Written by Yanis Kharchafi

Written by Yanis KharchafiFinancing my real estate purchase in 2025 : individual funds

The line-up:

Basically, a real estate purchase is financed by individual funds, yours, and a mortgage loan, granted by the bank.

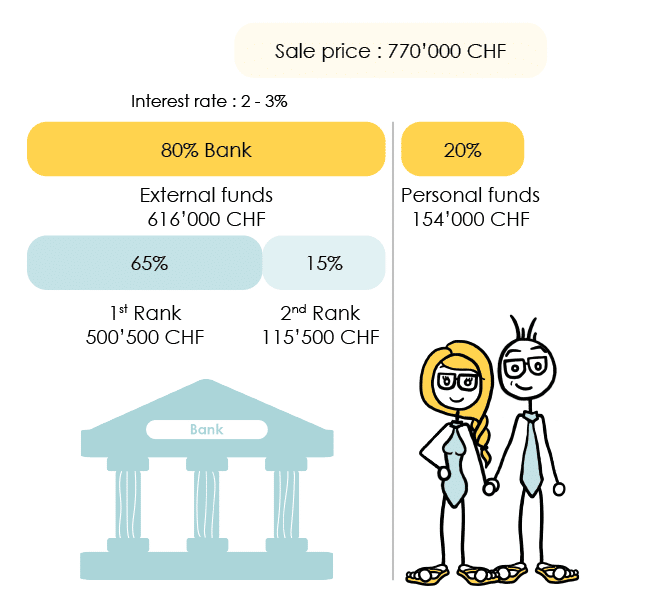

Real estate financing: An example is worth a thousand words

For better understanding, I propose a small illustration to help you visualize a real estate funding and, more precisely, the part we are concerned with here.

Let’s take as an example my apartment with a garden situated in the heart of Chalet-à-Gobet, on the edge of Lausanne. My wife and I just purchased it for a grand total of 770’000 CHF.

Individual funds have to a minimum of 20% of the total except in case of the pledge of your pillar 2 assets. We had to gather these 20% of the total amount, that is 154,000 CHF excluding the purchasing fees for the notary (and the State), in order to have a chance to be granted a loan by our bank. Luckily, I had 150,000 CHF and some change that happened to be laying around in the inner pocket of my coat.

Needless to say, had I gone to see my banker with 150 purple banknotes, he would have given me a strange look. It may have worked 20 years ago, but things have changed.

What forms can individual funds take?

- The assets on your accounts. Saving accounts, deposit accounts, private accounts…

- Your pillar 3A. Either by transferring the amount saved or by pledging them as mixed life insurances. If you have concluded your 3rd pillar(s) in a bank, then the total amount can be withdrawn, but be aware of the taxation on the withdrawal of the 3rd pillar. If you have contracted your 3rd pillar as an insurance policy, then it is possible that the current repurchasing value is not as high as the amount invested. It takes some time for the contract value of a 3rd pillar insurance policy to equal the value invested.

- Loans without interests, for instance from a friend or relative, I have even seen someone recommend asking one’s employer (personally, I didn’t dare, but this might be a lead…).

- Your 2nd pillar under certain conditions : There are 3 of them :

- Main home : In order to use your 2nd pillar for a property purchase known as an “EPL”, the property must be your home. It cannot be a real estate investment or a secondary residence.

- Maximum BVG contribution: You cannot finance your entire home using your 2nd pillar alone. You must be able to contribute at least 10% of the price without the help of your LPP. Once you have this 10% cash, the rest can come from your pension fund.

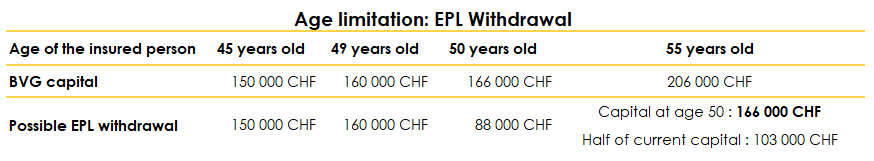

- The age of the BVG insuree: If you are over 50, then you will have the amount you had at 50 or half the amount you have today.

- Donations and/or early inheritances.

When you look at it this way, the 20% individual funds are less intimidating. There are many possibilities to gather the required amount.

If you have your eyes on your dream home but you are missing part of the 20% individual funds from your bank accounts, get in touch with us and we will have a look together at how we can gather the sum!

Be careful: it is important to draw your attention on certain things:

The percentages used in this example are approximate to facilitate the calculations. In reality, things are quite close but may vary by a few percent. Indeed, the FINMA (the market supervisory authority) sets the maximum second rank debt at 66.66% and not 65%.

Moreover, the FINMA is not the only one who can impose its law, the credit institutions also have a significant margin of manoeuvre depending on the clients and their case. They have the possibility to tighten the rules or, on the contrary, to make exceptions.

How can FBKConseils assist with your real estate project?

Introductory meeting

FBKConseils continues to support you in 2025 with a complimentary first meeting. Take advantage of 20 minutes to discuss your project, ask questions, and receive initial advice, either via videoconference or in our offices.

Advisory meetings

For complex projects, FBKConseils is available for more in-depth consultations. Take the time you need to address all your questions and validate each step with our experts.

Tax and budget simulations

Save time: entrust your calculations to FBKConseils. We prepare a comprehensive budgetary and tax analysis tailored to your project so you can move forward with confidence.

Assistance with administrative procedures

The administrative steps can be numerous and complex, but you’re not alone. FBKConseils helps you navigate from signing to settling in with ease.