Written by Yanis Kharchafi

Written by Yanis KharchafiSwiss Tax – Everything you need to know about the federal direct tax (FDT)

Introduction

Congratulations on making it this far! As in most countries, people talk a lot about taxes… but few truly understand the unique Swiss feature: the existence of three levels of taxation, municipal, cantonal, and federal. It is only by adding these three income taxes together that you can determine your total tax burden for the current year.

As you’ve probably guessed, the purpose of this article is to explain what portion of your income tax goes to the federal government, our Swiss Confederation.

The line-up:

What Is the Federal Direct Tax?

Let’s not get too technical and start with the basics.

Each year, everyone who either voluntarily submits a tax return (TOU) or is required to do so—such as Swiss citizens and holders of a C residence permit—must comply with Swiss tax laws. This means paying taxes on income and, very often, on wealth as well.

To figure out your total tax burden, it helps to break it down into three main categories:

- Cantonal and municipal taxes, which include both income and wealth taxes.

- Federal direct tax (FDT), which only applies to income.

These three categories can then be further divided into five parts:

- Municipal income taxes,

- Cantonal income taxes,

- Federal income taxes,

- Municipal wealth taxes,

- And finally, Cantonal wealth taxes.

Add all of this up, and you’ll get your total tax burden for the year. And yes, it’s an annual ritual!

In this article, we’ll focus on just one part of this complex equation: federal income taxes. Our goal is to help you better understand this essential component of your tax situation.

Is federal direct tax expensive?

This is a question we hear often from clients, but giving a definitive answer is nearly impossible. Everyone has their own opinion on the matter (and yes, we have ours too), but here, we’ll let you decide for yourself with real-world examples. Whether you live in Geneva, Lausanne, or Valais, the calculation for federal direct tax (FDT) remains the same. Unlike cantonal and municipal taxes, your place of residence has no impact on what you owe to the Confederation.

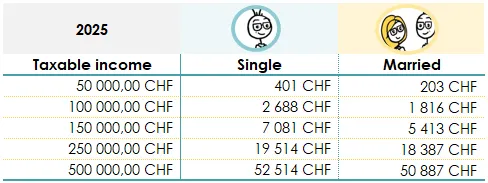

How to interpret the table?

Let’s take an example: a person with a taxable income of CHF 50,000 will pay:

- CHF 401 in annual federal direct tax if they are single.

- CHF 203 if they are married.

More broadly, the federal income tax represents a tax burden ranging between 0.41% and 10.1% of your taxable income, depending on your personal situation, for taxable incomes between CHF 50,000 and CHF 500,000.

Federal direct tax is just one of the three components of income tax. So, it’s worth asking whether this tax makes up a small or large part of the total amount you owe to the Swiss tax authorities.

To answer this, you need to consider cantonal and municipal specifics: each canton may use different calculation methods, adjust certain deductions, or offer specific tax reliefs.

In general, FDT represents about 15% to 25% of the total tax burden.

Now that you know what FDT is and how much of your total tax burden it represents, it’s time to explore how it’s calculated. It all starts with determining your federal taxable income… Stay tuned for the next part!

How to go from your gross income to your federal taxable income?

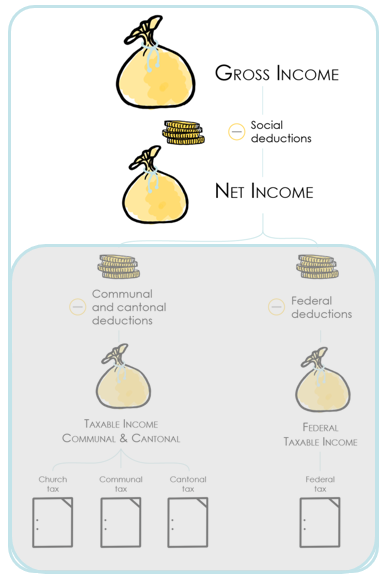

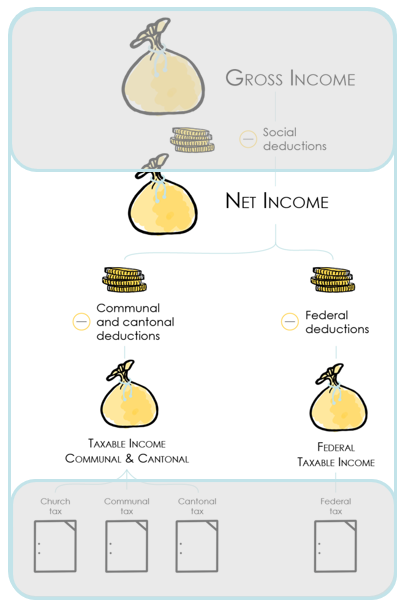

Step 1: from gross income to net income

Net income is your gross income minus social security contributions:

- AHV (1st pillar)

- Occupational pension (2nd pillar – LPP)

- Unemployment insurance

- Family insurance

- Accident insurance (LAA)

- Etc…

This is what’s usually paid into your bank account at the end of the month. If you are a foreign national without a C permit, the amount you receive will correspond to your net salary minus the withholding tax, which will also be deducted. However, if you are required to file a tax return, it is still your net income that will be taken into account. The withholding tax is not treated as a deduction, but rather as a tax credit.

If these concepts still seem a bit unclear, I recommend reading our article on salary certificates and pay slips in Switzerland. Once your net salary is determined—or rather, paid into your account—you’ll still have the right to make certain tax deductions allowed by our Confederation.

Step 2: from net income to taxable income – Tax deductions for the year 2025

Taxable income is your net income minus the deductions allowed at the federal level. These may not necessarily be the same as those allowed at the municipal and cantonal levels.

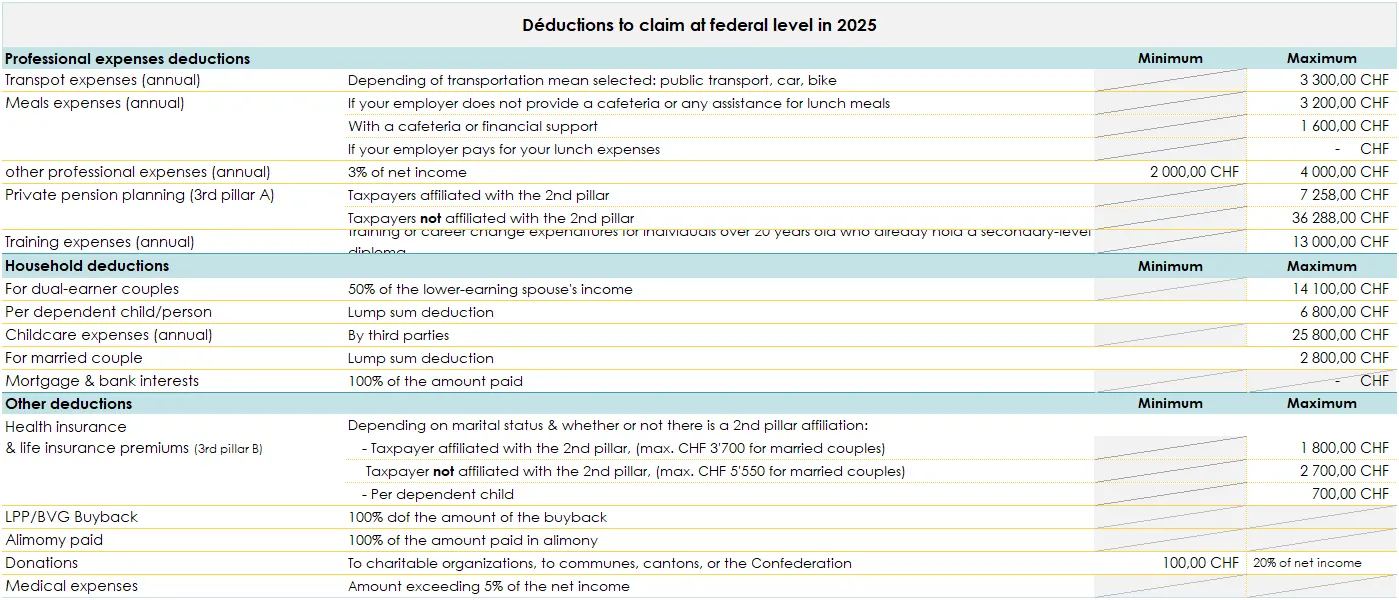

Deductions can be numerous and will largely depend on your lifestyle (married, single, children, homeowner, self-employed, etc.). To simplify, here are the main categories of allowed deductions:

- Expenses related to earning income: These include transport costs, meal expenses, and other professional expenses.

- Household expenses: Health insurance premium, medical expenses, 3rd pillar A, top-ups to your 2nd pillar.

- Social deductions: Typically granted automatically based on your household composition and income.

Here’s a table summarizing all the deductions granted by our dear Confederation.

How to calculate your federal direct tax?

Things are starting to come together. You’re now able to take your gross salary and determine how to arrive at the salary that will be taxed after social security contributions and other allowed deductions. There’s just one last step: calculating the tax using the tax brackets (FDT).

Unlike the cantons, the Confederation has chosen simplicity, offering two tax brackets and a deduction for children:

- The first bracket applies to single individuals.

- The second bracket is for married couples.

- Finally, a tax deduction can be made based on the number of children you have under your care.

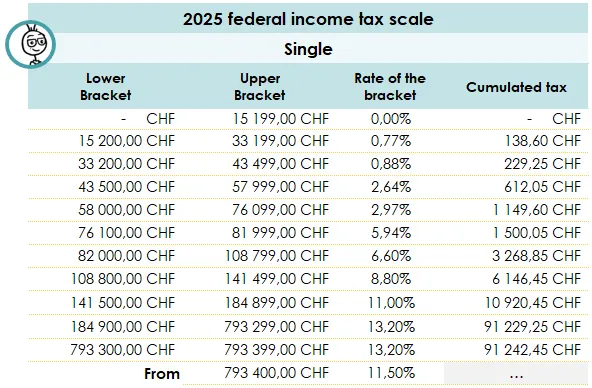

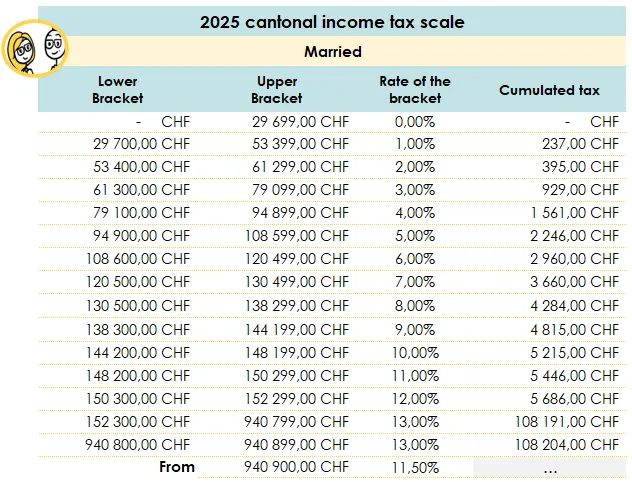

If you’re single, you should base your calculations on the following bracket:

If you are married or in a registered partnership, this is the one you should use:

Find all the federal tax brackets for past and future years here.

Calculating the tax, determining your tax rate

Did you find the bracket that applies to your situation? Great, let’s move on to the next step: identifying the range where your taxable income falls.

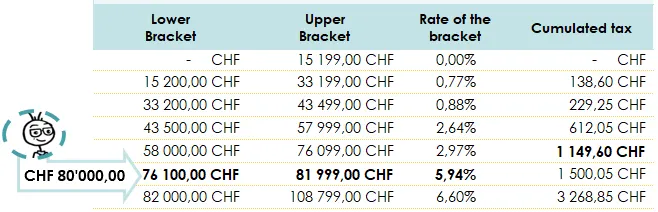

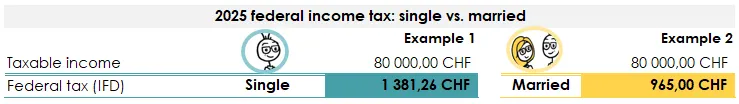

Let’s take a concrete example: my taxable income is a solid CHF 80,000.

Looking at the table for a single person:

- Tax on the previous bracket:

The table shows that the tax on the previous bracket (up to CHF 76,099) amounts to CHF 1,149.60. - Tax on the remaining amount

We then need to calculate the tax for the portion between CHF 76,100 and CHF 80,000. This represents CHF 3,900. This amount is taxed at a rate of 5.94%, which gives: CHF 3,900 × 5.94% = CHF 231.66

For a taxable income of CHF 80,000, the federal income tax will therefore be: CHF 1,149.60 (previous bracket) + CHF 231.66 (remaining amount) = CHF 1,381.26. As simple as that (well… almost)!

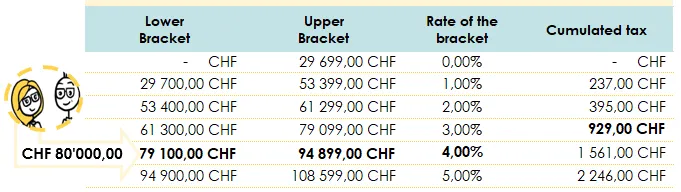

Example of calculating federal direct tax (FDT) as a married couple

If we take the same example — a married couple with an income of CHF 80,000 — the base federal income tax would be CHF 929 on the first CHF 79,099. Then, the remaining CHF 900 must also be taxed. The applicable tax rate is 4%.

Finally, we simply add:

CHF 929 + (900 × 4%) = CHF 965

And there you have it!

To determine your municipal and cantonal taxes, I invite you to check out our additional articles.

- How to calculate municipal and cantonal taxes in the canton of Vaud?

- How to calculate municipal and cantonal taxes in the canton of Geneva?

- How to calculate municipal and cantonal taxes in the canton of Valais?

How can FBKConseils assist you?

First meeting free of charge

At FBKConseils, we have good news: all new clients are entitled to a first free meeting, lasting 15 to 30 minutes. This is the perfect opportunity to address any questions you may still have after reading our articles. If necessary, we will also explain how FBKConseils works and the various forms of support we can offer.

Tax simulation

A life change, such as moving, getting married, starting a self-employed activity, or buying property, can have significant budgetary and tax impacts. FBKConseils offers to assist you by simulating these impacts to better anticipate what to expect.

Tax return

Taxes are our specialty! We are here to:

- Train you: If you want to master this tedious task, we offer training sessions to make you independent.

- Take over: If you lack the time or the desire, FBKConseils can handle your entire tax return and manage the process on your behalf. We provide these services for the cantons of Vaud, Valais, and Geneva.