Written by Yanis Kharchafi

Written by Yanis KharchafiWhat is the pillar 3B and how to choose it?

Introduction

Few people know it yet, the pillar 3B, also called free third pillar or life-insurance is worthy of consideration.

Often considered as a simple savings account, at best tax deductible in a minority of cantons, there is actually a lot more to it. It an cover the same death and disability risks as a 3A account in an insurance, the third pillar B is a kind of life-insurance open to all, regardless of status or income.

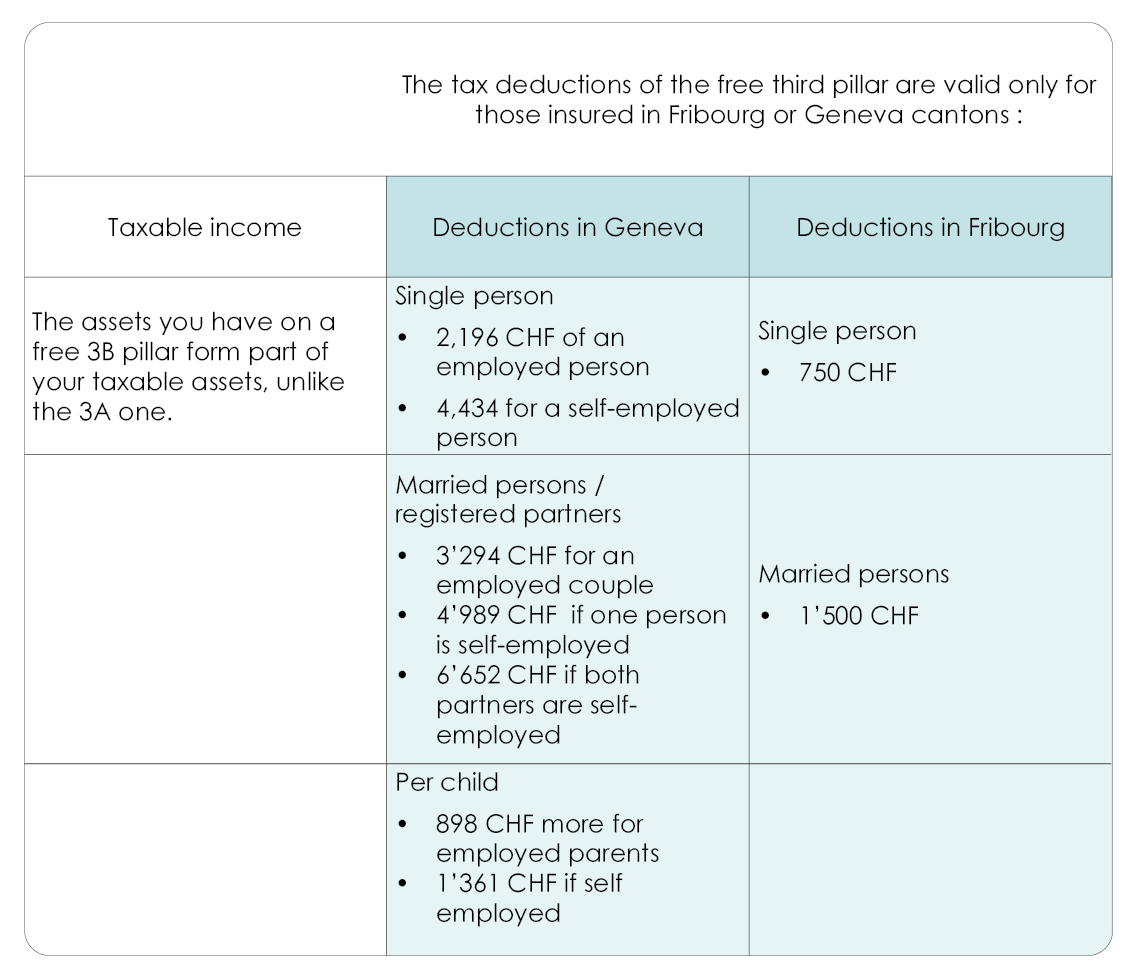

While only the cantons of Geneva and Fribourg allow to deduce the pensions paid from your taxes (up to 750 CHF per year and per person in Fribourg, and 2,200 CHF per year of a single person and 3,300 CHF per year for a married couple in Geneva).

The line-up:

What are the advantages of the 3rd pillar B?

- The possibility to terminate the contract and/or withdraw the repurchasing value whenever you wish. Be careful with the repurchasing values, they can be very, very bad in the first few years!

- The possibility to choose who to cover in case of death. Unlike the 3rd pillar A (“tied”), where the order of beneficiaries is laid down by law, there is no compulsory order in the 3rd pillar B. You can name your spouse, your children, your partner or even your company.

- Depending on the policy you choose, it will allow you to pledge its value to take out loans or reassure the organisation in the event of illness, accident or death. It’s an asset when negotiating a loan.

Just remember that the third pillar B, is kind of the zero-problem pack of retirement planning. Not the most advantageous one in the long-term but the one for which you will not have to ask yourself any questions.

3rd Pillar B and taxes

Before concluding this short chapter on the 3 pillar B, let’s take a brief look at taxes. Few people know this, but despite the fact that this contract is also known as the 3rd pillar, it has nothing in common with the 3 pillar A from a tax point of view.

- It is deductible only in some cantons and for much lower amounts than the pillar 3A

- It is imposed like fortune, based on repurchasing values (no imposition for the pillar 3A). You will therefore have to declare the value of your policy each year, and this amount will be included in your taxable assets.

- Upon withdrawal of your pillar 3B, no exit taxes will be levied, unlike the pillar 3A. Since, unlike the 3rd pillar A, you are taxed on your assets throughout your life, you will not be required to pay any tax on your withdrawals.

In conclusion, is it worth taking out a 3rd pillar B (life insurance)?

First of all, if you don’t live in a canton that accepts a deduction for 3rd pillar B, then don’t take out one unless you have a very specific reason for using such a financial product.

The 3rd Pillar B is above all a tool for protecting yourself and the people (natural or legal) closest to you.

Using Pillar 3B to protect your family

You’ve decided to buy a beautiful house with your wife and children. To finance this house, the bank realises that in the event of serious problems, one of the spouses alone would no longer be able to bear the costs of this home. You could take out a 3rd pillar B to insure exactly the amounts needed for each scenario, thereby reassuring your bank and protecting your family.

Using Pillar 3B to protect your partner

In life, it is not uncommon to form a partnership to create a business and make it grow faster. It is more unusual, but unfortunately not impossible, for a tragedy to befall one of the two founders and put the business in jeopardy. The remaining partner will have to be able to buy the shares in their company from the heirs. To avoid this problem, it is quite possible for each of the partners to sign up to a 3rd pillar B which, in the event of death, will pay a substantial sum to finance the purchase of the company at the right price.

Using Pillar 3B to protect your business

Another common situation in SMEs is that the founder remains a key person in the company after several years. If something were to happen to him or her, the company would go through difficult times. In the event of the founder’s death, the 3rd pillar B could be used to replenish the company’s capital until the problems are resolved.