Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on November, 3rd 2025.

What is a real estate amortisation?

Introduction

In real estate, amortisation simply refers to the the reimbursement of part of the mortgage loan, more precisely the 2nd rank, over a maximal time period of 15 years or, at the latest, before the legal age of retirement.

Be careful: if you want to opt for the pledging of your pillar 2, your 2nd rank might not be equal to 15% but 25% instead which will, in any case, have to be reimbursed on the same terms.

These two types of amortisation are called direct and indirect amortisation.

The line-up:

The two types of amortization in Switzerland: Main residences

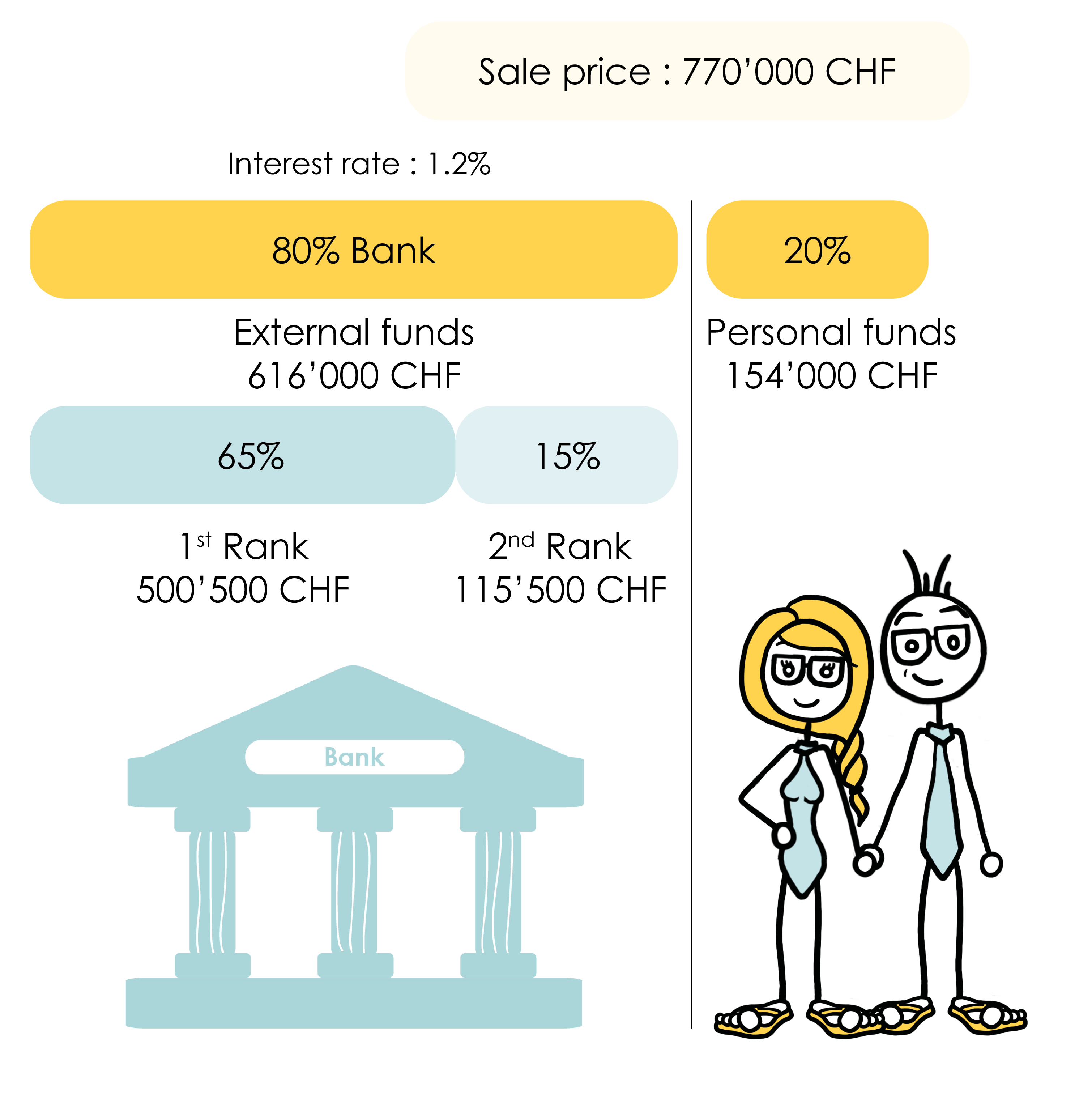

For those who haven’t yet read our articles on real estate financing, here’s a summary of the key points:

When purchasing property, if you don’t contribute at least 35% of the purchase price—in other words, if your debt exceeds 65%—you’ll need to repay the difference between the minimum 20% equity required and the 35% demanded. This repayment, known as amortization, must be made year by year, typically over a 15-year period.

Examples of real estate financing

- Standard case: Providing the minimum 20% equity:

- 30% Equity Contribution: 35% – 30% = 5% to be amortized.

- No Amortization: Equity contribution between 35% and 100% = 0% amortization required.

In Switzerland, lenders (banks, insurance companies, or pension funds) typically offer you a choice between:

- Direct Amortization: You repay the loan directly, gradually reducing the borrowed amount over time.

- Indirect Amortization: Payments are made into a savings solution (such as a 3rd pillar account), which will be used to repay the loan at a later date.

The choice between these two methods depends on your financial situation, tax optimization goals, and preferences for wealth management.

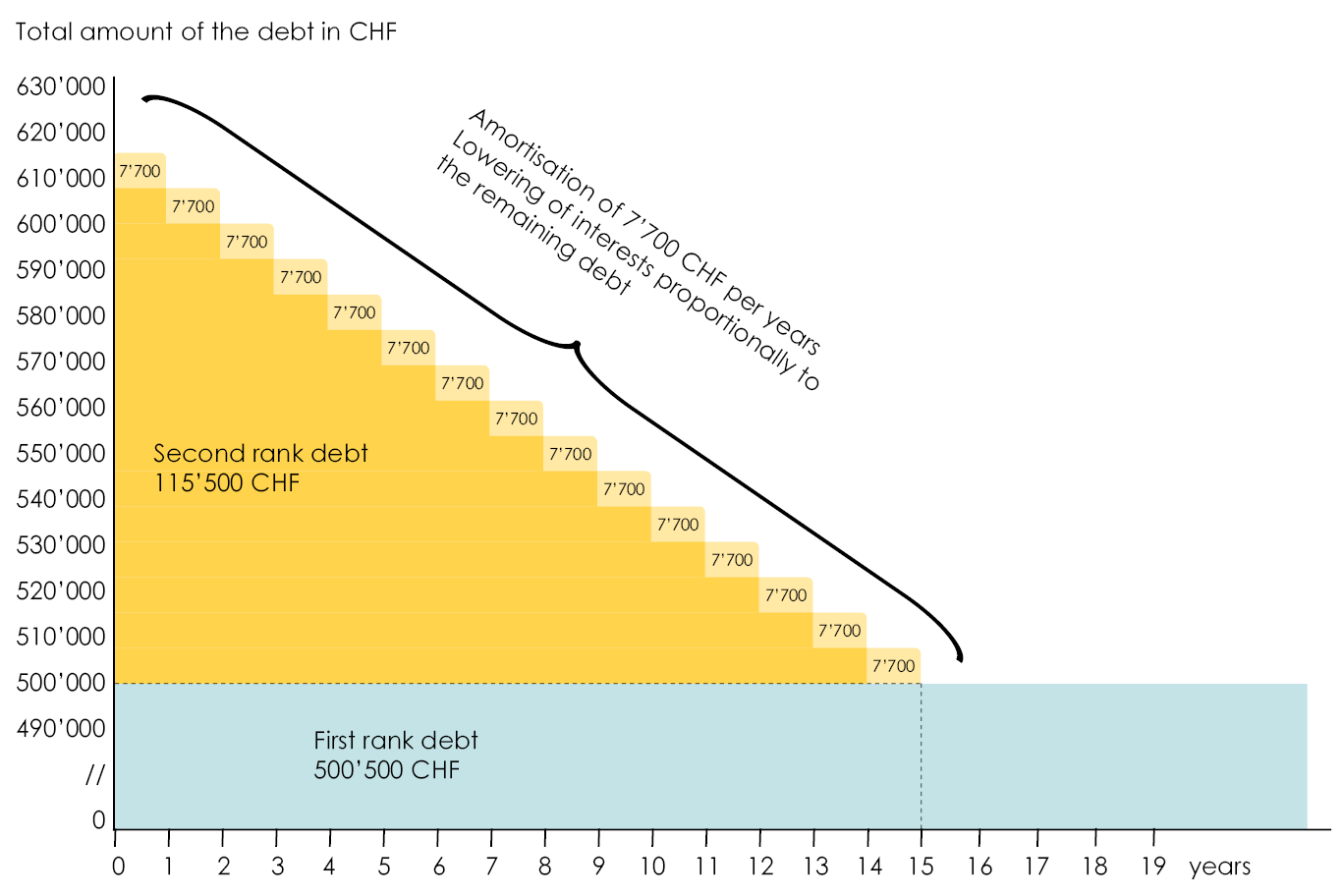

What is direct amortisation?

This is when you make monthly payments that directly repay part of your mortgage loan.

As the total loan amount decreases, your interest payments also go down year after year. However, since all mortgage interest is tax-deductible, this means you’ll gradually lose that tax advantage.

In addition, a large debt currently means a lower taxable wealth. As you pay off your mortgage, your net worth increases, and so do your taxes.

Advantage: Interest payments decrease.

Disadvantage: Taxes increase.

Before we move on to an example, let me remind you — or inform you if you missed the late-2025 national vote — that Switzerland voted YES to abolish the deemed rental value.

What’s the connection with our topic?

It’s simple: Swiss voters chose to eliminate a fictitious income (the deemed rental value) that applied to all owner-occupied properties. In exchange, mortgage debt and its related interest will no longer be tax-deductible.

In other words, starting in 2028, no matter the size of your mortgage or interest payments, you won’t be able to reduce your tax burden by declaring them in your tax return.

Being in debt will therefore no longer provide any fiscal advantage when buying or owning real estate in Switzerland.

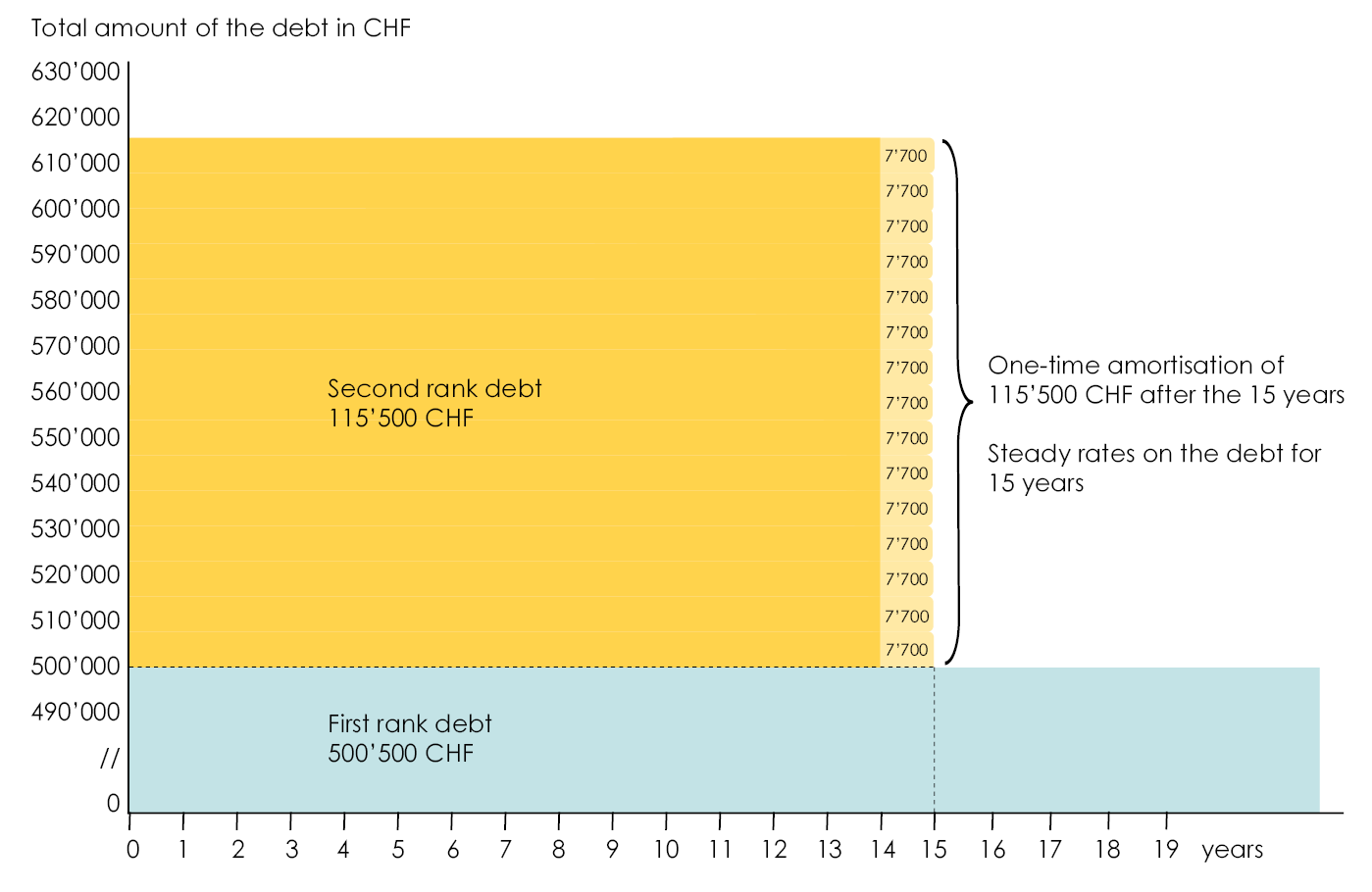

What is indirect amortisation?

In contrast to direct amortization, indirect amortization means that you pay the same total amount every month throughout the entire amortization period. But instead of directly giving this money to the bank, you keep it safely on a pillar 3A account, either at the bank, or at an insurance, or else, on a 3B account in case the maximal amount for 3A account has been exceeded.

Why choose this option? There are three main reasons — which will remain more or less valid even after the new law comes into effect:

Interest earned on your 3rd pillar: Some banks allow the 3rd pillar used for mortgage repayment to be invested (even though they’re not always thrilled about it). And that’s an interesting opportunity! Put simply, you could generate up to 5% annual returns on your 3rd pillar during the entire amortization period. By the end of your loan, the capital accumulated in your 3rd pillar (plus interest) could exceed the amount owed — meaning the difference goes straight into your pocket.

Debt interest deduction: Until 2028, taxpayers who paid interest on a debt (whether mortgage-related or not) could deduct those payments from their taxable income. This had the effect of reducing the tax burden for individuals who maintained higher levels of debt. In other words, the higher your interest payments, the lower your taxes. By opting for indirect amortization (repaying your mortgage through your 3rd pillar instead of directly to the bank), you kept your interest payments high while maintaining a lower taxable income.

Debt as a tool to reduce taxable wealth: In Switzerland, debt is also deductible from taxable wealth. And since the fiscal values of properties are often lower than the mortgage amount, keeping a large debt allowed you to artificially reduce your net taxable wealth.

And what happens to this account after 15 years? It is closed, the sum is transferred to your bank and the debt is downgraded to the 1st rank.

Avantage : multilevel tax deduction (reduction in income and wealth taxes, as well as the tax advantage related to the 3A account) until 2028.

Disadvantage: rates do not decrease during the first 15 years.

You can simulate your purchasing capacity as well as observe the amortisation thanks to our solvency calculator!

The two types of amortization in Switzerland: The case of secondary residences

While the rules governing the amortization of primary residences are well-known and clearly defined, things become much less clear when it comes to secondary residences, whether they are:

- Vacation homes or second residences (for personal use),

- Or investment properties (rented out).

In this area, no uniform regulation exists — each bank sets its own conditions.

However, after analyzing numerous real estate projects and assisting our clients, a general consensus emerges. Here’s what we can generally observe:

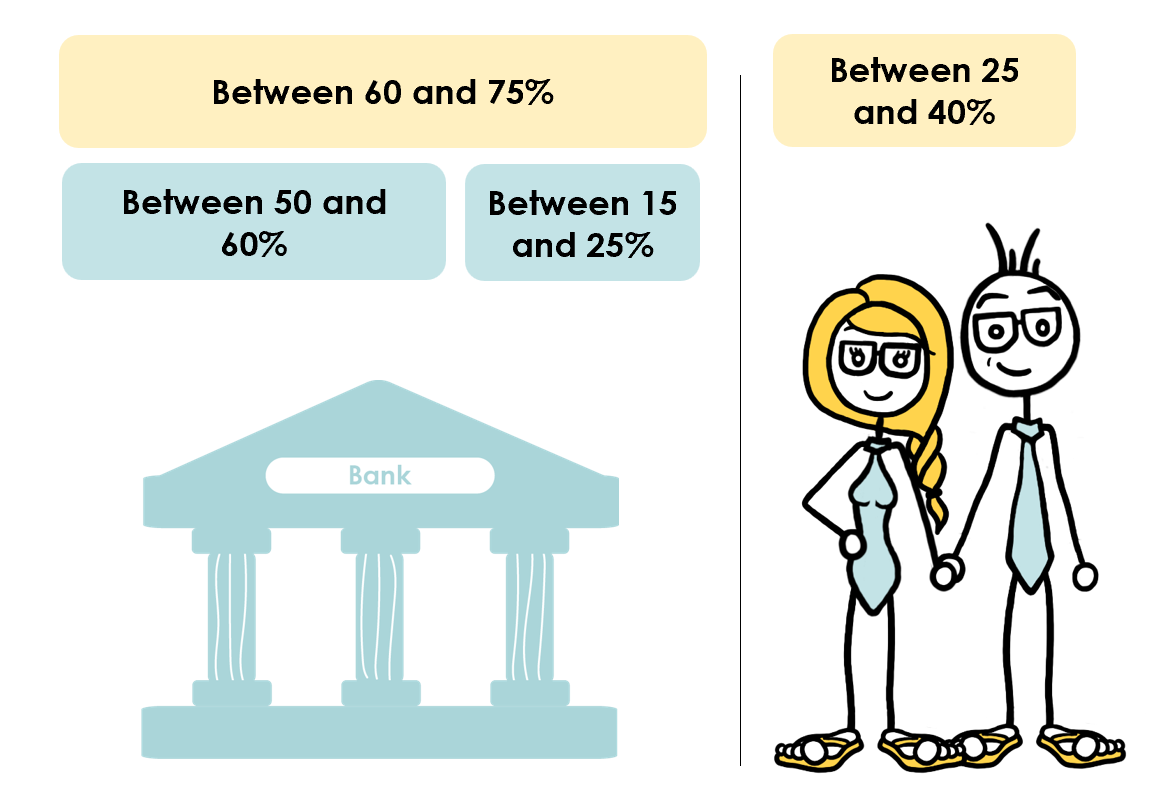

- Higher equity requirements:

For a primary residence, the standard split is 20% equity and 80% debt.

In contrast, for a secondary residence, banks usually require between 25% and 40% equity, limiting the loan-to-value ratio to 60%–75% of the purchase price. - Slightly higher interest rates:

Because the risk is higher than for a primary residence, banks apply less favorable rates, typically 0.2% to 0.5% higher than standard conditions. - Stricter amortization requirements:

This is where the biggest difference lies. For a primary residence, the debt must be reduced to 65% of the purchase price within 15 years.

For a secondary residence, banks often require a reduction down to 60%, or even 50%, depending on the client’s profile and the type of property. - Shorter amortization periods:

While the amortization period for primary residences usually spans 15 years (or until retirement age), secondary residences often have to be amortized over around 10 years.

How FBKConseils can assist with your real estate project?

While amortization may not be the cornerstone of your real estate purchase, it remains a significant factor to consider. Over a 15-year period, the choice between direct and indirect amortization could have substantial financial implications.

Introduction meeting

What better way to start than with a complimentary 20-minute meeting? This session will provide answers to all your initial questions.

Advisory sessions

It’s straightforward to work through the numbers together during a consultation and determine mathematically which scenario suits you best. The choice of amortization method can affect the duration of your repayment, your tax situation, and the financial burden of interest payments. At FBKConseils, we offer tax and budget simulations to answer all your questions.

Administrative support

A real estate purchase goes beyond calculations. At FBKConseils, we support you through all administrative steps, from project analysis to the final signature and organizing your move.