Written by Yanis Kharchafi

Written by Yanis KharchafiHow will marriage affect your taxes in the canton of Vaud?

Introduction

As you know, the answer to this question may vary depending on where you live, because in Switzerland a large proportion of your tax goes to the canton and municipality where you live.

In this article, we will focus exclusively on taxes in the canton of Vaud. For those in Geneva who have also decided to ask themselves the question, here is your article: Taxes and marriage in Geneva : a good idea?

Before answering this question, a few points need to be made:

- Here we are concerned purely and simply with income and wealth tax.

- Marriage can offer significant tax advantages in terms of donations and inheritance.

- Marriage also protects your spouse in the event of accident or illness.

With that out of the way, here’s my plan of attack, as always:

- A quick reminder of how tax works in the canton of Vaud with, as always, a few homemade simulations.

- Will you be entitled to new tax deductions as a married couple?

- A fitting conclusion

Sound good? Let’s get started!

The line-up:

How is tax calculated in the canton of Vaud?

If it’s clarification you’re after, then don’t waste your time here – go straight to our guide to calculating tax in the canton of Vaud. Quickly, the canton of Vaud has its famous family quotient system. This is a number that divides your taxable income to determine the rate at which you will be taxed.

This quotient equals :

- 1 if you are single,

- 1,8 if you are married,

- And we can add 0.5 per dependent child to this figure.

Incidentally, cohabitees are people who have decided to live together but not to marry. For you, the quotient remains at 1 and you can add 0.25 per child if you have joint custody. You will therefore have a quotient of 1.25.

Let’s get back to business. My name is Noé and I have a taxable salary of CHF 72,000 and my wife Zoé has a taxable salary of CHF 96,000:

- As a single person, I will be taxed on CHF 72,000 at the rate of CHF 72,000.

- As a single person, Zoé would be taxed on CHF 96,000 at the rate of CHF 96,000.

- If we were married, we would be taxed on CHF 72,000 + 96,000 = CHF 168,000 at a rate of 168,000 divided by 1.8 = 93,300.

This means that my salary of CHF 72,000 is taxed at a higher rate than if I was single, while my wife’s salary is taxed at a lower rate than her real salary…. You’ll agree with me that, on the face of it, this story doesn’t smell very good.

To put a value on it, we’re going to say that we live in the commune of Lausanne and that for the moment we have no assets or other income.

In conclusion, if after marriage our tax burden rises to CHF 40,428, whereas as a single couple we were paying a total of CHF 34,981, you can be sure that when you love someone you don’t count… CHF 5,447 extra in taxes!

But beware of those who draw conclusions based on a single example! Because even if this example is correct, it does not accurately represent reality.

Let’s do the same exercise again, but this time assuming that because of all the texts I write I no longer have time to take care of clients and therefore my income drops from CHF 72,000 to CHF 0 for the year 2024…

There you go, you’ve come to conclusions too early… Being married here would save you almost CHF 4,500.

What conclusions can you draw about marriage and tax in the canton of Vaud?

In fact, it’s quite simple to understand… If the family quotient were 2 for a married couple, then getting married or not getting married would almost always be equivalent (apart from the deductions we’ll discover later). The problem in the canton of Vaud is that the quotient is 1.8, or less than half.

To sum up, for equal or similar incomes, being married is a very bad decision, fiscally speaking, because you will have a higher average tax rate than if you were both single. On the other hand, the greater the difference in income between the two taxpayers, the more attractive it will be to propose, since the lower income, will considerably reduce the tax rate on the higher income.

Tax deductions for married couples in the canton of Vaud

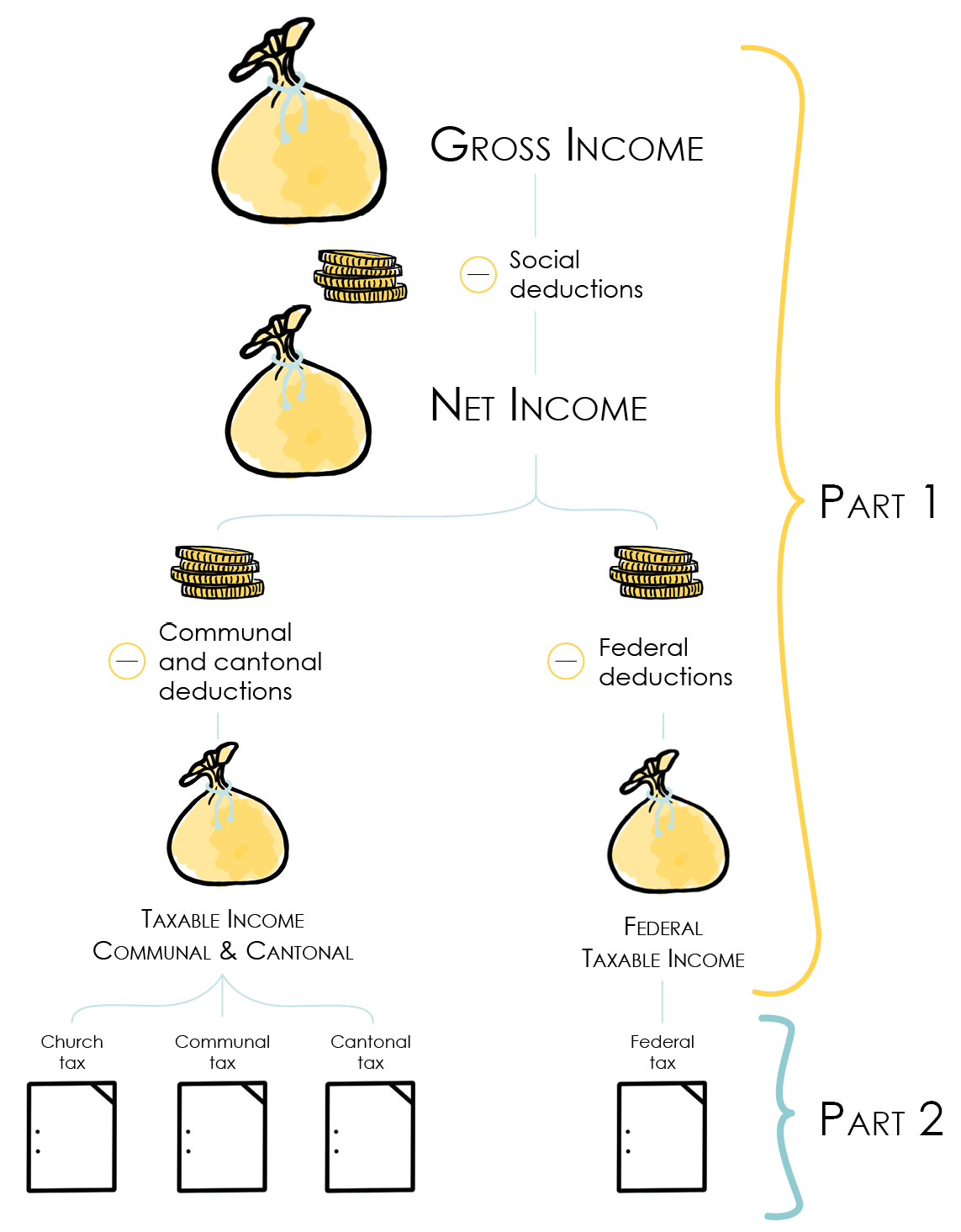

Even if you’ve already got a fairly clear idea of the situation, there are still a few points to be clarified because, as I like to remind you, tax is made up of two parts:

- Determine your taxable salary using tax deductions

- Calculate cantonal, municipal, and federal taxes

So, what about these deductions?

You will probably be a little disappointed, because yes, you will be entitled to a few deductions, but make no mistake, we are not talking about very large amounts…

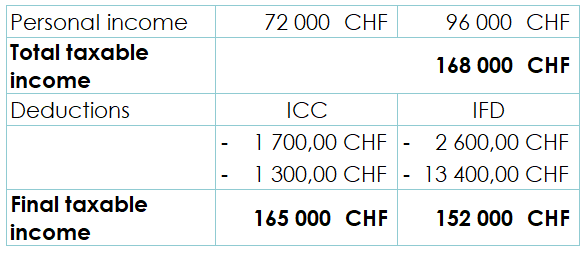

There are 4 deductions in all, two for cantonal and municipal tax and two for direct federal tax:

Tax deductions at cantonal and municipal level (ICC)

The deduction for double employment for spouses or registered partners

If both spouses work, you can deduct CHF 1,700 from your income.

Family allowance

When you are married, you will be considered a family and to congratulate you…each year you will be entitled to deduct a further CHF 1,300 from your income.

And that’s it! At least, for the taxes of the canton of Vaud, there’s still the confederation.

Tax deductions at federal level (IFD)

No matter how hard we look, only two deductions stand out. They are called:

– The deduction for spouses or registered partners living in the same household:

The amount of this deduction is CHF 2,600.

– The deduction for double employment of spouses or registered partners: CHF 13,400.

That’s it… We’re done… Let’s conclude by mixing up tax calculation and deduction, and then you can make up your own mind on the matter.

Finally, do Vaud taxes encourage marriage?

If we go back to our example, which was not in favour of marriage with my CHF 72,000 income and my wife’s CHF 96,000, would the situation change if we included the 3 deductions?

The new situation including deductions

There’s not much difference in this example… You’ll have narrowed the gap a little, but is it a reason to change your mind?

Bear in mind that every situation is different: children, income, deductions, etc. It’s not possible to give a precise answer that applies to every case, but even if marriage should never be reduced to tax issues, it’s not a bad idea to carry out this kind of simulation before saying yes for life. 😊

How can FBKConseils help you with taxes and marriage?

Carry out a tax simulation

At FBKConseils, we help you anticipate major changes in your life, such as marriage, the arrival of a child, a move or a property purchase, whether in Switzerland or abroad. We firmly believe that anticipation is the best way to manage your overall financial situation. That’s why we offer personalised tax simulations to help you anticipate the future impact of these events.

Tax return

When you make a major change in your life, such as getting married, we recommend that you entrust us with your tax return for at least the first year. The aim is simple: to create a solid example that you can use for future returns.