Written by Yanis Kharchafi

Written by Yanis KharchafiRetirement in Switzerland: Should you withdraw your 2nd pillar as a pension or as a capital?

The line-up:

Introduction

“So, for your 2nd pillar, will you take it as an annuity or a lump sum?” This is a crucial and unique question for anyone approaching retirement. You will almost always have the option to choose whether you prefer to take your entire balance in one lump sum or whether you’d prefer that your pension fund provide you with predefined and lifetime annuities, continuing until the end of your life. But to make an informed choice, there are certain factors not to be ignored:

- Our health status – the longer we live, the more annuities we might potentially receive from the pension fund.

- Our financial management knowledge – because when it comes to capital, it’s all about management, not taking unnecessary risks.

- Taxation related to this choice – because yes, taxes are always lurking.

- Our heirs – and what we may wish to leave them.

- Our current and future needs.

Don’t worry, we’ll go through all of this in more detail so that you can truly understand what each option entails!

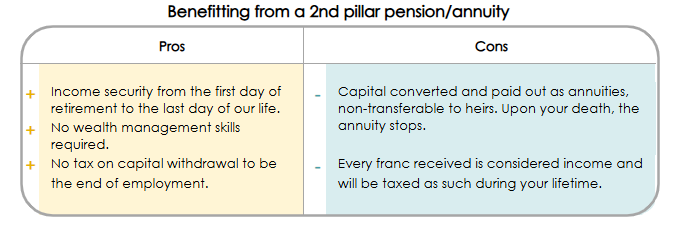

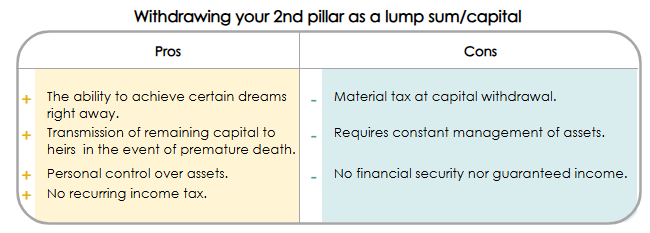

Withdraw the second pillar as annuities

Opting for infinite pensions is necessarily more reassuring. We know what we will get from the first pillar, we know the amount of the second pillar pensions and you can also easily simulate your tax burden, which will remain more or less stable over time. We can thus easily find out what our income will be an determine our buget accordingly.

In addition to fully understanding our situation, we leave our last job with the certainty that, until the last day of our life, we will have access to the same financial resources.

Be careful: By same financial situation, we mean the same income and not the same purchasing power! Second pillar pensions do not adapt to inflation. Over time, one’s purchasing power can considerably grow weaker.

Despite all these advantages, you are wondering what the hiccup is? Yes, there has to be one…or two in this case.

Withdrawing the second pillar as a capital

Hmmm here’s a good idea!

This possibility is attractive, it allows to benefit from vast resources after so many years of working. You will finally be able to treat yourself to this stunning country estate or go on a world tour with just a one-way ticket in hand. This idea is mouth-watering, but riskier! Indeed, having significant capital on one’s bank account compels to a certain assiduity and discipline when it comes to expenses. Once the capital is exhausted, all you will have left will be your OASI pensions to cry on. Therefore, it is essential to be able to manage that kind of money, how to invest it, how much you should buget yearly… That’s right! You will have to create what is called a disinvestment plan.

Pension or Capital: What should you pick?

It is always hard to find a clear and definitive answer applicable to everyone. However, it is possible to reliably determine the observable financial impacts (taxes and income) depending on our choice.

Let’s take my case as an example, I worked all my life as an advisor, I managed to put 500,000 CHF in my pension fund. Not bad! When I turn 65 years old, I will have to make this key decision between pensions or capital…

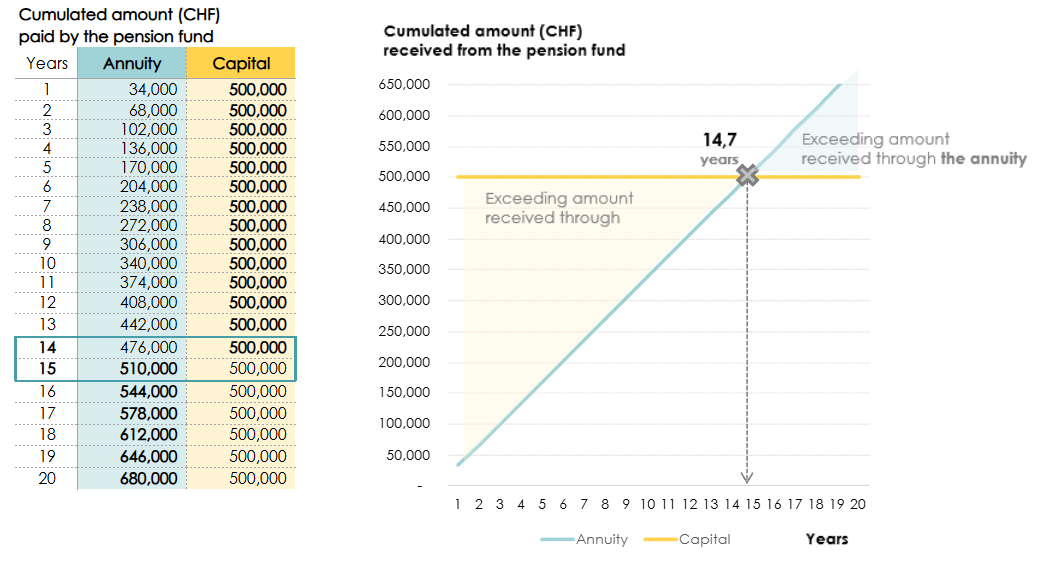

Thanks to my pension fund, I have the choice between a pension equivalent to CHF 34,000 per year or a one-time withdrawal of the CHF 500,000 deposited into my account. The conversion rate offered by my pension fund is exactly 6.8%. To know exactly what yours offers, it’s recommended to take a look at your LPP certificate. The question that arises is: At what age will the pension surpass my capital?

This table shows from what point one option is more beneficial than the other.

So we can conclude that after 14.7 years spent in retirement — in other words, when I reach 80 years old — I will have earned as much money by choosing the pension as I would have if I had taken my capital on day one. Unfortunately, it’s not that simple. We also have to consider taxes, well, yes… we can’t leave them aside…

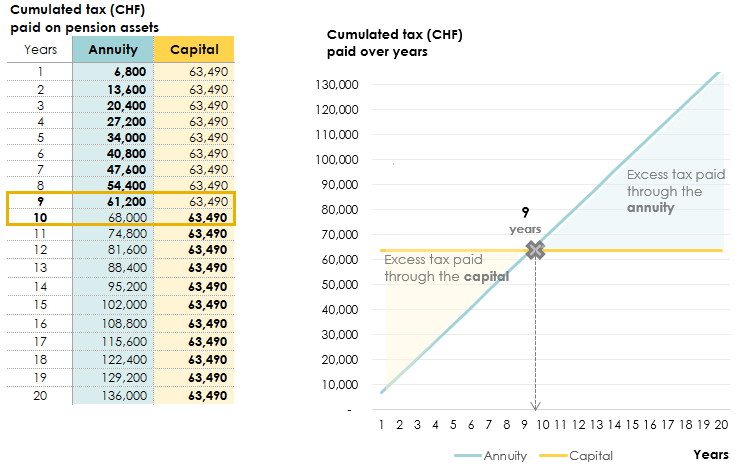

In the previous chapters, we have seen that the capital will be imposed only once at a reduced income tax rate. However, depending on my management choices and the investments I have selected, this capital will represent a taxable fortune (and the income from my investments will also be taxed as income). On the other hand, if I choose the pension, it will be taxed consistently throughout my life, like income.

You can see that income taxes are very high and that after nine years, they will have exceeded the amount paid out in capital.

Be careful: the graphic only factors in income taxes (cantonal and communal taxes, ICC and direct federal taxation, IFD) and does not take into account wealth taxes, which will be a lot lower anyway!

So, think twice about what is the best option for you before withdrawing your second pillar and of course, if you are struggling to make a decision, do not hesitate to get in touch with us!

How can FBKConseils help you?

An Introductory Meeting

The choice between capital and pension is undoubtedly one of the most important decisions of your professional career. Although our articles and resources are as comprehensive as possible, the 2nd pillar remains a vast, complex area, and unique to each situation. If you think that twenty minutes will be enough to get the necessary answers and make this crucial choice, we invite you to schedule a free introductory meeting.

Tailored Retirement Planning

At FBKConseils, we offer two approaches to address questions related to your retirement and its taxation:

- A budgetary, economic, and tax study: This analysis will give you a clear and detailed view of your retirement income and expenses.

- A personalized advisory meeting: In our offices in Lausanne, we will answer all your questions, perform simulations, and conduct the necessary research. At the end of this meeting, you will leave with all the essential information and tools to organize your retirement optimally.