Written by Yanis Kharchafi

Written by Yanis KharchafiUp to how much can I save to my pillar 3A in 2024?

In Switzerland, the 3rd pillar is a simple and effective way of saving while optimising tax. We have already written a number of articles on this subject to give you more details about

- Taxes on 3rd pillar withdrawals

- The difference between bank and insurance 3rd pillar savings

- What’s the difference between a 3rd pillar A and a 3rd pillar B?

- What are the advantages of opening several 3rd pillar A accounts?

The aim of this article is to give you a better understanding of the contributions you can make to your 3rd pillar.

The line-up:

Is there a minimum annual contribution for 3rd pillar A?

This first answer is clear and unambiguous: There is no minimal contribution to the third pillar A, whether at the bank or at an insurance. There, we said it! Depending on your income, you can estimate the buget you can allocate to it.

Please note that just because no minimum is legally required does not mean that some insurers have not decided to introduce a minimum contribution in order to accept you as a client. It is quite common in insurance contracts for you to be required to pay a certain amount each year (CHF 1,200, CHF 1,800).

We can’t stress this enough: opening a 3rd pillar insurance account has to be taken seriously.

What is the maximum you can invest in your 3rd pillar A?

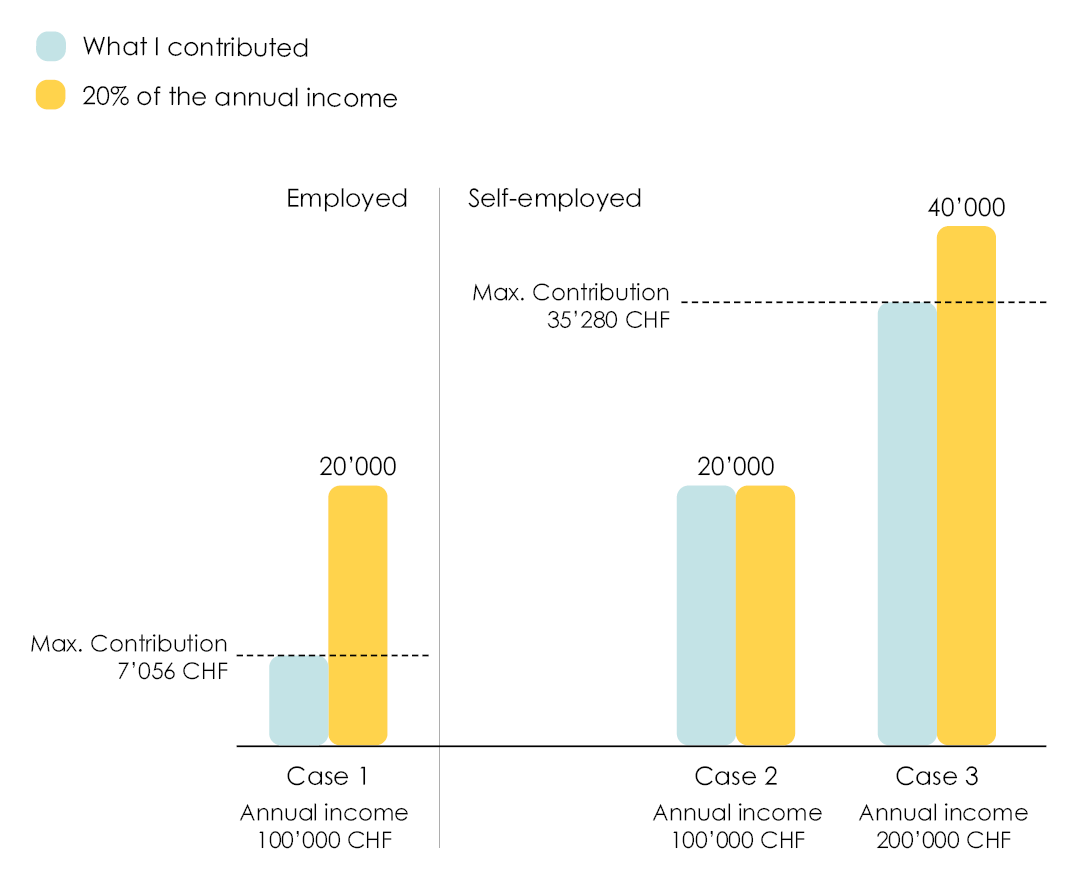

Unlike the previous chapter, there is an annual maximum authorised for the 3rd pillar A. This maximum depends on two factors: your status (employed or self-employed) and your income:

- 7,056 CHF in 2024 (and 2023) for employees, that is 588 CHF per month.

- 35,280 CHF in 2024 (and 2023) for self-employed persons or 20% if the annual income. In other words, the maximal contribution will always be 35,280CHF per year for every independent person with an income of 176,400 CHF or above.

Be careful: For self-employed persons to be able to contribute this much in their third pillar A, it is mandatory for them not to be insured on a voluntary basis to a pension fund. Each self-employed person should take the time to compare the advantages and disadvantageous of these two alternatives.

Case 1: you are employed and you made 100,000 CHF in 2023, you were able to contribute with the maximal amount of 7,056 CHF.

Case 2: you are self-employed and you made 100,000 CHF in 2023, you were able to contribute with the maximal amount of 20,000 CHF, which amounts to 20% of your income.

Case 3: you are self-employed and you made 200,000 CHF in 2023, you were not able to contribute with 40,000 CHF, which amounts to 20% of your income, but with 35,280 CHF, the capped maximal amount.

Be careful, these amounts are the maximal contributions for the third pillar 3A and not for each account. Whether you have one or several 3A accounts, the total maximum, all accounts included, remains 7,056 CHF in 2024 (and 2023) for an employed person or 35,280 CHF in 2024 (and 2023) for a self-employed person.

I can already hear your next questions! “Noé, I understood I can contribute. But what I would like to know is how much I can save in taxes thanks to the third pillar A?”

There are many specific features and advantages to opening at least one 3rd pillar account, so don’t hesitate to explore all our articles on the subject to find out all you need to know and make the most financially and tax-efficient choices.