Written by Yanis Kharchafi

Written by Yanis KharchafiHow to calculate wealth taxes in Geneva?

Introduction

If you have already read the article about the income taxes in Geneva, then the calculation of the wealth tax will be a piece of cake.

Otherwise, I would advise you to go have a look at it before you start reading the next paragraphs.

If you want to file your tax return for the canton of Geneva, don’t forget that we can free you from this burden. 😉 In the meantime, on this page, I present you 4 steps to calculate your wealth taxes in Geneva.

Ready… steady… go!

The line-up:

What are the wealth tax rates in Geneva in 2024?

To start things off gently, and to reassure some while worrying others, I’d like to give you an overview of the tax burden associated with your wealth in 2024. To do this, I’ll take an average between the least expensive commune (Genthod) and the most expensive commune (Avully).

- With taxable assets of CHF 50,000: you will have to pay tax of CHF 164, i.e. a tax rate of 0.327%.

- With taxable assets of CHF 100,000: you will pay tax of CHF 327, i.e. a tax rate of 0.327%.

- With taxable assets of CHF 150,000: you will pay tax of CHF 524, i.e. a tax rate of 0.349%.

- With taxable assets of CHF 200,000: you will have to pay tax of CHF 739, i.e. a tax rate of 0.370%.

- With taxable assets of CHF 250,000: you will pay tax of CHF 1,233, i.e. a tax rate of 0.411%.

- With taxable assets of CHF 500,000: you will pay tax of CHF 2,394, i.e. a tax rate of 0.479%.

- With taxable assets of CHF 750,000: you will have to pay tax of CHF 4,022, i.e. a tax rate of 0.536%.

- With taxable assets of CHF 1,000,000: you will have to pay tax of CHF 5,816, i.e. a tax rate of 0.582%.

- With taxable assets of CHF 2,000,000: you will have to pay tax of CHF 14,438, i.e. a tax rate of 0.722%.

- With taxable assets of CHF 4,000,000: you will have to pay tax of CHF 33,581, i.e. a tax rate of 0.840%.

Now that you have a rough idea of the amount you will have to pay in wealth tax in the canton of Geneva, I’d like to take you a step further and explain how to calculate this tax.

From gross to net wealth

The first step before proceeding with the calculations is to determine your taxable wealth. It couldn’t be simpler: start by adding up the financial value of all your possessions. This total represents your gross wealth:

- Cash

- Current account

- Financial stocks (stocks, bonds, shares)

- Private loans

- Cars

- Boats

- Fiscal value of your real estate properties

- investment fund shares

- Art and valuable objects

- Your property: This is a more complex subject. Depending on whether your property is located in the canton of Geneva, elsewhere in Switzerland or abroad, the value to be declared may vary considerably, even if the purchase price is identical. For the time being, the most important thing to remember is that all your properties must appear on your Swiss tax return.

Are you done? To find out the net wealth and move on to the next stage, you now have to subtract all authorised deductions.

Debts: mortgage, unsecured and private debts

Dettes hypothécaires

Without going into too much detail, you probably have an idea of what this means. When you buy a property and use a financial institution to finance all or part of the purchase price, the balance of your mortgage at December 31st of the current year can be deducted from your taxable assets.

Unsecured debt (or private debt)

This somewhat technical term simply refers to unsecured debts, unlike mortgage debts, which are secured by a property. If you default on a mortgage debt, the bank can sell the property and recover the proceeds as a priority. Unsecured debts, on the other hand, have no guarantees or order of priority. These may include consumer credit, loans from family or friends, or unpaid tax debts. Regardless of whether your debts are secured or unsecured, unsecured debts are also deductible for the amount outstanding at December 31st.

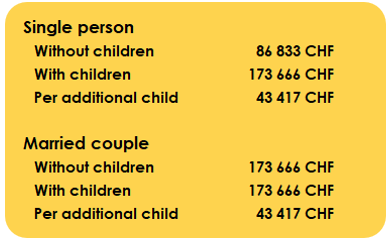

Exemption (or social deduction on wealth)

Most cantons set a tax-free amount, and where this is not the case (Vaud, for example), the first few francs are exempt from wealth tax. In Geneva, it depends on your situation. For 2024, the tax-free amount is :

- Per single taxpayer: CHF 86,833 compared with CHF 83,398 in 2023

- Per married couple: CHF 173,666 compared with CHF 166,797 in 2023

- Per dependent child: CHF 43,417 compared with CHF 41,669 in 2023

All good? Did you find your taxable wealth? Let’s move on to the calculation of the tax burden.

Calculation of basic wealth tax in Geneva.

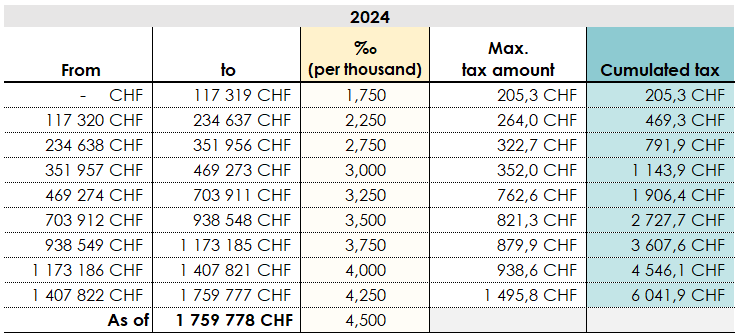

As with income tax in Geneva, cantonal and municipal wealth tax is calculated on the basis of what is known as the basic wealth tax. How do I find out what this is?

- Take your taxable wealth and find out in which bracket it falls, based on the two lists below.

If you wish, you can find them here (for the year 2023). The canton of Geneva has just shared with us the 2024 rates, which may not yet be updated on its website.

- Determine the tax corresponding to the previous bracket (and addition the amounts of both tables)

- Apply the rate of the current bracket to the difference between the maximal number of the previous bracket and your taxable wealth. Do this on both tables.

Table 1: basic tax on wealth for 2024

Table 2: additional tax on wealth for 2024

Let’s use an example to clarify all this. You will see, in reality, appearances are deceptive and what follows is actually simple, as long as we take it step by step.

Calculation of the first table: basic tax on wealth

My cousin Chloé, who is single and has no children, lives in Bardonnex and works in Carouge. She has gross assets of CHF 250,000 and no current debts.

To calculate her basic wealth tax, she must deduct the CHF 86,833 free of tax.

She obtains an amount of (CHF 250,000 – CHF 86,833) = CHF 163,167.

His assets are in the 2nd bracket, ranging from CHF 117,320 to CHF 234,637.

As we saw in the article on income tax, the 1st step in calculating basic tax is to identify the amount of tax accumulated from the previous bracket. In this case: CHF 205.30.

To this amount must be added the tax for the current band, calculated on the difference between taxable assets and the maximum figure for the previous band.

In other words: 163,167 – 117,320 = CHF 43,847. The rate to be applied is 2.25 per thousand – so multiply by 0.00225 (not 2.25% per cent).

43’847 x 0,00225 = 103.16 CHF.

By additioning both amounts, we get 205.30 + 103.16 = 308.46 CHF.

Chloé’s basic wealth tax is therefore CHF 308.46.

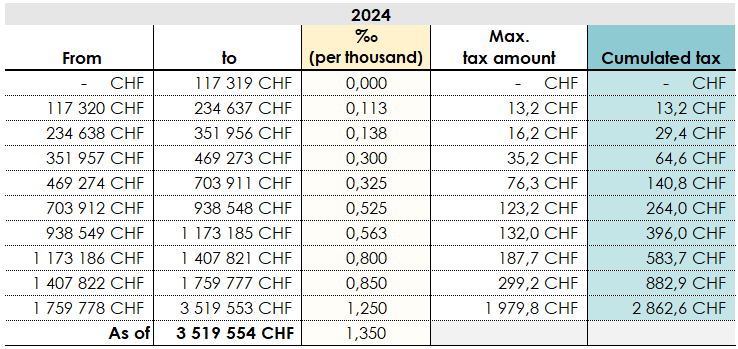

Calculation of the second table: additional tax on wealth

Before moving on, since we’re in the middle of the tables, let’s take this opportunity to assess the additional tax.

The procedure is the same as for basic tax.

If we go back to our table, Table 2: Supplementary wealth tax, we quickly realise that we are still in the 2nd bracket between CHF 117,320 and CHF 234,637.

The first step is to look at the maximum tax of the previous bracket. In our example this is 0. Which saves us a few blue banknotes and a few gray cells.

We still have to apply the rate of the current bracket to the difference between the maximal amount of the previous bracket and that of the taxable income, that is 163’167 – 117’320 = 43’847 CHF.

43’847 x 0.0001125 = 5.16 CHF.

Chloé’s addition wealth tax is thus of 5.16 CHF.

All this brain-bending for such a small amount!

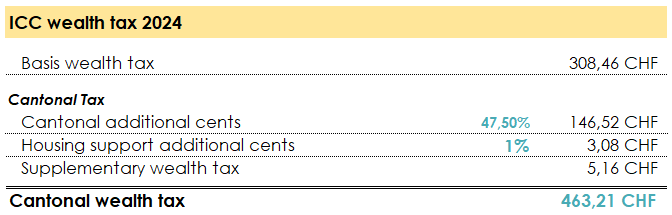

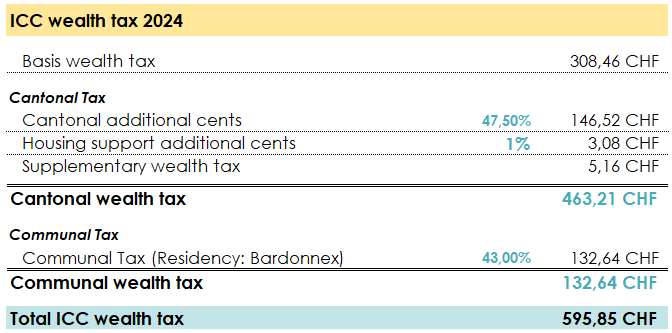

Calculation of the cantonal tax

Cantonal and local taxes are calculated on the basis of the basic tax, which in Chloé’s case is CHF 308.46.

For now, we do not take into account the additional tax but patience, it will come.

To this base ICC, we have to add…

- The cantonal additional cents to the rate of 47.5 % for Geneva.

- The additional cents of home assistance to the rate of 1% for Geneva.

308.46 CHF x 0,475 = 146.52 CHF.

308.46 CHF x 0,01 = 3.08 CHF.

Chloé’s cantonal tax is therefore of 308.46 + 146.52 + 3.08 = 458.06 CHF.

Last step: Add the additional wealth tax. In our example, we take our CHF 458.06 and add our CHF 5.16.

Don’t give up, we are almost done!

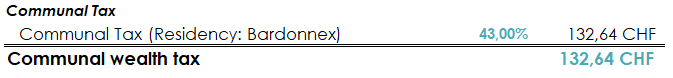

Communal tax calculation

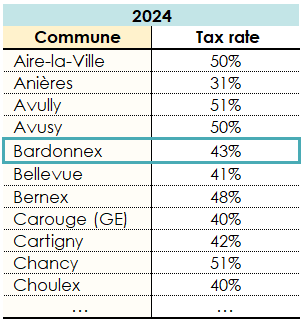

Unlike income, it is only the municipality in which you live that will tax your wealth. At what rate? You can find the 2023 tax rates for each commune in Geneva here. The 2024 version is available but has not yet been officially published (excel available here).

In order to complete our example, we will focus on some municipalities:

Don’t panic, there is only one step!

We need to find the tax rate of our commune, in our example: Bardonnex, and apply this rate to our basic tax.

All that remains is to add up all these amounts

If you want to know the total amount of your cantonal and communal taxes on your assets, do like Chloé and add up all the numbers you found.

To remind you, we calculated…

- A base ICC of 308.46 CHF

- An additional tax of 5.16 CHF

- For a total cantonal tax of 463.21 CHF

- A communal tax of 132.64 CHF

The amount of the ICC on wealth is thus of 595.85 CHF.

And at the federal level? Good news, unlike the income tax, there is no federal tax on wealth.

How can I optimise my wealth tax in Geneva?

To sum up, to optimise your wealth tax, you can either increase your debts, which means paying interest, or find investment solutions that allow you to legally avoid declaring certain assets on your tax return.

Increasing your debt

This strategy can only be advantageous if the interest you pay on the debt is less than the gains you make from it. It’s a bit technical, but the idea is simple: if you borrow money, it’s to make a profit. The aim is for this profit to be greater than the cost of borrowing. In that case, not only do you generate a return, but you also reduce your taxable assets.

Invest your money in a tax-efficient way

In Switzerland, the 3rd pillar A and the assets held in your pension fund are tax-free assets. So what does this mean? Making BVG/LPP purchases or investing each year in your 3rd pillar can, over the long term, significantly reduce your wealth tax. But beware: LPP buy-ins are a complex subject that merits in-depth analysis before you take the plunge.

How can FBKConseils help you with wealth tax issues in Geneva?

As always, FBKConseils is at your side to answer your questions and help you with all your tax affairs.

Filing your tax return

At FBKConseils, we offer a comprehensive service to help you declare your income and assets in Geneva. We have developed a 100% digital platform that allows you to create a personalised quote, receive a list of the necessary documents by email, and submit all these documents directly to our secure platform, accessible from our website.

Tax return training

We also offer our customers training sessions that will give you a better understanding of this field, the impact of your decisions, what can be deducted and, above all, how to become more independent in the years to come.

Verification of your tax decision

Just as important as the tax return, checking your tax assessment decision ensures that the tax authorities have fully understood your situation. In the event of an error, we can help you to lodge a complaint to correct what needs to be corrected.

Tax simulation

Before committing yourself to any project – whether it’s changing your life, getting married or having a child – we believe it’s always essential to check all the tax implications.