Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on February, 21st 2025.

Buying Real Estate : How will your taxes change?

The line-up:

Yes, purchasing of your real estate property will also have a fiscal impact on your situation!

When it comes to taxes, there is good and bad news. Let’s start with the good one: the tax value.

What is the tax value?

Every real estate property has a selling price, it is the amount that you will spend divided in two categories: personal investments and mortgage loan of the bank to pay the seller. Your property will thus form part of your taxable assets but interestingly not at its selling price but at its tax value.

And you know what? This is good news! And do you know why? Because it is usually lower than the amount of the price paid.

So, to assess the impact of a real estate property on your wealth, the first step is to determine its fiscal value. Easier said than done… According to the canton in which the property is located, the evaluation method of the fiscal value will differ.

Let’s be realistic and start with Geneva and Vaud computations. Each year, I will complement this article with additional cantons (hopefully up to the 26th).

Fiscal value in Geneva

In Geneva, your property’s fiscal value generally corresponds to its purchase price, discounted by 4% per year. The maximum authorized discount is thus 40%, which is applied 10 years after the purchase date. In a nutshell, the longer the property is kept, the lower the value to be entered in your Geneva tax return.

Fiscal value in the canton of Vaud

Not to be judgmental, I would say that everything is better in the canton of Vaud apart from the calculation of the fiscal value which is not as straight forward as in Geneva. In our canton, the first thing to do is to determine the tax estimate – luckily, the land registry is rather good at it. To obtain this estimate, there are two main metrics:

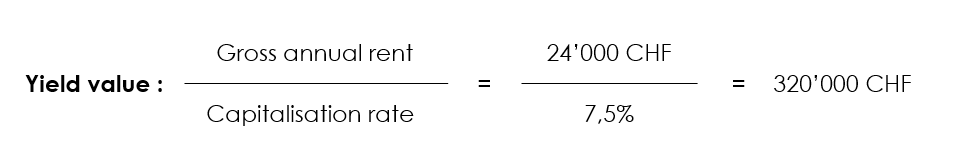

The yield value

This method consists of valuing your property solely on the basis of the rents it has the potential to generate. Let’s take as an example my apartment which can be rented for CHF 2’000 per month or CHF 24’000 per year. The relevant authorities will divide this rent by what they call a “capitalization rate”, ranging from 6% to 9%.

The market value

This is nothing more than the price at which your property could be sold. Let’s refer to our example in which Zoé and I bought our house in the center of Chalet-à-Gobet a couple of months ago, for CHF 770’000. No big deal, the market value will be equal to CHF 770’000.

Keep your seatbelts fastened, we are almost there: to finally get the fiscal value of your real estate property located in the canton the Vaud, the remaining step is to average these two metrics (yield and market values) and keep 80% of the result. Ta daaaaa, the fiscal value is calculated. Although complex, this could be avoided as anyhow, the fiscal authorities oversee the fiscal value definition.

Depending on the canton and the method of calculation, it is likely that your taxable assets will decrease with the purchase of a property and continue to decrease over time.

And now time for the bad news the rental value.

What is the rental value?

If you have previously done a little bit of research on real estate in Switzerland, you have probably heard about this national oddity. Even if for years, many competent people have been trying to make it disappear, I can tell you that in 2025 it is still very much a reality.

What exactly are we talking about?

The rental value, corresponding to a rental income that will be added to all your other revenues and consequently increase your taxable income, and your taxes.

Here you are thinking: « But you are living there, Noé, in this apartment! You are not renting it out. So why do you have to pay as if you were?”

I… I… Let’s just say that’s the way it is and that’s it.

To make it even more complicated, there is no precise way to calculate what you owe in taxes.

Similarly to the tax value described above, each canton has its own method of calculation. I will first describe how it works in the cantons of Vaud and Geneva.

The rental value in the canton of Vaud

The road to understanding the rental value in Vaud is long… but as usual, I will try my best to clear it for you.

Step 0 : The data of the real estate

To determine precisely the rental value of a real estate in which you reside you must be familiar with :

- Type of dwelling (Apartment, house, etc..)

- The surface in square meters

- Year of construction

- Geographical location: Municipality in which the property is located

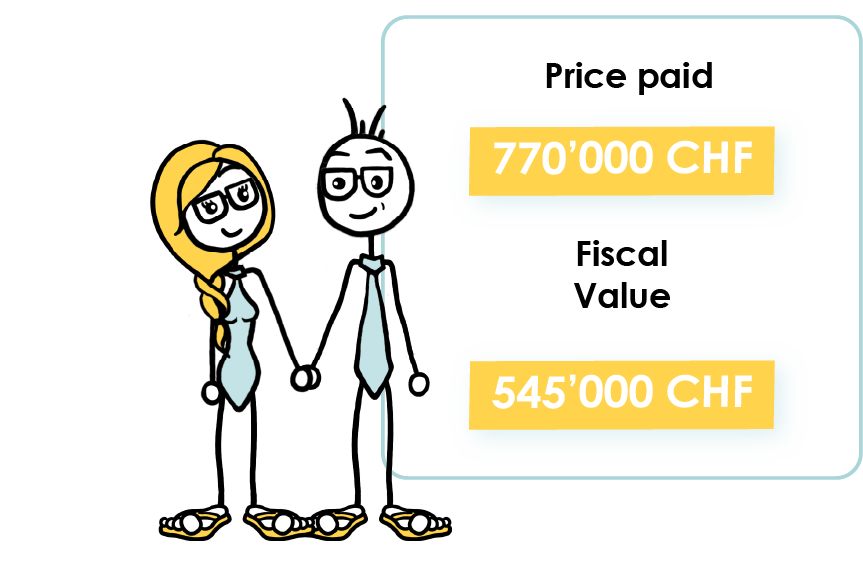

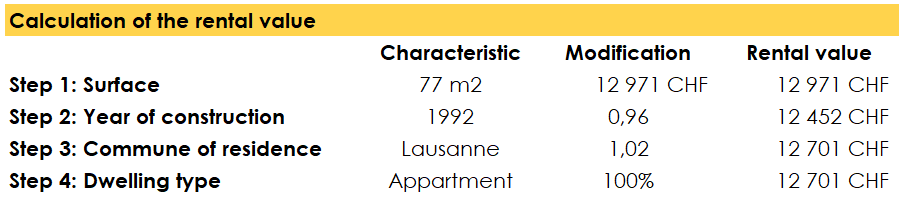

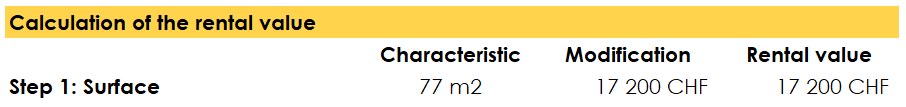

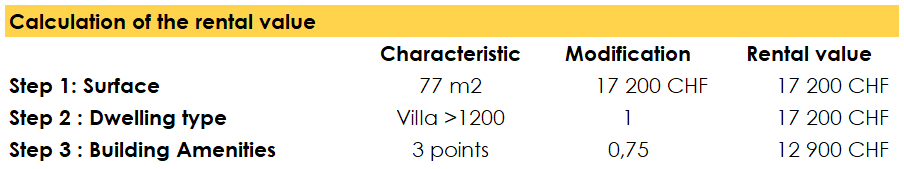

Step 1: The surface area as an indicator of the basis rental value

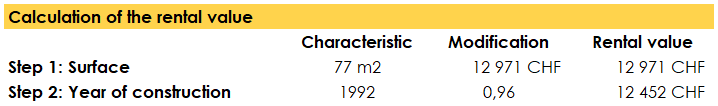

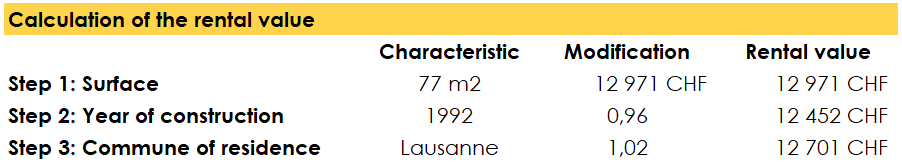

The main driver in determining the rental value is the size of your unit. The bigger it is, the higher the rental value will be. Following the example of our 77 square meter house, we will have a basis rental value of 12’971 CHF.

Step 2: Year of construction

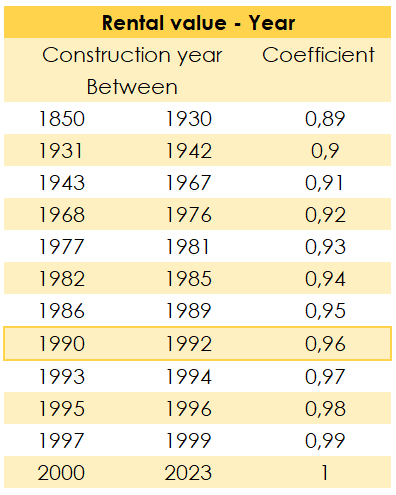

The older the property, the lower the rental value. Quite a straightforward process: we just have to refer to a second table. Personally, we were charmed by a not-so-old 1992 built property.

We will therefore be able to reduce our house basis rental value by 4%!

Step 3: Commune of residence

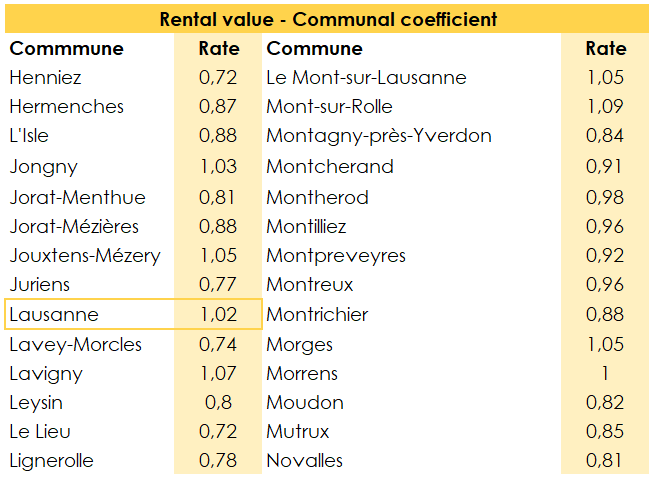

Logical or not, each commune chooses a coefficient to increase or decrease the rental value calculated so far.

To complete this step, we will multiply our basis rental value by 1.02.

To put our case in perspective, the cheapest commune has a coefficient of 0.72, while the most expensive applies a 1.15 coefficient.

Step 4: Dwelling type

Depending on the type of habitation you live in, further deductions will impact your rental value. If you live in a condominium or in a semi-detached house, do not miss the 10% discount on your rental value. Villa owners do not have this chance, as for them, no deduction will be accepted.

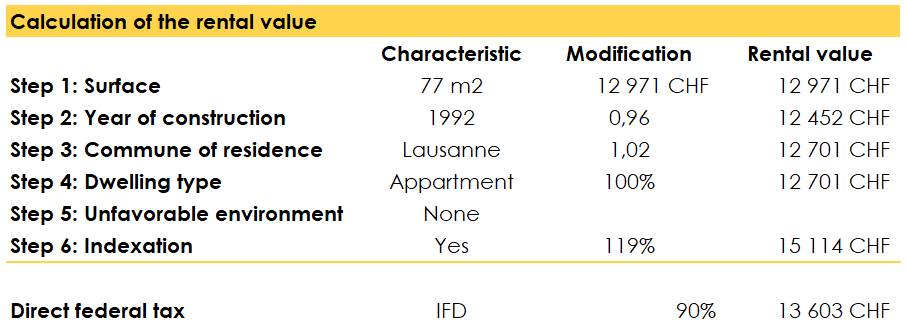

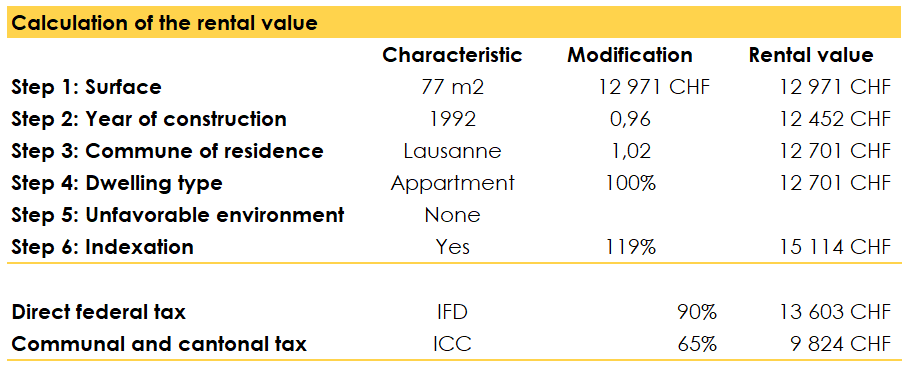

Step 5: Unfavorable environment / housing without comfort

If for exceptional reasons you are facing significant disturbances or your home is obviously uncomfortable, you can apply an additional 10% discount.

Step 6: Indexation of the rental value

Last step… I swear, it is not the most complex, although we could question the underlying rationale. Since 2020, we must multiply our rental value by 1.19.

Finally, the direct federal tax (IFD)

To figure out the amount the confederation will consider calculating the income tax, just take 90% of the rental value obtained in step 6.

And finally, the cantonal and communal tax (ICC)

Same mechanism as for the direct federal tax, but different rate: it falls to 65%.

Rental value in the canton of Geneva

Not so easy to find useful information on this subject, is it? Well, the audience is limited. Anyway, if you are still reading us, it means that in one way or another, you are concerned, interested or maybe just curious. And this piece of text is made for you.

Similar to the canton of Vaud, the canton of Geneva determines the rental value in 6 stages, enabling us to then step in the shoes of the tax authorities.

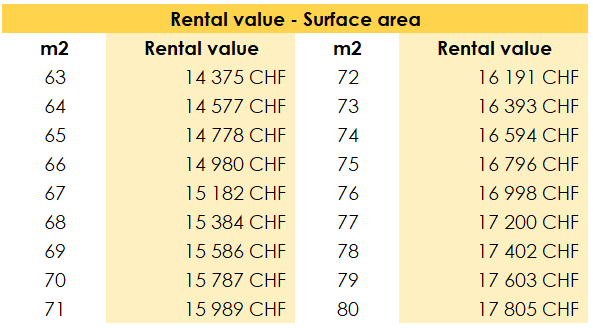

Step 1: The surface area as an indicator of the basis rental value

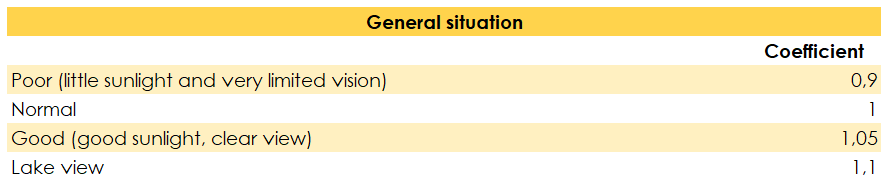

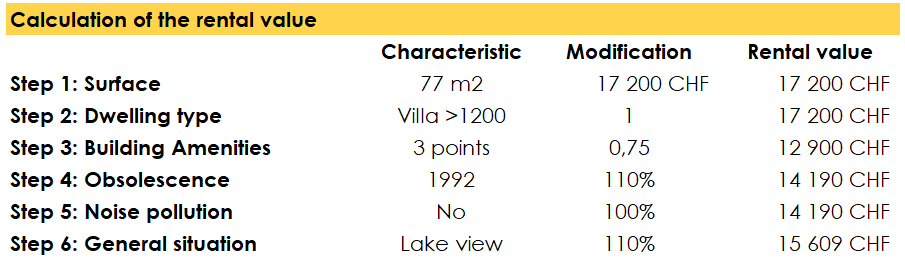

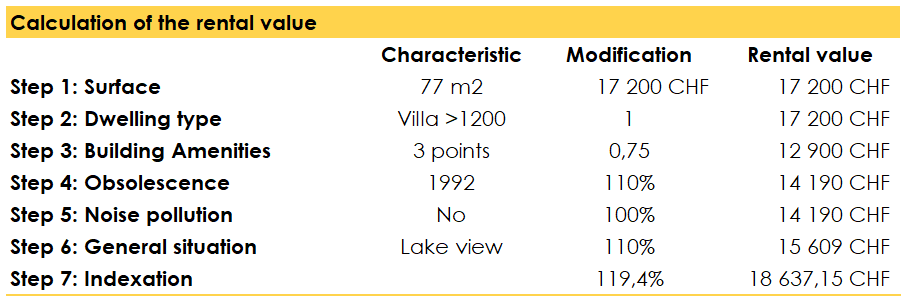

Below table is just a fraction of the big picture. The bigger the surface, the higher the rental value. If my apartment originally bought at Chalet -à-Gobet had finally been located in Carouge, then its 77m2 would give me a basic rental value of 17’200 CHF.

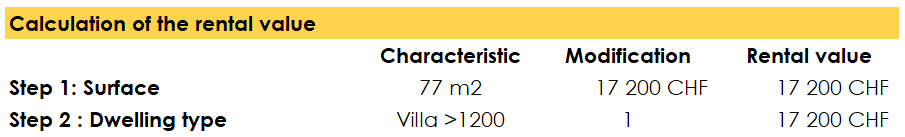

Step 2: What is the dwelling type of your property?

There are only 6 available options, not one more. Your real estate property can be either:

– An apartment (simplex) PPE: 0.8

– An apartment PPE (duplex, triplex, attic): 0.85

– An apartment in a villa: 0.9

– A semi-detached house: 0.95

– A single family house with less than 1200m2: 1

– A single family house with more than 1200 m2 : 1.05

Zoé and I live in a single-family house with (much) less than 1200m2, so we should multiply our basis rental value by … 1. Better knowing later than never, we could have just skipped this step.

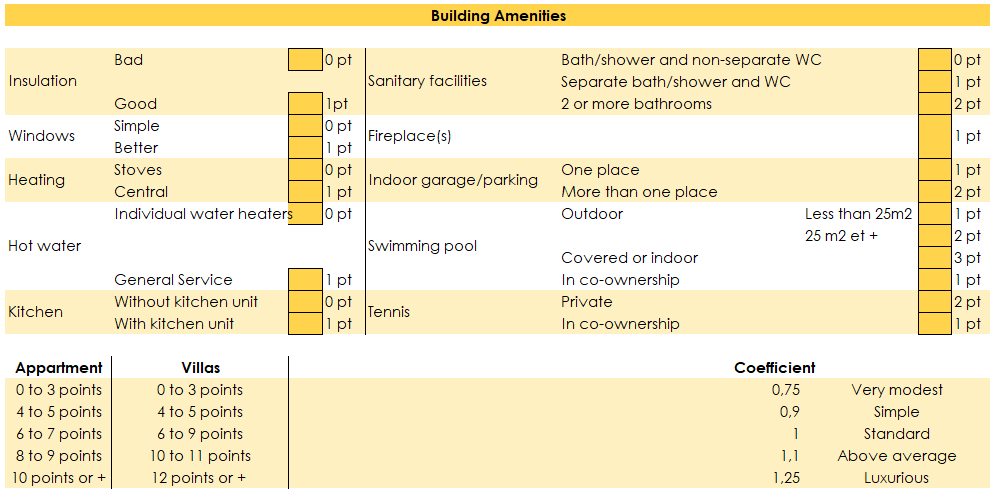

Step 3: Building amenities

This section will remind you of good memories, the traditional Multiple-choice questionnaire. Tick the boxes, fingers crosse, and count the points!

The final count will be translated into a multiplier for your rental value. Our house got 3 points, so good news, we benefit a discount as we will multiply by 0.75.

Step 4: The year of construction / general condition

Depending on the date of construction / major renovation, your rental value will change again:

- If built later than 01.01.1981: 1.10

- If built between 01.01.1971 and 12.31.1980: 1

- If built earlier than 01.01.1971 then it will depend on the general condition:

- Satisfactory: 0.90

- Major repairs are to be expected: 0.80

- Very bad condition, not suitable for living in: 0.7

Our property being fairly new (1992), we have to enter a coefficient of 1.1 which increases the current rental value by 10%.

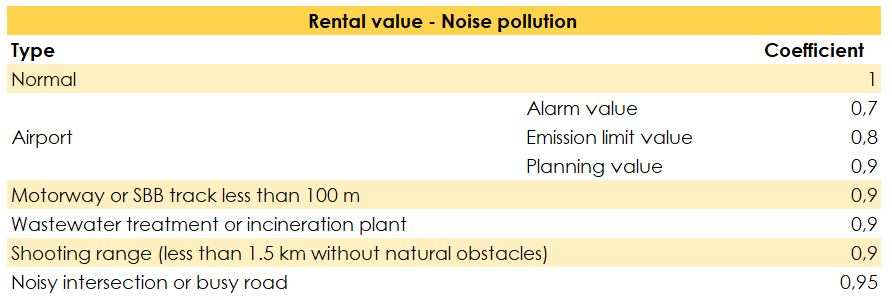

Step 5: Noise pollution

No further explanation is needed. If one of these criteria is checked, then an additional deduction will be granted. Luckily, we do not have any of these surrounding our home.

Step 6: General situation

If disturbances result in discounts, it works in both directions. Owning a property with a nice view or good sunshine exposure will lead to an increase in rental value.

Step 7: Indexation

As for the canton of Vaud, the rental value will be incremented by 19.4%, regardless of your situation.

Step 8: Maintenance costs

We have written an article dedicated to deductions for the canton of Geneva, in which we mention maintenance expenses. All in all, you can either deduct from this fictitious income:

- Effective expenses, if you believe your actual expenses exceed the flat rate amount

- Flat rate expenses, which depend on the age of the building both for the IFD and the ICC.

Step 9: Discount for occupancy

Now we have a gross rental value, to which a 4% discount should be applied per year of occupation. As for the fiscal value, the total discount is limited to 40%, after 10 years.

What are the deductions that home owners can claim?

Now, it is time for the second good news! The mortgage rates paid, as well as the maintenance costs are completely tax deductible. On top of these deductions, you may also be able to count on the depreciation of your debt to make significant savings on taxes.

Regarding the amortisation, it depends on whether it is direct or indirect. In the context of an indirect depreciation, the reimbursements is placed on a pillar 3A or B, which is also potentially deductible.

Last but not least, everything that is connected to the maintenance of your property in order to maintain its value will also reduce your taxable income.

What you should keep in mind: while real estate is a good way to make money, it is first and foremost one of the best ways to save some!

Something tells me that your next question is: when should I buy? The answer is simple: now.