Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on October, 4th 2024.

Understanding the calculation of the taxable income in Switzerland

Before getting to the heart of the matter, we would like to make it clear that this article only concerns taxpayers who have to file an “ordinary” tax return:

- Swiss citizens or holders of a C permit

- Persons taxed at source who are taxed according to the subsequent ordinary taxation procedure TOU

For all other people, mainly those who are taxed at source but are not obliged to make a TOU, this article does not concern you. However, here are some other articles that may interest you:

- Tax return: the key steps from withholding tax to tax assessment

- Withholding tax in Switzerland: does it concern you?

- How are withholding taxes calculated in Switzerland?

The line-up:

Introduction: What is the purpose of this article?

Most of our clients know that when you work you have to pay tax. What most don’t know, however, is how to go from a gross income negotiated when you were hired to your net income and finally to the income that will be taxed (taxable).

Step 1: Calculate your gross salary

It simply is the final sum of all your incomes throughout the year as well as your pensions and benefits related to your assets. For employees, gross income consists mainly of :

- Gross annual salary

- Bonuses and premiums

- Your 13th salary

- Employee shares

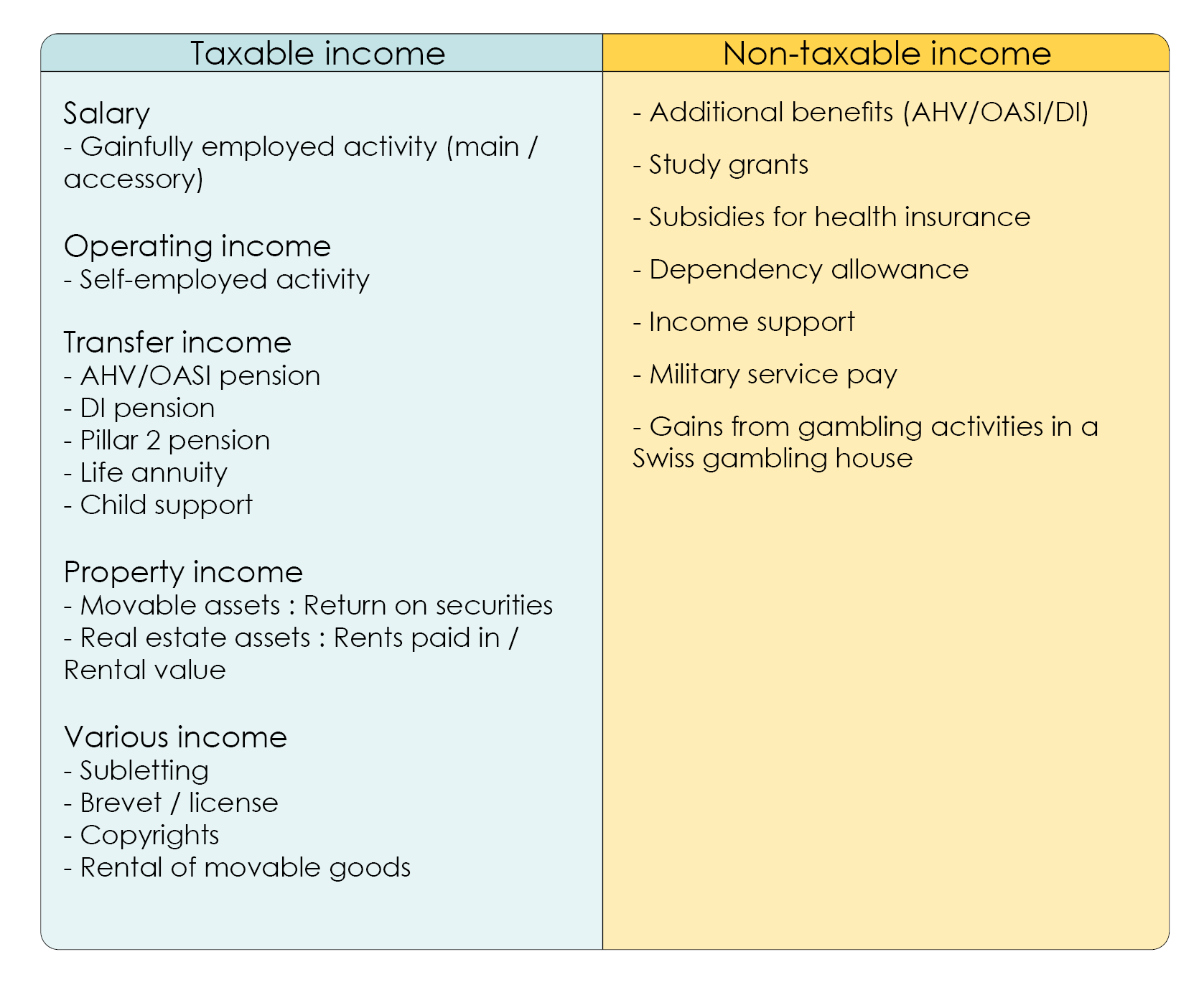

To your professional activity, you must add all other income that is not directly linked to your profession.

To help you, we have put together the main sources of income that must be declared each year and those that do not.

Did you calculate your gross income? Then let’s move on to the next step: the net income.

Step 2: Calculate your net salary

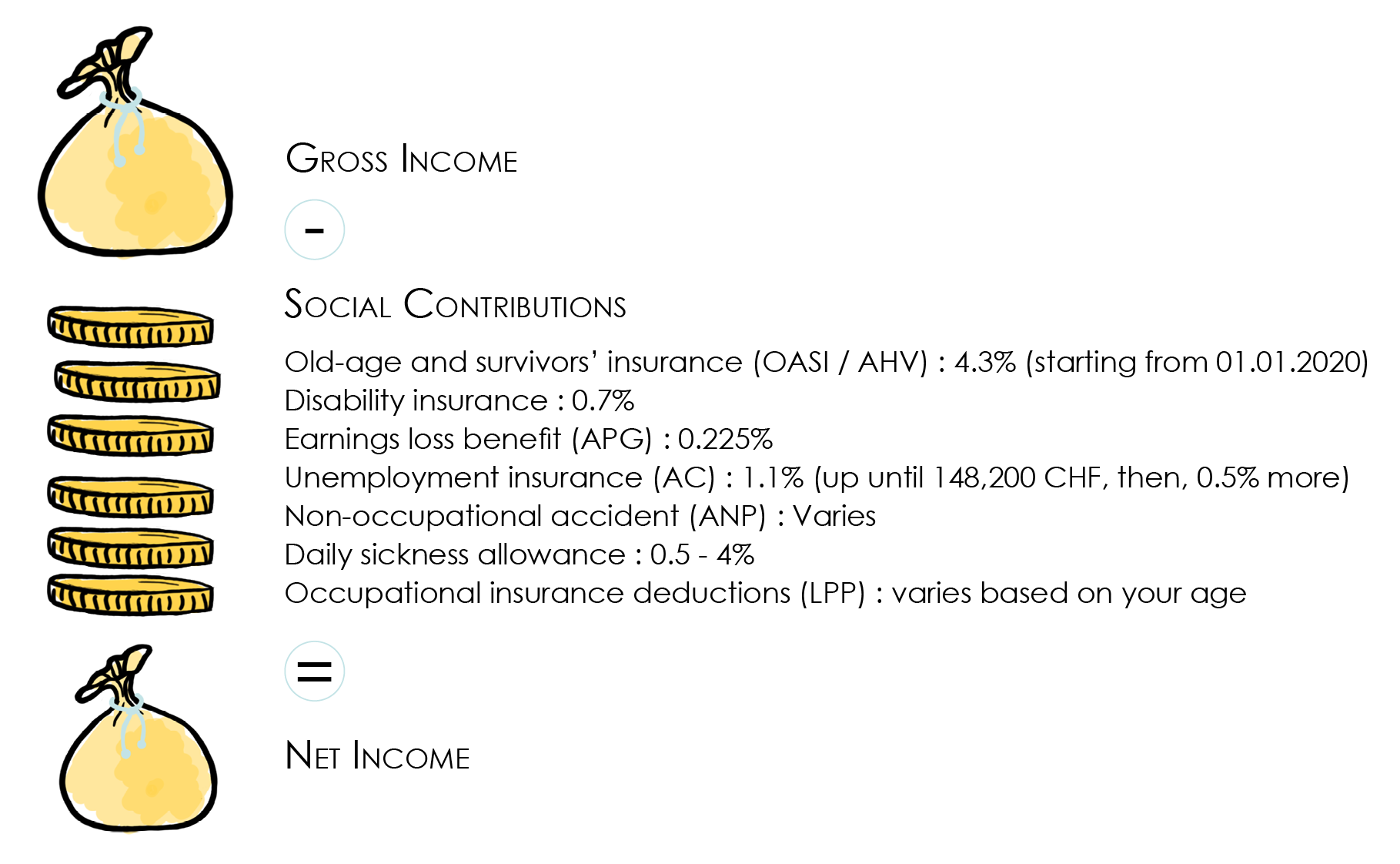

Net income is simply your gross income (calculated in the previous paragraph) minus social contributions.

If you are an employee, do you know exactly which social deductions are withheld on your gross salary.

It is the ones that are deducted at the end of each month by your employer. They appear on your pay slips.

If you are self-employed, you will have to deduct social security contributions (AVS, LPP, insurance and other cover) from your turnover when you draw up your annual accounts.

In conclusion, what you receive on your bank account each month is your monthly net income.

Just a reminder: if you are taxed at source, you will have an additional line showing the tax deducted directly by your employer.

Last step: taxable income.

Step 3: Calculate your taxable income

Hold on to your hats, because from now on everything will get a bit murkier. As you know, there are many cantons within the Swiss Confederation, and unfortunately for you (and for us), each canton has varying degrees of flexibility when it comes to setting the tax deductions allowed for its residents.

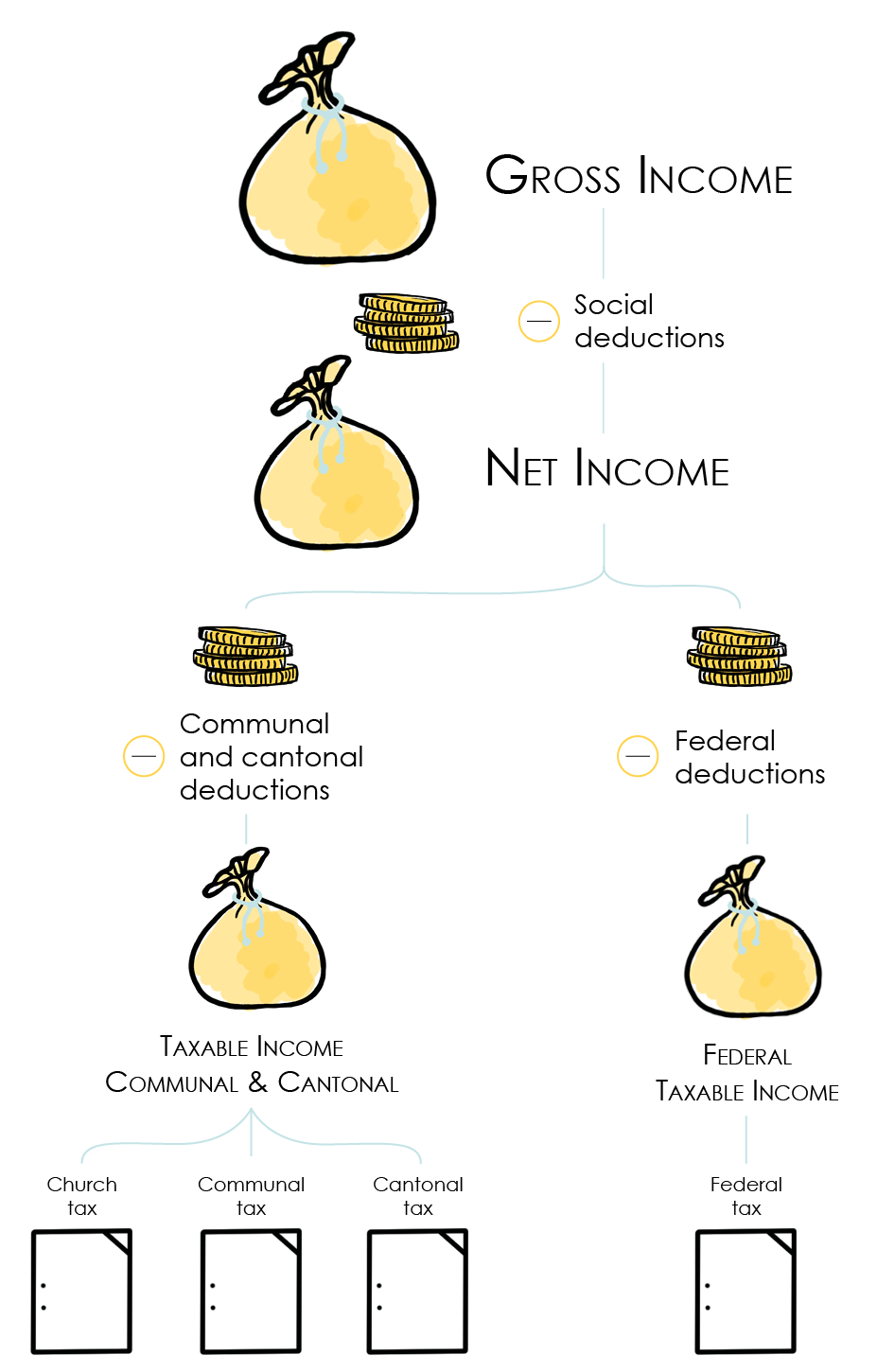

In other words, once you have obtained your income net of all social security contributions, you still have the right to make private deductions, which depend on the tax rules in force in your canton of residence and the Confederation, to obtain two taxable incomes finally:

- Cantonal and municipal taxable income: CCI.

- Federal taxable income: DFI.

What deductions are authorized by your canton and municipality of residence?

Broadly speaking, the types of income tax deductions are similar from canton to canton, but the amounts deductible can vary considerably. Here are the main categories of commonly accepted deductions:

- Transport expenses ;

- Meal expenses ;

- Various professional expenses (other professional expenses) ;

- Health insurance (LAMal and LCA premiums) ;

- Medical expenses;

- Interest paid on property and consumer loans;

- Training costs ;

- Bank charges ;

- Childcare costs;

- etc.

Although these deductions are generally recognised, each canton sets its own ceilings, which can have a significant impact on your taxable income.

It is important to note that certain deductions accepted in one canton may be excluded in another. For example:

- The 3rd pillar B is deductible only in three cantons, including Geneva, but is rejected in the canton of Vaud.

- Interest on building loans is accepted in the canton of Valais, but refused in Geneva and Vaud.

- Other business expenses are accepted as a lump sum in the canton of Vaud, but are excluded in the cantons of Geneva and Valais.

To help you better understand these specificities, we have prepared three articles dedicated to each canton of residence:

- The main deductions in the canton of Vaud

- The main deductions in the canton of Geneva

- The main deductions in the canton of Valais

These guides will help you calculate your taxable income at cantonal level. But what about taxable income at federal level?

What income tax deductions are available at federal level?

If you understand how deductions work at cantonal level, you’ll find federal deductions easier to understand. The Swiss Confederation allows virtually the same deductions as the cantons, although the amounts and lump sums may vary. To help you navigate direct federal tax, we recommend that you consult our specific section : How to calculate one’s direct federal taxation (DFI/IFD)?

Step 4: Determine your annual tax burden

Once you have determined your taxable income (CCI and DFI), all you need to do is (in quotes) understand the calculation method specific to your canton of residence to estimate your income tax. Each canton in Switzerland has developed its own method of calculating tax, and the differences between them are sometimes considerable. At FBKConseils, we’re here to help you through this complex process, by helping you to understand the tax specifics of your canton.

- Understanding your income taxes in the canton of Vaud

- Understanding income tax in the canton of Geneva

- Communal income taxes in Valais

Tips and tricks for better managing your taxable income

- Tip no. 1: When you start any professional activity, take the time to find out about social security contributions. Does your employer contribute generously to your pension? Is there sufficient cover for accident, disability and death? What will your net income be after all contributions have been deducted?

- Tip no. 2: Familiarise yourself with your payslip and salary certificate, which are the key documents for understanding your income and the deductions made. If in doubt, don’t hesitate to contact your HR department for clarification.

- Tip no. 3: At FBKConseils, we value self-reliance and financial education. However, we also recommend that you seek professional advice during the first year of filing to ensure that your return is accurate and that all your deductions are included.

How FBKConseils can help you?

At FBKConseils, we are passionate about tax (surprising as it may seem) and would be delighted to help you understand the Swiss tax system and the opportunities for tax optimisation. Since 2024, we have been offering our clients workshops on how to declare their income and assets correctly. This training will enable you to create a personalised template that you can use for future tax returns. We also offer consultations to carry out simulations or provide you with all the information you need to make informed decisions.