Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on October, 7th 2024.

Understanding wealth tax in the canton of Vaud

Introduction

In Switzerland, and in any canton, there are different types of tax, and more specifically two types of tax that you have to declare when you file your annual tax return: income tax and wealth tax. In this article, we will focus exclusively on wealth tax and wealth tax for residents of the canton of Vaud. Because, as always, there are major differences between cantons in terms of what is taxable, the value to be carried forward for these various items and, of course, the method of calculation, tax rates and, ultimately, your tax burden. The aim of this article is to answer all these questions so that you can understand how to declare your assets and optimise your wealth.

And before we start, if you’d like to find out more about income tax in the canton of Vaud, here’s a dedicated article: Understanding income tax in the canton of Vaud.

The line-up:

Who is subject to wealth tax in the canton of Vaud?

We propose to split this first question into two questions to give you greater clarity in our response. The first will be who must declare their wealth? And the second will be at what threshold do we have to pay wealth tax?

Who has to declare their assets in the canton of Vaud?

To put it simply, all residents, whether they are taxed at source (B permit), hold Swiss nationality or a C residence permit, must declare their income and wealth as soon as their assets exceed the threshold we will discover in the next paragraph. If you are taxed at source and you think you have taxable assets, you will have to file what is known as a subsequent ordinary tax return.

How much tax do I have to pay in the canton of Vaud?

Most cantons agree to leave out part of your wealth. More simply, they accept that each taxpayer can own a certain number of assets (bank accounts, investments, property) without taxing them from the first franc.

In the canton of Vaud, for a single person with assets of less than CHF 58,000 (for 2024), no tax is payable. If it exceeds CHF 58,000, you will have to pay wealth tax. For a married couple, the amount is simply doubled, so if together you have assets in excess of CHF 116,000, you will have to pay wealth tax.

Don’t be mistaken. Unlike the canton of Geneva (for example), this CHF 58,000 is not a deduction but a threshold below which you will not be taxed. If, after adding up all your assets, you arrive at a total wealth of CHF 100,000, you will not be able to deduct the CHF 58,000 – you will be taxed on the CHF 100,000.

Is wealth tax high in the canton of Vaud?

You may be surprised, but it all depends on how you perceive the word “high”. Some people will say that paying one franc is already too much, while others will say that it’s quite bearable. So as not to take sides, here’s how much tax you’ll pay each year based on your taxable assets. Whether you are single or married, the tax scales are the same.

There are a number of things that may not be immediately obvious but are nevertheless very important to understand:

Communes have a huge influence on your tax burden

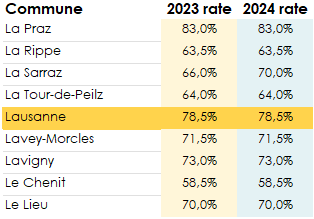

Whether it’s on income or wealth, the canton of Vaud has a tax system that allows its various communes to tax your assets to varying degrees. Depending on where you live, you will have to comply with the communal rules of your commune of residence. In the canton of Vaud, the communal difference can represent up to 15% of your total tax burden.

Wealth tax rates in the canton of Vaud

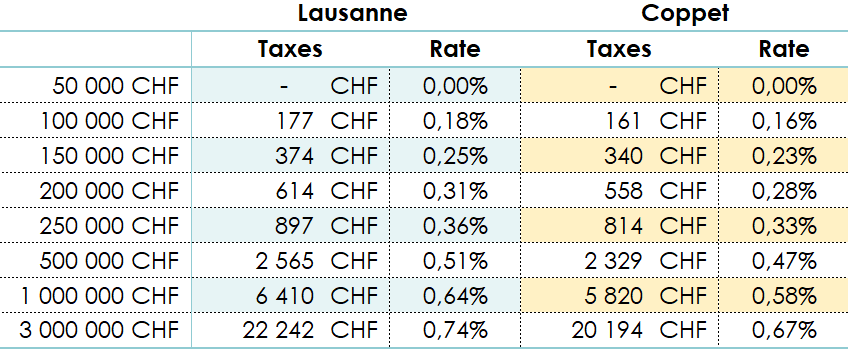

Here are the average tax rates in the canton of Vaud:

- Taxable assets of CHF 100,000: you will pay between CHF 156.90 and CHF 180.40 in tax

- Taxable assets of CHF 250,000: you will pay between CHF 795 and CHF 914.05 in tax

- Taxable assets of CHF 500,000: you will pay between CHF 2,274 and CHF 2,614.55 in tax

- Taxable assets of CHF 750,000: you will pay between CHF 3,928.45 and CHF 4,516.75 in tax

- Taxable assets of CHF 1,000,000: You will pay between CHF 5,682.75 and CHF 6,533.80 in tax

- Taxable assets of CHF 2,500,000: you will pay between CHF 16,208.70 and CHF 18,636.10 in tax

In short, the tax rate on your assets will vary between 0% and a maximum of 0.75%.

Do you think wealth tax is too high in the canton of Vaud?

How to determine your wealth in the canton of Vaud?

Before we start talking about figures, deductions and calculations, the first thing to do is to understand what will be considered part of your assets. There are two broad categories:

Movable assets

As opposed to real estate, movable assets can be made up of :

Your bank accounts (savings account, salary account, rent guarantee, etc.)

In Switzerland, it is compulsory to have an account with a bank (just to receive your salary), but it is not unusual for life events (marriage, children, savings, investments) to make you want to separate your savings in order to optimise their management. All your bank accounts will be included in your taxable assets. In Switzerland, bank accounts held abroad also form part of your taxable assets. Our clients’ most common accounts include :

Salary accounts

This is the current account that you will provide to your employer in order to receive your salary each month.

Savings accounts

This is your safety cushion, the account where many taxpayers like to put a portion of their income to make sure they can’t touch it too easily. These accounts can be used for holidays, a potential future property purchase or simply in case of a setback.

Joint accounts

This is a savings account that belongs to several people, whether within the same household, between brothers and sisters or between two partners. Your taxable assets will take into account the division of ownership between the various owners of this account.

Rental guarantee accounts

Few people know this, but rental guarantee accounts, which reassure landlords that you are not simply not going to pay the rent, are also part of your assets and should always be declared.

co-ownership accounts or renovation funds

If you own a shared-ownership flat, chances are that each year you will have to contribute a sum to replenish the building’s account in order to provide for potential future contingencies. At the end of the year, if the provisions have been wisely calculated, and your co-owner has not spent all of what he has set aside, the remaining balance must be shared between the co-owners and form part of your taxable assets.

Your investments

Yes, just like bank accounts, your stock market investments are also part of your taxable assets. Investments often include :

Investment in stocks

To calculate your taxable assets, you need to find the value of the shares at 31.12 of the year in question. In the vast majority of cases, the shares are listed, so you know the market value at all times. For unlisted shares, on the other hand, everything is more complicated and it will not be up to you to invent this value. In principle, it is the tax authorities who will request the company’s accounts and assign a tax value to your shares.

Investments in ETFs or investment funds

Whether you go through a broker, your bank or another financial institution, your assets should take into account the value of your portfolio in CHF on 31.12 of the year in question. If you work through a Swiss financial institution, there is a good chance that they will be able to provide you with a picot bello tax statement, which will make it very easy for you to obtain the amount of your assets. On the other hand, if you work with foreign brokers who do not necessarily close the tax year at the same time as us, then everything becomes more complicated and you will have to find a way of obtaining the value of your portfolio on 31.12.

Life insurance and other insurance products

This is a rather special case, because the term life insurance means different things in different countries. In Switzerland, life insurance can in some cases have a ‘surrender value’. In other words, if you terminate the policy, you get your money back. It’s a form of investment with protection… If your insurance has a surrender value, it’s this value that must be included in your taxable assets as at 31.12. On the other hand, if your insurance is nothing more than death or disability insurance, and if in the event of termination or cancellation of the policy you receive nothing, then this insurance has no impact on your assets.

Your household effects

In theory, if you own works of art, vehicles and other valuables, they should appear on your tax return at their market value, and therefore increase your taxable assets.

Your banknotes

This is not common practice, and who can tell? However, the rule would also be that all your financial assets held in the form of cash should be declared at their value on 31.12 in your personal assets.

Real estate assets in Switzerland (not abroad)

This is all your fixed assets, all your assets that cannot be moved. They include:

- Flat, house, building in Switzerland

- Building land in Switzerland

- Commercial property in Switzerland

Do you have to declare your assets abroad in Switzerland?

Yes, it won’t be enough to keep part of your fortune safe in a PEL, PEA or other French financial product for Switzerland to decide to leave you alone. Once you become a Swiss tax resident, all your assets held in Switzerland and abroad will have to be declared in Switzerland.

Real estate held abroad

Luckily for you, we’ve taken the time to write a full article on the subject of foreign property.If you don’t have the time or the inclination to read it, here’s a condensed answer: Yes, your foreign property must also be declared in Switzerland, but it will not be taxed in Switzerland. They will be taken into account when determining your tax rate in Switzerland.

What can be deducted from taxable assets in the canton of Vaud?

While all your assets will be taxed, all your debts, whether mortgage-related (coupled with a property) or unsecured (with no collateral, such as consumer credit), can be deducted from your total assets.

Taxable assets: Shares less debts

If you’ve reached this point, then you now know what you have to declare, what you don’t have to declare and, even better, what can reduce your taxable assets.

All you have to do is go through the exercise and work out exactly what your taxable assets will be.

The rest of this article is a special dedication to all tax enthusiasts who want to go further than simply understanding how wealth tax works. Would you like to understand how wealth tax is calculated and what scales are used? Then you’ll love what follows.

How to calculate wealth tax in the canton of Vaud?

I think that from now on it’s just you and me who want to understand why we pay tax and how it works. Before we start, I invite you to grab a calculator, a notepad and hang on. Here we go:

As described in the introduction, your assets will be taxed at two levels:

- Your canton of residence, in this article the canton of Vaud.

- Your commune of residence, Lausanne, Lutry, Morges, Nyon and Rolle.

We therefore need to calculate the tax for each of the two parts and then add them together to obtain the final result.

First stage: Cantonal wealth tax in the canton of Vaud

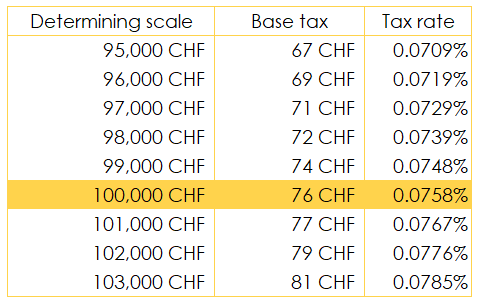

Quite simple, just one scale and one calculation. Here is an extract from the scale valid for 2024. You can find the full scale for the 2023 tax return at this link.

Let’s take a taxable asset of CHF 100,000 as an example. On this CHF 100,000, you will have a basic tax of CHF 76. To determine the final cantonal tax, you will have to multiply this basic tax by the cantonal rate, which for the year 2024 is 155%.

As a result, your cantonal wealth tax will be CHF 1.55 x CHF 76 = 117.

Second stage: Communal wealth tax in the canton of Vaud

No more complicated than step 1, you have to start from the basic tax calculated in step 1 using the same scale, and this time apply the rate for your commune. Don’t know where to find your municipal rates? Then simply click on this link.

In our example, we’ll assume that we live in Lausanne.

All we have to do is take the basic tax of CHF 76 and multiply by the Lausanne rate of 78.5% = CHF 59.66.

Finally, you will know how much wealth tax you will have to pay. This is the sum of cantonal tax and municipal tax: CHF 117 + CHF 59.66 = CHF 176.66.

Do you want to estimate how much you will pay in taxes? Then you should go check out our taxation calculator!

Tips and advice on wealth tax in the canton of Vaud

How do you know which values to enter on your tax return?

It’s not just a question of knowing what to declare, but also of understanding how to declare it. Many of our clients make mistakes when reporting their assets: what allowances are applied to your property? What conversion rates or other surrender values can legally be used to reduce your taxable assets?

What can you do if certain items of your wealth were not declared in previous years?

In Switzerland, and more generally in the canton of Vaud, it is possible to make mistakes (at least once) without necessarily being penalised. If you wish to correct an oversight, you can make a “spontaneous denunciation”, which gives you the opportunity to rectify the mistakes you have made.

How can FBKConseils help you understand your wealth tax?

At FBKConseils we specialise in all Vaud tax matters. As a general rule, our expertise enables our clients to better understand how to declare their assets. Most taxpayers who own property abroad tend to overstate the tax value of their assets.