 CHF.

So, once your taxable income equals or exceeds 123,200 CHF, you will be able to deduct 4,870 CHF from your taxes.

The standard 35% deduction

No more calculations needed. As we know, below 40,000 CHF, you will deduct 680 CHF, and above 123,200 CHF, you will deduct 4,870 CHF. So, for taxable incomes between these two amounts, you will be able to subtract 35% of your cantonal taxes.

The impact of children on your tax burden

Having a dependent child gives you the same tax rights as being married. In other words, once you have a child dependent on you, you will have the right to deduct from your taxes the same tax deduction explained in the previous section, and in addition, you can benefit from a tax savings of 300 CHF per child.

Let’s take a closer look at the impact for a single person with a dependent child, and then the impact for a married couple.

The impact of children if you are not married.

Even if it means that you are not or no longer married, you will still be entitled to keep (or register) the tax deduction related to the allowance, and on top of that, you will receive an additional reduction of 300 CHF per child.

The impact of children if you are married.

I must inform you that having a child will not result in a significant tax benefit, and fortunately, that’s not the reason we have children. Since you already benefit from a tax deduction due to your marriage, you will only be eligible for an additional reduction of 300 CHF per child in addition to the existing deduction for your child on your tax burden.

Calculating your total taxes in Valais: ICC + IFD

For those who have had the courage to read this article in its entirety and are still with us at this point, congratulations! However, don’t forget that everything we’ve covered so far only accounts for 49% of your income taxes. The largest portion still needs to be calculated, and it is divided between the municipality and the Confederation.

Don’t worry, FBKConseils is here to make your life easier. So, feel free to read the other relevant articles.

Oh, and before we dive into our services, don’t forget that we’ve only discussed income tax so far. In Switzerland, unlike many other countries, there is also a wealth tax. Yes, all your wealth, whether movable or immovable, is taken into account. Once you’ve calculated your taxes for the municipality and the Confederation, a quick detour to wealth tax is a good idea to wrap things up nicely.

How FBKConseils can help you?

A Free initial meeting

Whether you’ve read the entire article or simply scrolled to this section, know that we offer a free initial meeting lasting 15 to 30 minutes. This is a great opportunity to get to know each other, understand your situation and needs, and, most importantly, answer any of your initial questions.

Tax simulation

You may have heard that the canton of Valais is some sort of not-so-secret tax haven? Beware of preconceived ideas! A good tax simulation will quickly show you that this reputation doesn’t always reflect reality. With a few exceptions, taxes in Valais are not much different from the rest of French-speaking Switzerland.

FBKConseils is here to help you clarify the situation and avoid any unpleasant surprises.

2024 Tax declaration

Whether you want to learn how to fill out your tax declaration or prefer to delegate it entirely, FBKConseils is by your side to assist you with your 2024 tax declaration.