How much will you contribute to AVS (AHV) as a person without gainful activity?

Updated on January, 9th 2024.

In principle, everyone must contribute to the AVS (AHV), even persons considered to be without gainful employment, that is, those who do not engage in an activity which generates income. I know what you are thinking: “thank you, Captain Obvious”.

Hold on, there are also low-income persons.

Sounds crazy, doesn’t it? You don’t work, you don’t earn a salary, and yet if you’re between 21 and 65, you’ll probably have to pay AHV contributions in order to secure a maximum AHV pension.

Don’t worry, our pension system is based on 3 pillars. The 2nd and 3rd pillars don’t require any contributions when you’re not working – in fact, it’s forbidden.

In this article, we’ll look at how much you’ll have to pay in AHV contributions if, for example, you decide to retire before the reference retirement age: 65 for both men and women from 01.01.2024.

Who has to pay contributions without even being gainfully employed?

In this case, income is added to assets. The situation can be temporary or continuous, like for:

- Persons on early retirement

- Annuitants (leasing of property, annuity from abroad, inheritance)

- Beneficiaries of invalidity insurance annuities

- Students

- Registered unemployed persons who are no longer eligible for benefits

- Insurees with a low-income activity, of which the annual contributions (including from the employer) do not reach 482 CHF per year, which amounts to a yearly income of 4702 CHF.

- etc.

If you want to find out how much you should contribute, you’ve reached the point of the article where your head will start spinning.

Take a deep breath… Let’s go !

How do you calculate contributions for people with no gainful activity?

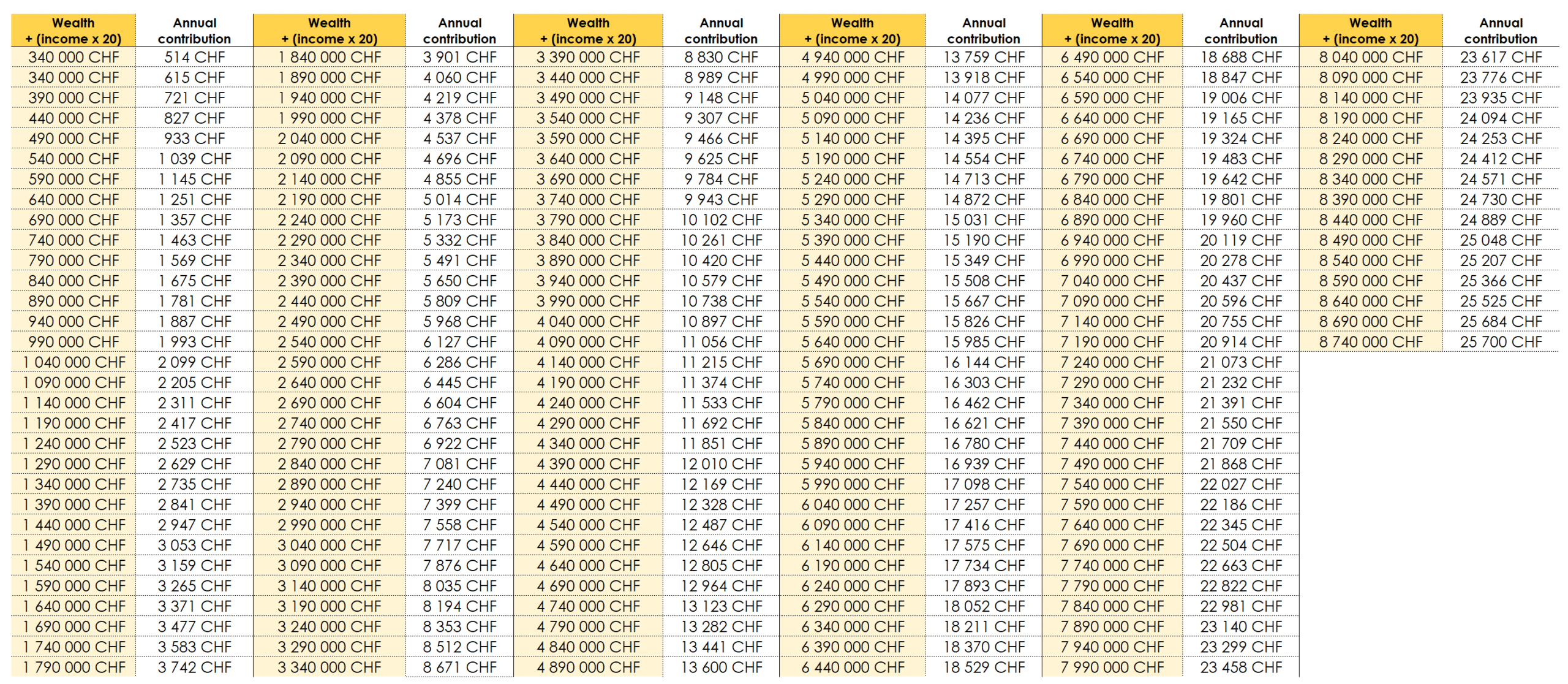

Multiply your annual income by 20 and add your assets. Once you’ve identified your number, refer to the table below.

The income can be various:

- Property rent

- Pensions

- Annuities

- etc.

Assets include, among other things:

- Bank accounts

- Investments

- The tax value of your real estate

- Surrender values of your life insurance policies

In my situation, I have a property that pays me CHF 1,500 in monthly rent, and this apartment is worth CHF 360,000. In addition, I have CHF 100,000 in my bank accounts.

If we follow the same procedure, I would have to :

- Calculate income: CHF 1’500 x 15 x 20 = CHF 360’000

- Calculate the share of assets: CHF 100,000 (bank account) + CHF 360,000 (apartment) = CHF 460,000

- Final result: CHF 460,000 + 360,000 = CHF 820,000

All we have to do now is search through the enormous table below to determine the annual AHV pension. My pension will be CHF 1,675 per year.

What about you? Which range are you in?

So, not that bad right? Now that you know how much you will contribute to the OASI if you do not have a gainful activity! What if you have one?

Discover our new online platform to entrust us with your tax return!

Complete your 2023 tax return online!

In the blink of an eye!