Written by Yanis Kharchafi

Written by Yanis KharchafiTax return: the key steps from withholding tax to tax assessment

The year 2024 is approaching, and whether you live in the canton of Vaud, Geneva or Valais, the time has come to ask yourself a number of tax questions. You’ve heard that taking the plunge and filing a tax return (subsequent ordinary taxation (TOU)) makes financial sense, but before you take the plunge, you’d like to know what to expect. We understand that it’s better to be prepared, and this article is here to help! We’ll take you through all the stages of the process, the dates you shouldn’t miss, and share some useful links if you’d rather delegate.

The line-up:

Step 0 : For people taxed at source: the application for subsequent ordinary taxation (TOU)

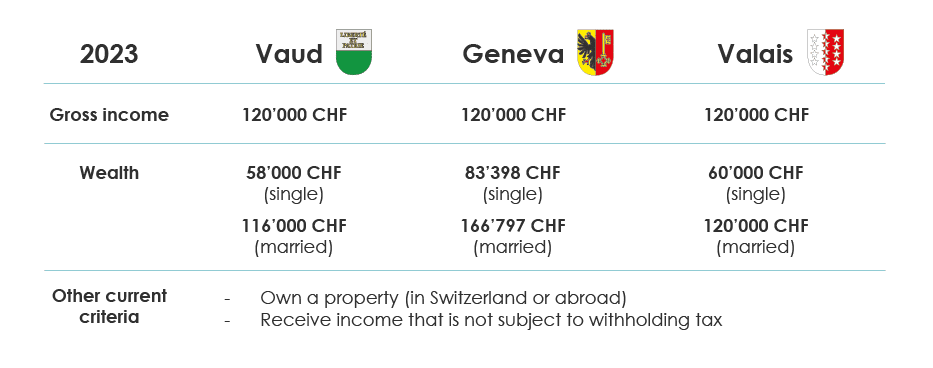

Before we get started, a quick reminder for those of you who don’t have a C permit or Swiss nationality: filing a tax return may be compulsory or optional, depending on your situation. If you have any doubts, we suggest that you first check which situation you find yourself in by reading our article on subsequent ordinary taxation. The table below summarises the levels at which the TOU is compulsory:

If the TOU is optional, and you have not applied for it in previous years, it is essential to make sure that it is in your best interests to do so. This is because withholding tax rates are different from those for ordinary tax, and if you don’t have enough deductions to claim, you could end up with a rather hefty bill. But how do you know whether you can expect a partial refund of what has been deducted at source? To find out, the options are limited: you need to simulate.

In the meantime, here’s a summary of the essential information:

When should I apply for a TOU?

The deadline for requesting subsequent ordinary taxation from the cantonal tax authorities is 31 March each year. To file a 2023 tax return, you will need to apply before 31 March 2024.

What happens once my TOU application has been sent?

Once you have applied for the TOU, you will have to complete a tax return for the year in which you apply, as well as for all subsequent years. If you have a choice, we strongly recommend that you do a simulation beforehand. The tax return will have to be submitted by a deadline that may vary from canton to canton.

What happens if I haven’t requested a TOU when I should have?

Finally, if you discover through this article that you should have applied for a TOU in previous years, but didn’t know it… Don’t panic. Chances are that once your application has been received, the tax office will send you the documents you need for previous years’ returns. Then, you will just have to fill it.

Step 1: Your login details and document preparation

Once you have submitted your TOU request, you will receive your login details for completing your tax return.

For people taxed at source who applied for a TOU the previous year, holders of a C permit or Swiss citizens, this document will be sent to you automatically at the beginning of the year. It contains three essential elements:

- Your taxpayer number (which you will keep from year to year)

- Your “control code” or “declaration code” (a unique code for the declaration in question)

- The deadline for submitting your tax return

At this stage, there is no turning back and a tax return will have to be completed. You will therefore need to gather together salary certificates, health insurance premium statements and other supporting documents before moving on to the next stages. Depending on your situation and the items to be declared (income, deductions, assets and debts), the list of documents will vary. At FBKConseils we have developed a platform to make your job easier. No need to search for the categories that apply to you, just answer a few questions and we’ll automatically determine the documents we need to complete your tax return.

However, if the deadline for submitting your tax return seems a little short, or if you are missing certain documents, it is possible to apply for an extension (for which you may have to pay) from the tax authorities in your canton:

- Vaud

- Geneva

- Valais ; There’s no need to ask for an extension – you should have received a payment slip with your tax return. All you have to do is make a payment of CHF 20 to move the deadline to 31 July (for employees) and 31 October (for self-employed persons).

Step 2: The 2023 tax return

Here we are, at last! Once you’ve received your login details and all your documents have been centralised, you can fill in your return and enter all your details in the software/web application provided by the Canton. For Geneva and Vaud, these will only be available in French, while Valais is also offering a German version.

You will find roughly twenty sections and sub-sections to complete, depending on your situation. If this is the first time you have opened VaudTax/Prestation VaudTax, GEtax or VSTax, don’t hesitate to click and explore to make sure you haven’t missed any deductions.

For many years now, you have been able to submit your tax return and supporting documents online. The final step is to attach the supporting documents you are asked to provide and upload them.

Step 3: Revision and additional supporting documents

Your tax return is now in the hands of the tax authorities, and you’re going to have to be a little patient, because it’s being reviewed by human beings, the taxmen and taxwomen. Their role is to check your tax return, verify the information you have entered on it and, if necessary, make corrections or ask you new questions. Please note that they are not there to add deductions that you may have forgotten, even the most obvious ones. For this, we refer you to our articles, updated with the new amounts applicable for the 2023 tax year:

If necessary, you may be asked to provide additional supporting documents that cannot or should not be sent initially. In this case, you will receive a request which must be acted upon without delay.

As you will have understood, the amount of tax obtained after completing the tax return is only an estimate. So far you have presented your view of your own situation, which is rather subjective, and hopefully favourable. But it’s up to the taxman to decide: is the use of your private car to get to work really essential? Is your child’s summer camp a deductible child care expense? Are the costs of renovations deductible from income tax, or do they form part of a capital gain on property? etc.

Step 4: The tax decision

Once your tax return has been analysed and, in some cases, adjusted, you will receive a tax assessment decision. You will then find out which deductions have been allowed, and in which proportions – which will directly, and indirectly, influence your total tax burden. In short, there are two possible outcomes:

1. Withholding tax is higher than ordinary tax

You have made sufficient provision for tax throughout the year (through instalments or withholding tax), and have managed to claim sufficient deductions, to arrive at a final tax figure that is lower than the amounts for which provision has been made. In this case, you can expect a partial tax refund.

2. Withholding tax is lower than ordinary tax

If your provisions turn out to be insufficient, you will receive invoices from the tax authorities for the difference.

As explained above, declarations are processed by humans, and you know what they say? “Mistakes are human”. Terrible, but true. Errors of varying magnitude or even misunderstandings can creep into the process, which is why it’s important to check (or have checked 😉) this decision quickly.

If you disagree, you can contest it within 30 days of notification, so if you’re in any doubt, don’t waste any time! And as always, if you need an informed opinion, we’re here to help.

Step 5: If necessary, appeal?

You’ve taken the time to check your tax ruling, but you’re still not convinced. Whether you’ve noticed a glaring error, or whether you’ve realised a little late that a “little oversight” was a little too big, you can always take action to try to correct it. Your request won’t necessarily be accepted, but it may be worth a try.

The tax decision can be contested within 30 days of notification by filing an appeal. An appeal is nothing more than a letter in which you explain briefly but clearly what is bothering you. This letter must be received by the tax authority within the time limit set and accompanied by all the supporting documents that substantiate your claim.

Here’s a word of advice: keep it factual and as concise as possible, while highlighting what you think is wrong.

We hope that, with all this, you now have the essential information you need to understand the steps and processes involved in filing your tax return.