Written by Yanis Kharchafi

Written by Yanis Kharchafi13 tax deductions in the canton of Valais for 2024

The line-up:

You did not even have time to digest the Christmas turkey, your ears are still numb from New Year’s Eve celebration, and you feel that your legs are not yet warm enough to run over 2024 at expected pace, but here we are: the tax return is looming.

And, as usual, there are no more than two options:

- Entrust your tax return to people of a different species, who apparently have nothing better to do with their lives. These guys are so passionate they even have created a dedicated App to ease your life when it comes to tax returns.

- Alternatively, you can download VSTax and refer to this article outlining the main deductions allowed in the canton of Valais.

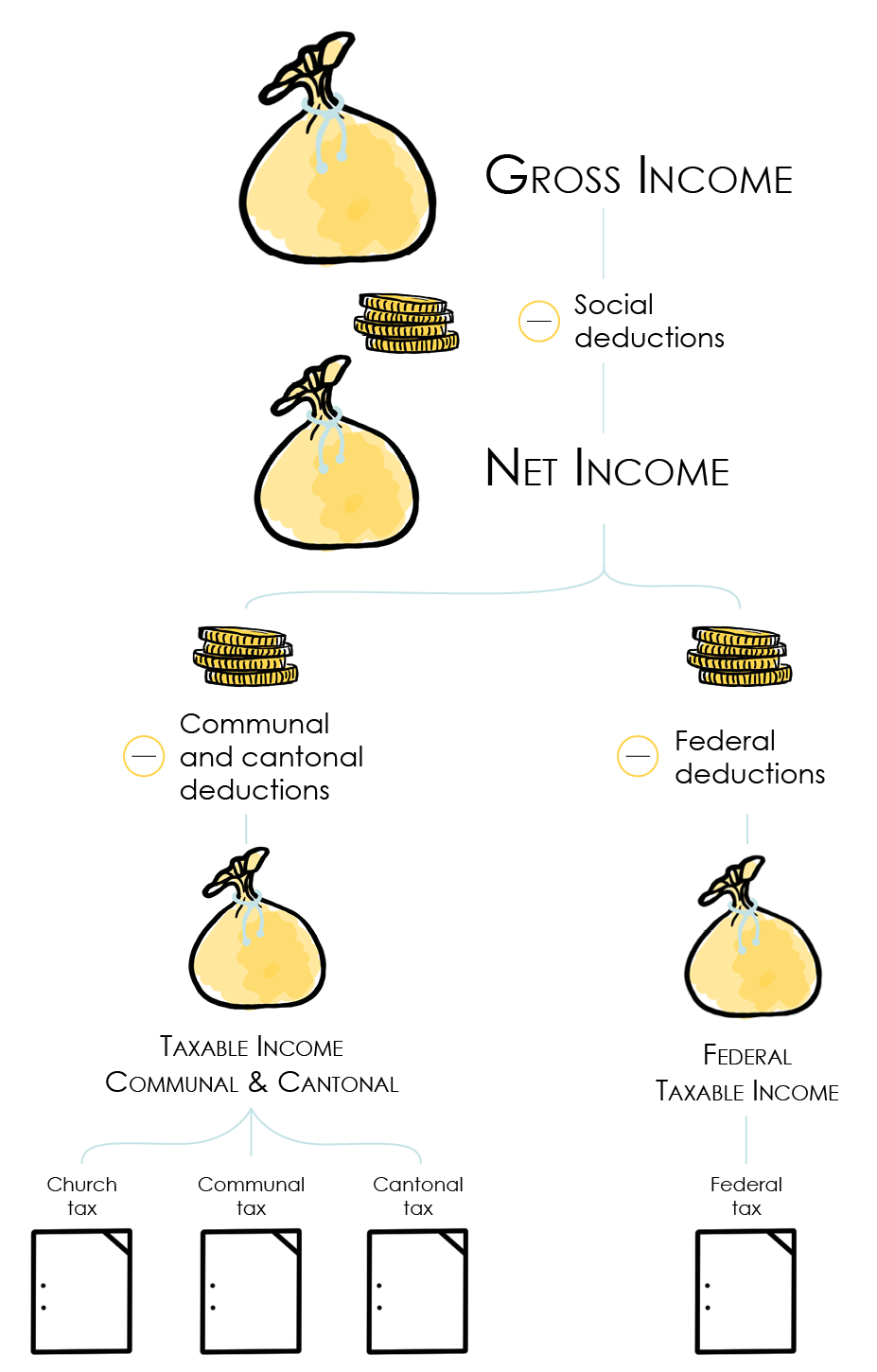

And if you happen to be of our fellows who, beyond wanting to perform your tax return by yourself, appreciate understanding the mechanisms of calculating communal, cantonal (ICC) and federal (IFD) taxes, these articles are made for you.

Last important clarification, this article details the main deductions at the level of the canton and the commune – but is not focused on the Confederation’s level. Despite an apparent standardization of the deductions, considerable variations may exist. If that’s what you are looking for, we invite you to take a look at the main deductions of the direct federal tax.

Business expenses – Transportation expenses

Although for the past few years we have experienced the advent of remote working coupled with a rising ecological awareness, some workers are still required to commute to work. The Valaisan tax administration, unlike the Swiss Confederation, is quite flexible when it comes to deducting transportation expenses. It provides taxpayers with 3 fairly generous solutions:

The “cycle bike”, that the rest of the universe has chosen to call, more simply, the bike

Regardless of whether it is electrical, has two or three wheels, or even has a small internal combustion engine, it makes no difference. Your deduction will be 700 CHF (which probably does not cover your investment).

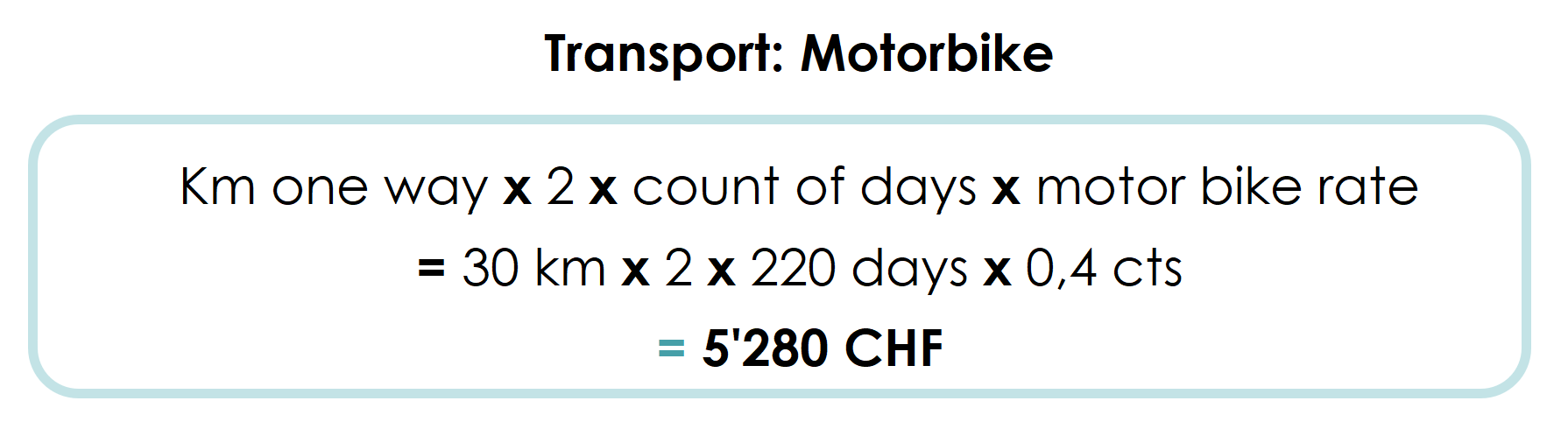

Motorcycles also called motorbikes or scooters

You did not feel like pedaling, so you bought a small Tmax to avoid the morning traffic jams? This solution will allow you to deduct 0.40 CHF per km ridden over the year.

For this calculation you have to count a maximum of 220 days per year and know the distance of the daily round trip. If you work 30 km from your home and you have worked 220 days, the authorized amount of deduction will be CHF 5’280.

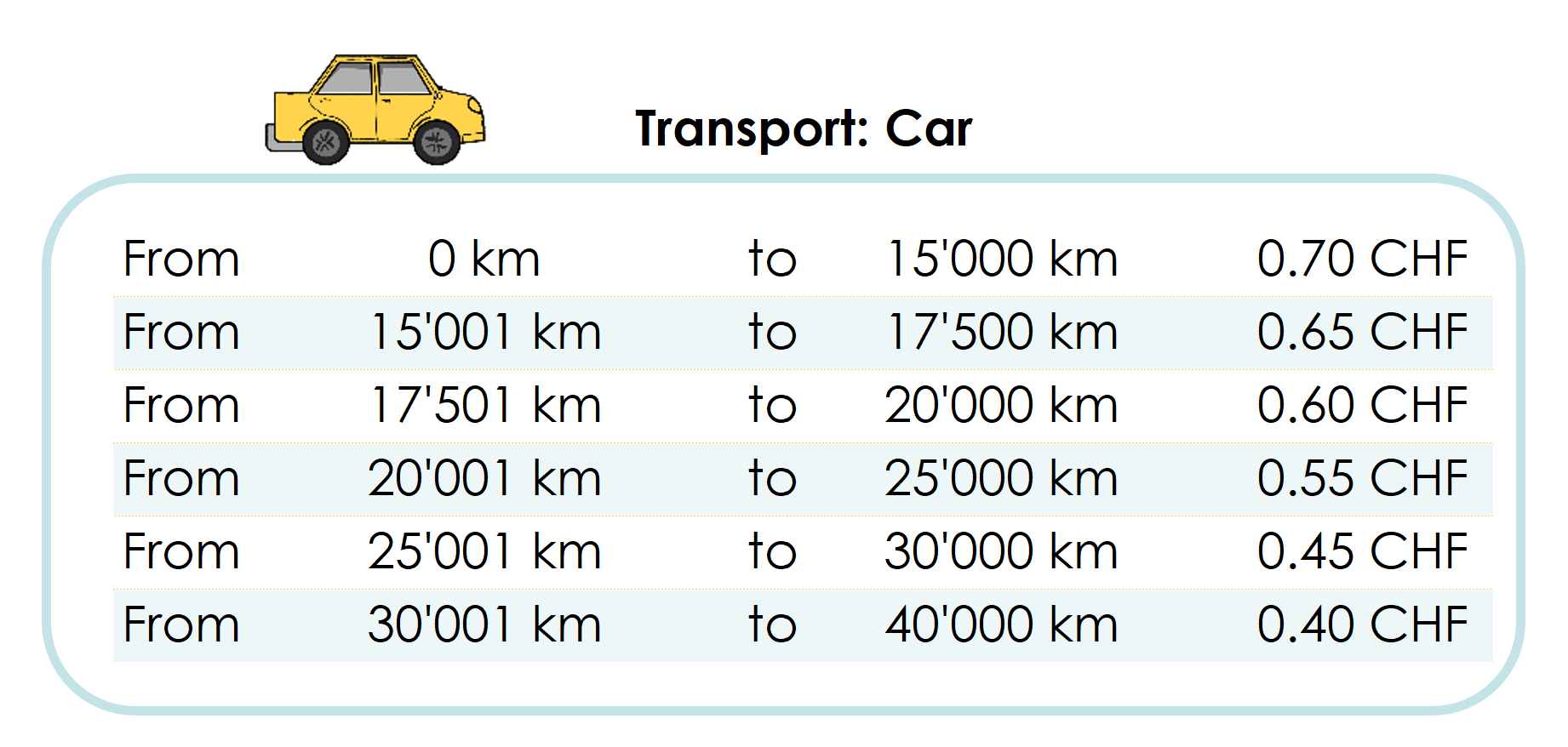

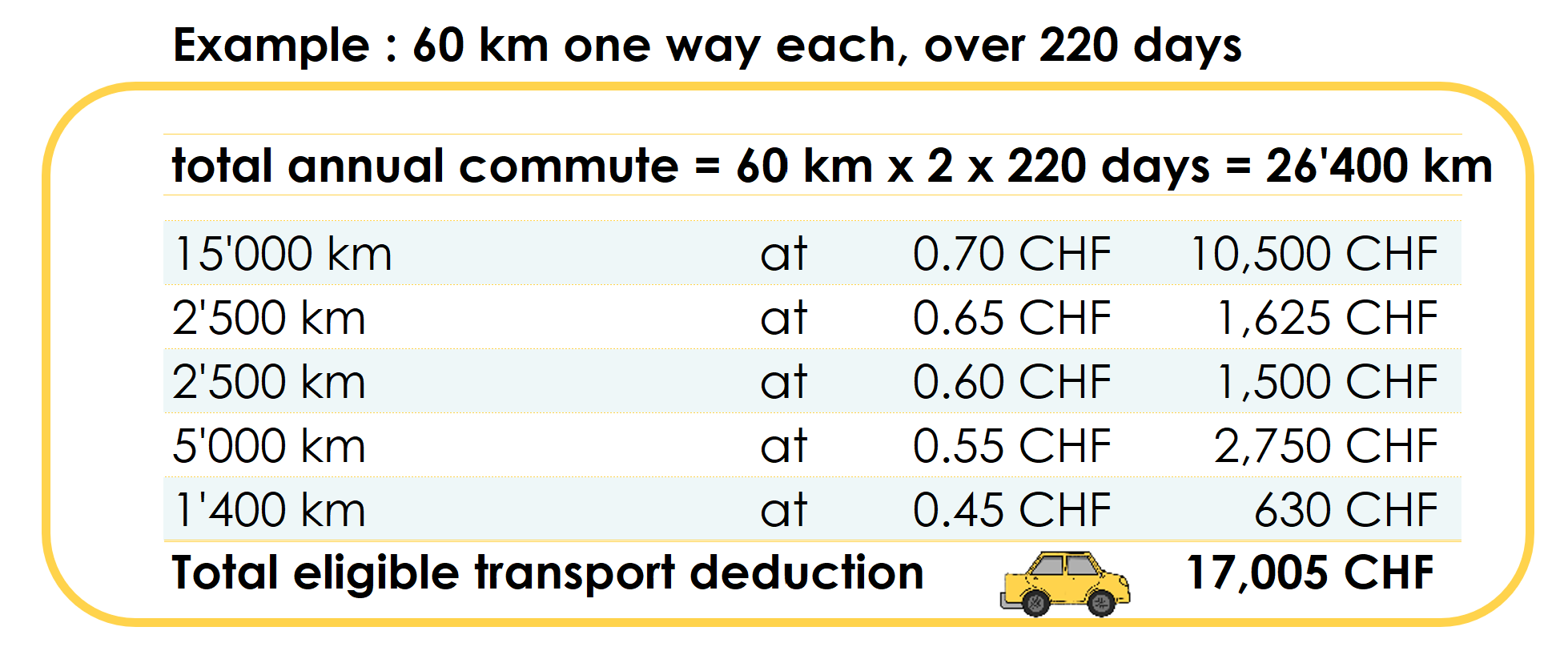

The car

This penultimate category of transport, authorized by the Valais tax authority, entitles you – provided you have no other transportation means at your disposal – to deduct as for motorcycles an annual amount that depends on the distance you need to travel in order to work on-site:

In order to clear up any remaining doubts, let’s take another example where I would work 220 days a year, for a daily 60 km commute (one-way):

Beware: All the above figures only apply to the Valais (ICC) and not to the Confederation (IFD) which limits the deduction for transport costs to 3’200 CHF per year.

Business expenses – Meals away from home

Quite straightforward: in Valais as elsewhere, up to CHF 15 per day can be deducted for lunches. However, there are two exceptions to the rule:

Meal expenses with partial employer contribution

- If your employer contributes in some way to reduce the cost of your lunches or dinners (if you work at night), then the deduction is halved: CHF 7.5. What can be considered as a contribution? It can take the form of a canteen at work with advantageous prices or financial participation for meals. Anyhow, if your employer contributes to your meal’s expenses, it is stated on your salary certificate.

Meal expenses with a significant employer contribution

- If your employer is heavily involved in supporting your food expenses, then no deductions will be admitted.

Additional accommodation

For simplicity’s sake, have you opted for the solution of settling away during the week in order to escape the 3 hours of traffic jam implied by a daily Sion-Geneva commuting? You have rented a small studio in front of your office? In this case, you are entitled to claim :

- CHF 15 extra for the evening meal, up to a maximum of CHF 3,200 per year

- The cost of renting your accommodation, up to a maximum of CHF 700 per month or CHF 8,400 per year

Other professional expenses

It is also a common deduction that allows, in the Valais as elsewhere, to claim all the expenses you may have incurred in order to carry out the work that was entrusted to you. By expenses, we mean computer software (word, exel), work clothes, tools, books etc. ….

This deduction can be claimed in two distinct manners:

Flat-rate business expenses

If you know that you did not keep all the receipts or that you did not have major expenses to cover the annual costs of working, then this is the right solution for you. No questions asked, you will be able to deduct 3% of your net income as long as this amount remains between CHF 2’000 and CHF 4’000. In other words:

– Net income below CHF 66’666, then the deduction will be CHF 2’000

– Net income exceeding CHF 133’333, then the deduction will be CHF 4’000

– Net income between CHF 66’666 and CHF 133’333, then you will be entitled to 3% of your net income

Easy, isn’t it?

Actual business expenses

This deduction is more technical to claim and is best suited for organized taxpayers who keep an accurate record of what they spend to conduct their working activity throughout the year.

If you think you’ve spent more than the lump sum described above and you’ve carefully kept records, then go for this option.

Please note, however, that all supporting documents must be attached to the declaration.

3rdpillar A contributions

This is not only true in the Valais but anywhere else in Switzerland and it is probably the most publicized deduction. The 3rd pillar A, called tied or even private pension plan, is a bank account or an insurance policy (focused on savings or risk coverage) in which you can allocate a given amount each year. To simplify things, let’s say that this amount depends mainly on your professional status:

Employee

Generally, everyone knows whether or not he/she is an employee, but in order to clarify any doubts, here is a simple rule: are you automatically affiliated to a 2nd pillar? If the answer is yes, then you are an employee and you will be able to deduct, in 2024, between 0 CHF and 7’056 CHF per year.

Self-employed

Based on the same definition, you are self-employed if you given the choice to affiliate yourself to the 2nd pillar. If you are self-employed and you have decided NOT to be affiliated, you will be able to deduct much more than if you decide to voluntarily contribute:

– Self-employed with voluntary 2nd pillar affiliation: Between 0 CHF and 7’056 CHF in 2024 (7’258 CHF in 2025).

– Self-employed without voluntary 2nd pillar affiliation: You can contribute up to 20% of your income but not more than CHF 35’280 a year for 2024 (36’280 CHF in 2025).

Dependent children and apprentices

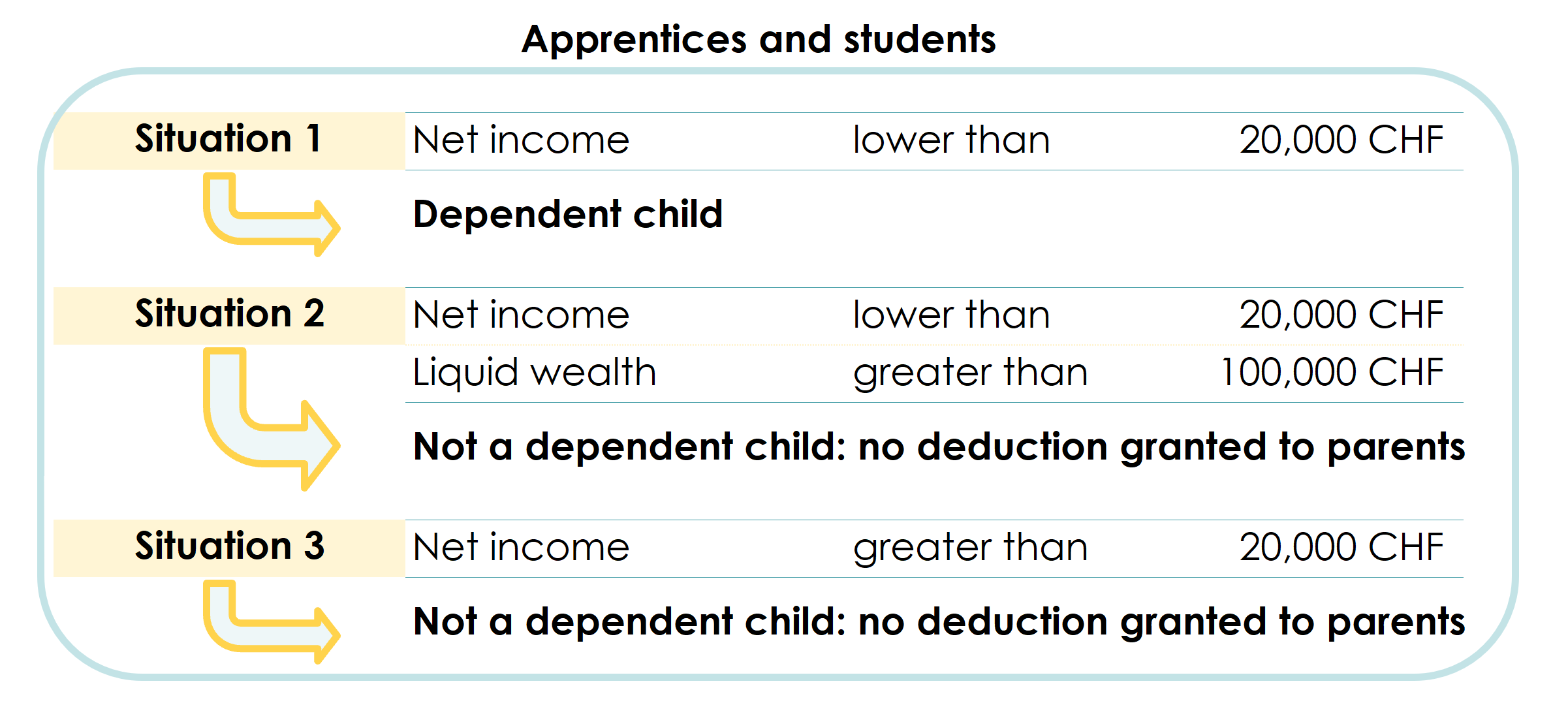

Before we talk about numbers, it’s important to know if your child is considered a dependent. There are two main considerations:

Children’s income and wealth

No matter how old your children are, if they have income and wealth then there is little chance that they can be reported as a deduction on your tax return. Here is a summary table:

Note: Parents whose children are required to move away from Valais to pursue tertiary education and thus need to reside permanently in another canton can claim an additional deduction of CHF 5,190 in 2024. A copy of the lease agreement and a certificate of enrollment from the university will need to be provided.

Your children’s age and status

Along with the income and wealth criteria, your children’s age and status will determine the amount you can deduct for 2024:

- Children up to the age of 6: 7’810 CHF per child

- Children from 6 to 16 years old: 8’890 CHF per child

- Child from 16 years old: 11’860 CHF per child

From the 3rd child on, the deduction is increased by 1’240 CHF per child.

Childcare expenses

It is common throughout Switzerland to be able to claim an additional deduction to compensate that you pay to have your children looked after. This comes on top of the deductions resulting from the simple fact of having children. Nevertheless, Valais is more generous than most other cantons. The deduction applies whether you have decided to delegate this responsibility to a third party or not.

The deduction for childcare expenses reaches CHF 3’110 per year and per child.

Deduction on spouse’s income

When married and both spouses are working, Valais and all its communes offer the possibility of deducting an amount of 6’250 CHF per year from one of the two incomes.

Alimony and maintenance contributions paid

Let’s start by distinguishing between these two types of payments: alimony is paid to an ex-spouse, while maintenance contributions are paid for a child, following a divorce or separation.

If you pay alimony, then you will be able to deduct it entirely (100%). Please note that this deduction is no longer valid as soon as the child turns 18.

Health, life and accident insurances

Unlike other cantons, Valais as the Conferedation mix up and aggregate various premiums: health insurances premiums, life insurances premiums and the accrued interest on savings capital.

Medical expenses deduction

Should you unfortunately have to pay medical expenses on top of your insurance premiums during the year, you can deduct a given amount from your taxable income.

Medical expenses are eligible for education once des exceeded 2% of your net income.

Let’s imagine that my intermediate income (which is, to simplify, very close to your taxable income) is CHF 55,000. I can only start deducting expenses from CHF 1,100 in expenses. Disabled individuals can benefit, for certain illnesses among others, from flat-rate allowances.

Training expenses

If you have seized the opportunity of taking on a training course during the year, you should know that a deduction is authorized under the following conditions:

- You already have a secondary school diploma (Maturité, apprenticeship, etc.)

- Or you are older than 20 and the training is not aimed at getting a first diploma of secondary degree.

The maximum deduction was CHF 12,270 per taxpayer in 2023. We look forward to knowing the new value for 2024!

Wealth deduction

Time for a break!

We’ve just gone through a dozen income-related deductions, and I believe you can already picture your future taxable income, once all applied.

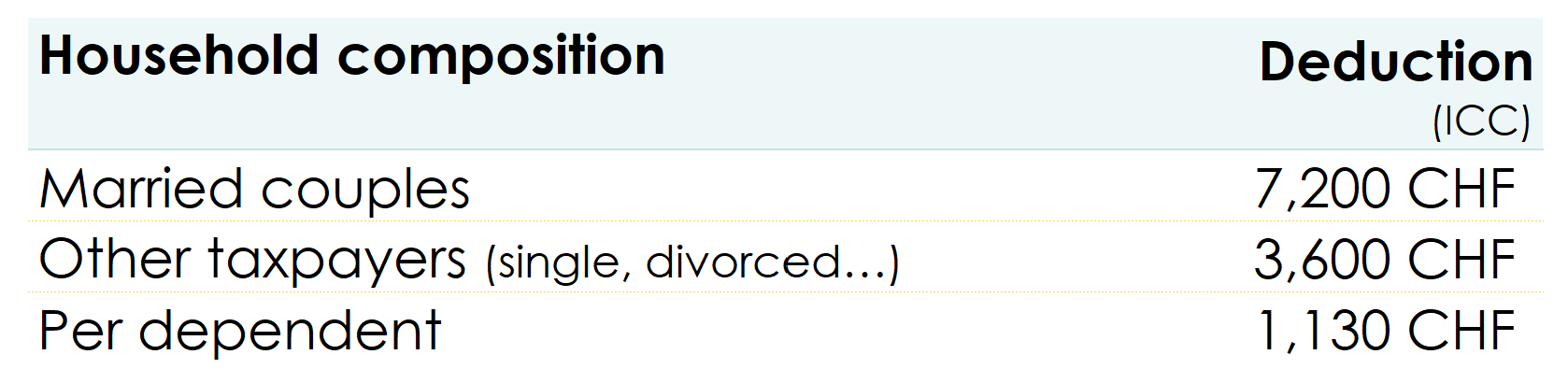

Still, I am not yet done… In Switzerland we have a wealth tax in addition to the income tax. Be reassured, this section only counts two main deductions, namely:

Flat-rate wealth deduction

You may be surprised to learn that you will have to declare every detail of your wealth in order to pay tax on it.

- Bank accounts

- Investment

- Real Estate

- Art objects

- Etc…

However, the canton of Valais does not tax your assets from the first franc and offers a lump sum deduction depending on your situation.

- CHF 30,000 for single people without children

- CHF 60’000 for married couples and single persons with dependent children

Deduction of debts

On top of the lump-sum deduction on assets, you can deduct all your debts from your taxable wealth.

How FBKConseils can help you?

First Free Consultation

At FBKConseils, we offer all our clients a first consultation free of charge, lasting 15 to 30 minutes. This meeting is an opportunity to answer any questions that may not have been addressed in our articles, explain how we work, and discuss the various ways we can assist you with your financial matters.

Tax Simulation

Although this article details certain deductions, the Swiss tax system, especially that of the Valais, is full of subtleties. If you are considering a significant life event such as the birth of a child, marriage, purchasing real estate, or even making purchases in your second pillar, FBKConseils can help you simulate the fiscal and economic impacts of these changes.

Valais Tax Return

Of course, like any fiduciary, FBKConseils is here to take care of your tax returns and manage communications with the tax authorities. But we go a step further: we also offer the opportunity to work hand in hand with our clients by setting up training appointments to help you master your tax return. We adapt to your needs to provide personalized and efficient assistance.