Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on October, 17th 2025.

How much will my AVS (AHV) pension be?

The line-up:

Introduction

As I never really know who knows what in what field, I’ll take the liberty of giving you a quick summary of retirement in Switzerland, but I promise we’ll soon get to the subject of this article: AHV pensions.

In Switzerland, the pension system is made up of 3 important pillars and yet they are so different, they look nothing alike.

- The 1st pillar, known as AVS (AHV)/ AI (DI): This is the heart of our article, and it is a pension pillar that operates on the pay-as-you-go principle. In other words, young people pay the pensions of disabled or retired people almost directly. The important thing to remember is that you will never build up your own capital. Contributions are deducted by your employer on the basis of your gross salary (plus variable and bonuses).

- The 2nd pillar, known as LPP/LAA, is the occupational pension scheme, which depends almost exclusively on your employer. It is up to your employer to decide, within the law, whether to be generous and offer over-mandatory plans or whether to make do with the statutory minimum BVG/LPP. Unlike AVS, the contributions deducted from your salary will enable you to build up your own capital over the years, which you can use in the future. This capital can either be paid out in the form of a pension or as a lump sum.

- The 3rd pillar A, also known as tied pension provision or private pension provision, is the only component of the pension system that is completely voluntary. You will never be obliged to take out a 3rd pillar. Our system offers you the option of putting aside a sum of between CHF 0 and CHF 7,258 each year (for 2025), which you can then withdraw as a lump sum when you retire to improve your old age. But what’s the point of investing money in a locked-in, optional product? Simply because the tax authorities allow you to deduct the amount paid in each year from your taxable income, thereby reducing your tax bill.

“Enough talking, give us numbers!”

I know, I know. However, in order to understand the numbers, namely those concerning OASI pensions, I must first introduce them with a few words. After all, we are talking about your retirement here, what you work for during the entire course of your life. So please focus a little…

The first pillar: How are AVS pensions calculated?

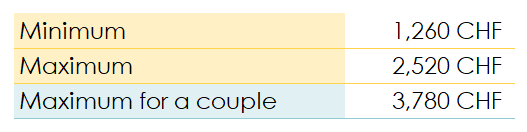

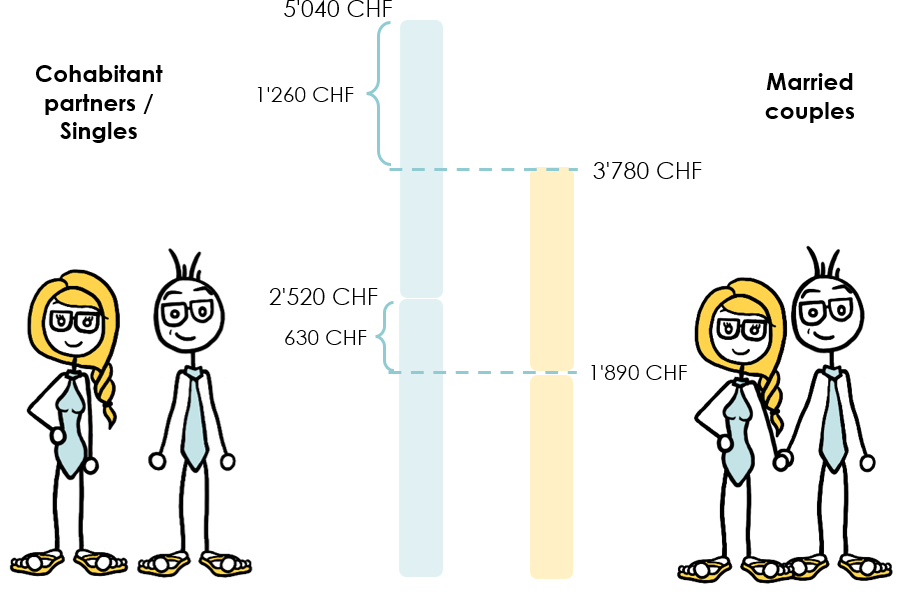

First of all, the first pillar is the only knotty one. Not to say that it is stubborn, but is the only one that has an upper and a lower cap. The retirement pension ranges from a minimum of 1,260 CHF (1,225 CHF in 2024) to a maximum of 2,520 CHF for 2025 (2,450 CHF in 2024) for a single person.

Bad news for the lovebirds reading me: the maximum of the retirement pension for a married couple does not exceed 150% of a single person’s maximum. Thus the maximum pension for a married couple is 3,780 CHF for 2025 (against 3,675 CHF in 2024).

We could stop here, if we wanted to press home, we could phrase this in various ways. In Switzerland:

- The maximal retirement pension for a married person is 630 CHF less than that of a single person.

- The maximal retirement pension for a married couple is 1,260 CHF lower compared with the amount of two maximal pensions for a “cohabitant partners” couple.

However, it is quite rare to have either the maximum or the minimum pension. Most pensions fall between these two amounts, so how do you know what your future pension will be?

Compared to the 2nd pillar, 1st pillar pensions depend on just two key factors:

Years of AVS contributions

To obtain the maximum possible, you must have contributed from the age of 21 until the age of 65, i.e. 44 years.

Your average salary during your career in Switzerland

To obtain the maximum AHV contribution, your average salary must be CHF 90,720.

Admittedly, if it’s not all that clear at the moment, I’d like to offer you a little additional information thanks to these two more comprehensive articles:

- How to secure a full AVS (AHV) pension for your retirement?

- How to secure a maximal retirement AVS (AHV) pension?

Here’s a simple example: You arrived in Switzerland at the age of 40 and since then have earned CHF 65,000 until the age of 65.

- Number of years of contributions: 25 years

- Average salary CHF 65,000

Once these two criteria have been calculated, refer to what Switzerland calls scale 44.

Step 1: Look in the left-hand column for CHF 65,000, then look in the right-hand column for the corresponding pension: CHF 2,156 per month.

Step 2: You must separate the years for which you paid contributions from those for which you did not. In our example, you worked from the age of 40 to 65, which is equivalent to 25 years instead of 44. 25/44 x 2,157 = CHF 1,225 per month.

That’s it for this latest article, and as always, I hope you find it useful.