Written by Yanis Kharchafi

Written by Yanis KharchafiAVS (AHV) contributions for employed persons

Introduction

Let’s be honest: the first pillar (AVS) isn’t anyone’s favorite topic… not even ours!

But one thing we’re convinced of is this: everyone should know what they’re paying and why. Sure, the first pillar isn’t the most effective tool for optimization in Switzerland, but it’s an unavoidable step — and we promise, it won’t take long. And we’re sure you’ll still pick up a few interesting tidbits along the way.

In this short article, we’ll take just 2 minutes to explain how AVS contributions are calculated, whether you are an employee, self-employed, or not in gainful employment.

The line-up:

AHV contributions for persons in gainful employment

AHV contributions for persons in gainful employment amount to 10.6% of their gross income. I was alarmed when I first read this! Then, I found out my employer would be footing half the bill.

What’s more, the 10.6% is not paid in full to finance AVS pensions; by paying this sum you are contributing to two other social systems:

- Invalidity insurance (AI): 1.4

- Loss of earnings insurance (APG): 0.5%.

Depending on your canton and your situation, other social security contributions may be deducted:

- Unemployment insurance (AC)

- Family insurance (AF)

- Maternity insurance (Amat)

- Etc.

In short, here’s what you need to remember: if you are an employee — whether you’ve started your own business or work for a company — you will have a mandatory flat-rate deduction of 5.3%.

This deduction should be clearly visible on your monthly payslips and on your annual salary certificate. In principle, there is no need to check or optimize it — it’s a rule that should remain unchanged.

AHV contributions for self-employed persons

Unlike employees, individuals engaged in self-employment must cover their entire AVS contribution themselves, based on their annual income.

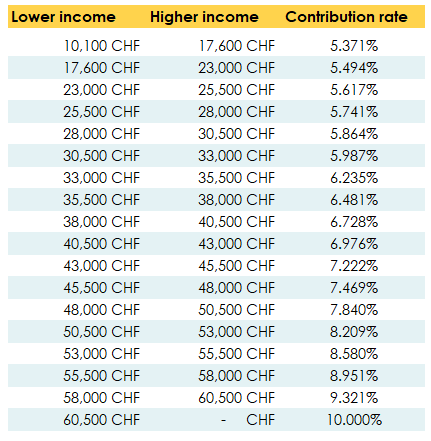

For the vast majority of self-employed people in Switzerland, the contribution rate is 10%. And if I say “the vast majority,” that means a minority actually pay less than 10% — indeed, for anyone whose taxable profit (from their self-employed accounting or annual income statement) is below CHF 60,500, reduced rates apply:

- Between CHF 17,600 and CHF 60,500: the rate increases step by step, as shown in the table below

- Below CHF 10,100: the minimum contribution applies, i.e., CHF 530

- Between CHF 10,100 and 17,600: the rate rises to 5.37% of your taxable profit

Before concluding, it’s important to understand that in Switzerland, most people who become self-employed do so wholeheartedly and have gone to great lengths to achieve this status and work independently.

But be careful: our country sometimes holds unpleasant surprises for those who “involuntarily” earned money without really seeking it.

Let me explain: imagine you inherit an old alpine chalet, and on a whim decide it would be nicer if it were completely renovated, converted into four apartments, and even better, if those apartments were sold.

Well, if this dream became reality, at the time of the sale, there’s a good chance the AVS would step in and say:

“My dear, your project is lovely, but in my eyes, you have carried out a real estate development activity.

You owned land of a certain value, transformed it, improved it, and sold it for a much higher price.

In other words, you generated income through economic activity. I kindly ask you to pay me around 10% in AVS contributions, in addition to the taxes owed on the capital gain.”

The point is that AVS contributions for the self-employed don’t only apply to liberal professions, but to all taxpayers who have put time, resources, or money into an activity with the voluntary or involuntary aim of generating a profit.

AVS Contributions for individuals without gainful employment (PSA)

Without encroaching on the popularity of another article I’ve written about AVS contributions for individuals without gainful employment, I’ll provide just a brief overview of what you can discover by clicking the link.

First, the key question is: what does “without gainful employment” actually mean? Does it include being a student, retired, semi-retired, unemployed, or on maternity leave? There are so many situations that could fall under this definition…

The answer is relatively simple: it includes all of these situations except unemployment, retirement, and maternity leave. For all the others, AVS contributions must be paid.

To summarize: whether you are a student or semi-retired, you have no choice — as long as you haven’t reached 65, you must contribute to the first pillar like everyone else.

But why not the others?

- People receiving unemployment benefits already contribute through their daily allowances.

- People on maternity leave also contribute, thanks to the salary they continue to receive from their employer.

- Retirees are already beneficiaries of the AVS system: it is their past contributions that fund their current pension. However, note that retirees who decide to return to gainful employment become AVS contributors again.

In short, for everyone else — those who don’t fall into any of these categories — your AVS contributions are calculated based on two main criteria:

- Your wealth as of December 31 of the relevant year

- Any pensions or annuities received during the year

It is a careful mix of these two components that determines your annual contribution amount.

Once again, I invite you to consult our full article for all the details.

Before concluding, one final note for married men or women who have put their careers on hold: good news! In Switzerland, if your spouse works, their AVS contributions are generally sufficient to exempt you from contributing personally.

For more detailed information, I recommend contacting the authorities responsible for your first pillar directly.