Written by Yanis Kharchafi

Written by Yanis KharchafiHow does accounting and taxation work for the freelancers?

You’ve done it, you’ve taken the first step or you’re about to embark on an entrepreneurial adventure in Switzerland? Congrats! As always, you’ve come to the right place to learn the basics.

We have decided to divide all this information into several chapters. This one will be devoted to bookkeeping and taxation as a self-employed person, but two other topics have also been covered on our website:

– The administrative formalities involved in becoming a freelancer

– How does retirement work for the self-employed?

The line-up:

Self-employed accounting

In Switzerland, two types of accounting are recognised, depending on your choice and the size of your individual business:

– Ordinary accounting, a bit like a Michelin-starred chef’s recipe,

– And simplified accounting, your quick and efficient comfort food.

As the name suggests, the difference lies mainly in the complexity of the bookkeeping.

Ordinary accounting

This type of accounting, which is less flexible than simplified accounting, is compulsory only if a self-employed worker has been able to generate an annual income exceeding CHF 500,000.

If this is not the case for you at the moment, you can go straight to the next chapter.

This accounting system is based on the Swiss Code of Obligations, and more specifically on articles 957 CO and following.

The idea behind all this is to regulate as much as possible the way in which companies’ financial situations are presented so that the tax authorities, banks or other investors can get a clear picture of your business.

You need to be able to present two (sometimes three) ledgers showing all your income, expenditure, assets and debts. These ledgers are called :

– The balance sheet (where everything begins and ends)

– The profit and loss account (or income statement, or the exciting story of your financial year)

– The notes to the accounts (the juicy details for the more curious)

The balance sheet

This is one of the two main parts of your accounts. The balance sheet is a collection of information showing :

– Your assets

– Your liabilities

– The profit brought forward (positive or negative) from your year of hard work

The balance sheet: Your assets and liabilities

In this section, you will need to list all your assets:

– Cash (in the mattress, in the bank, in the flower pot, etc.)

– Your valuable machines and tools (yes, even that old coffee machine)

– Loans (the ones we often prefer to forget)

– Prepaid expenses (as a little bonus for yourself)

– And so many other gems…

The balance sheet: Your debts

As with your company’s assets, debts should be reported in order to give a clear financial statement of the people to whom you owe money:

– Loans to third parties

– Unpaid expenses

– Loan from a bank or investor

– Mortgage debt

– etc.

As a general rule, debts will be classified from the most payable in terms of date to the least payable.

The profit and loss account

While the balance sheet shows assets and liabilities, this account highlights all the income received and expenses paid during the concerned year. On one side we have the income related to our business:

– Fees

– Services sold

– Products and goods sold

– Commissions received

– Etc.

And on the other side we have expenses:

– Salaries

– Membership fees and insurance

– Purchases of goods

– Training

– Development

– etc.

Once all the annual entries have been made, this account shows whether or not profits exceeded expenses. The result may be either an operating profit or an operating loss.

Finally, this result will be added to the balance sheet to complete the annual account.

Notes to the financial statements

These are not compulsory but are very useful. They provide more detailed information on the methodology used to arrive at the balance sheet and income statement. They provide information on:

– Accounting standards and practices

– Further information on the condition of goods

– Interest rates

– Depreciation tables

– Valuation methods

– etc.

In short, everything that makes the other two major documents easier to read.

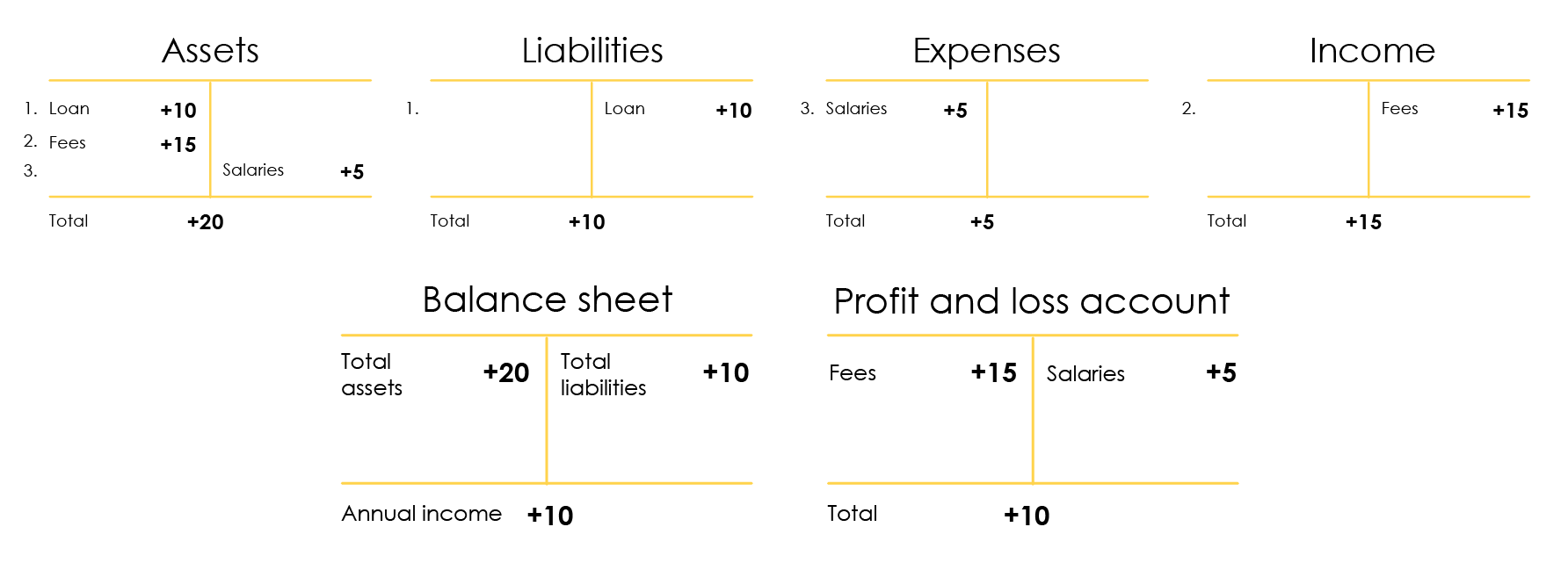

To facilitate an overall understanding of accounting within the meaning of the Swiss Code of Obligations, I would like to give you a small example of a company active in financial advisory services and starting up on 01.01.2023 with a start-up capital of CHF 10 lent by its founder. During 2023, the company will sell an hour of advice for CHF 15 and will have to pay a salary of CHF 5 (including social security contributions).

The first entry will be the loan of CHF 10 by its founder, which will impact ;

– Our assets, i.e. our current account: + 10

– Our liabilities, i.e. our debt: +10

Then, during the year, we will generate income through a salary, which will affect

– Our assets, our bank account: +15

– And our expenses: +5

If we were to show these accounts to a bank or an investor, they would quickly see that we have borrowed money to launch our business, we have a positive profit and loss account, in other words we have positive financial margins from the first year and that this has finally increased the value of our balance sheet by CHF 10 over the year 2023.

It’s impossible to make accounting simpler and more straightforward. In reality, nothing is quite as it seems…

We have interest rates for the loan, we have depreciation on our assets, it is possible to create provisions in case of potential future problems, it is also possible to provide a service without being paid in return, etc., etc. Accounting, whether you like it or not, is a story for auditors and accountants. But at least you have the general idea.

In my view, keeping ordinary accounts on your own is not easy for everyone and can lead to errors of assessment by the tax authorities. Simplified bookkeeping, on the other hand, can be done by yourself and will do the job just fine.

Simplified accounting or the milk book

If you have more or less understood ordinary accounting, simplified accounting will be child’s play.

If you don’t want to have to comply with the accounting standards laid down in the Swiss Code of Obligations, your business must not exceed an annual turnover of CHF 500,000.

Here, the principle is the same, but much less strict. The aim of the game is to present a precise statement to the tax authorities:

– Your income

– Your expenses

– Your assets

– And your debts

For the moment, there’s nothing new under the sun, or at least it’s not immediately obvious, but in practice you won’t be subject to any strict accounting principles and you’ll have much more room for flexibility.

To make your life easier (as always), there’s nothing better than our good old Excel spreadsheet, which will allow you to keep track of all your finances. On one hand, what you’ve paid throughout the year, on the other everything you’ve collected, and finally you do the same with your bank accounts and debts.

I know better than anyone that when you start your business you tend to get everything mixed up: your bank account is usually the same as your business account. You don’t distinguish very well between your business assets and your private assets and it’s not uncommon for you to pay your business expenses from your private accounts… If that’s the case, you’re not alone, ooh no.

It’s common practice, but believe me, it’s practical during the year, but it immediately becomes much more ‘annoying’ at the start of the following year when the deadline for filing your tax return arrives.

Our advice: try as best you can to keep your businesses with their own bank accounts and try as far as possible to pay your expenses from this dedicated account. The less you mix things up, the better you’ll be able to keep track of your business from a fiscal and financial point of view.

In addition, from a purely practical point of view, accounting and tax standards are not the same for private assets/liabilities as for business assets/liabilities, so there can be many implications.

Yes, everything is never black or white… Typically, the vehicle you use to take your children to tennis practice is also used to transport your goods, and your home is also your office…. You will need to take the time to define when and how these assets are used in order to determine what is the private share and what is the commercial share.

Taxation for the self-employed

In this large first part, we went into detail about the accounting of a self-employed person, but not his tax system, because yes, even self-employed people pay tax.

What’s really cool about FBKConseils is that the taxation of the self-employed is pretty much the same as for an employee, so take the time to read all our articles on the subject, depending on your canton of residence: https://fbk-conseils.ch/impots/

On this page, you will find an explanation of taxes for the cantons of Vaud, Valais and Geneva.

So the first step is to keep your accounts as tidy as possible and then, just like an employee, you need to start the process of filing your ordinary tax return. It’s as simple as that: download the software in question (VaudTax, GETax, VSTax), arm yourself with your taxpayer number and your control code and get started, as you did in previous years.

There are two important differences to take into account:

The salary certificate Vs. the annual income: As a self-employed person, you do not have a salary certificate, but you will have an annual income from your business, which will be the salary to be declared. This is the result of all your receipts minus all your expenses.

The second difference lies in your assets. It is important to enter all your private and business assets, specifying whether they are part of your private or business assets.

In terms of authorised deductions, tax rates and calculation methods, nothing changes. For the same taxable income, an employee will pay exactly the same amount of tax as a self-employed person.

The last important thing is that a self-employed person, particularly in the first few years, may have a negative turnover, with costs exceeding income, it happens… and you should know that, as surprising as it may seem, you will be entitled to reduce your overall income accordingly.

Let’s say you have a house with taxable income of CHF 10,000 and your business lost CHF 7,000 that same year. Your taxable income would be CHF 10,000 – 7,000 = CHF 3,000.

So, are you ready to embark on this great adventure? Try not to think too much about accounting, tax or retirement – it’s discouraging, but keep it in the back of your mind because it’s important.