Written by Yanis Kharchafi

Written by Yanis KharchafiHow to secure a maximal retirement AHV pension?

Introduction

Welcome to this article, dedicated to one of the most important aspects of retirement planning in Switzerland: securing the maximum pension from the first pillar (AVS).

If you’ve had the chance to read our other articles on retirement, you already know that the Old-Age and Survivors Insurance (AVS) forms the first foundation of the Swiss pension system.

It was originally designed to provide all beneficiaries with a pension covering their basic living needs.

The goal of this article is therefore to explain how the AVS pension is calculated, how to obtain the maximum amount, and finally, to help you determine whether the system still fulfills its original purpose today.

Let’s start with a quick spoiler to set the tone:

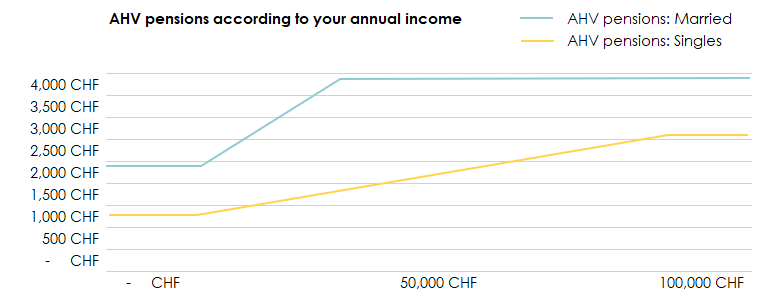

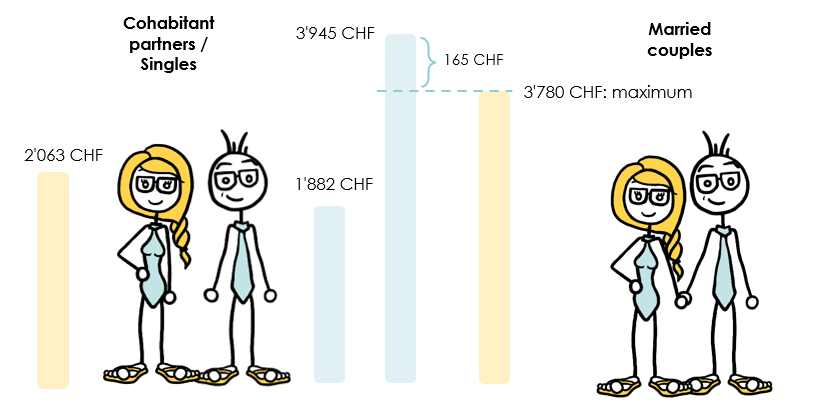

The maximum AVS pension for a single person will reach CHF 2,520 per month in 2025 (up from CHF 2,450 in 2024), while the maximum pension for a married couple will amount to CHF 3,780 per month for the same year (compared to CHF 3,675 in 2024).

The line-up:

What are the criteria for obtaining the maximum AHV pension?

As we quickly saw in our article “How much will my AVS (AHV) pension be?“, there are two fundamental criteria for hoping to obtain the maximum from the 1st pillar:

- The number of years of contributions

- And the average salary throughout your career

Before diving into the different scenarios, let’s start with a quick and simple math refresher:

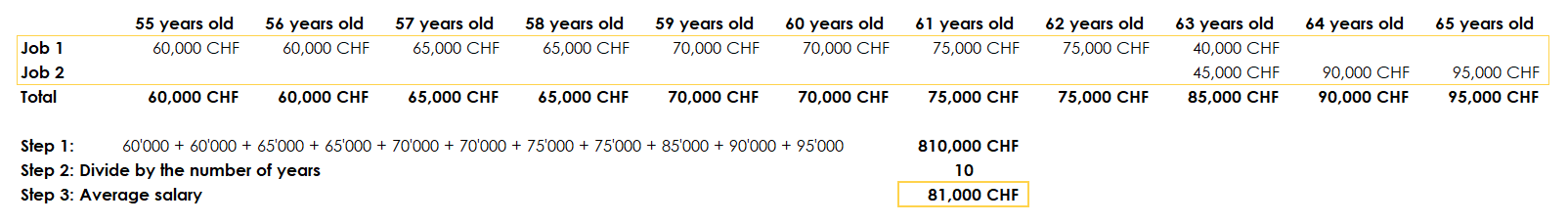

How do you define your average salary?

To make our example easier to follow, let’s assume that you worked only 10 years in Switzerland, from age 55 to 65.

Now that we have this example, let’s take a closer look at the details.

How do I get the maximum pension if I’m single?

Are you single — or have you made the wise decision to stay that way until retirement?

Then you’ll need to have earned an average annual income of CHF 90,720 over your 44 years of professional activity (from age 21 to 65) in order to receive the maximum AVS pension.

In our previous example, your average income was CHF 81,000, so unfortunately, the maximum pension won’t be attainable in this case.

What if your average salary is less than CHF 90,720 a year?

To determine your average salary accurately, you should ask the AVS directly for your individual account statement. This is the paper on which you will see the salary declared each year by your employers. This process is free and quite simple — you can complete it using this link.

Once you have found the corresponding average salary, you can open your scale 44 and check which pension your salary corresponds to.

How can I get the maximum pension if I’m married?

There is no difference when you are married: each spouse will pay AVS contributions based on their salary, deducted directly by their respective employers. As with single people, you can simply ask the AVS to send you your individual account statement.

When you reach retirement age, the average salary of each spouse will be calculated and your AVS pension will also be based on this same scale 44.

What’s the difference with single people?

When you are married, there are three main differences in terms of AHV pensions compared with cohabiting couples:

If only one of the spouses is working, then the working spouse will also contribute for his or her soulmate, to avoid the latter having any gap years when he or she reaches retirement age.

If you are married, the pensions of both spouses may not exceed 1.5 times the maximum pension for a single person. In other words, a married couple cannot receive more than CHF 3,780.

In the event of divorce, the salaries on which both spouses have contributed will be added together and split in two. The two former spouses will therefore have the same average salary throughout their marriage.

Before going into the legal changes introduced by the entry into force of AVS 21, I’d like to point out that a maximum pension as defined in this article does not necessarily mean that this is the amount you will actually receive.

Contribution duration switch since the entry into force of the OASI 21 reform

Since the inception of the OASI pension scheme, men have had to contribute for 44 years, and women for 43 years. As of January 1, 2024, both men and women are required to contribute to their OASI pension plan for 44 years. That way, the “reference age” for retirement is 65 for all individuals—whatever their gender(s).

True dat, there’s nothing worse than rules that change along the way… Too bad for women who were about to celebrate their sixty-fourth birthday—they now must wait another year before they can retire; with no gain in return.

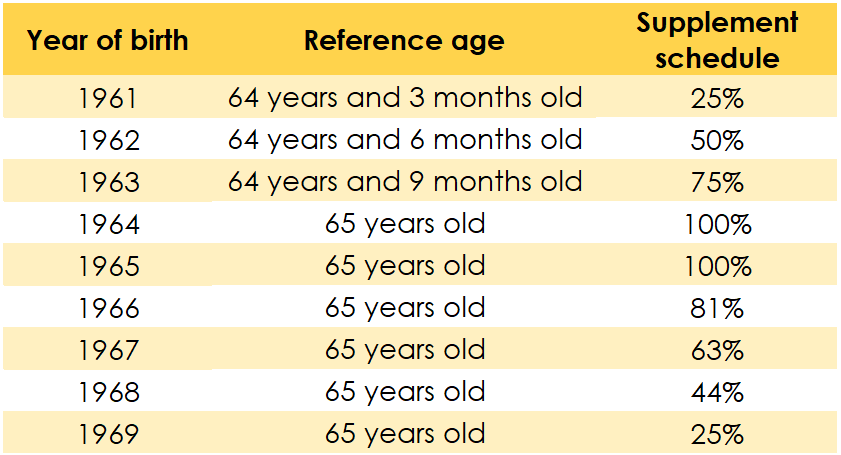

But do not worry child… Considering that the pencil-pushers and other desk jockeys in Bern, whose jobs entail issuing regulations and interpreting laws, must have already thought everything out and have left nothing to chance… or didn’t they…? So that this change seems less sweeping for women, our Council have introduced structural and societal changes spread over several years and have financially compensated women who were about to retire, i.e., those born between 1961 and 1965.

A higher OASI pension—it all depends upon your average income

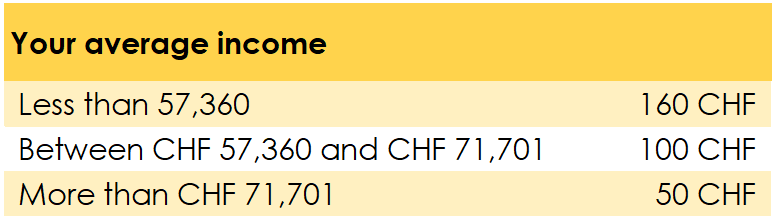

If you were born between 1961 and 1969, you are entitled to an increase in your pension. The monthly amount might depend on your average income.

Still, not all women affected by the OASI 21 reform will be able to make such a crazy mound of dough… This graph shows the maximum amount each age range can claim. The more a woman was born closer to 1961 or 1969 respectively, the smaller the amount the given woman will receive.

How can this graph be understood?

Example 1: You were born in 1961 and your average annual salary amounts to CHF 55,000? Then you should be entitled to retire when you reach 64 years and three months of age. And since you have lost three months of retirement, the State compensates you by granting you 25% of CHF 160 per month—i.e., CHF 40 per month.

Example 2: You were born in 1964 and your average annual salary exceeds CHF 100,000? Then, sorry for you, you are among the first generation to have to work an extra year, but, in return, the OASI pension fund will compensate you for that wasted retirement year by granting you (100% of) an extra CHF 50 per month.

According to a Tribune de Genève article published in 2018, a mere third of Swiss singletons are benefiting from a full OASI pension. This makes sense, in a way, since the average full-time salary in the Alpine country stands at CHF 74,000.

With an average annual salary of CHF 95,000 per married couple during the statutory time limit, a loving couple receives the maximum annuity, split pro rata to their combined earned income.

So, for example, if I am entitled to a pension of CHF 1,882 and my future wife gets a pension of CHF 2,063, the two of us will only be receiving CHF 3,780. Each pension will be reduced accordingly until the maximum amount is reached. In our example:

If you want to work out how much both wife and husband are going to get from this maximum amount, the calculation is the following:

Let’s conclude with a more encouraging figure: 50% of Swiss couples receive the maximum OASI pension scheme—in the end, love always wins!