Written by Yanis Kharchafi

Written by Yanis KharchafiHow much taxes will you have to pay if you withdraw your pillar 3A?

Introduction

Oh, I know what you are about to say!

“But Noé, if I opened a third pillar account, it was specifically to save on taxes, not to delay them until I retire!”

I know, I know. But the taxation of the third pillar is below the usual rates. The more your assets are important, the more the tax rate increases.

The line-up:

Taxes to be paid on the withdrawal of your 3rd pillar A when residing in Switzerland

Each canton applies its own rules to the 3rd Pillar A

Even though tax principles are directly linked to the recommendations of the Confederation, as is the case in most tax-related matters in Switzerland, the cantons have considerable freedom in determining how they wish to tax you. As a result, some cantons are more attractive than others for withdrawing your 3rd pillar (and by the way, this also applies to the 2nd pillar).

Taxes on 3rd pillar A withdrawals in the canton of Vaud

If I withdraw CHF 50,000 in the canton of Vaud, and more specifically in the commune of Lausanne, I will have to pay CHF 1,690 (3.4%) in tax as a single person. If by then I find my soulmate, I will pay a little bit less, to be precise 1,345 CHF. If I withdraw double the amount, that is 100,000 CHF, I will have to pay more than double in taxes: 4,659 CHF (4,7%) as a single person and 3,691 CHF as a married person.

Taxes, as you probably have understood by now, is calculated based on the amount withdrawn. actually, the third pillar is considered as a special revenue and is therefore taxed on the basis of the scale for income tax but with an exceptionally reduced scale (about 1/5th).

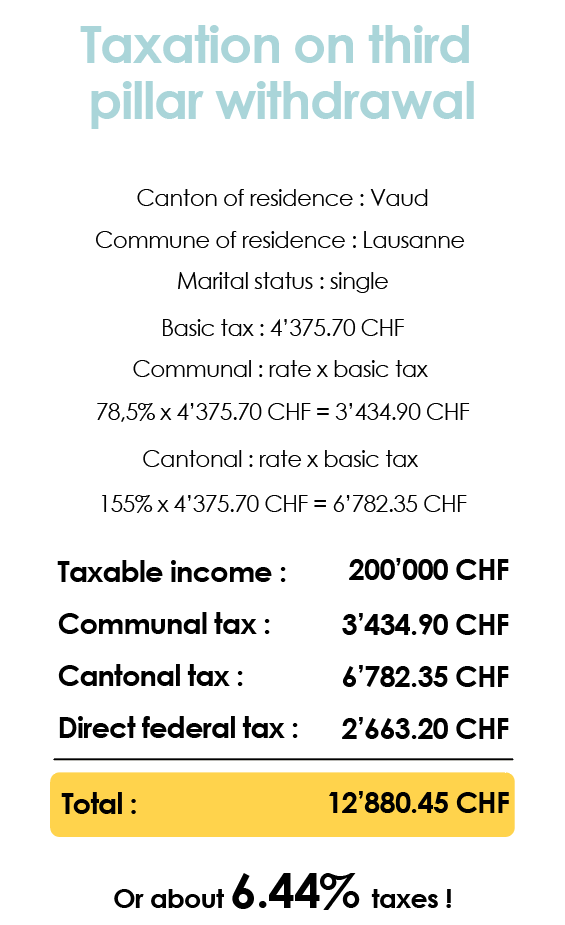

Let’s take my friend Noa as an example, over the years, he salvaged a capital of 200,000 CHF at a bank. He still does not have a wife or kids and will be taxed in his commune and canton of residence: Lausanne / Vaud.

As a little gift for the people of Vaud, here is a fairly reliable calculator provided by your beloved canton of Vaud.

Taxes on 3rd pillar A withdrawals in the canton of Geneva

If you’ve skimmed our articles like a groupie, you’ll already know that Geneva has probably the most complex and incomprehensible calculations in the French-speaking part of Switzerland.

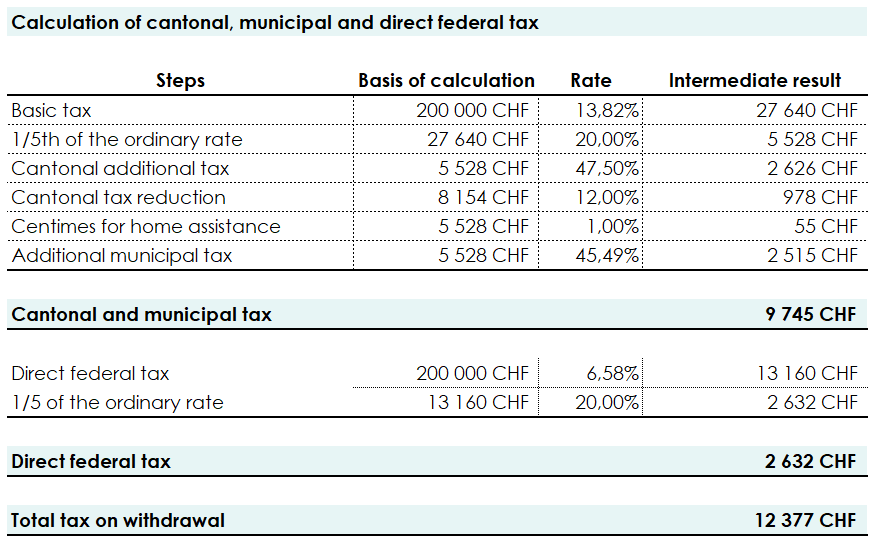

If, as in our example from the canton of Vaud, you have saved CHF 200,000 in your 3rd pillar and you decide to withdraw it as a single person, here is how your tax will be calculated:

We can’t do all the examples and take all the amounts, but what we can do to make your life easier is to give you the Genevoise calculator website so that you can do your own simulations.

And I don’t need to tell you that calculating is good, but continuing to inform yourself and doing everything you can to reduce your tax burden as much as possible is even better.

Taxes on 3rd pillar A withdrawals in the canton of Valais

Valais makes no exception to the rule. Withdrawals from the 3rd pillar (or 2nd pillar) also involve exit tax.

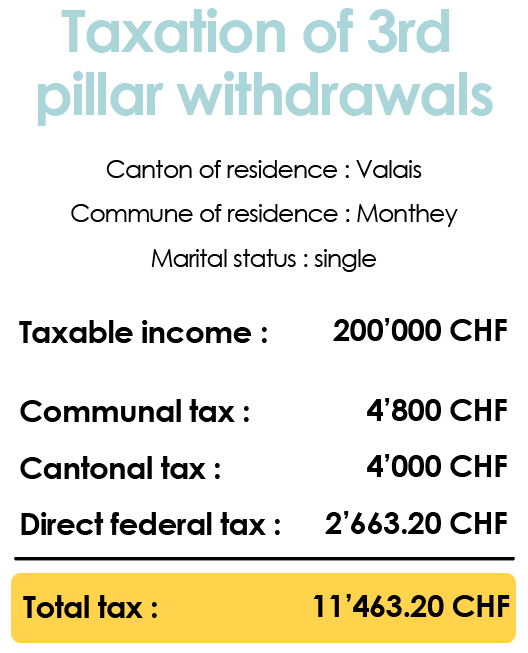

We will also consider the case of Noa, who has set aside CHF 200,000 over the years and wishes to withdraw it. He currently lives in Monthey.

Total tax will amount to CHF 11,463.20.

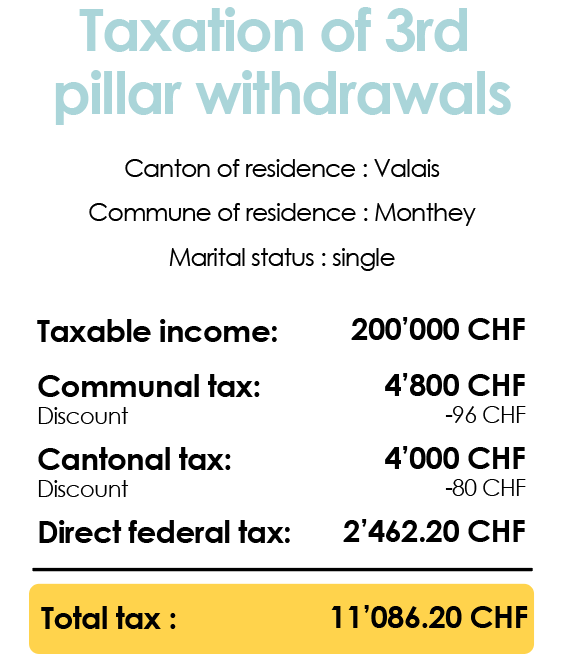

What if my friend was married and wanted to withdraw exactly the same amount?

The difference is CHF 377… Not sure that’s enough to make the decision to get married…

As for the canton of Vaud and the canton of Geneva, here is a handy little calculator so that you can do your own simulations.

Now you know more about how to withdraw your 3rd pillar depending on your canton of residence and marital status.

We would like to remind you that the canton plays a very important role, but so does the municipality. There can be major differences between communes within the same canton.