Written by Yanis Kharchafi

Written by Yanis KharchafiFinancing my real estate purchase: what is my mortgage loan made up of?

Introduction

In Switzerland, in most cases, a real estate purchase is financially divided into two main components:

– The equity: this is the piece of the real estate price that you will have to fund. We share everything you need to know about it in a dedicated paper.

– The mortgage: The debt that will be added to the equity in order to raise the full price asked by the seller.

This paper focuses on the external funds, also known as the mortgage, the loan or the debt. When taking out a mortgage, the contract is usually split into two segments or layers, called ranks.

In this article you will discover all the specifics of a mortgage contract and the role of banks and lending institutions in the acquisition of your home.

The line-up:

What mortgage financing is made of?

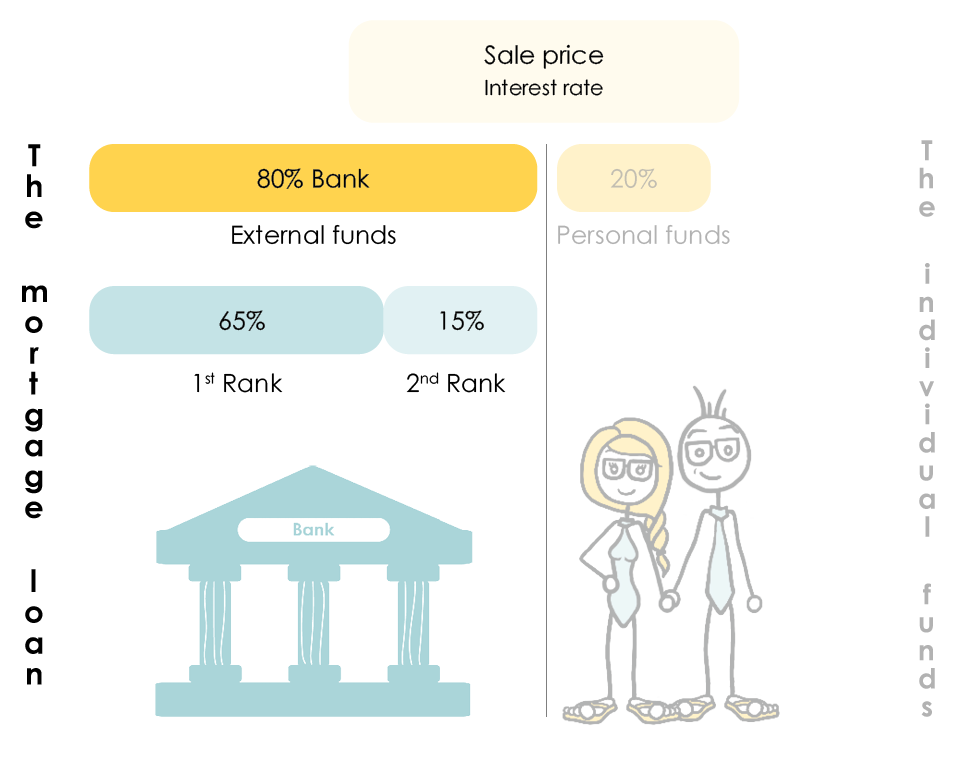

As usual, we have pictured the financial aspect of a real estate purchase:

The 1st rank represents 65% of the property (or exactly 66.66%). The second one, 15% (13.33%). If the apartment you are hoping to buy is worth 1 million CHF on the market, you will have to gather at least 200,000 CHF and then the bank will loan you 800,000 CHF, of which 650,000 CHF will be of 1st rank and 150,000 CHF of 2nd rank.

The difference between the two is that you have to reimburse the 2nd rank over a maximum of 15 years or, at the latest, before retirement age. Whereas for the 1st rank, there is no time limit and, in most cases, it is never reimbursed. It can even be inherited.

Example of a mortgage financing

Breaking down the purchase price

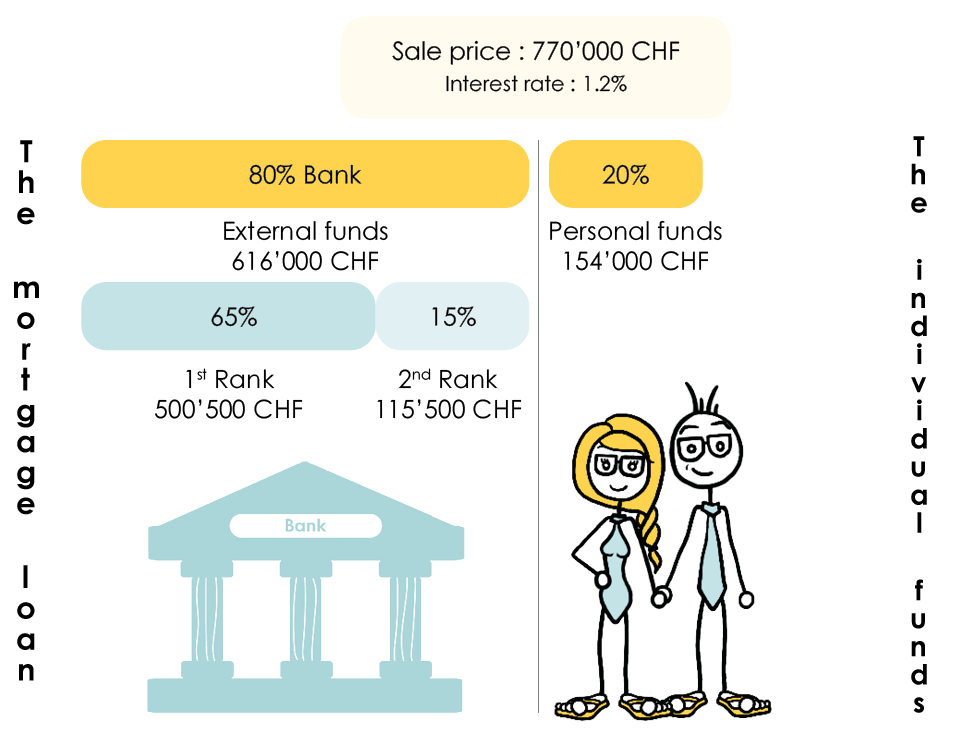

Let’s take myself as an example. After having decided to purchase with Zoé and after a bit of research, we ended up finding a pure gem on the edge of the city, in the charming commune of Chalet-à-Gobet.

The bank agreed to loan us the necessary amounts, at a fixed rate of 1.2% at the end of 2025.

The sale price being 770,000 CHF, our personal contribution amounted to 154,000 CHF, the 20% individual funds required by the bank. We therefore need a mortgage loan of 616,000 CHF split as follow: 500,500 CHF of 1st rank and 115’500 CHF of 2nd rank.

If you want to calculate all these elements for your own situation, you should check out our solvency calculator!

How does the repayment of the 2nd rank work?

As explained above, when you inject less than 34% of equity, i.e., when your equity represents 20% to 34% of the full price, you are required to take out a 1st and a 2nd rank. In any case, you will have to repay the 2nd rank over a maximum period of 15 years, or before the day you retire.

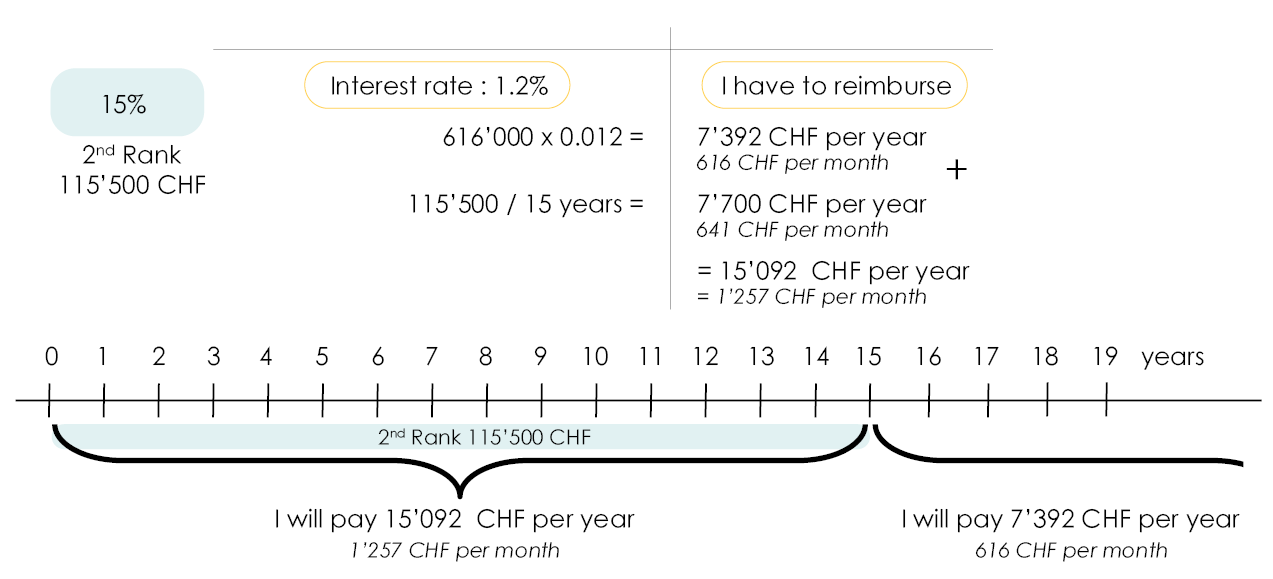

Case 1: We are under 50 years old

Since we are less than 50 years old, we can repay the 2nd rank in the next 15 years. Thus, to the 7,392 CHF responding to annual interests, 7,700 CHF are added. Each month of the first 15 years, we must repay 1’257 CHF. Then once the amortization is completed (i.e., the 115’000 CHF repaid), there will only remain the interest on the debt to be paid, which represents 7’392 CHF per year (616 CHF per month).

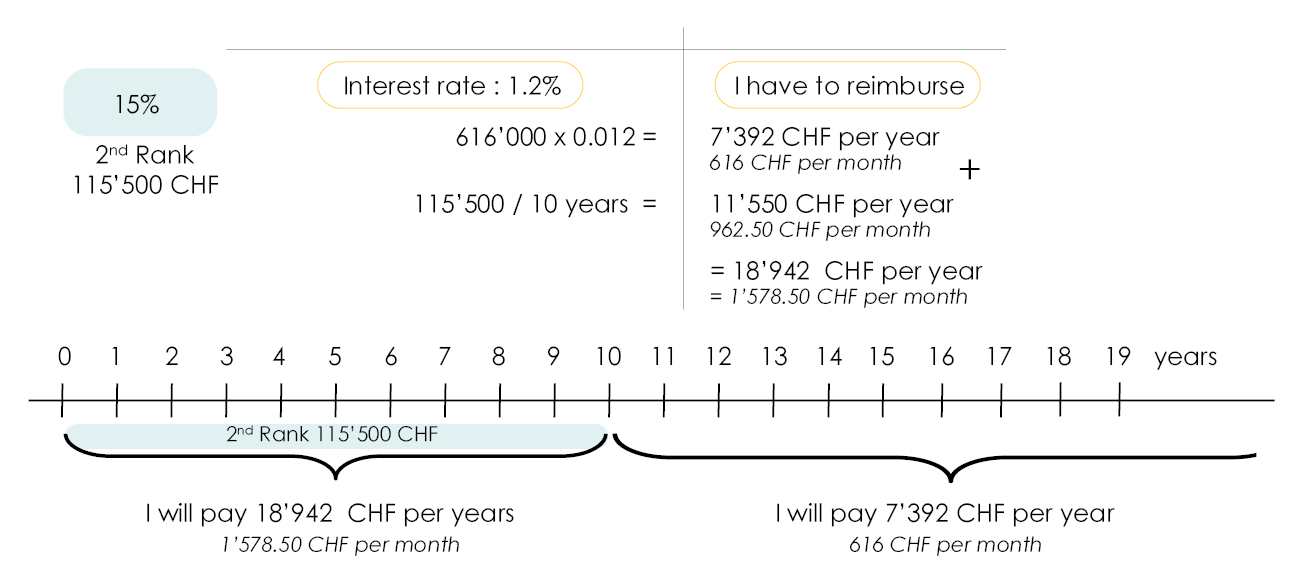

Case 2 : We are 55 years old

Let’s say I’m 55 years old (just for the example of course!) And that I therefore am 10 years away from the legal retirement age… Yes, It happens for everyone!

In this case, I will have to reimburse the 2nd rank in 10 years because I will be retired at 65 years old. So, to the 7,392 CHF, 11,550 CHF are added. I will therefore have to pay 1,578.50 CHF for the first 10 years. Then, 616 CHF after the first 10 years.

This reimbursement over 15 years is called amortisation.

There you go, now you know what your debt is made of.

How to pick a mortgage contract?

In Switzerland, banks do not have a monopoly on mortgage loans. Some pension funds and many insurances also offer alternatives to finance your future home. While the financing mechanism above described is similar for all types of institutions, some major contract type differences must be acknowledged, specifically when it comes to rates and duration.

Fixed term contracts

Whether it is for the 1st or the 2nd rank, you will have the possibility to subscribe to a fixed term contract, setting the rate applied over a given period. The longer the duration, the lower the rate. Rates vary every day, making the examples that we could give you quickly obsolete.

Let’s say that by the end of 2025, if you wanted to purchase your primary residence, mortgage rates were approximately as follows:

- 10-year mortgage: annual interest rate around 1.50%

- 5-year mortgage: annual interest rate around 1.25%

- 2-year mortgage: annual interest rate around 1.05%

Of course, these rates are purely indicative. They depend on many factors: the strength of your financial profile, the amount of equity contributed, the quality of the property, the bank’s internal policy, and the relationship you maintain with your financial institution.

So, how to select the best fitting duration? As in all forward-looking matters, there will never be a guaranteed answer. If you are rather risk averse, do not like volatility and want to be able to plan your future expenses to the nearest franc, then consider this: the longer the term, the greater the predictability and thus, the security. If, on the other hand, you are unafraid of surprises (good or bad) and do not want to miss a potential chance to reduce your mortgage interests burden, you probably should stick to short terms, keeping in mind the risk rate hikes. It’s up to you!

Last but not least, fixed term contracts can be time bombs in some cases. If personal reasons (divorce, transfer, unemployment, health, etc.) require you to sell your property before the end of the term, beware of the substantial financial penalties that the lending institution may claim.

Saron contracts

Have you heard this term before? Not so long ago, the word “Saron” didn’t even exist. Back then, we talked about Libor mortgages. The principle remains quite similar: the Saron simply represents the rate at which banks lend money to each other over very short periods.

In addition to lending among themselves, banks came up with a rather clever idea: to borrow money for you at that same rate, add a margin (more or less significant), and then resell you the loan. The result? They borrow at a low rate, lend to you at a higher one, and the difference… goes into their pocket. In the end, the mechanism is quite similar to that of fixed-rate mortgages, but over much shorter durations.

So, what’s the real difference with a fixed rate?

Honestly, the word “fixed” is a bit of a convenient shortcut, because in reality, the Saron rate is also “fixed”—but only for a very short period. That’s why it’s more accurately called a variable rate: it adjusts every three months, either up or down, and you have to accept those fluctuations.

In contrast, when you sign a fixed-rate mortgage contract for 10 years, you’re guaranteed to pay the same rate throughout the entire period, with no surprises. That makes budget planning much simpler.

In theory—and in the “real world”—there should be no reason for rates to change drastically from one quarter to another. But over the past three years, with pandemics, geopolitical tensions, and financial market instability, fluctuations have become significantly more pronounced.

What is the Saron rate at the end of 2025 – beginning of 2026?

Despite everything the world has gone through in recent years, short-term rates, such as the Saron, have remained surprisingly low. By the end of 2025, we even saw a new dip into negative interest rates — something we hadn’t experienced since late 2022.

Does that mean you’ll be paying 0 CHF in interest? Or even better — that the bank will pay you to borrow?

On paper, yes, that’s exactly what it means…

But in reality, Swiss banks have decided to set a floor at 0% (even if the real rate is negative), and then add their margin on top.

So, what does a Saron mortgage offer actually look like?

- Example 1: Let’s say the short-term rate is 0.75%. The bank adds a margin of 0.5% to 1%, resulting in a final rate between 1.25% and 1.75%.

- Example 2: Conversely, if the short-term rate drops into negative territory (-0.5%), the bank will take 0% as the base rate (the floor), then apply the same margin. The final rate would therefore be between 0.5% and 1%.

Should you go for a short-term rate like the Saron?

Personally, I quite like this type of product, and my view is pretty straightforward. Over the past ten years, anyone who chose a variable rate came out ahead — rates stayed so low that it was almost unbeatable. So yes, I made that choice myself.

But it all depends on your profile and your risk tolerance:

- If you’re not comfortable with risk, stay away from the Saron. Just like in the financial markets, you have to be able to handle both the ups and the downs while keeping your cool.

- If you prefer long-term budget stability, for example because you’re expecting a child or planning for retirement, it may be worth paying a bit more each month in exchange for knowing your exact costs for the next ten years.

In that kind of situation, it’s generally wiser to avoid the Saron and choose a fixed-rate mortgage instead — more stable, more predictable, and more reassuring.

How FBKConseils can assist you with your real estate project?

Introductory meeting

Have questions about your real estate project? At FBKConseils, we offer a free initial consultation. During this 20-minute session, we’ll analyze your situation and answer as many of your questions as possible, either online or in person at our Lausanne office.

Advisory meeting

Your project deserves our full attention. If a more in-depth session is needed, FBKConseils organizes comprehensive meetings without time limits. We’ll examine every aspect of your investment and provide you with the tools to make an informed decision.

Budget and tax simulations

Understanding the numbers is essential before purchasing property. FBKConseils conducts the necessary research and simulations for you, providing a detailed report to support your decisions and negotiations.

Administrative procedures

Bridging the gap between theory and practice can be challenging. FBKConseils stands by your side to manage every administrative step, simplifying the process from decision-making to the realization of your real estate project.