Written by Yanis Kharchafi

Written by Yanis KharchafiUnderstanding income tax in the canton of Geneva

Introduction :

Calculating one’s taxes according to gross income is like peeling onions layer by layer. At the end, there is not much left and we shed a few tears along the way.

The advantage is that the surprise effect is avoided since the bill arrives at the begining of the year. Of course, even though the amount will remain unchanged, we can relieve you of the chore of doing your tax return in Geneva by doing it for you. But if you are interested in the calculation, then here is the procedure.

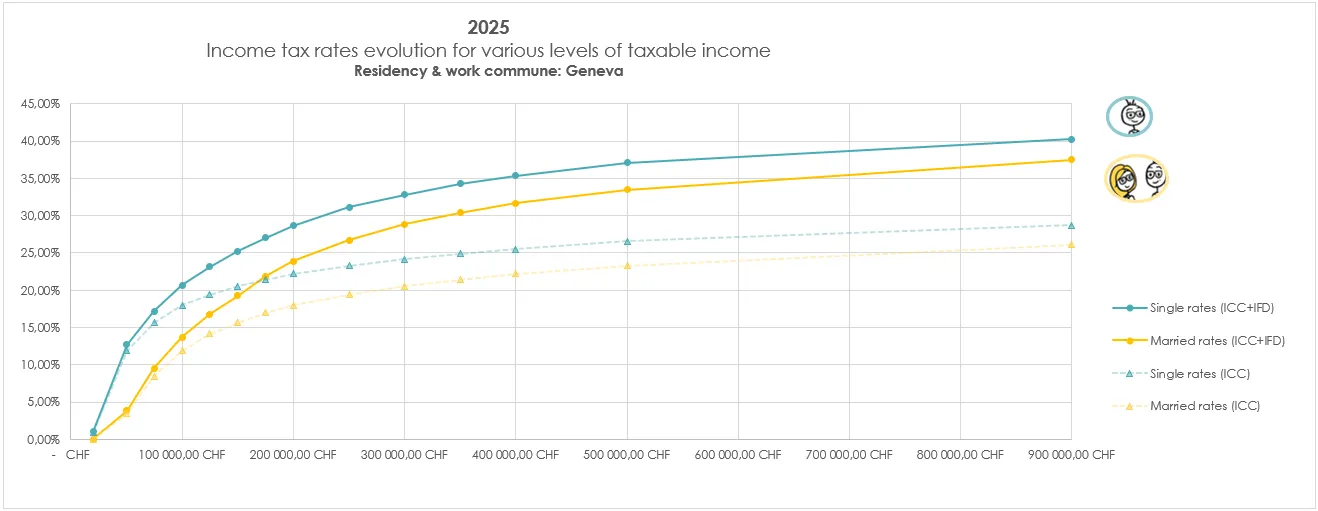

As you probably know, there are two levels of income tax in Switzerland and, by extension, in the canton of Geneva: the cantonal and communal income (ICC) and the direct federal taxation (IFD)

For the sake of clarity, I divided the calculation into two parts. On this page, I will only show you how to determine the cantonal and communal income taxes (ICC).

Before you start, bear in mind that taxation in Switzerland is a grey area for most. Euphemism. The problem occurs when we try to understand everything at once. The best strategy, however is to take it step by step.

Let’s go!

The line-up:

Do Geneva residents pay high taxes?

Before explaining how to calculate your taxes in your canton, I thought it would be useful to give you a comparison with the rest of Switzerland. Is Geneva a tax-friendly canton or, on the contrary, punitive?

So, the basics are clear: in Geneva, as in most cantons in French-speaking Switzerland, taxes remain fairly high on average, even if, fortunately, the trend is downward from year to year.

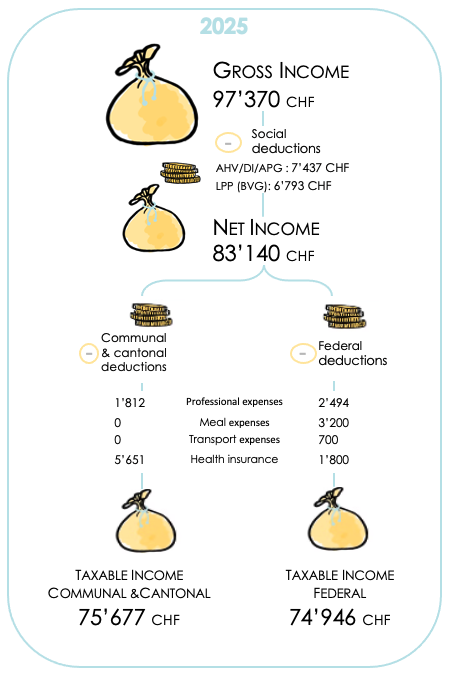

Let’s now move on to calculating your tax. The first step is to understand how to convert your gross salary, the amount negotiated with your employer, into your net income.

Tax calculation : Step 1 – From gross to net salary.

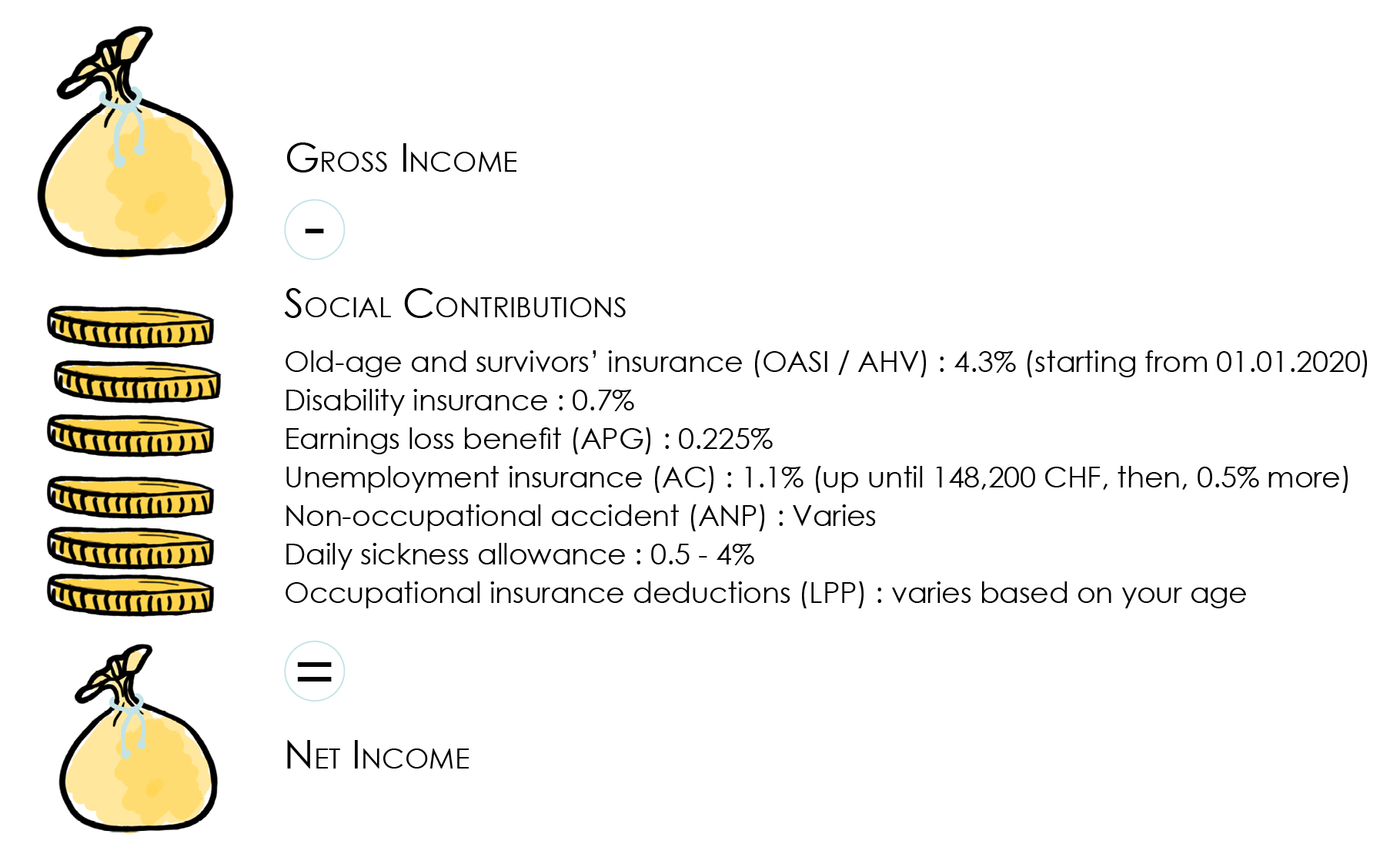

The gross salary represents the amount negotiated with your employer or yourself if you are an entrepreneur or self-employed.

Net salary is what appears on your bank account at the end of the month. The difference between the two is made of deductions related to social insurances (except for people taxed at source who, in addition to social security deductions, have income tax deducted from their salary).

That being said, the net salary is not the taxable income yet.

Tax calculation : Step 2 – From net salary to taxable income.

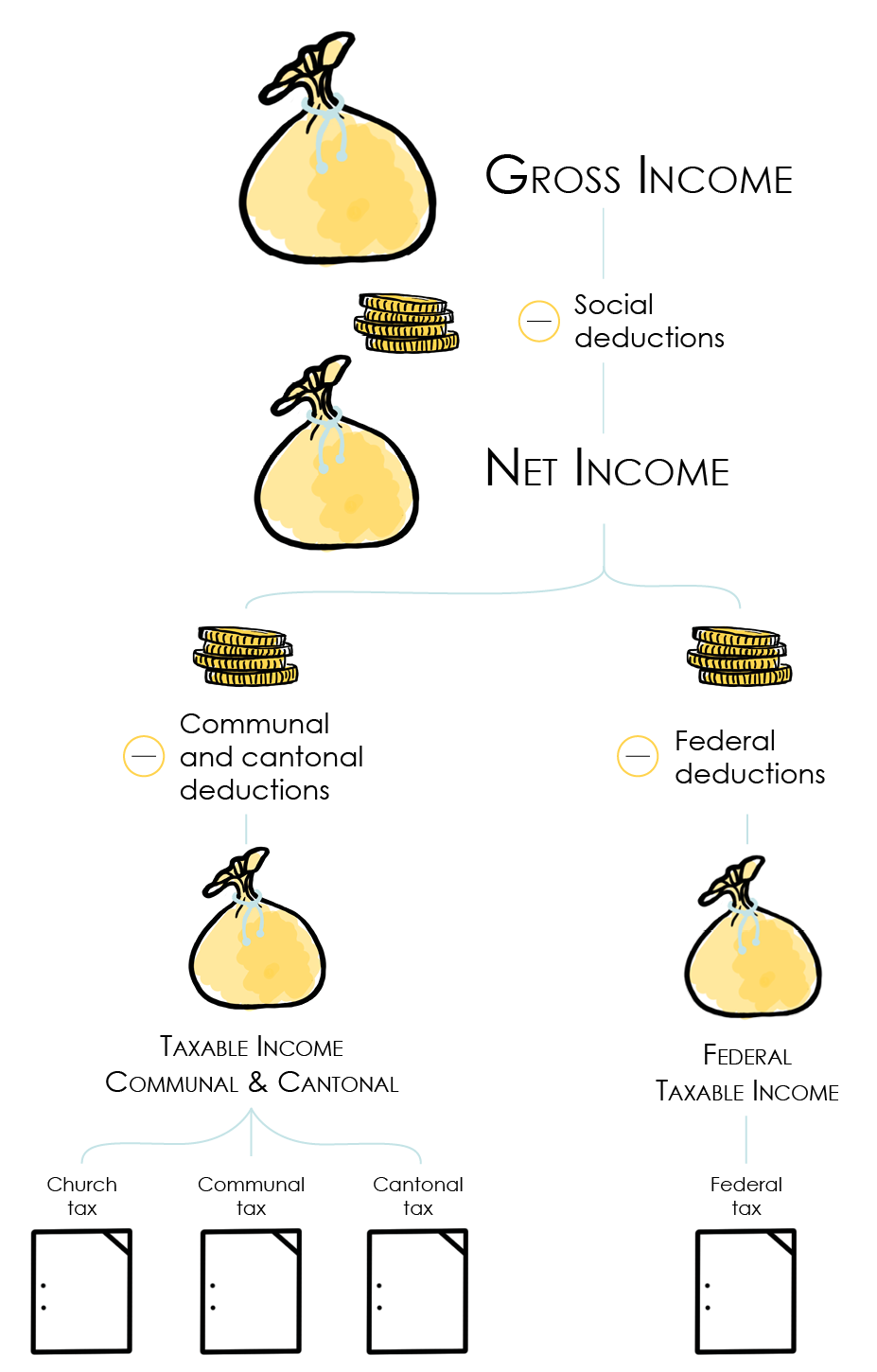

To go from net income to taxable income, there is only one step: subtracting the authorised deductions. And to do that, you need to separate everything into two categories.

Why are there two categories? Because the deductions allowed are not always the same at cantonal and federal level. Sometimes they are, sometimes they are not. In addition, the scales differ.

In summary, what is authorized at the communal level is also authorized at the cantonal level; this is why they are grouped. But this is not necessarily the case at the federal level. The amount of authorized deductions can also vary.

Here is a non-exhaustive list of generally accepted deductions:

- Pillar 3A and B (note that 3B is virtually unique to Geneva)

- LPP repurchases

- Childcare costs

- Medical costs

- Health insurance

- Transportation

- Meals

- Etc.

Here is an example of 2025 deductions for a relatively simple situation.

And if you would like more information on Geneva’s deductions, check out our dedicated article: The 12 authorized deductions in Geneva.

Tax calculation: Step 3 – Calculate the base cantonal and communal taxes in Geneva.

Now that we’ve converted your gross income into taxable income for CCI and DFI purposes, you’ve taken an important first step. The second part of the process can now begin, but be warned: it will require patience and rigor. To do this, we will first focus on calculating tax for a single person, then add a paragraph for married couples, and finally address a brand new cantonal specificity: partial splitting. The calculation works the same way even if you are married, so stay tuned. To begin with, we need to determine a basic tax amount, then perform a few calculations specific to the canton of Geneva, before we can arrive at the final tax amount.

Calculating basic tax.

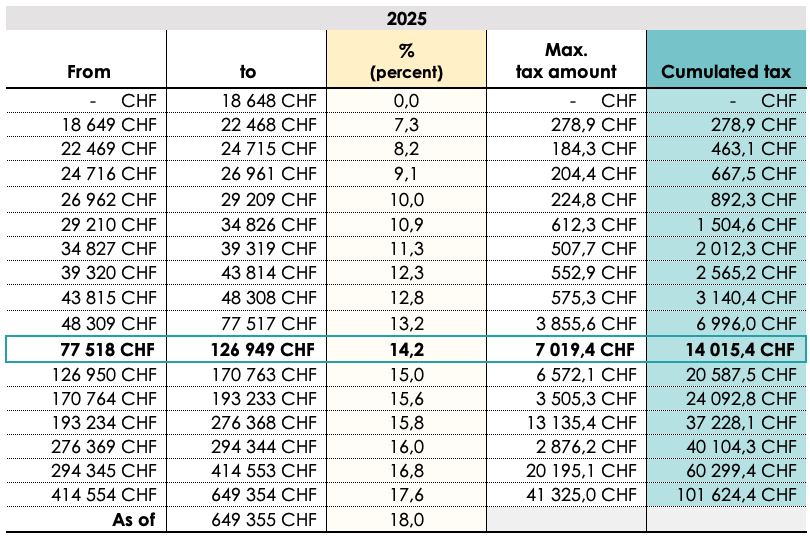

It all starts with a scale that is updated every year by the canton of Geneva and that works for both the commune and the canton.

And if you ever feel lost (because I’m anticipating), don’t worry. We’ll go through all these calculations again with a concrete example and figures to guide you step by step.

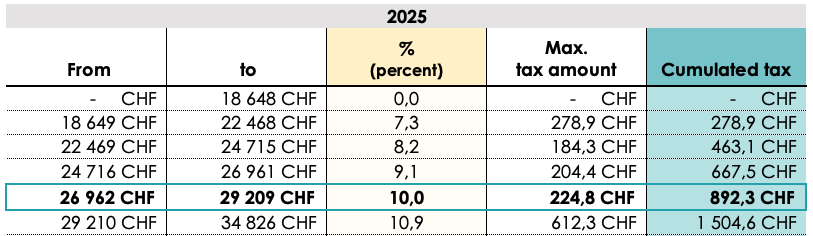

Part 1: Take the amount of your taxable income and find out in which bracket it falls.

Part 2: Determine the tax corresponding to the previous bracket

Part 3: Apply the rate of the curent bracket to the difference between the maximal number of the previous bracket and your taxable income.

At this point, I feel like crying out loud, but it would not be very professional of me. Instead, I will use an example to illustrate the next steps. Presented this way, they are hard to grasp. But with an example, it will all become clearer.

My cousin Chloé, who lives in Bardonnex and works in Carouge, has a taxable income of 90’000 CHF. In other words, after her employer has deducted AVS, LPP, unemployment, etc., and after Chloé has claimed all her deductions: transport, meals, 3rd pillar, etc., she still has a cantonal and federal income of 90’000 CHF to pay tax on.

First thing to do: look at this table (valid in 2026 for your 2025 tax return).

Chloé’s scale is highlighted in bold: 77’518 – 126’949 CHF.

The amount to keep in mind is the total tax of the previous bracket (48’309 – 77’517): 6’996 CHF.

Be careful, this is not (yet) the base ICC. This is just the first step.

To calculate this, remember the taxable income. For Chloé, this is CHF 90’000. The difference between 77’517 CHF, which is the maximum figure for the previous bracket, and the taxable income, is 90’000 – 77’517 = 12’483 CHF.

This new amount is taxable at the current rate of 14.2%. And 14.2% of 12’483 CHF gives us 1’773 CHF (12,483 x 0.142 = 1’773 CHF).

All that remains is to add these two amounts together to find the basic ICC tax: 6’996 + 1’773 = 8’769 CHF.

Phew! The base ICC, therefore, is of 8’769 CHF.

Now, you can suspect that if it is called “base” tax, this means we still have a way to go before calculating your final taxes.

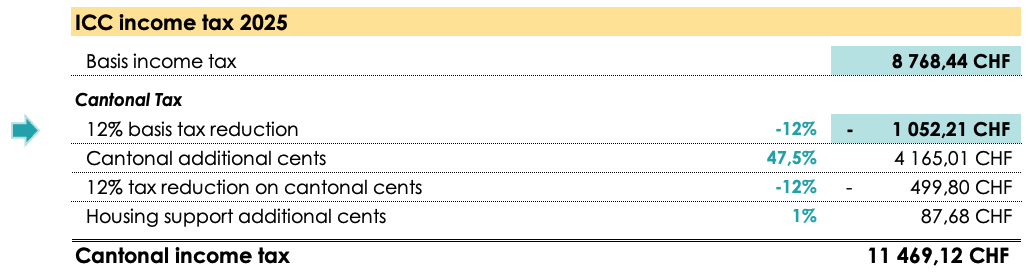

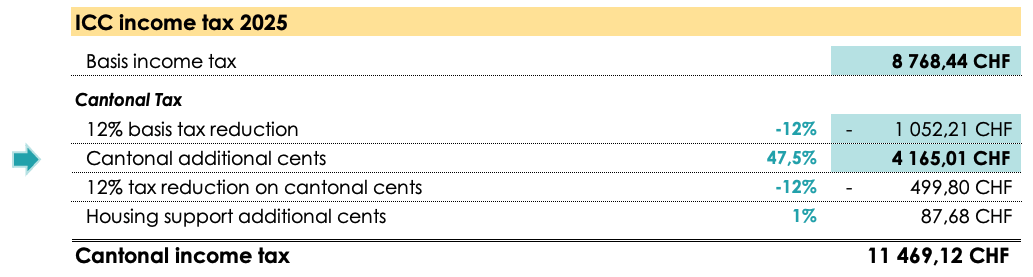

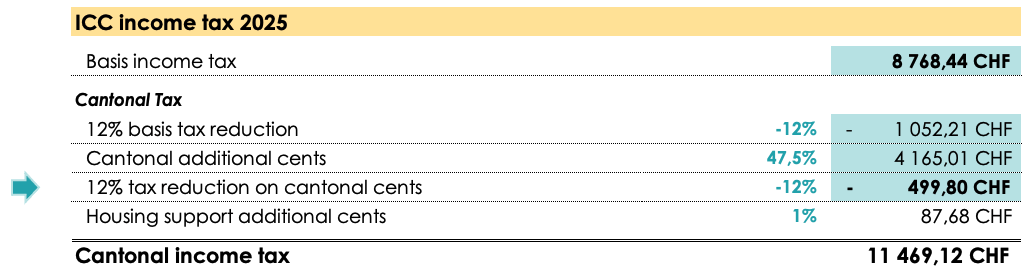

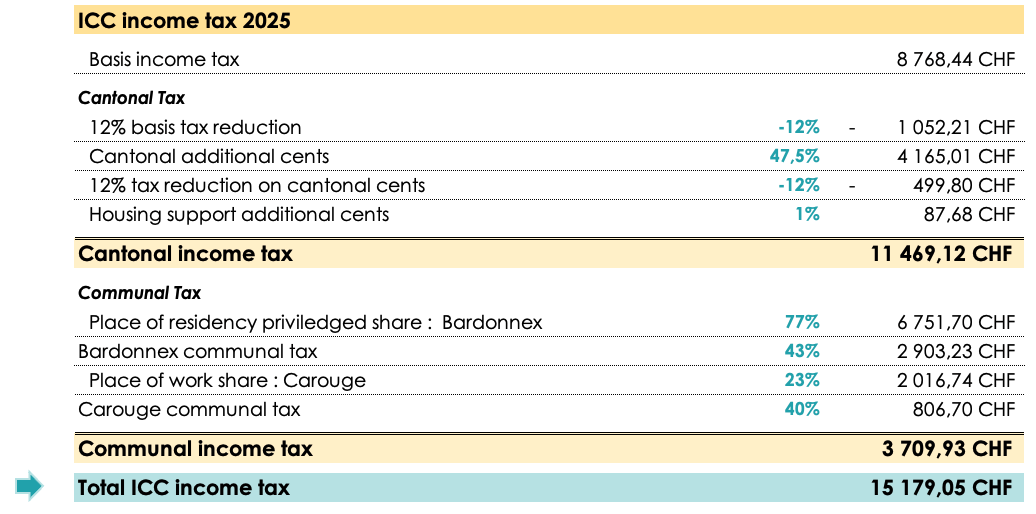

How to calculate cantonal taxes in Geneva?

If this already seems strange or complicated to you, believe me, you haven’t seen anything yet. Let’s start again with this basic tax and continue step by step.

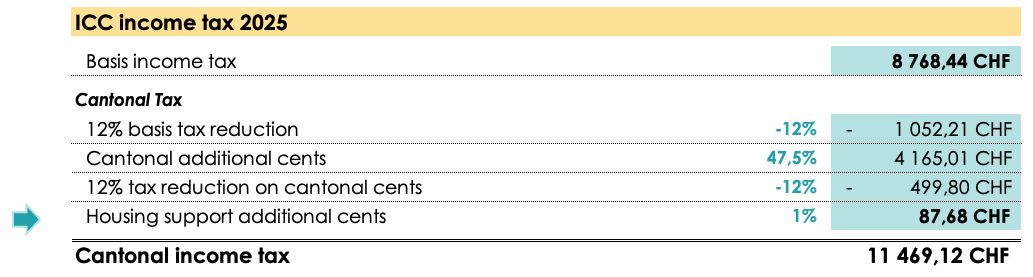

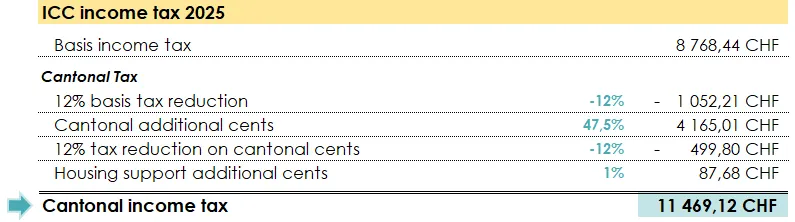

1. 12% reduction on the base tax.

The canton of Geneva kindly takes 12% off the base ICC.

Let’s take Chloé’s example.

12% of her basic ICC (CHF 8’769 x 12%) gives 1’052.2 CHF.

Keep this in mind for the final calculation.

2. Adding additional cantonal cents.

Additional cantonal cents are expressed in percentages and refer to the amount the canton wants to withhold on your base tax. In Geneva, it is 47.5%. In other words, everyone in Geneva must pay 47.5% of their base tax to the canton.

Please note that the calculation is based on the basic ICC (and not on the basic ICC minus 12%): 8’769 CHF x 47.5% = 4’165 CHF.

3. Subtraction of the 12% on the additional cantonal cents.

This time, the canton deducts 12% of the amount calculated just before: 4’165 CHF x 0.12 = 499.8 CHF.

4. Adding the additional home assistance cents.

What is this home help? It is not clearly defined. What is certain is that it exists and that it must be paid for.

The assistance represents 1% of the base ICC: CHF 8’769 x 0.01 = 87.68 CHF.

5. All we have left to do is addition these amounts.

In short, you have a base ICC. Cholé’s is 8’769 CHF.

Two additional amounts that the cantons call “cents”. Chloé’s are 4’165 + 87.68 CHF.

And two amounts to subtract. Chloé’s are 1’052.21 CHF and 499.80 CHF.

In our example, the final cantonal tax is 11’469.12 CHF.

To find out your final cantonal and communal taxes (ICC), you still have to add the communal tax. Hold on tight, we are almost done!

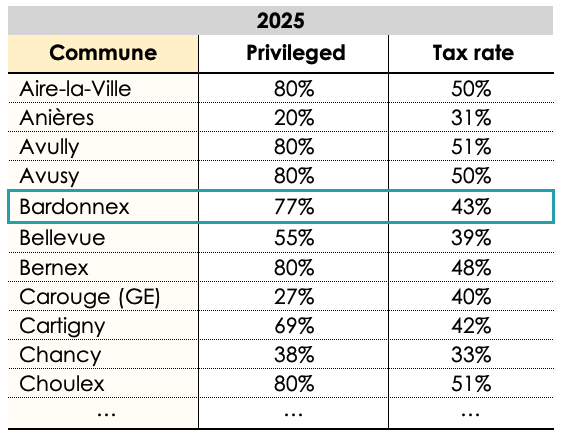

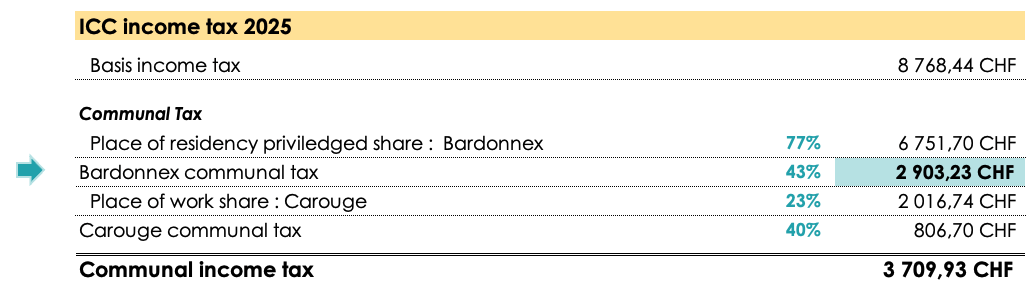

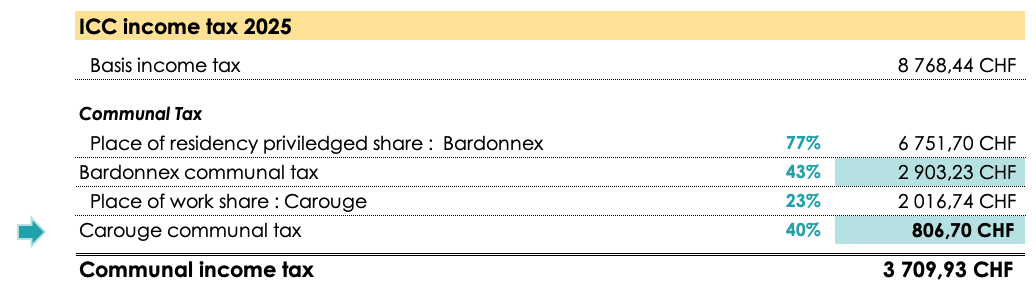

How to calculate the communal tax in Geneva?

The communal tax, just like the cantonal one, is calculated on according to your base ICC.

Part of your base tax goes to your commune of residence and the other part goes to the commune you work in.

The commune of residence had priority. It enjoys what is called a preferential part. This part is fixed. The remaining part will go to the other commune.

The list of rates is available on the canton of Geneva’s website.

Chloé lives in Bardonnex, which receives 77% of the share. The remaining 23% will go to the municipality of Carouge, where she works.

To calculate the tax, you first have to determine the 77% of the base ICC.

8’769 CHF x 0,77 = 6’751.70 CHF.

You can see the tax rate in Bardonnex is 43%. Bardonnex’s share of the basic tax is multiplied by its municipal rate, i.e. :

6’751.70 x 0,43 = 2’903.23 CHF.

Chloé has to pay 2’903.23 CHF to her commune of residence.

To find out her total communal tax, she still has to add the tax she will have to pay to the commune where she works, Carouge.

The 23% of the base ICC is 2’016.74 CHF. The taxation rate in Carouge is 40%. And 40% of 2’016.74 is 806.70 CHF.

Chloé’s communal tax therefore is 2’903.23 + 806.70 = 3’709.93 CHF.

The final ICC calculation.

We have seen that the base ICC is not the final tax but rather a basis on which to calculate the two first levels of taxation.

To determine the amount of your communal and cantonal taxes, you just have to add both amounts you just calculated.

For Chloé, it is 11’469.12 +7’709.93 = 15’179.05 CHF!

Chloé is single, maybe you are not. In which case, you are probably wondering whether the calculation is the same for a married couple or a registered partnership.

Everything we have seen throughout this article, which almost resembles a math class, remains true, with one exception.

Geneva income tax for married couples or registered partnerships.

When you are single, the starting point for your calculation is your income. This amount is used to determine your taxable income, basic tax, etc.

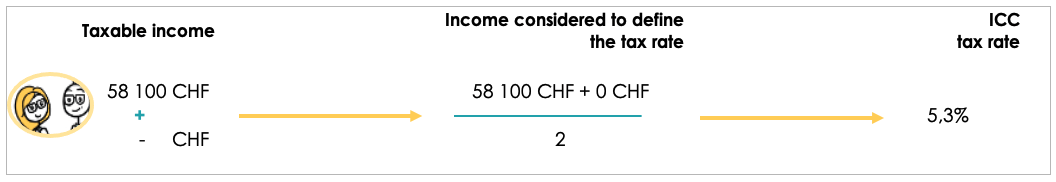

When you are married or in a registered partnership, the income of both partners is additioned and divided by two.

The starting point for your calculation is therefore no longer your individual income, but your combined household income divided by two.

For example, if Zoe earns 58’100 CHF taxable income and I earn 0 CHF, then the tax rate will be calculated based on 29’050 CHF (58’100 CHF divided by two).

A change in marital status mainly affects the calculation of basic tax. Here is a summary of the steps involved:

Add up your income and divide it by two.

The aim of this first step will be to determine what we call the income used to calculate the tax rate. Married couples have a taxable income and an income that will be used to calculate the tax rate – in our case, 58’100 CHF taxable income and 29’050 CHF used to calculate the tax rate. The canton of Geneva calls this ‘full splitting’. Why full? Simply because the income is divided by 2!

Refer to the municipal and cantonal income tax rates table and find the income that determines the rate (CHF 50,000).

We have slightly truncated the table, which is still available further up in this article:

Restart the calculation of the basic tax according to these new values:

- Tax for the previous bracket: 667.50 CHF,

- We add that of our bracket: (29’050 CHF – 26’961 CHF) x 10% = 208.90 CHF,

- This gives us an initial basic tax amount, but please note that this is provisional: 667.50 CHF + 208.90 = 876.40 CHF,

- The applicable rate is calculated as follows: 876.40 CHF / 29’050 = 3.02%,

- This rate is applied to the household’s taxable income = 3.02% x 58’100 CHF = 1’752.60 CHF.

There you have it, we have at least determined the basic tax for our married couple! But, once again, we don’t stop there. We still have to calculate the final tax, going through the intricacies of the cantonal and municipal calculations, which we have already detailed above. If you decide to embark on this final step, good luck; it’s a demanding exercise!

For our part, we will stop here for the sake of example.

However, if you need a little extra help, FBKConseils is available to provide you with personalized support. Finally, don’t forget that the deductions available vary slightly depending on your situation. They are generally slightly more advantageous for married couples or registered partnerships, although this is not always enough to make marriage financially attractive.

This short paragraph may not cover all aspects of marriage and taxation, and you are right. That is precisely why we have written a comprehensive article on the subject: marriage and taxes in Geneva.

Income tax in Geneva for separated or divorced parents with joint custody: partial splitting

What about separated parents who are equally responsible for the care of their children, whom the tax authorities prefer to refer to as ‘family responsibilities’?

For these cases, the canton of Geneva recently introduced ‘partial splitting’, which grants a slightly lower tax rate despite single status.

In practical terms, instead of dividing taxable income by two (as for married couples), the income used to determine the tax rate is obtained, for each single, divorced, or separated parent residing in the canton of Geneva and living with at least one child, by dividing taxable income by 1.8.

You know the rest: all that remains is to determine the basic tax, then the municipal and cantonal taxes, and finally the total tax (ICC).

What about federal tax?

To find out the total amount of your annual income taxes, you still have to add the direct federal taxation (IFD).

If you still have a bit of energy left, you should have a look at the article dedicated to the IFD calculation (direct federal taxation).

What about wealth tax?

Finally, to find out the total amount of your annual taxes, you have to take the tax on wealth into account.

It is easier to calculate and I will tell you everything you need to know about how to do it in the next article, dedicated to the wealth tax in the canton of Geneva.

And then… it is the light at the end of the tunnel! By additioning the ICC, the IFD and the wealth tax, you will find the total amount of your taxes.

If you read the whole thing, I take my hat off to you.

The calculation of taxes is a mathematical marathon. My brain is sore. I am going to relax for a bit.

Do you have any questions? We are at your service, feel free to contact us.

How can FBKConseils help you with income tax in the canton of Geneva?

At FBKConseils, we specialise in personal taxation, whether you live in Valais, Vaud or Geneva. We can answer all your questions and, better still, help you with all your tax-related matters.

A complimentary introductory meeting

Since our inception and still in 2026, FBKConseils offers its clients, as well as anyone with questions, an initial introductory meeting lasting around 20 minutes, free of charge.

This moment allows us to answer your questions and explain our working methods in more detail.

Assistance with your tax return in the canton of Geneva

Nothing could be more standard: we offer all our clients comprehensive assistance with completing their annual tax returns.

Tax return training

For some time now, we have been offering training sessions to help you better declare your income and assets. These training courses enable those who wish to do so to become more self-sufficient in the years to come and to better understand the taxation process.

Checking your tax decision

Every year, FBKConseils is surprised by some of our clients’ tax assessments. The tax authorities can sometimes make significant changes to what was initially planned, and like everyone else, they can also make mistakes. That is why checking your tax assessment is almost as crucial as completing your tax return flawlessly.

Tax simulations

We recommend that all taxpayers facing significant life changes — moving house, getting married, having a baby, or experiencing an increase or decrease in salary — anticipate the tax implications of these events as best they can. At FBKConseils, we can carry out all these simulations and, where possible, suggest ways to optimize your tax situation.

Voir les 1 commentaires

9h20

Hi,

I have two questions:

1. The 25% of the base ICC is 983.05 CHF. The taxation rate in Carouge is 40%. And 40% of 983.05 is 393.22 CHF. – Why is here used 25% for base calculation? Should this be 28% as the Preferential share for Carouge?

2. How is Additional communal cents calculated if I work outside of Geneva, for example in Visp, canton Valais?

Thank you.

Regards,

Tomas

Comments are closed.