Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on January, 14th 2025.

How to secure a full AVS (AHV) pension for your retirement?

The line-up:

How can I qualify for a full AVS pension plan for retirement in Switzerland?

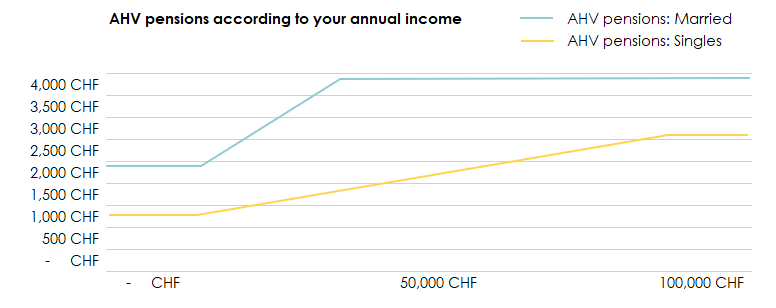

If your goal is to receive complete AVS (AHV) retirement benefits, pursuant to the rule of law in effect, you’ll need to have contributed for 44 years. Each year during which you do not contribute corresponds to a loss of pension of 1/44. The fondue-eating terminologists working for the federal government in Bern have called each lost year a “(contribution) gap”. On January 1, 2024, the AVS (AHV) 21 reform came into effect; thus, men and women have to contribute the same number of years to their pension fund. This means that all of us have to work 44 years—from age 21 to 65—in order to receive a full pension scheme.

For instance, if I go abroad for a one-year sojourn and forget to fund my AVS, then I’ll have a year’s worth of (contribution) gap. Or let’s imagine that Zoé and I have a baby. Since we’re a modern couple, I am the one who decides to take care of our offspring full-time. As Zoé is gainfully employed, she’ll be able to pay my contributions.

Can you recover these missing years?

You need five years to make up for any gaps in AHV contributions

Yes! But only up until five years following the gap year. If when I turn 65 I am told:

- I see you did not contribute during the year of your 27th birthday

- Shoot (let us remain polite)! I spent a year in Cancun for a … cultural stay. I completely forgot! But I can make up for it now, I have the money.

- Sorry Sir, but it is too late. You had up until the end of your 31 years to catch up on your delay.

- How much will I be penalised for?

- For 1/44th of your full pension.

- Oh no, no math today, I woke up with a terrible headache…

- In short, you determine your full pension and multiply it by 0.045. You then subtract the result to the first amount and you will find your actual pension.

Continuing to work after the reference age—65 years of age

Until 2024, if someone has a blast at their job, they are allowed to keep working after they retire, if they want to, e.g., with the aim of adding a little extra to the pot. Well, rest assured—it will still be possible! The only good thing is that as long as you are claiming your pension, it is gaining in value. Up to 2024, the years you work after age 65 can be counted as part of the 44 years required to qualify for a full pension. In other words, if you got to Switzerland when you were 24, you can theoretically work until you reach 68 and receive a full AVS pension scheme. As a rule of thumb, and quite logically, the last years of your career are, more often than not, the ones during which your income is the highest. So, by working beyond 65, your average income is going to increase and your pension amount consequently.

It is also possible to obtain a statement of individual account if you seek all the relevant information regarding the status of your AVS contributions. This comprehensive statement of account can be requested and modified only once every five years. Keep that in mind and don’t hesitate to ask us for help; it would be a shame not to receive a full AVS pension—especially since it’s so easy to get one!