Written by Yanis Kharchafi

Written by Yanis KharchafiThe pledge of your 2nd pillar assets

The line-up:

Introduction

What would you think of not withdrawing your pillar 2 within the framework of the homeownership promotion scheme (EPL) but to pledge it instead?

Little piece of advice, next time you see your banker, bring your pension certificate with you and ask whether he could evaluate this possibility.

Put simply, pledging or collateralisation of your pillar 2 works the same way as withdrawing it but without actually making a withdrawal.

Does this idea sound bizarre? Not really…

Instead of taking out the necessary assets that are kept warm in your pension fund, you will guarantee them that if you do not honor your loan engagements, they can seize your second pillar assets by means of forced withdrawal. It is a win-win situation, the bank can grant you a mortgage loan and, more importantly, you get to not use your pillar 2. Thereby, your covers and annual interest paid on your capital remain untouched.

How a pledge works?

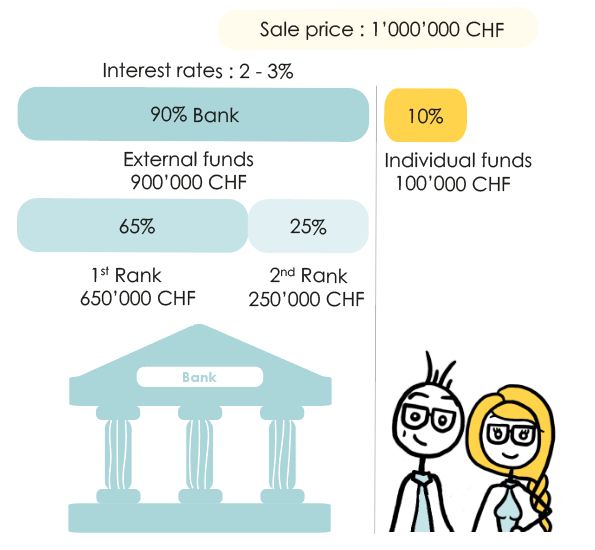

Let’s take a moment to imagine purchasing a primary residence worth CHF 1,000,000. In a typical scenario, the financing would be distributed as follows:

- Own funds (cash): CHF 100,000

- Withdrawal from the 2nd pillar (EPL): CHF 100,000

- Debt (bank loan): CHF 800,000

Now, in a scenario where you choose not to withdraw those CHF 100,000 from your 2nd pillar but instead pledge them, the financing would look like this:

- Own funds (cash): CHF 100,000

- Debt (bank loan): CHF 900,000

You might be wondering why choose a pledge instead of a direct withdrawal. Don’t worry, if these few lines don’t convince you, wait until you discover the advantages and disadvantages. I hope by then, everything will become clearer and you’ll be able to make an informed decision.

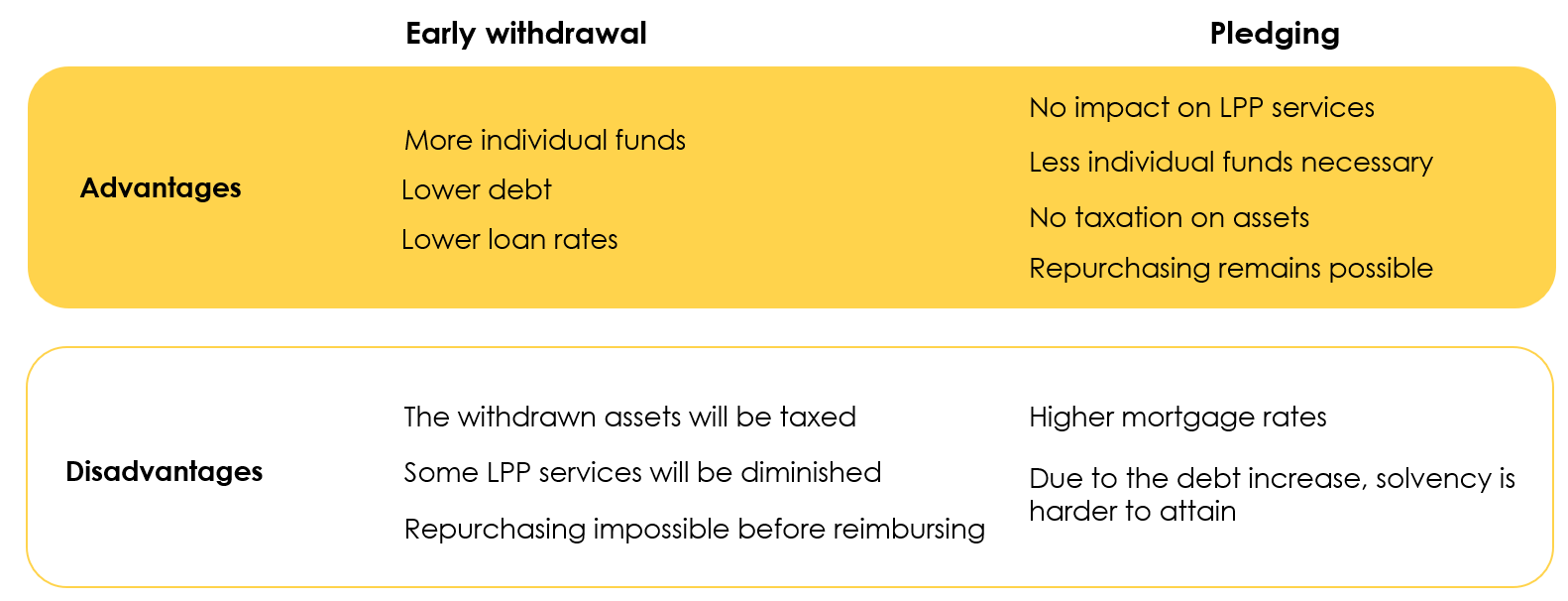

Advantage of Pledge – 1: Constant Retirement Pensions

If it’s not entirely clear, here are a few additional explanations. Depending on your pension fund, pensions are calculated as a percentage of the amount held in your 2nd pillar. The best example is retirement: for most policyholders, the annual LPP pension corresponds to a percentage of your LPP capital (for example, 6.8%). If you have CHF 300,000 in capital, you could expect to receive: CHF 300,000 * 0.068 = CHF 20,400 per year. By making an EPL withdrawal of CHF 100,000, you would be left with only “CHF 200,000” in capital after the withdrawal: your annual pension would drop from CHF 20,400 to CHF 13,600.

Advantage of Pledge – 2: No Tax on Capital Withdrawal

In the case of a pledge, there will be no tax, and for once, it’s quite intuitive. Specifically, you won’t be withdrawing money from your 2nd pillar, but rather pledging it, putting it as collateral, as a guarantee… I’m running out of synonyms, but if there’s no withdrawal, there’s no tax to pay. It’s an advantage, certainly, but more so in the short term. The day you decide to leave Switzerland, retire, or become self-employed, you will need to pay that tax.

What’s the catch?

Just like every solution, it comes with its disadvantages:

Disadvantages of pledge – 1: A pledge implies a higher debt

Since you are not withdrawing this money, you cannot use it to pay the seller of the property you wish to buy. The insurance company or the bank financing your property will therefore have to lend you a larger amount, increasing the amount of debt.

The disadvantage is that your debt will be higher (up to 90% of the property’s price).

A more difficult solvency to achieve: The income will need to be higher.

In the calculation of financial institutions, the amount of debt plays a key role in the feasibility of your project. The debt will negatively impact two points in the calculation:

Theoretical mortgage interest

Financial institutions use an interest rate between 4% and 5% of the debt to calculate the annual mortgage charge. The higher the debt, the larger the interest amounts will be, and consequently, your income will need to be higher in order for a loan to be granted.

Amortisation

The law requires a minimum repayment within 15 years of the purchase or before retirement age—whichever comes first. By this time, your debt must not exceed 66% of the property’s value (which is not always the same as the sale price). In a standard scenario, you borrow 80% and will repay (amortize) 1% per year. In the case of pledging your 2nd pillar, you will borrow 90% of the property’s value, and thus need to repay 1.6%. This difference impacts not only your solvency but also the overall financial burden during the first 15 years of your real estate project, which becomes heavier.

Pledging? Withdrawing your pillar 2? Each situation has to be evaluated on a case-by-case basis. Here is a short summary of these two options.

How can FBKConseils help you?

Introduction meeting

At FBKConseils, we offer a free initial consultation of about 20 minutes, either in person at our office or via videoconference. This meeting is designed to answer your initial questions and provide you with an overview of your real estate project.

Personalized advisory session

Twenty minutes is a good start, but a real estate project is often more complex than it seems. If the first meeting doesn’t answer all your questions, we offer tailored advisory sessions. The duration of these sessions is flexible and adapted to your needs. This allows us to perform all necessary research and provide detailed fiscal and economic simulations to guide your decisions.

Assistance with administrative steps

Buying real estate is not just about numbers; it also involves a lot of paperwork. From gathering documents and negotiating with banks to selecting a notary or architect, the workload can quickly become overwhelming. At FBKConseils, we support you at every step, helping you manage this “paperwork” and move forward effectively with your project.