Written by Yanis Kharchafi

Written by Yanis KharchafiFinancing my residence in 2026 : Equity capital

Introduction

To my great surprise, real estate is a topic that fascinates many of our clients. Quite a few keep this project in the back of their minds, and let’s be honest — they regularly check property prices. But after seeing the price per square meter, the apparent complexity of the buying process, and the continuous stream of legislative changes that have been rolling in since the end of 2025, many end up giving up.

I find this unfortunate, because in most cases, this decision comes simply from a lack of understanding of how a property purchase actually works:

How much can I borrow?

What are the current mortgage rates?

What level of income do I need?

In this first article of a longer series, we’ll focus on the amount of liquidity required to finance your future property, in other words, the famous “cash you need to bring in.”

I’ll mainly focus on the rules that apply to primary residences, but keep in mind that different rules may apply if the property is a secondary residence or a rental investment.

For this kind of topic — and based on experience — I believe that rather than diving into theory and concepts, it’s best to walk through a concrete example step by step.

The line-up:

Financing your primary residence: The minimum equity requirement

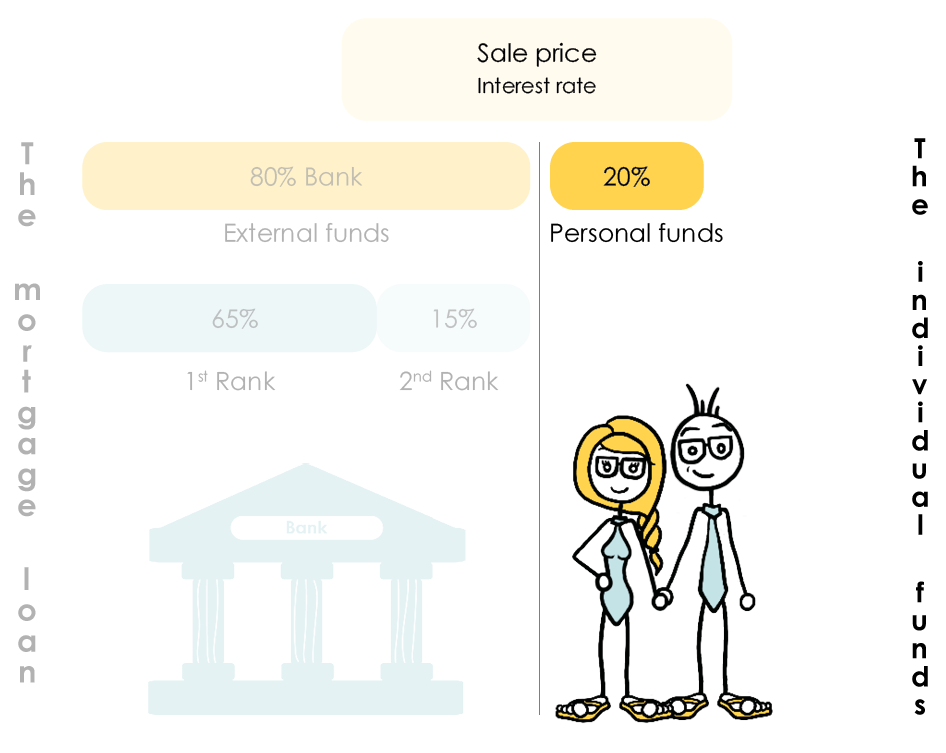

For better understanding, I propose a small illustration to help you visualize a real estate funding and, more precisely, the part we are concerned with here.

Let’s take as an example my apartment with a garden situated in the heart of Chalet-à-Gobet, on the edge of Lausanne. My wife and I just purchased it for a grand total of 770’000 CHF.

Individual funds have to a minimum of 20% of the total except in case of the pledge of your pillar 2 assets. We had to gather these 20% of the total amount, that is 154,000 CHF excluding the purchasing fees for the notary (and the State), in order to have a chance to be granted a loan by our bank. Luckily, I had 150,000 CHF and some change that happened to be laying around in the inner pocket of my coat.

Needless to say, had I gone to see my banker with 150 purple banknotes, he would have given me a strange look. It may have worked 20 years ago, but things have changed.

So, as you’ve probably understood by now, this first section sets the basic rule: your own funds must represent at least 20% of the purchase price!

What forms can individual funds take?

It’s not very complicated: in Switzerland, anything that looks even remotely like cash generally makes banks happy.

Among the most commonly accepted sources of equity, you’ll find:

- Bank accounts: whether your accounts are in Switzerland or abroad doesn’t matter — a bank account is a bank account.

- Investment accounts: if part of your savings is invested, the same principle applies — as long as you’re willing to sell your positions to free up cash, those funds will be accepted.

- Employee shares: in some large companies, employees receive participation shares every few years (vesting). Once the vesting period has ended, you can sell your shares and use the proceeds as equity.

- Gifts, advances on inheritance, and inheritances: if someone loves you enough to share part of their wealth with you — great! Those amounts can also count as equity.

- “Subordinated” loans: not a very well-known or glamorous term, but easy to understand — the bank wants to make sure that no one else gets repaid before them. So, if a relative lends you money and states in writing that the bank will be repaid first, this loan will be accepted as equity.

- The 3rd pillar B (unrestricted pension savings): this type of plan is quite common in Geneva but rare elsewhere in Switzerland, as it’s not tax-deductible. It’s often expensive and not particularly profitable, but if you have one, you can cancel it and withdraw its surrender value to top up your equity.

These first sources are what we call available funds.

However, in Switzerland, another type of asset can also be used — and when it comes to a primary residence, it almost always is: retirement funds.

- The 3rd pillar A: without getting into too much detail, know that for financing your main home, no problem — you can withdraw your assets freely. Be careful, though: any withdrawal from the 3rd pillar A is taxable.

- The 2nd pillar (occupational pension plan): this is where things get more complex. You first need to understand how the 2nd pillar works, and then make sure you meet several strict conditions to use it for buying or building your primary residence. And, just like with the 3rd pillar, a withdrawal from the 2nd pillar also triggers a withdrawal tax.

Conditions for using your 2nd pillar to purchase real estate (EPL)

Condition 1 — Primary residence: To use your 2nd pillar as part of an EPL real estate purchase, the property in question must be your main residence. It cannot be an investment property or a secondary residence.

Condition 2 — Maximum occupational pension contribution: You are not allowed to finance your entire property solely with your 2nd pillar. You must contribute at least 10% of the property price without using your pension funds. Once that threshold is reached, the remaining amount can come from your pension fund.

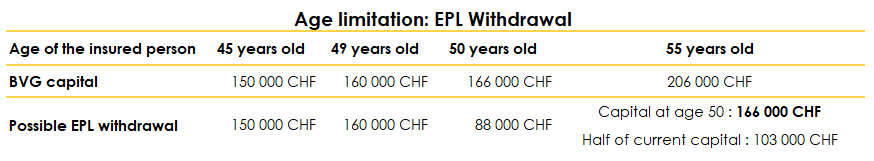

Condition 3 — Age of the insured person: If you are over 50 years old, you can only withdraw the amount available at age 50, or half of your current 2nd pillar balance — whichever is higher.

Example of using the 2nd pillar to purchase a primary residence

This is a crucial point, as the rules around the 2nd pillar are often misunderstood in Switzerland.

Let’s imagine the following situation:

- Available cash: CHF 50,000

- 2nd pillar pension funds (LPP): CHF 500,000

Can I buy an apartment worth CHF 770,000?

Some might be tempted to say yes, since my total assets (2nd pillar + cash) clearly exceed the 20% minimum equity requirement, which would be CHF 154,000. But no! At least 10% of the purchase price must come from sources other than the 2nd pillar, which in this case is CHF 77,000. With only CHF 50,000, I do not meet this threshold, and therefore cannot finance the purchase under these conditions.

Now, consider a second example:

- Available cash: CHF 300,000

- 2nd pillar pension funds (LPP): CHF 500,000

Can I withdraw my entire 2nd pillar to avoid going through a bank and fully finance the apartment myself? This time, the answer is yes: you can invest CHF 270,000 in cash and withdraw CHF 500,000 from your 2nd pillar to cover the rest of the purchase price.

However, pay attention to the third condition mentioned earlier: after age 50, the maximum withdrawable amount from the 2nd pillar is calculated differently!

Financing my secondary residence: Minimum equity

We are now leaving the world of primary residences and entering that of secondary residences.

When I talk about secondary residences, I mean properties kept at the owner’s disposal—such as a vacation home, a chalet, or a property occupied by children—but in no case properties intended to be rented out for income.

I spent some time looking for legal texts that explicitly state the minimum equity required to finance a secondary residence. Strangely, there is no precise legal requirement—only recommendations and practices that vary between banks.

So, what can we conclude?

According to my research, the FINMA (Swiss Financial Market Supervisory Authority) and the ASB (Swiss Bankers Association) allow mortgage institutions some discretion, as long as they respect the principles applied to primary residences.

Conclusion: most banks have adopted a common rule: instead of the 20% equity requirement for a primary residence, they now ask for 30% to 50% for a secondary residence. Yes, it stings a little.

Concretely, for an apartment priced at CHF 770,000, this represents CHF 231,000 to CHF 385,000 that must come out of your pocket. Naturally, the temptation might be to use your 2nd or 3rd pillar. Well, no! This is a rule set in stone: if the property is not your primary residence, only non-pension funds can be used as equity.

I think you get the idea without further explanation. But let’s stay curious: how does the bank decide whether you need to provide 30%, 40%, or 50% of equity?

To be honest, there is no universal answer. However, several factors can influence this decision:

- Location of the property: Is it in Switzerland, France, or elsewhere? The more difficult it is for the bank to accurately assess the property’s value, the higher the required down payment. This reasoning also applies within the country: a small bank in Geneva might have less interest or fewer means to finance a property in Jura.

- Strength of your financial profile: The stronger your financial situation, the more debt you can reasonably take on, reducing the risk for the bank. The “quality of the file” depends not only on your assets but also on the relationship you maintain with your financial institution: does it already finance another property in your name? Do you have investments with it?

- Bank strategy: As in any sector, some institutions have a real appetite for financing secondary residences, while others prefer to avoid such files. Approaches can therefore vary significantly from one bank to another.

How can FBKConseils assist with your real estate project?

Introductory meeting

FBKConseils continues to support you in 2026 with a complimentary first meeting. Take advantage of 20 minutes to discuss your project, ask questions, and receive initial advice, either via videoconference or in our offices.

Advisory meetings

For complex projects, FBKConseils is available for more in-depth consultations. Take the time you need to address all your questions and validate each step with our experts.

Tax and budget simulations

Save time: entrust your calculations to FBKConseils. We prepare a comprehensive budgetary and tax analysis tailored to your project so you can move forward with confidence.

Assistance with administrative procedures

The administrative steps can be numerous and complex, but you’re not alone. FBKConseils helps you navigate from signing to settling in with ease.