Written by Yanis Kharchafi

Written by Yanis KharchafiHow does retirement work for the freelancers? AVS, LPP and 3rd pillar

Introduction

Have you decided to make a career change and throw yourself headfirst into an entrepreneurial adventure? Have you already had a chance to read our complete guide to starting your own business?

In this 2nd guide, we’re going to focus more specifically on retirement for the self-employed, so that you can better anticipate the pensions and capital you may receive once your career is over.

That leaves you with just one essential guide to read before going any further: accounting and taxation for the self-employed.

The line-up:

The first pillar for the self-employed: AVS & AI

How do I choose my AVS compensation fund?

I don’t know if this is good news, but a freelancer, just like an employee, is obliged to join the AVS. There are several AVS compensation funds, and they all work in the same way. So, the best decision is probably just to choose the one that covers your canton.

- AVS compensation funds for the canton of Vaud : https://www.caisseavsvaud.ch/fr/Accueil/Caisse-cantonale-vaudoise-de-compensation-AVS.html

- AVS compensation funds for the canton of Geneva (OCAS) : https://www.ocas.ch/

- AVS compensation funds for the canton of Valais : https://www.vs.ch/web/avs

You will need to fill in their questionnaire and prove the strength of your business plan.

How does the first pillar work?

Once you have selected your AVS compensation fund and are affiliated, you are considered self-employed in a broad sense. You will need to provide them with an estimate of the annual profit you expect to generate.

It is on this profit that you will have to pay quarterly AVS contributions.

To help you prepare for these bills, we suggest you find out how AVS contributions are calculated.

AVS contributions

Contributions for the self-employed are slightly different from those for employees. The difference lies in three points:

– There are no unemployment contributions

– There are no accident insurance contributions.

– As you no longer have an employer, you will be responsible for all social security contributions.

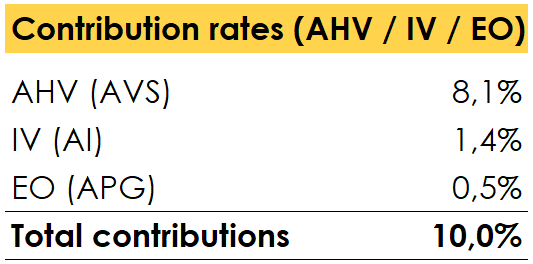

The contributions (effective from January 1, 2025) can be summed up in 3 points, as shown in this small table:

However, if your income does not exceed CHF 60,500 during the year, the contribution rates are reduced accordingly.

What salary is used for AVS contributions?

In the first year, you will need to simulate the income you will actually earn. The AVS will use this amount as a basis for calculating the amounts to be paid, and when you arrive at the beginning of next year, you will have to balance the books on the basis of accurate accounts.

– Either the contributions are insufficient, and you will have to pay the difference.

– Either the contributions are too high, and you will be reimbursed.

It’s all very well to contribute… But what’s the point? What will your rights be? How will you get your money back?

How do AVS pensions work?

You’ve paid into the pension scheme for many years without a second thought and now you’d like to give it a rest. The AVS will pay you a pension for life from the first day of your retirement until the last.

Since the method of calculation and the amounts are the same for all employees, I invite you to read our article on calculating AVS pensions to find out when you can retire (especially since the “AVS 21” reform).

The second pillar for the self-employed : BVG / UVG

If you’ve read the article on AVS pensions, you’ll have realised that it’s rather reassuring to receive a pension for life, but that the amounts are still rather disappointing. Unfortunately, the first pillar will not cover all your financial needs.

As a self-employed person, you will have the opportunity (and I stress the word opportunity) to join the 2nd pillar on a voluntary basis in order to contribute a certain amount of your income to build up retirement capital.

The 2nd pillar / LPP in the broad sense :

Unlike the first pillar, the LPP/BVG is a capital that belongs to you and will never be distributed to other insured persons. It is essentially made up of :

– Voluntary contributions from the insured

– Interest and returns on your BVG capital

– The division of BVG capital after a divorce

As long as you are affiliated to the 2nd pillar, your BVG capital will never stop growing until the day you retire (or if you claim another reason for withdrawing your 2nd pillar capital).

When you retire, your capital can either :

– Be withdrawn in the form of an annuity for life as for the first pillar

– be withdrawn as a lump sum

– Divided into an annuity and a capital sum

We have also explained 2nd pillar pensions and capital in another article.

The 2nd pillar: Is it worthwhile taking out a 2nd pillar?

As this is an option and not an obligation, the freelancers are entitled to ask themselves: should I join the 2nd pillar or would it be better to keep this income to develop my business or simply to treat myself?

This is not a question to which there is a simple answer, but before giving you some advantages here is a brief reminder of how the 2nd pillar works for the self-employed:

Depending on your salary and the interest paid, your second pillar capital can be split into two parts:

– The mandatory part

– The non-mandatory part

Mandatory LPP: the bare minimum

The 2nd Pillar Act sets out all the legal minimums:

Salary on which you will pay contributions

Depending on your age, the minimum contributions are as follows

o 7% aged 25 to 34

o 10% aged 35 to 44

o 15% aged 45 to 54

o 18% aged 55 to 64 for women / 65 for men (before the new AVS 21 standards came into force)

Interest rate

The more contributions you pay, the higher your capital will be. In addition to the contributions, your pension fund will invest your money in the markets according to their rules and do its best to make your capital grow from year to year. On the mandatory part of the contributions, annual interest of 1% is guaranteed. Interest rates vary between 0% and 6%, depending on the quality of the asset management. This capital will grow every year thanks to the investments made by your pension fund. On the mandatory portion, they will be obliged to pay you 1% interest.

Mandatory BVG/LPP: A tailor-made 2nd pillar

If you have followed this article carefully, you will have seen that there are :

– Minimum contribution rates

– Minimum interest: 1%.

– Maximum LPP/BVG insured salary: CHF 90,720

Together, these represent the mandatory part of your 2nd pillar.

But the 2nd pillar offers the possibility of flouting the rules by increasing (always voluntarily) contribution rates and the insured salary. The aim? Contribute a maximum in order to deduct a maximum.

You will have the choice of increasing your salary up to CHF 90,720 and contributing a maximum of 25% of your income.

So now you know how you’re going to contribute and the options available to you, but you’re not quite sure what for? So let’s get on with it.

2nd pillar tax benefits

In addition to the need for insurance and cover, the 2nd pillar can be a great tax saver, as all risk (invalidity and death) and savings (retirement) contributions are tax deductible.

In other words, all your contributions will be deductible. It’s basically as if you were paying yourself a salary that would not be taxed.

If you bear in mind that tax can rise to over 30%, the saving (excluding interest) would represent 30% on each franc invested in your 2nd pillar.

Interesting, isn’t it?

As well as not being taxed, the 2nd pillar has other aims besides saving tax. It also provides protection against 3 significant risks:

– Risk of death

– Risk of disability

– Provide you with a decent pension in addition to the 1st pillar.

Retirement, disability and death cover

One thing nobody likes to talk about or think about is what will happen if I retire, become disabled or die? The 2nd pillar is an effective solution to these questions.

If you do not join the LPP, then apart from the 1st pillar and its relatively low pensions, you will have to assume these risks on your own:

– Retirement: Over time, you’ll need to build up enough capital to cover all your financial needs when you retire:

o Financial investment

o Savings

o Buying real estate

– Disability: From our point of view, this is where the risk is the greatest. If you are no longer able to work, you will have to rely solely on the DI to keep you going, and believe me, that will be neither easy nor sufficient. The 2nd pillar allows you to “choose” the disability pensions you will receive in the event of disability. These pensions are generally calculated on the basis of your insured salary. For example, I want to insure 60% of my income in the event of disability.

– Death: If you die before retirement age and you are self-employed, there are also first-pillar pensions that can be paid under certain conditions:

o Widows’ pensions

o Widowers’ pensions

o Orphans’ pensions

But it’s always the same problem: depending on your lifestyle (house, children, household responsibilities), these pensions will probably be insufficient to replace your former income. The 2nd pillar also allows you to include widow’s/widower’s pensions and lump sums following a death.

In conclusion, if you don’t have investment plans in your company or an attractive savings solution to secure your old age, the 2nd pillar is the number 1 tool for protecting yourself and your family during your career, while keeping taxes low and securing a worry-free retirement.

Before moving on to the 3rd pillar, there’s one last question on my lips: how do you choose your 2nd pillar?

The 2nd pillar: How do you open a 2nd pillar and with whom?

If you have weighed up the pros and cons and would like to join a 2nd pillar scheme, there are 3 possible options:

– Pension funds in your field of activity

Some pension funds are specialised in a specific area (doctor, lawyer, artist, etc.). If one of these areas applies to you, you should first contact them to obtain a tailor-made solution that best suits your needs.

– Your employees’ pension funds

If you employ staff, you will also be able to apply for membership of their institution, even if it is not part of your business sector.

– The supplementary institution

This is a public institution that allows any self-employed person to join. This will never be the most suitable solution in terms of cost and options, but it does offer cover close to the legal minimums.

It’s time to switch to the 3rd pillar: private, unrestricted, A, B pension provision? Let’s get started!

The 3rd pillar for the self-employed

There are countless articles on the 3rd pillar that we have written or that you can find on other sites (not as good as ours).

- How much can we save in taxes thanks to the pillar 3?

- Pillar 3A at the bank or with an insurance, what is the best choice?

But here we are going to focus more specifically on the 3rd pillar for the self-employed.

I suggest we start with Pillar 3A.

The 3rd pillar A: Private or tied pension provision

This is the same 3rd pillar A opened by an employed person. It is a bank account or insurance policy into which you can put a certain amount each year to save for your retirement.

The big and only difference comes from the possible amounts.

– The 3rd pillar if you are not affiliated to the 2nd pillar

In your self-employed activity you did not wish to affiliate to a 2nd pillar, so you can contribute 20% of your income or a maximum of CHF 36,688 in 2025 to your 3rd pillar.

– The 3rd pillar if you are affiliated to the 2nd pillar

If you are self-employed and wish to join the 2nd pillar, you can deduct 20% of your income or a maximum of CHF 7,258 in 2025 from your 3rd pillar.

There is no other difference.

Our advice? In the first few years, it might be a good idea to opt for a 3rd pillar A bank account (and not an insurance policy!). That way, you avoid the problems associated with buy-back values and, depending on your budget, you can invest the amount of your choice with no obligation from one year to the next. Once you have started your business and your income are more certain, the 2nd pillar combined with the 3rd pillar could be the best option.

3rd pillar B: Unrestricted pension provision

The first important thing to know is that, unlike the 3rd pillar A, the 3rd pillar B is only a solution offered by insurance companies. It cannot be taken out with a bank. What’s more, except in certain cantons, it is not really deductible from municipal and cantonal tax (ICC).

As a result, it is generally not a good solution for saving tax. Nevertheless, even if it seems to have only disadvantages right now, the 3rd pillar B can in some cases be an effective insurance.

The 3rd pillar B, more commonly known as life insurance, allows you, while still alive (and in good health), to protect yourself against death and invalidity in addition to the 2nd pillar, with much greater flexibility in terms of beneficiaries. The 2nd pillar allows you to cover family members only (at a lower cost). You won’t have any leeway over who is insured, and capital and pensions will be paid out in a very specific order.

With the 3rd pillar B, on the other hand, you decide without limit who will receive what and in which situation. It is the perfect tool for protecting your partners and your company in the event of a major problem. It allows you to free up capital to keep your business running when the going gets tough.

I think we’ve given you enough information about retirement for the self-employed for today. You should now be able to understand what’s at stake and, above all, ask yourself the right questions about your future.

Even if, when you start out as a self-employed person, the last problem you seem to have is the very distant future, I can assure you that it’s very important to keep all this in the back of your mind and to take the necessary steps as soon as possible so that you can complete your project with a light heart.

How can FBKConseils support you with your independent business?

Starting out as an independent professional is a demanding journey. While we can’t choose your field of activity, FBKConseils is here to assist you with all the other essential aspects. Creating, managing, and making an independent business profitable requires knowledge and tailored support. Here’s how we can help:

An initial introductory meeting

Sometimes, a simple conversation is enough to dispel doubts. We offer a 20-minute free consultation designed to address your essential questions and lay the groundwork for your project. This meeting is the perfect opportunity to clarify your ideas and plan the next steps of your entrepreneurial journey.

In-Depth advisory sessions

Once your project is launched, it’s often necessary to tackle complex topics such as:

- Solutions to prepare your retirement, including subscribing to a 2nd pillar plan.

- Tax optimization strategies to maximize your income.

- Financial simulations to better anticipate the costs and benefits of your business.

At FBKConseils, we organize personalized advisory sessions to explore these questions in depth and provide answers tailored to your situation.

Accounting, Tax filing, and VAT management

As an independent professional, you’ll often face administrative formalities that can feel time-consuming. FBKConseils is here to ease your burden:

- We take care of your business accounting.

- We assist with your annual tax returns.

- We manage your VAT-related procedures, if applicable.

With our support, you can focus on what truly matters: growing your business.

With FBKConseils, you’re never alone when facing the challenges of entrepreneurship. Contact us today to discover how we can support you at every step of your journey.