Written by Yanis Kharchafi

Written by Yanis KharchafiWhat tax will you pay when withdrawing your 2nd pillar in Switzerland?

Introduction

Welcome to this new article designed to help you understand the taxation of 2nd pillar withdrawals for anyone looking to withdraw it in Switzerland. However, if your goal is to withdraw your 2nd pillar abroad, different tax rules apply, and we encourage you to switch to a different article. In principle, after these two introductory lines, only Swiss residents who are eligible to withdraw their LPP assets should remain:

- A well-deserved retirement (from age 60)?

- Purchasing property as a primary residence?

- Starting a new self-employed activity?

No matter which option you choose, you are within your rights: you have the possibility to request the withdrawal of your 2nd pillar.

Today’s question is to understand how the taxation will work and what amount will need to be paid once the withdrawal request is submitted.

I warn you, there are many nuances, and the calculations can be a bit tricky.

The line-up:

How does the process of withdrawing your 2nd pillar work for Swiss residents?

Many clients contact us for help withdrawing their 2nd pillar funds but know that this is a somewhat tedious process, although it is relatively simple overall. It’s just a matter of providing a few supporting documents and being patient, nothing more. I will give you more detailed explanations based on the reason you intend to give for the withdrawal. But before getting into those details, it is important to determine where your 2nd pillar funds are located regardless of your reason. There are three possible options:

- Your 2nd pillar funds are with your pension fund: This is the case for employees or self-employed individuals who voluntarily subscribe to a professional pension plan.

- Your 2nd pillar funds are in one or more vested benefit accounts. When you change jobs, get divorced, or take a career break, the funds that were originally in your pension fund have been moved either by your instructions or directly by the pension fund (if they haven’t received any new instructions from you) while waiting for you to be able to access them.

- A mix of the two previous options: It is also possible that you are employed and contributing to your employer’s 2nd pillar pension plan, but that, due to a previous job or divorce, a portion of your 2nd pillar funds is placed in a vested benefit account.

Identifying where your pension funds are located is the first step to begin considering a withdrawal.

Requesting the withdrawal of your 2nd pillar for retirement (early or not)

This first scenario is generally the most common: you’re nearing the end of your career and have taken the time to simulate that a lump sum withdrawal is preferable to an annuity in your situation? Then, it’s quite simple—just gather the following documents:

- An ID (and your spouse’s if you’re married)

- A civil status certificate, as in the case of marriage both spouses must approve the withdrawal and sign the documents

- Your account statement

- The form created specifically by your pension fund (or vested benefit foundation): There is no standard form; each institution has its own. It may be available directly on their website, or you may need to request it.

Once all the documents are gathered and completed, we recommend sending your file by email to get confirmation that everything is in order and to check if the original documents are required. If all goes well, a few weeks later, you should see the money in the desired bank account.

Requesting the withdrawal of your 2nd pillar to finance the purchase of a primary residence

In Switzerland, property prices keep rising, and more and more buyers are turning to the 2nd pillar to help finance part of the sale price. Although the process is somewhat similar to early retirement withdrawals, the purpose is not exactly the same.

In the first case, the withdrawn funds were permanently released, with no restrictions on their use. However, for a property purchase, we’re talking about a housing encouragement withdrawal (EPL). The funds remain yours, but they can only be used for a specific purpose. If they are used otherwise, they must be reimbursed. So, what does this mean for your withdrawal request? The financial institution holding your funds will need to perform the same checks as for a permanent withdrawal, but will also verify that the funds are being used strictly for purchasing a primary residence.

In addition to the standard documents:

- An ID (and your spouse’s if you are married)

- A civil status certificate, as in the case of marriage, both spouses must approve the withdrawal and sign the documents

- Your account statement

- The specific form created by your pension fund (or vested benefit foundation): There is no standard form; each institution has its own. It may be available directly on their website, or you may need to request it.

You will also need to provide:

- An extract from the land register (to prove you are the proud owner)

- For a construction (or expansion): a quote, construction plans, and sales brochure

- The deed of purchase for the property in question

- The address and bank account of the notary responsible for receiving the funds and transferring them to the sellers. For construction, the funds should be paid directly to the company handling the work.

Requesting the withdrawal of your 2nd pillar to start a self-employed activity in Switzerland

For a self-employed activity, this is also a permanent withdrawal (like for retirement), meaning you will not need to repay the amount. Therefore, unlike property purchases, the funds can be transferred directly to your account. The condition? You must be able to prove that you are indeed self-employed. You will need to gather the following documents:

- An identification document (and that of your spouse if you are married)

- A civil status certificate, because in case of marriage, both spouses must approve the withdrawal and sign the documents

- A bank statement

- The form specifically created by your pension fund (or your vested benefits foundation): There is no standard form, each institution has its own. It is either available on their website or you will need to request it.

- Also, an attestation from the AHV compensation office (1st pillar) confirming your status as a self-employed worker.

How does the taxation process of your 2nd pillar work when you are a Swiss resident?

Finally, let’s get into the heart of the matter: the taxation of your pension funds. Before we dive into calculations and simulations, here’s how it all works:

- Step 1: Withdrawal request sent and approved

- Step 2: Receiving the funds: Unlike the funds transferred abroad when you reside in Switzerland, the pension institutions will pay you the full amount, down to the last cent, with no tax withholding. Cool, right?

- Step 3: Paying the taxes: Once you’ve received the funds, you won’t have to do anything. The institution that transferred the funds will notify your canton of residence that the amount has been credited to your account and that you owe them money.

- Step 4: Tax bill: The cantonal tax authority will calculate precisely what you owe to the canton, the municipality, and the Confederation, and will send you the details in the form of an invoice.

- Step 5: Paying the bill: Pretty straightforward, you receive the bill and pay it. One small piece of advice: take the time to verify the amounts that have been withdrawn, ensure that your family situation has been properly accounted for, and check that there are no calculation errors.

How much tax will you pay when withdrawing your 2nd pillar pension in Switzerland?

This is the most complex part of our article because, in Switzerland, each canton has the freedom to tax your capital as they see fit when it comes to taxes. It is true that in the French-speaking cantons, there is some level of consistency in the taxation methods. Most cantons follow the practices issued by the federal authority (LIFD), which states in Article 38: “It is calculated based on rates representing one-fifth of the scales set out in Article 36, Paragraphs 1, 2, and 2bis, first sentence.” In other words, you take the amount, then calculate what the tax rate would have been if it had been a regular income (like a salary), and divide this rate by 5. Here’s a numerical example to help clarify.

How to calculate the exit tax on a withdrawal of CHF 150,000 in capital?

A single resident of Vaud living in Lausanne who wants to withdraw CHF 150,000 from their 2nd pillar in 2024 should follow these specific steps to calculate the tax due:

Step 1 – Determine the base tax using the income tax rate:

CHF 150,000 = CHF 15,023

Step 2 – Determine the municipal tax:

The tax rate in Lausanne for 2024 is 78.5%. Multiply the base tax (CHF 15,023) by 78.5%:

CHF 15,023 × 78.5% = CHF 11,793.55

Step 3 – Determine the cantonal tax:

The tax rate for the entire canton of Vaud in 2024 is 155%. By analogy, multiply the base tax by 155%:

CHF 15,023 × 155% = CHF 23,285.65

Step 4 – Add both amounts and divide the total by 5:

CHF 23,285.65 + CHF 11,793.55 = CHF 35,079.20

CHF 35,079.20 ÷ 5 = CHF 7,015.83

Step 5 – Determine the federal income tax:

This is straightforward: a simple income and tax scale. For CHF 150,000, the federal tax is CHF 7,202.50. Just divide this amount by 5:

CHF 7,202.50 ÷ 5 = CHF 1,440.50

Finally, the total tax on this withdrawal will be:

CHF 7,015.83 + CHF 1,440.50 = CHF 8,456.33

If the details of the calculation seem a bit abstract, our article on the income tax calculation in the canton of Vaud goes into more detail on the steps mentioned above. And if you live in the canton of Geneva, know that the principle remains the same, but the steps will differ completely.

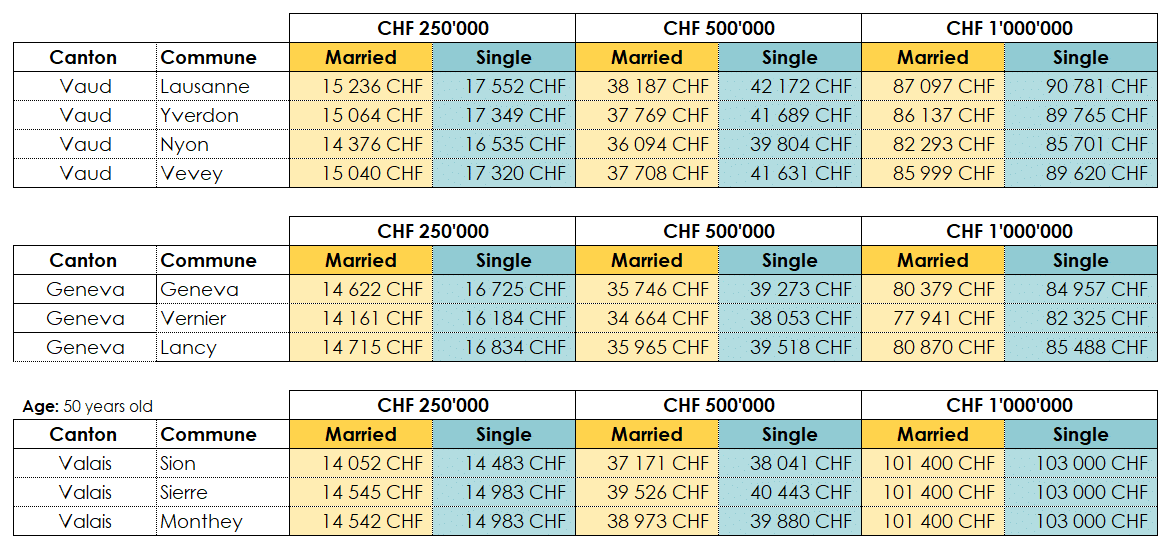

This is how the French-speaking cantons like Vaud and Geneva operate in practice, but others, such as the canton of Valais or Fribourg, have decided to proceed differently, likely because they don’t necessarily want to follow the same method as the others. In our opinion, it would be too long and complicated to detail the methodology for each of Switzerland’s 26 cantons, but here is a summary of the cantons covered by FBKConseils.

Note: Just because you’ve heard that transferring your capital through Schwytz might be the best idea for tax savings doesn’t mean it will work. As long as you remain a resident in Switzerland, it’s your municipality and canton of residence that will tax you.

Is it possible to optimize 2nd pillar withdrawals when living in Switzerland?

This is the moment where you’ll finally get the answer to the big question: how can you pay less taxes? Living in Switzerland, I won’t lie to you, the options are still somewhat limited, but here’s an approach worth considering.

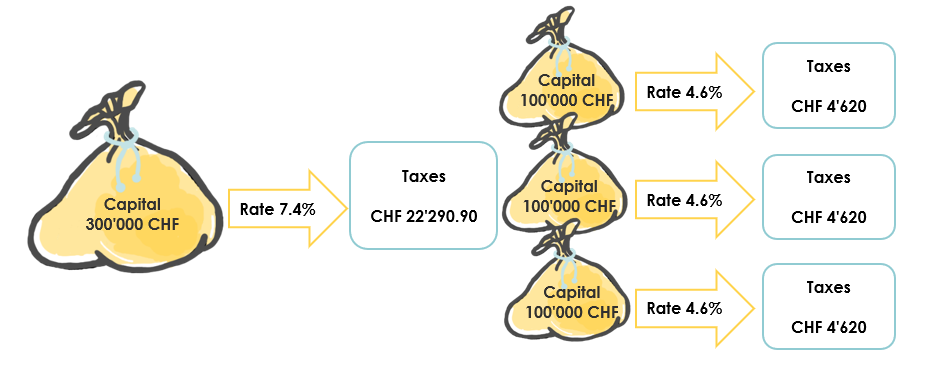

As you’ve now understood, all cantons tax the withdrawn capital based on the amount withdrawn. Logically, the smaller the capital, the lower the tax rate, and the smaller the bill. The question becomes clearer: how can you reduce your capital without deciding to contribute less? The solution: find a way to split (separate) your capital into several distinct accounts. Eureka!

In conclusion, withdrawing CHF 300,000 all at once would have cost CHF 22,290 in Lausanne, compared to CHF 13,860 when withdrawing 3 x CHF 100,000.

If I were a mentalist, I would say that your first thought was: Oh no, how can I split my capital? Admit it, I’m spot on, aren’t I? Well, let’s dive into that now.

EPL Withdrawals (Encouragement for Home Ownership)

If you buy your primary residence, you will have the option to finance part of your home using your 2nd pillar, which will empty your account. Then, you’ll gradually start to fill it up again.

Changing Jobs

Whenever you change employers, you also change pension funds. The funds that are not transferred can be split into a maximum of two separate vested benefit accounts. Thus, with a new pension fund and two vested benefit accounts, your capital will be divided into three.

Divorces

In Switzerland, it’s not uncommon that when a divorce is finalized, the pension assets are split equally between the two spouses. Mathematically, this means that one of them will receive a portion that they can store safely in a vested benefit account.

How FBKConseils Can Help You?

A First Free Consultation

As always, FBKConseils offers new clients the opportunity to book a first 15- to 30-minute consultation, designed to answer as many of your questions as possible.

Tax Simulations

Withdrawing your 2nd pillar or, more generally, planning for your retirement takes time and information. FBKConseils offers to guide you through the entire management of your retirement.

Administrative Procedures

We take the time that you don’t have to handle all the administrative steps related to withdrawing your 2nd pillar: compiling your file, interacting with pension institutions, and managing the payment process.

Voir les 5 commentaires

20h16

Thank you for the information.

I would like to know what happens in the canton of Zug if the voluntary contribution to pllar 2 is withdrawn prematurely that is before 3 years. Thank you.

15h10

Hello! And thanks for your blog, very interesting and helpful :).

One question, if I withdraw a pension fund from the United States, while I live in Switzerland (not a US resident, I just happened to work there for 2 years), do you think the same 1/5 rate would apply? Or would I have to pay taxes as if it were regular extra income?

Thank you very much!

16h11

Thank you for your question.

With the United States it’s always tricky to answer. The normal procedure would be to first check the agreement between Switzerland and the United States to make sure which country imposes what. Then, secondly, look at how this capital will be taxed. It’s not an easy procedure to check.

If you have any questions, please do not hesitate to contact us,

9h32

Hi, I have a query as below for which i didnt get a clear answer so far. Can u help to answer or advice who can answer it:

1) I am above 60 years old. Unemployed and registered with ALV/RAV, getting ALV payments every month so far.

In this situation, Can I close my (Pillar 2) Vested Benefit account with bank and withdraw the money for my personal use or other investments ?

2) After above withdrwal, In case I take up employment in future this year or next year, Do I have to refund above withdrawn pillar2 money?

Thank you in advance.

16h14

Thank you for your comment,

Unfortunately we don’t quite understand what you mean by ALV/RAV. Nevertheless, in theory, from the age of 59 for a woman / 60 for a man, it is possible to withdraw your 2nd pillar without any additional conditions.

Thereafter, if you decide to return to paid employment, you will have to start contributing again from the beginning, but without having to repay the funds.

Comments are closed.